Thank you the sponsor of our final Advocacy Update:

The Legislature adjourned sine die on Thursday, May 12th in the early evening, concluding the 2022 session and the 2021-2022 biennium. The House did not set a veto session, so it will be up to the Governor to call the legislature back if a veto necessitates one. At one point in the session, we opened one of our updates by noting that this would be a very consequential session given the enormity of the budget, the federal funding sugar high, the retirements, the coming election, the redistricting, the proposals that set priorities for decades, and the impending “tax avalanche” for the future session in 2023. Indeed, it was a very consequential session with a legacy of “a great reshuffling.”

Retirements

- More than one-third of the Senate (12 confirmed) is retiring, a previously unseen level of departures in that body which will mean a large loss of institutional knowledge. More than half of the chairs in the House, with the running total at nine, are retiring among the over 40 members of the House moving on. Outside the legislature, there are equally consequential vacancies in the positions of Lt. Governor, Secretary of State, and Treasurer. There will also be a new Senate Pro Tem next session.

Large budget

- At $8.3 billion, we just witnessed the largest budget in state history as it allocates what is left of the federal COVID relief dollars from the American Rescue Plan Act (ARPA).

All the federal dollars

- All the federal money is gone, more isn’t coming, and if it was, could we land the small state minimums that Senator Patrick Leahy was notorious for bringing home?

Vetoes

- The Governor brandished the veto pen throughout the session and delivered some high-profile vetos. In total, there have been 26 from him since he became Governor; however, it has not had the impact on his popularity the Democrats expected, and seems to have only propelled him.

Redistricting

As folks leave the legislature, some headed out for reelection and some for a new, higher office, many will be campaigning in new districts.

We covered seventeen weeks of this session in detailed updates, and in an attempt to make the update shorter, we may link back to previous updates for more details. Here are links to our past advocacy updates from this legislative session: Week 1, Week 2, Week 3, Week 4, Week 5, Week 6, Week 7, Week 8, Week 9, Week 10, Week 11, Week 12, Week 13, Week 14, Week 15, Week 16, and Week 17. You can also find a summary of the 2021 legislative session here, which we also link to for additional context.

We could write pages on each of these sections; however, we have done our best to make this final update as concise as possible. If you want more information on any of these sections, please reach out at [email protected] or schedule an appointment using this link. Finally, we work hard to keep you up to date with the latest from Montpelier each week, so if you have suggestions on how to make the updates better next year, or any other feedback, drop us a note

Table of Contents

Economic, Workforce, Business, and Employment Issues

Routinely, we have many bills in this section; however, this year, there is most work from the economic committees is in one large omnibus bill carrying many of the issues that would typically flow separately. Not only that, issues that in past years would have garnered a great deal of attention and taken up days of committee time, such as minimum wage or paid leave, were just tossed into the omnibus bills with minimal discussion compared to the past.

S.11 (H.159, H.703, & H.634) Miscellaneous Workforce and Economic Bill

The bill(s) faced procedural hurdles and a bit of a shell game on its long journey to a massive committee of conference. The House Committee on Commerce and Economic Development and the Senate Committee on Economic Development, Housing, and General Affairs had some rather broad gaps to close based on ideological disagreements that are longstanding. On workforce, the Senate wanted to “fill the bucket,” while the House was focused on “plugging the bucket.” The reality is we need both, however, there is only so much funding. The final bill included $99 million in appropriations, with a thorough (though not exact) breakdown of those appropriations available here.

What’s in the bill:

VEDA Loan Program – $19 million

After the economic recovery bridge grants developed last session proved to be cumbersome in their application for many businesses, the legislature needed to reconsider how to best deliver relief to hard-hit businesses forced to close or dramatically crucial their operations by government mandates to protect public health. The Administration put forward a proposal to have the Vermont Economic Development Authority (VEDA) administer a program that will give loans to qualifying businesses that then convert to grants.

To be eligible for a grant, an applicant can show a 22.5% loss in its adjusted net operating income in 2020 and 2021 combined compared to 2019. Further, at least 50 percent of the reduction in net operating income must have occurred in 2021. The loans have a cap of $350,000.

Stay tuned for more details about how to apply for these forgivable loans.

