Thank you to this week’s sponsor of our Advocacy Update:

April 7th, 2023

The Legislature is working towards adjournment, with only about 14 legislative days left for the Senate’s morning committees to finish their business before shutting down. Traditionally, that puts the adjournment about two weeks after or around the 12th or 13th of May this year, however, the discussion is starting to foreshadow a slightly later adjournment.

As we’ve highlighted in previous updates, this session is unprecedented in a number of ways. It has the largest class of first-year legislators in history, and it likely also has the highest number of new committee chairs the Legislature has ever seen. These circumstances necessitated legislative work to start much slower than a typical session, leaving less time for deliberation of massive legislative changes. Despite this, the Legislature is looking to tackle and tame numerous thorny issues that the seasoned legislatures before them have not been able to address, such as housing, childcare, and paid family medical leave, just to name a few.

As if this weren’t enough, the House, Senate, and Governor could not be far enough away from each other in the positions they’ve staked out on nearly every issue thus far. These are just a few glaring examples of the divisions between the two bodies, and with much deliberation still ahead on items such as the HOME Act, we haven’t seen the full chasm yet.

In this week’s update:

- Housing bill discussion begins in the House

- Homeless Bill of Rights could exacerbate community relationship rifts

- Committee advances cloud tax; looks to tax other services

- “Right to repair” bill advances too late for this session, conversation alive

- Clean heat standard deliberation continues in the House

- Senate gives green light to municipalities to implement their own local option tax

- The Laundry List

Housing Bill Discussion Begins in the House

The House Committee on General and Housing began their work on S.100 as passed the Senate though the Chair of that committee made clear that there would be a bifurcated jurisdiction on the bill with House General primarily focused on housing programs and House Environment and Energy taking on the regulatory side.

We need you to reach out to your Representative(s) and encourage them to add substantive relief from Act 250 into the legislation. You can find your representatives here.

Here are some good talking points;

- S.100 is a great bill, however, it is less effective without meaningful relief from Act 250!

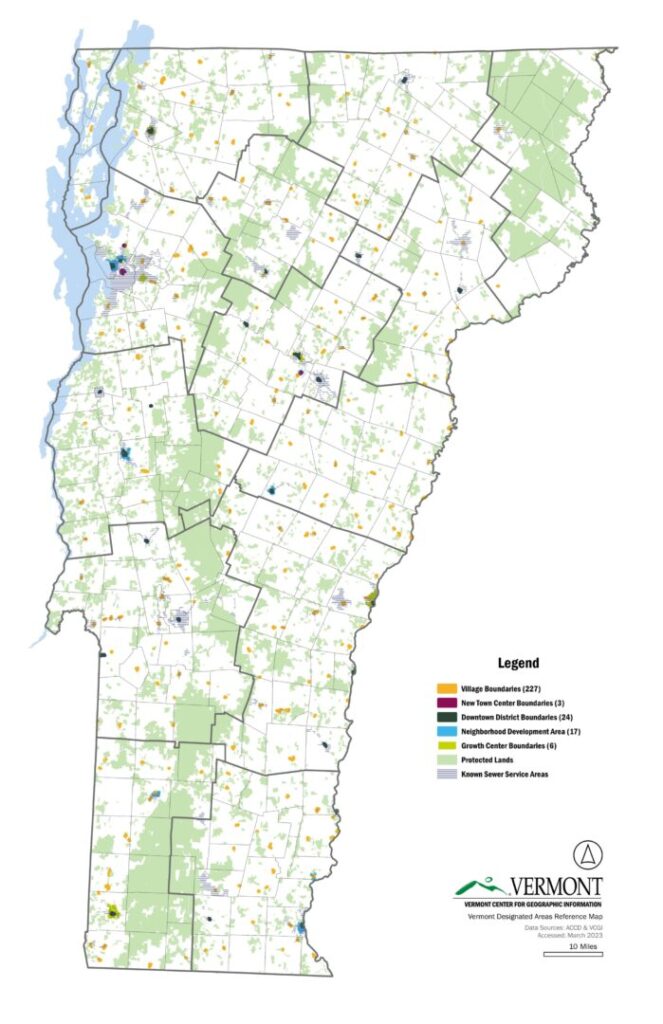

- Designated areas represent about 0.3% of the state’s land, and within those areas, the increase of the trigger to 25 will be relatively inconsequential – we need relief from this restriction in more areas than this.

