This update is sponsored by

On May 12th, the historic 2023 session came to a close. The best way to summarize the session is “adjourned, but not done.” The Legislature has been planning since early in the session to come back for a veto session where the Democratic supermajority squares off against the most popular Governor in America on possibly up to five or six (the budget, childcare, gun, juvenile justice, and perhaps the bottle bill legislation) pieces of vetoed legislation on June 20, 21, 22 with the start of a new fiscal year not far away.

The session started slowly due to the four factors we highlighted in our first update of the session.

- One-third of the legislators were new to their position – the largest new cohort in history – representing a significant loss of institutional memory. This meant a slow start, and learning the ins-and-outs of state government was a defining feature of the first two months of the session.

- Two-thirds of the Chairs in the House were new. As if things hadn’t been shaken up enough, even the leadership was new in committee.

- More than two-thirds of the Legislature is comprised of members from one party, giving that party the ability not to accommodate the desires of the Executive Branch if they so choose. The veto not having such a prominent role meant that intra-party differences mattered more; think back to when one party had control of the Legislature and the Executive Branch. Finally, caucuses were particularly important this biennium, such as long-established “climate caucus” and the newly well-organized “rural caucus” made their mark.

- Upwards of three-quarters of a billion dollars in spending was been promised or promoted by that party with complete control of the Legislative Branch, while storm clouds appeared in budget forecasts for future years. Not all that was proposed could happen, making for some difficult decisions.

Coming into the session, legislative leaders felt they had the mandate to address childcare and housing, systemic issues that had thwarted previous legislatures with a more experienced makeup. The slow start meant that the Legislature also had less time to fully address these issues, which made for a chaotic crossover and a great deal of pressure on adjournment.

The session was characterized by a high degree of division between the House, Senate, and Governor. With supermajorities in the House and Senate, the intra-chamber fighting between two political parties was replaced with inter-chamber disagreements between the leadership of the same party in the House and Senate.

Connect with LCC

During this session, LCC’s advocacy team testified on over 17 bills, tracked hundreds, and sent 18 advocacy updates with an open rate of 38% to keep Vermont employers, advocates, and legislators informed.

We’re already preparing for the next legislative session, as some perennial issues will arise, and there is legislation that will carry over to the next half of the legislative biennium.

Click here to schedule a call with our team, or email us at [email protected].

Table of Contents

Financing and Revenue

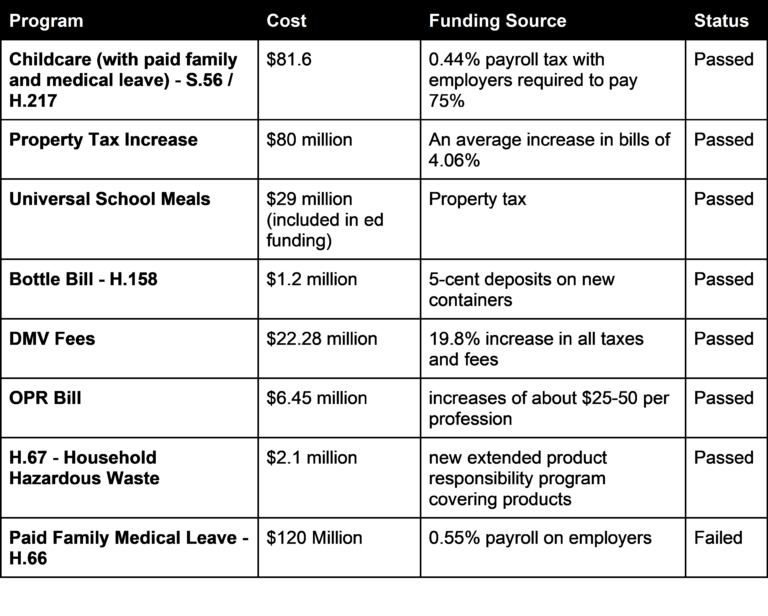

The best summary of this session’s tax policy might have come from the Commissioner of the Department of Taxes, Craig Bolio, as he joined the House Ways and Means Committee to discuss the childcare funding package. The Commissioner highlighted that Vermont is a small state with a small tax base that is already highly burdened, with Vermonters currently paying 13.6% of their income in state and local taxes, the highest in the country after New York, Connecticut, and Hawaii, with this session’s policy potentially pushing us above Hawaii he noted. He remarked that the childcare bill envisions a $178 million income tax increase, there is an $80 million property tax increase, and even though paid leave will not happen this session, it will likely bring a $107 million payroll tax increase next session. He noted that all these tax increases on Vermonters come at a time when food and housing costs are high, and the country is facing potential economic downturns such as bank failures and U.S. defaulting due to the debt ceiling fight. Additionally, April revenues missed the forecast by $43 million, led by personal income decreases, leading to concerns about the fiscal future of the state.

The total new permanent taxes total nearly $193 million this session. If the legislature is to return next legislative session and only pass the payroll tax associated with paid leave, the total of the legislative biennium will be $313 million.

The Budget

This year’s budget, H.494, is an $8.5 billion budget which represents a roughly 13.6% increase in spending over the base budget. The Governor continually used his weekly press conferences to express outrage over this year’s increase in base funding as well as the inclusion of programs such as a mandatory paid family leave program and the clean heat standard that were not in the budget. The Governor also continued to voice his frustration that more funding is not being reserved for the mandatory match required to make use of federal infrastructure funds coming to the state in future years.

This year saw increases in fees that have not been increased in some time, such as those for services from the Department of Motor Vehicles and, in a separate bill, fees to fund the Office of Professional Regulation. The budget also contains the workforce development bill described below.

One issue in the budgeting process was a group of about 31 lawmakers who threatened to sustain a veto of the budget and used their bargaining power to try to direct more funding to program housing those who are experiencing homelessness. The program is coming to an end due to dwindling federal funding. Budget drafters ended up finding about $12 million for the program.

Related links:

- Governor Delivers Budget Address

- Emergency Board hears good news for this year, bad news for future years

- Budget battle

Miscellaneous Tax – H.471

The miscellaneous tax bill, H.471, gained a lot of extra pieces as the legislative session came to a close. The bill is a must-pass bill due to including the link up to the federal tax system, so therefore, other, less controversial must-pass items were added to it to ensure they passed.

Added to this is a long-standing LCC priority, a workaround for the cap on state and local tax deductions. This provision was unfortunately removed by the House in the final stages. We discuss further in the below section this measure, which would have saved Vermont pass-through owners $10-20 million in federal taxes and net the state upwards of $0.8-1.5 million.

The bill also had added to it all of the language that was must pass from S.94, the bill covering VEGI and TIF, which we discuss in a section below. Finally, the annual rate setting for workers’ compensation was added to this legislation.