COVID Paid Sick Leave – $16.5 million

S.11 establishes a new program in the Department of Financial Regulation to reimburse part of the cost for employers of providing COVID-19-related paid leave to employees during the calendar year 2022. Grants may be used to reimburse employees for unpaid leave for COVID-19-related reasons and be equal to 67 percent of minimum wage or the employee’s regular hourly wage times the number of hours reimbursed, whichever is greater. The number of hours reimbursed cannot exceed the lesser of 80 hours or two times the employee’s average weekly hours. The maximum hourly reimbursement for an employee cannot exceed $27.50.

Stay tuned on further details of the program and how to apply.

Community Recovery and Reinvestment Program – 10 million in S.11 and $30 million in budget

The Administration sought to expand the Capital Investment Grant Program passed last session. While they did not see eye-to-eye with the legislature and final Treasury Guidance for the use of ARPA dollars changed the program’s direction, a final version did come to fruition. The latest version allows nonprofits and municipalities to apply.

Stay tuned on further details of the program and how to apply.

Unemployment Insurance

Last session, a final compromise was struck between legislators to add an additional supplemental benefit to unemployment insurance. When that faild to be implemented because the U.S. Department of Labor intervened, the Senate wanted to find another way to deliver it. A final compromise was ironed out in the last week to raise the maximum weekly benefit by $60 for the next three years until $8 million is expended from the UI Trust Fund.

Arts and Culture Grants – $9 million

Grants to help those in the arts, culture, and creative economies recover from the economic impacts of the pandemic.

New Relocating Employee Incentives – ~$3.1 million

The bill allocates these general fund dollars in one large tranche to the existing program with the understanding they will be used over two fiscal years. The Program no longer requires that relocating workers must work in an occupation on the Vermont Department of Labor’s list of “Occupations with the Most Openings” in its “Short Term Employment Projections 2020-2022.”

Numerous Workforce Programs

These programs range from grants for students staying in the state after graduation, assistance for professions in need, funding for vocational assessment for formerly incarcerated individuals, scholarships, and more. Read more about the entire package in this JFO breakdown here (beware that this is an approximation of the bill as it changed slightly in the final hours).

The bill also contains language that was agreed to in the final days on preventing excessive robocalls to Vermonters and a study on sports betting in Vermont.

What didn’t make it in the bill:

State and Local Tax Cap Workaround

- The Senate added to S.11 language which would create the opportunity for those who have LLCs, LLPs, or S-corporations to work around the cap on state and local taxes (SALT) established as part of the Trump Administration’s tax cut bill. We covered this in detail last week. 21 organizations, and counting, signed on to a letter to the Speaker of the House imploring the House to concur with language sent by the Senate and join the growing list of 20 other states who provide this relief to their businesses. Read more here. The House did not concur; however, we will be back next year to make our case.

Marketing Funding

- Disappointingly, the bill did not contain any funding to market the state or assist in relocation concierge services with a statewide network as previously envisioned.

Minimum Wage

- An increase of the minimum wage to $15 per hour by 2025 was included in the Senate’s version of the omnibus economic and workforce bill, which the House struck down in conference Committee. The House heard that the prevailing effective minimum wage is $17.54 an hour.

Study on Paid Family and Medical Leave

The Senate was adamant this be a portion of the bill; however, the House felt that enough studying had been done on this issue.

H.730 – Miscellaneous Alcohol Bill

This bill was a quietly contentious battle, consistently boiling at high heat throughout the session without ever boiling over into public spectacle. The passed H.730, the miscellaneous alcohol bill makes a number of consequential changes in Vermont’s alcohol distribution.

Most notably, the bill creates a new category of alcoholic drinks for retail sale called “ready-to-drink spirits beverages,” mostly referred to as “RTDs.” This legislation paves the way to take this growing market segment out of the controlled state distribution. RTDs will need to be under 12% alcohol by volume (ABV) and would be required to come in containers under 24 fluid ounces and subject them to a new $1.10 cent per gallon tax, instead of the 5% that spirits would typically be subject to.

The bill also makes changes to hard cider. Under current law, hard cider beverages pay the 55 cents per gallon vinous beverage tax. Section 28 of the bill changes this to make hard ciders with less than 7% ABV subject to the 26.5 cents per gallon malt beverage tax. This change is made effective for FY 2024.