- In a recent poll done by UNH, housing is the number one concern for Vermonters.

- About 55% of the state has planning/zoning and subdivision, which are suitable places to have a 25-unit trigger for Act 250. These communities can use these changes in a sustainable way to provide the housing they desperately need.

- We do not have time for further studying of the issues, we need action now.

If you have any questions about these issues, please feel free to reach out.

A side-by-side of the bill can be found here.

The legislative text of S.100 as passed by the Senate can be found here.

House General Committee Discusses Homeless Bill of Rights

The House Committee on General and Housing heard some initial testimony on and discussed H.132, a bill creating a “homeless bill of rights.” The bill adds “perceived housing status” to the list of immutable characteristics protected by law and sets forth that no law or ordinance should “penalize the individual engaging in harmless activities that are associated with homelessness,” which is a vague enough term that could include many different things to many different people.

Witnesses testifying in support conceded that the legislation would likely not do much to support the population, however, concerns n the past have centered on that the legislation making it more difficult to handle poor behavior in Vermont’s downtown areas, especially when that behavior might be attributed to a “perceived” status. The prevailing plan is to add this legislation to the HOME Act upon the Committee’s completion of that legislation, which would make the broadly supported HOME Act more contentious.

If you have thoughts on this matter, please reach out to LCC’s advocacy team at [email protected].

Committee Advances Cloud Tax; Looks to Taxing Other Services to Pay for Childcare

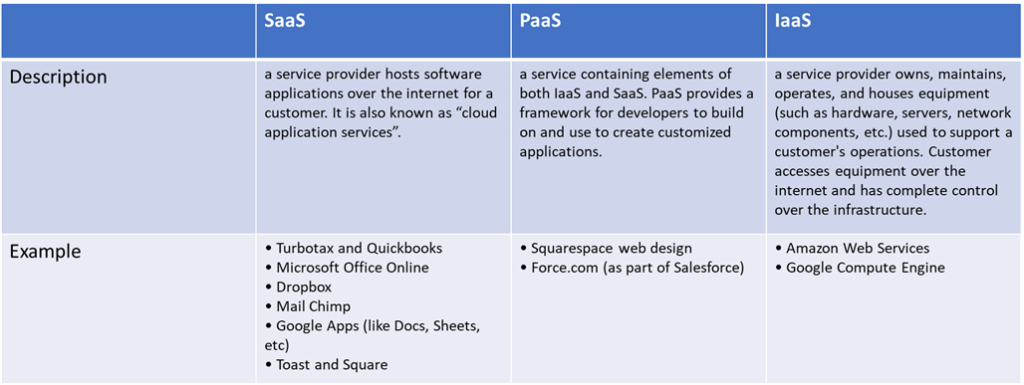

The House Committee on Ways and Means, while working on a Senate-passed S.93, which would exempt wood boilers from the sales tax, an amendment that would tax internet services not already taxed in Vermont, often referred to as a “cloud tax.” The amendment would repeal the current exemption on “pre-written software accessed remotely,” The Committee’s intention is to tax all types of software, including software as a service, platform as a service, and infrastructure as a service (understand these distinctions better here).

The Committee then pivoted to discuss the tax of services broadly in anticipation of a discussion of funding S.56, the childcare bill. The Committee was presented with an overview of what few services are already taxed in Vermont and a history of taxation of services.