Local Options Tax – S.60

Local government nerds will know that Vermont is what’s referred to as a Dillon Rule state which means that the powers of local municipal government have to be expressly granted to municipalities. This is why Vermont has its charter change process by which if a town wants to levy a local options tax on sales or rooms and meals, the town must first bring the tax before voters as a proposal and, if successful, bring that proposal to the Legislature for approval. S.60 represents a major change in municipalities’ relationship with the state as it removes the need for the town to bring a local options tax proposal approved by voters to the Legislature for approval. The legislation would not circumnavigate the need to have voters of a municipality approve the change, it would only mean that the conversation on town meeting day is the final say.

In the past, the Legislature has exercised power over charter changes to prevent local options taxes. Most notably, at one time, South Burlington sought to levy a local options tax on rental cars, the vast majority of which are based in that municipality, given the presence of the state’s largest airport. Legislators prevented the passage of that charter change due to that concern.

This bill passed the Senate and was referred to the House Committee on Government Operations and Military Affairs, however, they have been bogged down by massive conversations such as legislative pay and impeachment. Discussion on this bill will likely resume next year.

Related Link:

SALT Cap Workaround – S.45 & H.61

After multiple years of work, two bipartisan bills to provide a long-time priority for Vermont almost made it across the finish line. These bills, H.61 and S.45 would allow owners or partners in Vermont LCCs, LLPs, or S-Corps to work around the federal cap on state and local tax deductions created in 2017. Along with the bill introductions, LCC sent a letter on behalf of a massive coalition in support of this legislation.

This was a truly unique opportunity for the state of Vermont to pass legislation that affects how much in federal tax Vermonters pay. Our state should jump on this opportunity as 29 other states have and stop sending millions of dollars out of the state unnecessarily. The legislation represents a win-win for the state as it helps businesses save on federal taxes, in turn keeping upward of $15-20 million in the state while also bringing in $0.8-1.5 million in additional state tax revenue. You might call this a missed opportunity, however, some would claim that giving Vermont small businesses this federal tax break would increase wealth inequality.

The Senate quickly took up and passed S.45. When it arrived in the House Committee on Ways and Means, there was an initial discussion around S.45 where some members of the Committee expressed concern about business owners avoiding federal taxes and questioning if we should not be taking away tax revenue from the federal government. The legislation was eventually added to the childcare bill, S.56, by the Ways and Means Committee as a way to blunt the impact of income tax increases, however, with agreement on that legislation elusive, it was moved to the miscellaneous tax bill, H.471, by the Chair of the Senate Committee on Finance. Unfortunately, the Chair of the House Ways and Means Committee pushed for the languages to be removed from the bill in concert with concessions to the Senate’s childcare funding package.

This has been a longtime objective of LCC, which has tracked this very technical solution at the federal level and lobbied for implementation at the state level since 2019.

Related links:

- Learn more about the SALT cap workaround here.

- Unique bill creating a federal tax break for Vermont businesses introduced

- Senate-passed bill would save Vermonters money on federal taxes; House not sure they want that

Sports Wagering – H.127

This year, Vermont joined the national trend since a landmark Murphy v. National Collegiate Athletic Association (NCAA) opened the floodgates for the state to legalize sports betting. H.127 will allow up to six companies to operate a “sportsbook” in Vermont and apply a 20% tax rate on the adjusted gross revenue. The bill would create a dedicated fund to hold the revenue and fees collected by the state, with some of that money set aside for programs targeting problem gambling which will grow to about half a million dollars. The legal sports betting market is expected to be up and running in January 2024.

The Joint Fiscal Office estimates the bill will generate approximately $2.0 million in FY 2024 and between $4.6 million and $10.6 million in FY 2025 in sports wagering revenue. The bill has passed the Legislature and is on its way to the Governor’s desk, where he is expected to sign it.

Related Links:

Education Fund – Yield & Universal School Meals Bills – H.492 & H.165

The education fund started the session with a surplus of $65 million in the Tax Commissioner’s December letter.

This year’s yield bill, H.492, will increase the cost to the average taxpayer by about 4.06% despite a decrease in the tax rate due to the overall rise in property value across the state. The non-homestead property tax rate is $1.391 per $100.00 of equalized education property value. The bill accommodates the $29 million in FY 24 for universal school meals and adds $9.1 million for a one-time true-up in the teachers’ pension fund. The bill also sets aside $13 million for a buydown of property taxes next year. A fiscal note can be found here.

As mentioned above, H.165, directs $29 million from the state’s education fund to pay for students’ meals on a permanent basis. A fiscal note can be found here.

Economic Environment: Housing, Childcare, and Employment

Halfway through this session, the University of New Hampshire released a poll covering the areas of most concern to Vermonters. “Housing” was number one at 32%. Following this, tied for second place, were “cost of living” and “taxes” at 9%. Vermont is consistently ranked as one of the least friendly states for business despite the insistence of many that it is not the case. This session exemplifies the challenges of the Legislature attempting to be more business-friendly while also accomplishing the goals of a more left-leaning caucus.

The legislature contemplated items such as a labor bill that would challenge the same preemption Florida is challenging, engaged in a housing debate that would make one feel as if they were dropped into an east coast Wyoming. Still, there were some more business-friendly outcomes, a bifurcation of the small group and individual healthcare markets, legislation to help lower liquor liability insurance costs, additional funding for the Vermont Training Program, and housing policy that fell short of major changes to Act 250 yet will still have a positive impact on housing development.

Housing Bill – S.100

Housing is the limiting factor in our economy, and a recent poll by UNH listed it as far and away the most important issue to Vermonters. Based on the projections of the 2020 housing needs assessment, Vermont will need to increase the state’s total housing stock by about 5,800 primary homes before 2025 to meet expected demand among new households while also housing the state’s homeless and replacing homes likely to be removed from the stock. Our state has the oldest housing stock in the country, which was recently highlighted. The Vermont Housing Finance Agency testified that since the 2020 housing needs assessment, further analysis actually puts the number of new primary homes needed at 30,000 to 40,000 units by 2030.

Whilst it is easy to be pessimistic about the status of the final bill due to the once again mostly impenetrable defenses of Act 250, S.100 does provide some positive policy changes that will help address our state’s housing needs. It likely will not be enough, however, it is a start.

The Senate Committee on Economic Development, Housing, and General Affairs produced a fantastic bill that has subsequently been watered down by the process in more conservative committees that follow. Along the way, the Governor bemoaned the bill’s loss of meaningful action on Act 250 and pushed the Legislature to do more every step of the way. The House saw a chance to make some changes in the House Committee on General and Housing, instead, disgruntled members learned their housing charge doesn’t include land use laws or regulations. The Rural Caucus stepped up to make asks for a more permissive bill to meet the state’s needs and was able to make significant changes to promote housing.

The bill predominantly focuses on restricting municipal zoning in areas served by water and sewer infrastructure. Unfortunately, municipalities may define what areas are “served by municipal sewer and water infrastructure,” which may make some of the “by-right” provisions ineffective. Even without these issues, it’s unclear how much will be achieved without Act 250 changes. California’s new duplex law, for example, has had a limited impact so far, according to a new study from the University of California, Berkeley.