The bill has numerous other changes, such as special event permit change, allowing attendees more freedom to wander away from the vendor space, and changes to the structure of leadership at the Department of Liquor and Lottery. The bill makes changes to background checks and the raffle tickets for third-class licenses to access rare and unique products. Direct-to-consumer language did not make it into the final version of the bill and the Committee and Department of Liquor Control are struggling with all the implications.

A major legacy of this discussion was some acknowledgment that our status might not best serve the state as a control state in which spirits and liquor need to be sold solely through the 80 statewide state-controlled stores. This was almost the subject of a study; however, along with other provisions that were pulled by the Senate Finance Committee, however, DLL can move those conversations and has expressed interest.

More about the bill’s fiscal impact and overview can be read here.

H.320 – provisions preventing continued employment after settlement of a case

H.320 sought to prohibit agreements that prevent an employee from working for an employer following the settlement of a discrimination claim similar to those the legislature passed in the last few years around sexual harassment claims. Two prominent Vermont attorneys, often on opposite sides of these types of issues, found agreement on this legislation and testified that while they want to protect individuals who file these claims, the legislation would inevitably have unintended consequences that will at best render little aid and, at worst, serve as an impediment to those it intends to serve. Others testified to this effect. That’s because both sides benefit from these provisions, and from testimony from those representing both sides, they’d like to keep these provisions. The employee in the form of a more substantial settlement and the employer in the form of finality. We think an underlying assumption of advocates for this bill is that there is a coercive nature of these agreements when in reality, it is part of a negotiation between two parties represented by legal counsel and crafting an agreement that best serves their needs. In general discussion with attorneys on this issue, the feeling is that once a relationship is broken, it’s generally broken, and people don’t want to go back anyway.

H.320 passed the House; however, the bill did not make it out of the Senate. The Senate Committee on Economic Development, Housing, and General Affairs worked on the bill in the final days, however, a promised floor amendment to add “card check” language likely kept leadership from bringing it to the floor for a tumultuous vote that would have split the caucus.

LCC sat down with our recurring employment attorney roundtable during the session to discuss this bill; you can watch that here.

We understand that these issues are sensitive, and the complicated nature of legislation such as this means that our work to find suitable solutions on legislation can be mischaracterized. If you have any questions or want to understand our position more thoroughly, we’d welcome you to reach out to us directly.

H.329 – Lowering the threshold for discrimination

H.329 attempted to do three significant things. First, it defined “harassment” such that it does not need to be severe or pervasive to be ruled unlawful, nor does it need to be compared to the treatment or outcomes of similar employees. Second, it would create a six-year statute of limitations for harassment and discrimination within housing, public accommodations, and employment, thereby codifying the existing statute of limitations for contractual damages and extending it from three to six for personal injury damages. Third, as originally drafted and intended, an employee would not need, and to some extent was encouraged not to, go through an employer’s internal processes before filing a legal claim against an employer.

This legislation missed the crossover deadline and faltered many times as the Committee grappled with unintended consequences and received heavy lobbying from schools not to be included in the bill. Ultimately, the bill did not make it over the finish line, however, the provisions around discrimination in housing ended up in S.226, and the provisions around the statute of limitations ended up in H.729, the miscellaneous judiciary bill. Most involved were not concerned about the statute of limitations language, given that most attorneys advise clients to retain records for the six years given that is already the term for contractual damages.

LCC sat down with our recurring employment attorney roundtable during the session to discuss this bill; you can watch that here.

LCC understands that these issues are sensitive, and the complicated nature of legislation such as this means that our work to find suitable solutions on legislation can be mischaracterized. If you have any questions or want to understand our position more thoroughly, we’d welcome you to reach out to us directly.

H.489 – Health Insurance Reduction for Businesses

The Legislature once again pursued language to allow the large and small group insurance markets to remain unmerged for another year to take advantage of ARPA premium subsidies, lowering premium rates for small businesses, which saved small businesses $17.7 million last year. See language here. There was conversation around the need to find about find about $2 million to make that happen, however, this did not occur. The savings and success of this is contingent upon Congress continuing the Advanced Premium Tax Credit.