Right to Repair Bill Moves Out of Committee Too Late

The House Committee on Agriculture passed H.81 a “fair repair” or “right to repair bill,” which would require manufacturers of agricultural or logging equipment to provide parts and diagnostic tools and the necessary manuals to the owners of that equipment and independent mechanics. The bill missed the crossover deadline, so it may be a conversation that continues into the next session, however, there are paths forward for legislation that has missed crossover.

VT Saves Retirement Program Passes the Senate

The VT Saves Program passed the Senate, creating a public option for employees without a retirement plan offered by their employer. Such employees could contribute 5% of their income to a retirement plan administered by a public sector company, facilitated by the Vermont State Treasurer. The program is an opt-out program and would require an employer with more than five employees to register the employee’s decision to opt-in or opt-out with the Treasurer. Employers are prohibited from contributing to the plans under federal regulations. The program will be rolled out first to employers with more than 25 employers in 2025 and those who have more than five employees in 2026.

Clean Heat Standard Still Under Deliberation in the House

The House Committee on Environment and Energy is continuing its work on S.5, the clean heat standard. The Committee was presented with a draft short-form amendment that was the product of work by Associated Industries of Vermont, the Lake Champlain Chamber, and others seeking to do a few things. First, it would be sure to make clear to the Public Utilities Commission that “process fuel” users in the industrial space affected by the program receive assistance and credit for efficiency measures. Second, it would allow for some interim efficiency from fuel switching. Three, it seeks to place a ceiling or some manner of cost containment such that the cost of credits does not push fuel prices unreasonably high.

Bill Would Give All Municipalities Immediate Tax Authority

Local government nerds will know that Vermont is what’s referred to as a Dillion Rule state which means that the powers of local municipal government have to be expressly granted to municipalities. This is why Vermont has its charter change process by which if a town wants to levy a local options tax on sales or rooms and meals the town must first bring the tax before voters as a proposal and, if successful, bring that proposal to the Legislature for approval. S.60 represents a major change in municipalities’ relationship with the state as it removes the need for the town to bring the proposal approved by voters to the Legislature for approval. The legislation would not circumnavigate the need to have voters of a municipality approve the change, it would only mean that the conversation on town meeting day is the final say.

In the past, the Legislature has exercised power over charter changes to prevent local options taxes. Most notably, at one time, South Burlington sought to levy a local options tax on rental cars, the vast majority of which are based in that municipality, given the presence of the state’s largest airport. Legislators prevented the passage of that charter change due to that concern.

The Laundry List

There are many moving pieces, and we do our best to add the ones that don’t get a section in the newsletter yet should be on your radar here. On any given day in the State House, there are about 175 hours of committee time outside of floor time, and then the hallway, cafeteria, or other time spent legislating.

- Read past updates here – week 1, week 2, week 3, week 4, week 5, week 6, week 7, week 8, week 9, week 10, week 11, week 12, and the last session’s wrap-up.

- The House Ways and Means Committee moved the language in the stalled bill H.10, which was sent to them by the House Committee on Commerce and Economic Development and represents a considerable amount of work on the Vermont Employment Growth Incentive program. The committee added the language of H.10 to S.94, a bill extending the Barre TIF district.

- The Senate passed S.25 banning PFAS found in cosmetics, toiletries, athletic turf, and textiles. The bill includes exemptions for textiles used in extremely wet conditions and personal protective equipment.

- The House Committee on Commerce and Economic Development took up S.48, a bill aimed at curbing the theft of catalytic converters, which received considerable support from a metal recycler and law enforcement in testimony.

- The Senate Committee on Judiciary took up for initial consideration H.288, which makes changes to liability language in Vermont Dram Shop law to help bring down the extremely high cost of liquor liability insurance in Vermont.

- The House Committee on General and Housing took up S.103, one of two problematic labor bills that have moved this session.

- As we’ve covered before, JFO reported this session that Vermont’s population is rapidly aging; well, a story by Digger outlined that the population is also not growing despite the narrative that the pandemic has drawn many people to stay within our borders.