In areas covered by water and sewer, the bill will:

- Prohibit deed restrictions and covenants that require minimum dwelling unit size and more than one parking space.

- A municipality can’t require more than 1 parking space per dwelling unit, but may require 1.5 spaces in areas without sewer and water for multi-unit dwellings if existing other parking isn’t sufficient.

- Municipalities must allow duplexes where single-family units are allowed. Municipalities must permit multi-unit dwellings with up to 4 units in areas of the town served by sewer and water unless the town requires more units

- In residential districts served by sewer and water, bylaws shall establish building and lot standards to allow 5 or more units per acre; no dimensional standard for multi-unit dwellings can be more restrictive than those for single-family dwellings

- In residential districts served by sewer and water, affordable housing may add additional units up to 40% of the density and may add an additional floor.

Municipal Zoning

- It creates a problem in that it changes the ability of any 10 voters or property owners in a town to appeal a zoning decision; requires that a person allege an injury protected under 24 V.S.A. chapter 117. For affordable housing development, the injury shall not include the character of the area.

- Changes the requirements for accessory dwelling units (ADUs)

- Prohibits municipalities from prohibiting hotels from renting to those using housing assistance funds

- Establishes building and lot standards for multi-unit dwellings

- Limits what aspects of emergency shelters can be regulated in town zoning

- Adds definitions for accessory dwelling units, duplexes, emergency shelters, multi-unit or multifamily dwellings, and served by municipal sewer and water infrastructure

- Requires municipalities to submit specific information to the Department of Housing and Community Development when adopting or updating zoning bylaws

- Allows towns to give administrative officers authority to approve minor subdivisions and decide if a hearing is required

- Clarifies that the character of the area cannot be appealed in decisions on certain types of housing

- Requires the town plan to be consistent with the goals of Chapter 117 and include specific actions needed to address housing

- Removes the ability of rural towns to adopt changes to bylaws by Australian ballot

Funding

- Allows the Department of Housing and Community Development to use up to 20% of municipal planning funds to provide assistance to towns to meet the requirements of the neighborhood development area designation

- $10 million for the Missing Middle Rental Revolving Loan Fund

- $10 million for VHIP

- See more funding here

Planning, Navigation, and Duplication

- Requires the Vermont Association of Planning and Development Agencies to study various issues related to improving and coordinating effectiveness between municipal, regional, and State planning

- Appropriates funds to the Vermont Association of Planning and Development Agencies for the purpose of hiring Housing Navigators

- Adds detail to the required housing element in a regional plan

- Directs ANR to identify any State permitting requirements or ANR processes that may be duplicated under State and local permits and propose how to eliminate such redundancies. Report due Jan. 31, 2025.

Act 250

- Raises the Act 250 jurisdictional threshold for housing units from 10 units to 25 for downtowns, neighborhood development areas, new town centers, village centers with zoning and subdivision bylaws, and growth centers. This is a temporary provision that sunsets on July 1, 2026.

- In a municipality with permanent zoning and subdivision bylaws, the construction of four units or fewer of housing in an existing structure shall only count as one unit towards the total number of units.

- Removes the cap on the number of priority housing projects that are exempt from Act 250 for downtowns, neighborhood development areas, growth centers. This is a temporary provision that sunsets on July 1, 2026.

- In order for someone to be exempt under the new temporary Act 250 exemptions, they need to request a jurisdictional opinion, stating they would be exempt by June 30, 2026. Construction of exempt housing projects would need to be substantially completed by June 30, 2029.

- Allows municipalities to apply for master plan permits under Act 250 for their designated downtown or neighborhood development area. With a master plan, future development in the downtown would only need an Act 250 permit amendment, not an individual permit.

- Clarifies that the Act 250 fees apply per application and the cap on fees applies per application, not per project.

Some things left on the cutting room floor;

- Commercial to residential conversion – LCC brought forth language that would have allowed redevelopment of a parcel under an existing Act 250 permit not to require a permit amendment in the instances in which the redevelopment was converting the commercial space to less than 25 residential rental units.

- Municipal delegation – a plan pushed by Chittenden County municipalities, spearheaded by Mayor Miro Weinberger, in which the legislature would delegate Act 250 criteria review to local governments that adopt bylaws addressing Act 250 criteria and demonstrate the capacity to administer Act 250 locally. This would eliminate duplicative and expensive permits that cost developers time and money as an alternative to the longstanding ask of removing designated areas from jurisdiction. Instead, the bill creates a report by December 31, 2023, from the Vermont Association of Planning and Development Agencies with a proposed framework for delegating the administration of Act 250 permits to municipalities

- 10/5/5 – A large campaign attempted further changes to the 10/5/5 that would have expanded it to more of the state.

This bill also includes some additional studies and working groups we’ll discuss in the section covering off-session work.

A complete summary of the bill can be found here.

Related links:

- Long-awaited housing bills released for introduction

- HOMES Act passes first senate committee; tough road ahead

- Housing bill gets watered down in subsequent amendment

- HOME Act back and forth continues; we need your help with proposed amendment!

- Housing bill passes Senate without substantive changes to Act 250

- Housing bill discussion begins in the House

- Housing Bill conversation continues in another committee

- Housing bill has everyone’s attention

- Housing bill moves forward with some mixed feelings

- Does Vermont need a Housing Solutions Act next session?

Childcare – S.56 / H.217

A bill that started out with the promise of no family paying more than 10 percent of their household income towards childcare ironically now will increase the cost of childcare for some families due to payroll tax exposure. The final product is not the expected bill around affordability and is now a bill about stabilizing childcare providers. The year started with the delivery of the long-awaited study from RAND. The Senate took the lead with their version._

The House and the Senate came to an agreement on the policy of the bill relatively quickly, however, an agreement on the funding remained elusive.

- The Senate funded the legislation with a 0.43% payroll tax as well as reallocating the funding from the child tax credit after its repeal. (Senate version fiscal note)

- The House version funded the legislation with a large increase in the corporate and personal income tax totaling $125 million in FY 25 and growing to $171 million in subsequent fiscal years. (House version fiscal note)

In the final days of the session, the agreement of the policy only became more solid, while the agreement on the funding became more elusive. The Governor had been adamant that he didn’t want to see new taxes and identified about $50 million in base funding in his budget to double the size of childcare subsidies this year. Both the House and Senate used that and found an additional $20 million in one-time readiness grants.

In the 11th hour, the House agreed to the Senate’s funding structure, with a payroll tax of 0.44%, with at least 75% of the tax required to be paid by employers. The final language moved in H.217, a worker’s compensation bill. A fiscal note of that bill can be found here.

The childcare bill can most easily by explained as trying to do the following;

- Raising wages for early childhood education (ECE). Provider’s budgets consist of between 75 to 80 percent wages and salaries, and they will have roughly 35 percent more funding.

- That funding comes through increasing subsidies to mitigate the financial flow-through cost impact to families,

- More funding needed to pay for those subsidies, so the Legislature looked to raise taxes somewhere.