Housing, Development, Energy, and Environmental Bills

Early in the session, we shared a must-read for everyone working in Vermont environmental policy. Ezra Klien took aim at how “one generation’s solutions have become the next generation’s problems … the environmental victories of yesteryear have become the obstacles of this year.” In the piece, he discusses the housing issues of California in the context of their landmark 1970 environmental law that has “become an all-purpose weapon for anyone who wants to stymie a new public project or one that requires public approval.” The piece even has a specific call-out of Vermont environmental groups squashing renewable energy and makes a great case that in this day-and-age moderates are the true environmentalists.

This is a perfect parallel for how this session went for environmental legislation as environmental groups held back Act 250 modernization yet again as well as joined with the Governor to prevent the Clean Heat Standard. We did a deep-dive in an earlier update into the issues of housing and every legislator in the building knew that from pressure from constituents and advocates that this was the number one priority that they needed to deliver on this session.

S.234 & H.492 – Act 250 bills

The end of the legislative session saw a massive skirmish over Act 250 and housing language. The House passed H.492 about ten weeks into the session, which looked to bring the state’s Act 250 appeals process back to the early 2000s. It restructured the Natural Resource Board into the Environmental Review Board (ERB), which would hear appeals instead of the Environmental Court, thus bifurcating the current consolidated appeals process. The ERB would have had a full-time chair and have five members nominated by an Environmental Review Board Nominating Committee which will have seven members; three from the Governor, two from the House, and two from the Senate. The bill also created a new pre-hearing discovery period with non-expert witnesses.

When the bill arrived in the Senate around 30 high-profile Vermont names, including mayors and developers, sent a letter to Senators opposed to the changes to Act 250 governance proposed in H.492. At the same time, the House was passing H.492, the Senate passed S.234, which aimed to take a balanced approach to changes to Act 250. The bill included the following proposals;

- Forest fragmentation: new language creates a new jurisdictional trigger for natural areas in which the state feels development would lead to forest fragmentation. The bill also requires resource mapping for these areas.

- Road rule: language also creates a new jurisdictional trigger in instances when a new road for a driveway or entrance to development exceeds 800 feet or 2,000 feet of multiple roads or driveways.

- Timeliness: If a municipality doesn’t respond with the impact of a project within 90 days, “the application will be presumed not to have an unreasonable burden on educational, municipal, or governmental services.”

- One-acre towns: the bill looks to clarify the Act 250 jurisdiction in one-acre towns in the fallout of legal proceedings that previously had substantial changes to the rule and have since been reconsidered.

- Neighborhood development areas: under the bill a town may have a neighborhood development area if they allow four dwellings per acre. It also eliminates the requirement that the development within the NDA is currently served by sewer or wastewater infrastructure.

- Flood zones: in an effort to allow smart growth in neighborhood development areas, flood zones can be part of neighborhood development areas with suitable infrastructure.

- Governance: while the House sought to overhaul governance, the Senate sought to study it.

- Other items: the bill creates a study committee on the program’s jurisdiction over agricultural businesses and makes changes to better accommodate the forest products industry.

In an attempt to force their governance changes, the House consolidated the Act 250 bills and passed S.234 with H.492 in it and sent it back to the Senate. They also removed the provisions in S.226, which we’ll discuss later, that involved Act 250, and put them in S.234. This was all in an attempt to make this a must-pass bill and force support for the language the signatories on the letter and the Governor opposed. They did drop the road rule as well. This was met with pushback from those representing the constituencies signed on to the letter opposing H.492, which precipitated another letter with more signatories and a division within the Senate caucus. Meanwhile, the Governor threatened to veto the bill due to the forest fragmentation language.

Ultimately, the Senate passed S.234 on a vote of 17-13, after everything except the forest fragmentation and governance language was added to S.226, as we discuss in the next section. S.234 will be vetoed by the Governor.

S.226 – Omnibus Housing Bill

If you haven’t read the section on S.234 (above), then this section won’t make sense. If S.234 was the Titanic headed towards an iceberg, then S.226 was the neighboring boat that saved the good work that was done on housing at the last minute. For four years, the Senate Committee on Economic Development, Housing, and General Affairs sought to make housing more affordable and easier to build with permit reform that always got pulled into the broader Act 250 bills that couldn’t make it across the finish line. That happened again this year when their work was pulled into S.234 by the House, which as we discussed above, saw enormous bipartisan pushback. The Chair of that Committee had had enough and crafted an amendment to move the entirety of S.234 to S.226, without the problematic forest fragmentation and governance language. That amendment can be found here in a comprehensive summary of what is now the bill S.226 which includes additional assistance to first-time home buyers, the “missing-middle program, and much more. The bill will be signed by the Governor.