- The increased resources to ECE providers could draw more into that workforce.

The concern of many is that the increase in ECE wages will not be enough to draw workers into the field, as the prevailing wages in the broader economy are very high, many employers are competing for workers in a state that has a deficit of about 23,000 workers.

Subsidies in the bill change in the following ways;

- The income limit for full coverage moves from 150% of the federal poverty level (FPL) to 175% FPL

- Subsidies are now offered up to 400% in 2024 and the 575% 2025 percent FPL instead of the current 350 percent. (See a federal poverty calculator here.)

The bill has been speculated to be a veto target due to the payroll tax, however, it passed the Senate with 24 votes and the House with 118 which means the Legislature may be able to easily override a veto.

Related links:

- Rand report outlines nearly $300 million ask for childcare

- Senate childcare spending bill released; no revenue source identified

- Childcare discussion picks up in the Senate

- Childcare bill voted out of Senate Committee with paid leave included

- Childcare proposal receives its funding provisions; payroll tax

- Competing childcare visions on a collision course

- Money Committee looks at Personal and Corporate income to pay for childcare

- Massive corporate and personal income tax increases proposed for childcare funding

Paid Family Medical Leave – H.66

The House Democratic caucus unanimously lined up behind H.66 at the start of the session with 103 sponsors of the bill, signifying that they could override a veto where they had failed due to infighting before. Meanwhile, the Governor was already in the process of a three-part rollout of enrollment in a voluntary paid leave program that would be managed by a private, third-party administrator. Benefits for state employees become available on July 1, and open enrollment for business is available in 2024.

The House passed H.66, largely unchanged since it was first introduced, which would create the most generous paid family and medical leave program in the country, with an initial cost of $111.5 million to start and an ongoing cost of $94 million funded by a 0.55 percent payroll tax. The Senate’s leadership had expressed, even before the session, that instead of paid leave, childcare was the priority, a sentiment echoed in an interview with the Senate President Pro Tem in the final weeks of the session.

H.66 still remains in the Senate Committee on Economic Development, Housing, and General Affairs, and work will resume in the next legislative session.

Related links:

- Paid Family and Medical Leave Returns

- Paid Family and Medical Leave bill released with a veto-proof number of sponsors

- Paid family and medical leave proposal reviewed in the House

- House committee passes most generous paid family leave bill in the country

- Childcare bill voted out of Senate Committee with paid leave included

- Paid Family and Medical Leave voted out of House Committee

- House, Senate, and Governor all have different, competing visions for paid leave

Problematic Labor Bills – S.102 & S.103

Business advocates were caught slightly off guard when two massive labor bills were introduced about six legislative days before the crossover deadline. As introduced, these bills were a package and much broader, including items such as ending Vermont’s status as an at-will employment state, a massive severance pay package, prohibition on electronic monitoring, a ban on noncompete agreements, and raising the minimum wage. S.103 passed with only provisions around equal pay protections, an end to the severe and pervasive standard, and a prohibition of no rehire provisions. S.102 did not make it to the final passage.

S.103

The two areas of concern in this bill are;

Confusing discrimination language for employers and employees to work with – Broadly, the changes to existing language around discrimination in this bill are problematic because it redefines harassment as one event rather than what exists under case law now; one severe event OR a series of pervasive events. The bill would now say that it need not be severe or pervasive, which has multiple negative impacts. This bill could effectively make the courts and the Attorney General’s Office a central human resources department because a single incident will trigger litigation when it should trigger HR intervention, while the language around the petty slight and trivial inconvenience is too vague and could trigger a great deal of litigation that would be very difficult. This proposal also puts employers at risk because they are responsible for an employee’s single incident – under severe or pervasive, there is the ability for the employer to intervene.

Banning no-rehire provisions in the settlement of litigation hurts everyone – Legislators in the House heard from attorneys representing employees and employers that provisions designed to prevent the rehiring of an employee after the settlement of a lawsuit should not be banned as they serve an important purpose for each side. The genesis of this proposal is an underlying assumption of advocates for this bill that there is a coercive nature of these agreements when in reality, it is part of a negotiation between two parties represented by legal counsel and crafting an agreement that best serves their needs. Additionally, often if the original issue has proceeded to this point, the relationship is completely unsalvageable.

This bill also creates equal pay protections. This bill has passed the House and Senate in an agreed upon version, however, a last day time issue prevented it’s final passage. This will likely be finalized in a veto session. While it is possible that this could be vetoed, it is more likely that the Governor will reserve the veto pen ink for larger priorities.

S.102

The Lake Champlain Chamber joined the House Committee on General and Housing to share perspective on the litany of issues with S.102, which prevents “captive audiences” in which an employer can compel an employee to attend a meeting on issues perceived as political or religious. The legislation is aimed at making it easier for unions to form by preventing employers from holding meetings in which they share their perspectives on how unionization can change the workplace. The bill can also be construed and potentially used by employees that do not want to participate in meetings that involve topics they deem political, such as those around diversity, equity, and inclusion (DEI) or environmental, social, and governance (ESG) metrics.

LCC explained that the preemption that this bill is in contention with is already being challenged in court by Florida and Connecticut. Connecticut has a law they passed that is very similar to the one proposed in Vermont, while Florida tried to enact a law that would stop employers from hosting training such as DEI training. This exemplifies how trying to regulate speech is a double-edged sword that creates unintended consequences.

The bill also creates the ability for unions to form new bargaining units without a full election and instead collect petitions signatures from 51 percent of the employees in a process called “card check.” LCC walked the committee through examples of how this seemingly harmless proposal is like allowing politicians into the polling place and to look over a person’s shoulder while they fill out their ballot, or worse yet, how some employees could be purposely excluded from the conversation.

The Committee gained an idea of how complex and difficult this legislation is and will postpone further work on the bill until next year. The bill did pass the Senate, and work will resume next session in the House Committee on General and Housing.

Related links:

- Senate Economic Committee looks to end “at-will” employment, raise minimum wage, and more

- Problematic bill would end at-will employment, create severance pay, and more

- Bill creates confusing and problematic definitions of harassment and discrimination; would unnecessarily ban important employment agreements

- Problematic labor bills advance

- Problematic labor bills continue to move

- One problematic employment bill stalled, and another continues to move

VEGI – H.10 & S.94

At the outset of the legislative session, Vermont’s sole economic growth program was threatened with the introduction of H.10, which would have effectively destroyed the Vermont Economic Growth Incentive Program (VEGI). The VEGI program is designed to give participants of the program installment payments over four years, which are a pre-agreed-upon portion of the tax liability they’ve already paid if the company reaches their employment and capital investment goals. If, in any year, the awardee doesn’t hit the target, they don’t get any funds. This is why many who support the program make the case that “there is no such thing as a failed VEGI application.”

Criticism of the program falls into a few categories. Some rely heavily on the impossible concept that applicants or participants in the program might have received funds from the program after failing to hit growth targets by conflating a notice of agreed-upon future incentives with actual incentives. Others doubt that the program is needed and doubt that the economic growth would not happen “but for” the incentives. Still, others just don’t like the program and don’t trust its administration. And finally, some feel that it is unneeded with such a low unemployment rate.

The program has a sunset that needs to be extended, or it would end after this year, so a VEGI bill not passing was not an option. The House Committee on Commerce and Economic Development backed off the more aggressive language and had a new draft, which sought to extend the sunset of the program and have a third party evaluate the program and other options for economic development incentives. That solution was short-lived, however, when the bill missed a crossover deadline, and H.10 was then wrapped into S.94, a bill that was originally just the extension of the Barre TIF district.

S.94 didn’t move fast through the House either, and when it finally arrived in the Senate, it left the Senate Finance Committee only a few legislative days. Due to this, the language that was urgent and the committee had time for was pulled into the miscellaneous tax bill. The Senate passed a one-year extension of the VEGI program in that legislative vehicle.

Related Links:

- Vermont’s Sole Economic Growth Program Threatened

- Davis & Cioffi: there is no such thing as a failed VEGI application

- Bill on VEGI continually debated

- House Commerce still pondering VEGI revisions

- Lawmakers Won’t Overhaul State Job Program, Order Study Instead

- VEGI and TIF Bill moves

Small Group Insurance Markets – S.54

This legislation allows the continuation of the bifurcation of the individual and small group markets first made possible during the pandemic. The division of these two markets helps keep down the cost of health insurance for businesses while federal subsidies play the role the business plans usually cover by subsidizing the individual plans market. This is a fantastic win-win situation that will require further attention as we approach 2025.

This bill has already been signed by the Governor and went into effect as Act 7.

Workforce Development Bill – H.484 & H.482

The workforce development bill had trouble making deadlines and therefore was wrapped into the budget bill. The House passed $41 million in funding to various ends to support the Vermont economy, which can be seen in this summary by the Joint Fiscal Office. The Senate scaled back only a few items.

Some items of note are;

- Vermont Training Program – Section 19 appropriates $5 million from the General Fund in the fiscal year 2024 to the Vermont Training Program to fulfill Vermont’s obligation to procure incentives in accordance with the Produce Semiconductors for America (CHIPS) Act.

- Small Business Technical Assistance – Section 30 appropriates $1.25 million from the General Fund in the fiscal year 2024 to ACCD to establish the Small Business Technical Assistance Exchange, established in Section 29 of the bill, to provide grants of no more than $5,000 per business for technical services.

- Rural Industry Development Fund – Section 36 creates the Rural Industry Development Grant Program, which will provide grants through local development corporations for business relocation and expansion efforts. It establishes the Rural Industry Development Grant Fund for this purpose. Grants shall not exceed $1 million or 20 percent of the total project cost. Section 37 transfers $10 million from the General Fund in the fiscal year 2024 to the Rural Industry Development Grant Fund.

H.452 brings the state into alignment with federal requirements and harmonizes current practice with Vermont statute. You can read a summary of that bill here.

Something of note, the funding for the Vermont New and Remote Worker program, which has gained national attention for incentivizing people to move to the state, was scrapped in the budget. The program has been a favorite of the Senate for the last few years while the House questions its true utility.

Related links:

- Governor Scott Gives his Inaugural Address; highlights workforce gap

- Workforce Development Bill nears final approval

Unemployment and Workers’ Compensation – H.217 & H.55

H.217 and H.55 both started out in House Commerce and Economic Development and were merged to fit in H.217. Near the end of this bill’s journey, the House Committee on Appropriations sought to use this as a vehicle to move their version of the childcare bill when the two bodies were at loggerheads.

Workers’ Compensation Changes:

This bill makes numerous somewhat minor changes to the unemployment and workers’ compensation programs.

- Removes the sunset on current law that allows for a workers’ compensation claimant to object to a discontinuation of benefits notice and seek an extension of benefits for 14 days while the objection is reviewed by the Department of Labor.

- Parameters around work search requirements for those who are temporarily disabled.

- Increases dependent benefit for total disability benefit

- Clarifies cost of living adjustments

- More miscellaneous that can be found here

Every year, the legislature needs to set a rate for the surcharge on workers’ compensation rates for the Workers’ Compensation Administration Fund, which creates another must-pass bill with implications for how businesses serve their employees in the state. This year’s legislature will make it so that in the event that the General Assembly does not establish the rate shall remain unchanged from the prior fiscal year.

Unemployment Changes:

H.55 sought to make changes with large implications and instead now studies them in H.217. The bill contains;

- Changes to provide more inclusive terms for families in the unemployment insurance program.

- Requires nonprofit employers with fewer than four employees will be required to provide unemployment insurance

- Requires the Vermont Department of Labor to work with stakeholders to conduct outreach on the differences for nonprofits between being reimbursable or contributing employers in the unemployment system.

- Studies expanding the unemployment system to include instances of individuals leaving an employer for issues of family or personal needs.

Related links:

Dram Shop Law & Liquor Liability – H.288

Vermont has for some time had higher rates of insurance for liquor liability, however, this has recently boiled over to a level in which some businesses with third-class liquor licenses have found themselves uninsurable or paying extremely high rates. The International Organization of Standards (ISO) rates state’s on a scale of 0-10 based on their risk of insuring due to the state’s liquor laws, and insurers/actuaries then use that rating to set insurance premiums for businesses. A rating of 10 means the state has very strict liability. Vermont and Alabama are the only two states that have a rating of 10. Six states have 0 ratings, with the majority of other states falling equally between those extremes.

Most states establish liability on negligence, while Vermont establishes liability on strict liability, meaning that the defendant is liable for damages even if he or she was not negligent or at fault.

The legislation also requires all proprietors of businesses with a liquor license to acquire liquor liability insurance. The bill passed out of Committee unanimously and represented changes beneficial to Vermont businesses. It is estimated that this could lower VT’s ISO rating from its current 10 (the highest it can be) to something closer to a 7.

- H.288 addresses our state’s strict liability statute and creates accommodation for when those serving have followed their duty to the letter of the law.

- The bill also restricts the chain of liability not to include landlords while also creating a requirement for the landlord to be notified of violations.

- Finally, the bill creates a requirement to hold liquor liability insurance. The Department of Liquor and Lottery (DLL), in consultation with the Department of Financial Regulation, will adopt rules governing minimum policy requirements, including coverage amounts, for liquor liability insurance. In the future, prior to the issuance or renewal of a liquor license, DLL will require each licensee or applicant to carry liquor liability insurance that meets the minimum coverage requirements they adopt.

H.288 has passed both the House and Senate and is on its way to the Governor.

Related links:

- House Judiciary Committee takes up Vermont dram shop law issues

- Legislators look to lessen liquor liability to address insurance issues

Miscellaneous Alcohol Bill – H.470

This year’s miscellaneous alcohol bill makes numerous changes, as listed below.

- Increases the annual limit on fourth-class licenses allowing the Board of Liquor and Lottery to grant up to a combined total of 20, instead of the current 10, a manufacturer or rectifier.

- Made amendments to sampling and event permits

- Extends the sunset on the sale of alcoholic beverages for off-premises consumption or, as it’s commonly called, alcohol to-go, and tasks the Vermont Department of Liquor and Lottery with, in consultation with other stakeholders, with studying and reporting on the public safety impacts of the sale of alcoholic beverages for off-premises consumption with any recommendations for legislative action..

- Replaces the term “cider” with “hard cider” in the Vermont statute when referring to alcoholic beverages.

- Numerous other changes can be found here.

H.470 passed both the House and Senate and is on its way to the Governor.

Related links:

VT Saves Retirement Program – S.135

The VT Saves Program creates a public option for employees without a retirement plan offered by their employer as a follow-up to the Green Mountain Secure Retirement Plan established by statute in 2018 that was unable to get off the ground. Under the program;

- Employees contribute 5% of their income to a retirement plan administered by a public sector company facilitated by the Vermont State Treasurer.

- The program is an opt-out program.

- An employer with more than five employees to register the employee’s decision to opt-in or opt-out with the Treasurer.

- Employers are prohibited from contributing to the plans under federal regulations.

- The program will be rolled out first to employers with more than 25 employers in 2025 and those who have more than five employees in 2026.

H.135 passed both the House and Senate and is on its way to the Governor for signature.

Related links:

Proposed Expansion of Auditor’s Power to State Contractors – S.9

S.9, was a bill that sought to dramatically expand the State Auditor’s authority to audit private employers who have state contracts. The bill was so sweeping that the auditor could request information about the pay of individual employees of the employer; in fact, the inability of the Auditor to do so was the genesis of the legislation.

There are three main things to understand about this issue;

- The Auditor’s role is to audit the state agencies, which includes the contracts they manage, however, any auditing of the contractors should be a review of their interaction with the state agency according to the terms laid out in the contract. This proposal represents a major departure from this authority.

- If the Auditor feels that the state agency is doing a poor job managing contracts, the Auditor should bring that first to the state agency. The auditor should be working through the agency that is contracting with the vendor if the auditor wants to identify new information reported related to the vendor’s performance or improvements in oversight.

- Because of this additional layer of state government and allowing for new performance criteria after the contract is signed, it will likely have had a chilling effect on the number of bids for state contracts in a state that already has a difficult business environment.

This bill still sits on the wall in the House Committee on Government Operations and Military Affairs, where they may possibly resume work next year. If you have a state contract or hope to someday offer a service to the state, and you have concerns about this legislation, please reach out to us.

Related links:

- Proposed bill would give unfettered access to internal workings of state contractors

- Senate Committee passes bill giving State Auditor authority over state contracts

- Bill expanding auditor’s authority gets its committee time

- State auditor’s powers remain limited as legislation lingers in committee

Safe Storage of Firearms – H.230

It may seem strange to hear a chamber weigh on a bill such as H.230 given neither a history of weighing into conversations around laws with regards to firearms nor a deep bench of expertise on the matter, however, what the Lake Champlain Chamber does have is a membership that is deeply concerned with a recent rash of gun violence in our community and an imperative to do something to curb this disturbing trend.

In the early fall, LCC pulled together an ad hoc public safety committee of our Board of Directors to put forth policy recommendations for greater public safety for our region. The end work product looked similar to that put forth by Burlington’s Mayor, Miro Weinberger, so the Board of Directors unanimously voted to adopt the Mayor’s Public Safety Priorities as the Chamber’s policy positions on public safety at their February Board Meeting.

Among the items in this 16-point plan is a component around safe storage which is what brought us to the House Judiciary Committee for testimony. Within the City of Burlington, six of the last 17 firearms seized by the Burlington Police Department in the course of investigations in 2022 were found to be stolen firearms. Safe storage is not a new policy discussion in the city or region.

In 2014, 61% of Burlington residents voted to send a charter change to the Legislature that would have required safe storage within city limits. The language endorsed by our Board also has a reporting requirement for lost or stolen firearms. Had the legislature allowed Burlington the ability to act on charter changes that voters had overwhelmingly supported, an initiative for safe storage potentially could have prevented some of Burlington’s most disturbing incidents.

While the focus of this bill is suicide prevention, LCC wanted to voice support for safe storage, Section 3 of the bill, and asked legislators to consider the impact on broader public safety. Regulations such as background checks, which President Biden expanded, and age limits are easily sidestepped if firearms are unsecured. Vermont has a long, proud history of second amendment rights with a thriving outdoor community and industry with many that use firearms responsibly, it is not an unreasonable regulatory burden to ask these individuals to ensure the safe storage of firearms to ensure the safety of their communities in a similar way than all other New England states do.

You can watch that testimony here.

H.230 passed both the House and Senate, however, speculation is that it may be the target of a veto.

Related links:

- LCC Board endorses public safety policy agenda

- LCC Weighs in on safe storage of firearms

- Learn more about these items in our Live @ 5:25 segment with Mayor Miro Weinberger.

“Homeless Bill of Rights” – H.132

The House Committee on General and Housing heard some initial testimony on and discussed H.132, a bill creating a “homeless bill of rights.” The bill adds “perceived housing status” to the list of immutable characteristics protected by law and sets forth that no law or ordinance should “penalize the individual engaging in harmless activities that are associated with homelessness,” which is a vague enough term that could include many different things to many different people.

Witnesses testifying in support conceded that the legislation would likely not do much to support the population, however, concerns in the past have centered on the legislation making it more difficult to handle poor behavior in Vermont’s downtown areas, especially when that behavior might be attributed to a “perceived” status.

The Committee heard from the Burlington Business Association and the Lake Champlain Chamber on the atmosphere and strained relationships that have become apparent in downtown Burlington as well as other more densely populated areas in the state. It was made clear in testimony that the business community had a deep level of empathy for this community and is leaning into solutions based on that instead of draconian measures seen elsewhere in the world that would create a wedge. The Lake Champlain Chamber identified the crux of the issue as the bill’s ability to be exploited by those who are not homeless yet but could make a case they have “perceived homelessness,” which paired with vague language that protects “harmless activities associated with homelessness” without defining what those are would have unintended consequences, specifically in “places of public accommodation.”

This bill remains in the House Committee on General and Housing, where it will likely be worked on further next session.

Related links:

- Homeless Bill of Rights could exacerbate community relationship rifts

- Business groups testify on the “homeless bill of rights”

Energy and the Environment

The Democratic/progressive super majority paved the way for some of the longstanding priorities of many in the predominant caucus to advance this year. Issues such as “right to repair” and the bottle bill broke through after almost more than a decade of the proposal’s persistence.

Clean Heat Standard – S.5

Now rebranded as the “Affordable Heating Act,” this is legislation from last biennium – you can read a recap of that here. The long and short of the legislation is that it failed in a veto override by one vote last year because more extreme elements of the environmental activist community pushed against the bill due to a belief that nothing should be burned for heat, including liquid biofuels and woody or nonwoody biomass. Legislators were back this year with a revised version that directs the Public Utilities Commission (PUC) to spend the next year and a half and about $1.6 million dollars on developing what can be put most simply as a cap and trade system in an attempt to lower the greenhouse gas emissions from non-transportation fossil fuels. A check-back provision in the bill requires the legislature to vote to enact the program after it is designed by the PUC but before full implementation.

Under this program, those who import fossil fuels into the state are defined as “obligated parties” and are required to reduce greenhouse gas emissions attributable to the Vermont thermal sector by retiring required amounts of tradeable clean heat credits, which they can either purchase or deliver eligible clean heat measures, to meet the thermal sector portion of the greenhouse gas emission reduction obligations of the Global Warming Solutions Act.

The legislation is seen as necessary by many due to the passage of the Global Warming Solutions Act, which created a statutory obligation for the state to meet greenhouse gas reduction goals or face potential legal consequences. The fallout of missing these goals would be that state agencies would have emergency rulemaking authority and might resort to draconian measures to meet the statutory obligations. Still, many are disappointed in the program marching forward under the banner of “heating” and “thermal” use while, through its definitions, pulling in all fuels, including “process fuels,” which will add cost to sectors such as farming, construction, and manufacturing.

Of special interest to business owners is a potential decision around how to deal with process fuels, such as those used not for heat but instead for manufacturing, cooking, or backup power. These fuels are pulled into the bill by definition, however, the PUC will need to address how they might be treated differently in a credit market.

The debate over the cost of the program was contentious, with the Secretary of the Agency of Natural Resources bringing estimates to the Legislature, suggesting that the plan could effectively add a tax of $0.70 per gallon on kerosene, heating oil, and propane and cost the state’s economy $1.2 billion to make the necessary changes.

It is difficult to estimate these costs due to so many variables as well as the fact the program ultimately would not be designed by the Legislature but rather by the Public Utilities Commission (PUC), which until now has had no experience with the entities that would be obligated parties under the legislation.

If the program sounds complicated, that’s because it is, as you can see in this infographic, which simplifies it as much as it can. In short, credits can be earned by certain activities, such as installing heat pumps, that reduce fossil fuel use. Fossil fuel dealers then have an obligation to purchase those credits or create their own.

Many in the legislature have taken the perspective that the bill is an overpriced study because, as we noted earlier, the legislation is directing the PUC to design the program but not implement it. The issue with that logic is that there is a high likelihood that whatever the PUC creates and brings back to the legislature they will likely say is too well calibrated and complicated to adjust for whatever the legislature doesn’t like, and at this future date, there will be a doubt that the state will meet the greenhouse gas targets statutorily mandated under the Global Warming Solutions Act. This will lead advocates to claim that the confluence of sunk costs and impending citizen suit via GWSA means that there is no time or ability to do anything other than accept what has been presented by the PUC. That’s just our prediction, and we did predict the outcome of GWSA correctly.

After the bill’s passage, the Governor and House Leadership trade jabs, with the Governor making good on his promise to veto the bill. The Legislature overrode the Governor’s veto by a vote of 20 to 10 ( all seven Republicans and Democratic Senators Mazza, Starr, and Wrenner) in the Senate and in the House overrode with 107 votes. S.5 now goes into law.

Related links:

- Return of Clean Heat Standard

- Cost of Clean Heat Standard estimated at 70 cents per gallon, $1.2 billion to economy

- Clean Heat Standard, now Affordable Heating Act passed by committee

- Clean Heat Standard discussion all about legislative accountability

- Senate-passed Clean Heat Standard would require a legislative vote in 2025

- Clean heat standard deliberation continues in the House

- Clean Heat Standard Passes House

- Governor and House Leadership trade jabs over clean heat standard ahead of veto

“Right to Repair” / “Fair Repair” – H.81

This legislation will need to pick up where it left off in the next half of the biennium. The “fair repair” or “right to repair bill,” has been a longtime objective of many in the legislature, with a particular emphasis on farm equipment from rural representation. The bill would require manufacturers of agricultural or logging equipment to provide parts and diagnostic tools and the necessary manuals to the owners of that equipment and independent mechanics. The bill missed the crossover deadline, however, work continued on it in the House, with the House eventually passing the legislation. The conversation will start in the Senate next year.

Related link:

The Bottle Bill – H.158

This has been a longtime priority for many in the predominate caucus over the past decade with the efforts to hold it back finally being overtaken this session. The bill restructures the redemption system by requiring beverage container manufacturers and distributors to participate in a newly formed producer responsibility organization. The organization would be responsible for creating and implementing a stewardship plan that would manage the beverage container redemption system going forward. The Agency of Natural Resources (ANR) would oversee the organization and verify stewardship plan adherence.

The bill also expands the types of beverage containers subject to deposit to include bottled still water, hard cider, and vinous beverages, with vinous beverage containers subjected to a deposit of 15 cents per container and other new container types subjected to a 5-cent deposit.

A notable future issue is that if the Secretary of ANR determines that the redemption rate goal set in statute was not met for two consecutive years, the beverage container deposit rates would increase. The maximum deposit rates would be 20 cents per container for liquor and vinous beverages and 10 cents per container for all other beverage types.

This bill almost passed the legislature, however, got hung up in procedure in the House. While it could likely be a veto target, this legislation was passed with an astounding 115 votes in the House, however, only garnered 19 votes in the Senate, meaning a veto could be sustained.

A Fiscal note can be found here

Banning Substances in Cosmetic, Menstrual Products, and Textiles – S.25

S.25 sought to regulate cosmetic and menstrual products containing certain chemicals and chemical classes and textiles and athletic turf fields containing perfluoroalkyl and polyfluoroalkyl substances.

- Cosmetic and menstrual products manufacturers, suppliers, and distributors are prohibited from intentionally adding the listed chemicals or chemical classes to any amount in their products. The prohibited chemicals include Ortho-phthalates, PFAS, Formaldehyde and formaldehyde-releasing agents, Methylene glycol, Mercury and mercury compounds, 1, 4-dioxane, Isopropylparaben, Isobutylparaben, Lead and lead compounds, Asbestos, Aluminum salts, Triclosan, m-phenylenediamine and its salts, and o-phenylenediamine and its salts.

- Textiles would not be able to be manufactured, supplied, or distributed if they contain regulated PFAS that have been intentionally added in any amount.

The bill could be problematic for a myriad of Vermont businesses, including but not limited to the state’s outdoor industry, which requires the use of these textiles. The proposed legislation passed the Senate and now sits in the House Committee on Human Services, where work will likely resume next year.

The Laundry List

-

Catalytic Converter Bill – S.48

- This bill passed both the House and Senate and seeks to limit the number of catalytic converters that a person can transport at once or sell to a scrap metal processor per day unless they run a business repairing or recycling vehicles or have the documentation they own them.

-

Hazardous Household Waste – H.67

- H.67 covers the sale and disposal of products that contain hazardous household waste (HHW) in Vermont. The legislation requires manufacturers of such products to participate in a stewardship organization that implements an approved collection plan. Currently, products sold in the state contain hazardous substances and require special treatment in our state’s solid waste management entities to hold special events for the collection of this waste or set up permanent special facilities infrastructure. This program aims to address this current cost which could be as high as $2.2 million per year. This bill has passed an is on it’s way to the Governor.

-

Privacy Bill – H.121

- The House Committee on Commerce and Economic Development had an interest throughout the entire session in restricting the use of individuals’ private data, however, they grappled with what model to follow and how to strike the best balance. The Chairs and some members of the Committee wanted language that is being used in Connecticut with no entity-level exemption for more of a regional approach. Many of the Committee members want the language that Attorney General Charity Clark more favors California’s version with no entity-level exemptions and a private right of action. The Committee plans to use some of the time during the veto session to work on the legislation and has been given permission to hold meetings on the subject before the next session.

-

Telecommunications Permitting (248a) Sunset – H.110

- H.110 was passed and extends the sunset of Section 248a for three years. On or before January 15, 2024, the Commissioner of Public Service in consultation with the Public Utility Commission, shall report on the process of citing telecommunications facilities under 30 V.S.A. § 248a. The report will address how to make the process easier to participate in for municipalities and individuals, how to encourage municipal participation and recommend any necessary updates.

-

Office of Professional Regulation Bill – H.305

- The Office of Professional Regulation requested in H.305 an increase in fees that have not been updated for a long time as the office is running a deficit. The revenue generated by professional licensing fees would increase by an estimated $3.5 million biennially, and revenues generated by corporation fees would increase by an estimated $1.8 million annually. Fiscal note here. This bill has passed and is on its way to the Governor.

-

Legislative Pay – S.39

- A topic of discussion for some time has been if legislators are receiving the proper remuneration for the work that they do, and if they were, could the Legislature looks more representative? A VTDigger series gives context to legislators’ employment and income in this session and some credibility to the concept. S.39, as passed, nearly doubles legislative salaries, makes them eligible for state health insurance, and makes reimbursement of legislators’ expenses slightly more generous.

Links to Past Updates

- week 1

- week 2

- Join us for our Legislative Breakfast

- Paid Family and Medical Leave Returns

- Vermont’s Sole Economic Growth Program Threatened

- Return of Clean Heat Standard

- Governor Rolls out BAA, More to Come

- Prospective Property Taxes Rates a Pain Point for Legislators

- Legislators, Governor, Mayors Set Stage on Public Safety

- The Laundry List

- week 3

- week 4

- Register for our first legislative breakfast before February 2nd

- Paid Family and Medical Leave bill released with a veto-proof number of sponsors

- Proposed bill would give unfettered access to internal workings of state contractors

- Committee reviews report on potential sports betting in Vermont

- Unique bill creating a federal tax break for Vermont businesses introduced

- The Laundry List

- week 5

- Our Legislative Breakfast is this Monday!

- Budget Adjustment Act passes house

- Senate childcare spending bill released; no revenue source identified

- Paid family and medical leave proposal reviewed in the House

- Cost of Clean Heat Standard estimated at 70 cents per gallon, $1.2 billion to economy

- Report on Universal School Meals funding suggests taxing the internet, sugar, or sales tax increase

- House Commerce hears proposed costly changes to the unemployment insurance system

- LCC Joins Mayor, Community Leaders in Opposition to Question 7

- The Laundry List

- week 6

- week 7

- Childcare discussion picks up in the Senate

- Unemployment Insurance legislation mostly finalized in House Commerce

- Bill on VEGI continually debated

- Vermont gets a C grade on its infrastructure

- LCC Board endorses public safety policy agenda

- House committee passes most generous paid family leave bill in the country

- Clean Heat Standard, now Affordable Heating Act passed by committee

- The Laundry List

- week 8

- Join us for our next legislative breakfast on March 13th

- HOMES Act passes first senate committee; tough road ahead

- Governor calls for local match for federal infrastructure funds

- House Commerce still pondering VEGI revisions

- Senate Committee passes bill giving State Auditor authority over state contracts

- Join Us for Visitor Economy Day in the State House

- Senate Economic Committee looks to end “at-will” employment, raise minimum wage, and more

- House Judiciary Committee takes up Vermont dram shop law issues

- Clean Heat Standard discussion all about legislative accountability

- The Laundry List

- week 9

- Join us on March 13th for our legislative breakfast

- Quick Updates

- Problematic bill would end at-will employment, create severance pay, and more

- Bill creates confusing and problematic definitions of harassment and discrimination; would unnecessarily ban important employment agreements

- Senate-passed Clean Heat Standard would require a legislative vote in 2025

- Participate in town meeting day and connect with your legislators

- The Laundry List

- week 10

- Childcare bill voted out of Senate Committee with paid leave included

- Paid Family and Medical Leave voted out of House Committee

- Housing bill gets watered down in subsequent amendment

- Join us for Tourism Day this coming Wednesday!

- Problematic labor bills advance

- Check-in on liquor legislation

- LCC Weighs in on safe storage of firearms

- The Laundry List

- week 11

- Childcare proposal receives its funding provisions; payroll tax

- House, Senate, and Governor all have different, competing visions for paid leave

- We had a fantastic tourism day at the Vermont State House

- HOME Act back and forth continues; we need your help with proposed amendment!

- Workforce Development Bill nears final approval

- The Laundry List

- week 12

- week 13

- Housing bill discussion begins in the House

- Homeless Bill of Rights could exacerbate community relationship rifts

- Committee advances cloud tax; looks to tax other services

- “Right to repair” bill advances too late for this session, conversation alive

- Clean heat standard deliberation continues in the House

- Senate gives green light to municipalities to implement their own local option tax

- The Laundry List

- week 14

- week 15

- Housing bill has everyone’s attention

- Business groups testify on the “homeless bill of rights”

- House committee continues to attempt to erase severe and pervasive standard

- Money Committee looks at Personal and Corporate income to pay for childcare

- Clean Heat Standard Passes House

- VTDigger series gives context to legislators’ employment and income

- The Laundry List

- week 16

- The gaps that still need to be closed

- Massive corporate and personal income tax increases proposed for childcare funding

- Bill expanding auditor’s authority gets its committee time

- Governor and House Leadership trade jabs over clean heat standard ahead of veto

- Problematic labor bills continue to move

- Questions on the VT Saves Retirement program answered

- The Laundry List

- Week 17

- The road to adjournment

- Housing bill moves forward with some mixed feelings

- Does Vermont need a Housing Solutions Act next session?

- Childcare bill is still being discussed in the money committee

- One problematic employment bill stalled, and another continues to move

- Bill covering VEGI and TIF passes House