S.210 – Vermont Rental Housing Improvement and Rental Registry

The contentious, multi-year battle over a rental registry, which began in S.79 last year and was vetoed, came to an amicable enough end. The rental registry got pulled from S.210 in a compromise with the Governor, and instead, $400,000 in ARPA funds were appropriated to support a complaint-driven version of the program. As we cover later, this will need a funding source in future years if it continues.

The Vermont Rental Housing Improvement Program will be able to move with $20 million in funding to provide grants of no more than $50,000. The bill also carries $4 million for accessory dwelling units, ADUs with money carved out to help to navigate the process for those hoping to build them.

S.113 – (Act 92) establishing a cause of action for medical monitoring expenses

This year, Governor Scott signed the medical monitoring bill, S.113, capping off an over six-year back and forth over that policy, involving dozens of versions and multiple vetos. This bill serves as a great example that, despite years of rhetoric that groups would obstruct any advancement of an issue, eventually, a reasonable conclusion can be found.

The bill creates a cause of action for medical monitoring for those affected by contamination and would draw much of its language from the Crawford decision written for the Sullivan vs. Saint-Gobain case stemming from PFOA exposure in Bennington. Those who have followed our newsletter will remember that the decision is more closely aligned with LCC’s counter-position than the proposal from the legislature. The language proposed in S.113 goes beyond the proximate cause under the Crawford decision, which was problematic, however, by the end of the work on the bill, the language fit the Crawford decision more closely. More details about the bill can be found here.

H.715 – Clean Heat Standard

In what might have been the biggest upset of the session, this legislation that passed the Legislature was vetoed by the Governor, and then the legislature failed to override the veto by one vote. The legislation was opposed by the Republican caucus, which you would expect; however, it took heavy fire from environmental groups on the far left fighting it for various reasons ranging from its inclusion of biofuels, to it not going far enough. Ultimately, the pushback from environmental groups was enough to peel off one vote and prevent the bill from becoming law.

If you’d like to learn more about what the bill would have done, you can look back at past updates for more context. Put simply, it would have created a system by which fuel dealers in the state would need to switch to other energy sources, sell less fuel, or buy credits to offset their emissions. The battle at the end of the session revolved around the Governor requiring a way for the legislature to sign off on any final version of the program the Public Utilities Commission created over the two years after the bill was signed. The legislature conceded on this point only to have the Governor veto it anyway on the ground the check-back provision was not strong enough. This precipitated the failed veto override.

Tax, Revenue, and Appropriations Bills

Yet another year of record federal funds available to legislators and surpluses above what was forecasted made for a difficult session, with more requests for appropriations than was available. We noted in earlier updates that this was a different kind of session because appropriators were able to put the budget together rather fast, while the committees of jurisdiction had trouble agreeing on their tranche of appropriations.

H.740 – Budget (Big) Bill

We’ve covered the $8.3 billion dollar budget as it developed this session; here are some highlights of the final version. Here are some high-level items.

- Broadband – $95m ARPA Capital Projects Fund, State Parks Connectivity – $1.6M ARPA Capital Projects Fund

- Housing – VHCB $50m ($30m ARPA, $10m GF contingent, and $10 in base), S.226 Safe & Affordable Housing provides $20m for ‘missing middle” and manufactured housing, S.210 provides $20m VHIP rental unit update program

- Community, Workforce, and Economic Development – $137.8m, including S.11

- Childcare providers ($4.9m), Children’s Integrated Services ($900k), and Parent Child Centers ($1.5m) base increases

- UVM ($10m) and VSC ($10m) base increases and VSC ($14.9m ARPA) transition bridge plan

Here are some budget resources:

- House Summary H.740 Conference Report

- COC Budget Summary – $ Amounts

- Senate Summary H.740 Conference Report

- ARPA Appropriations (G Secs and other bills)

- FY2023 General Fund Onetime Appropriations and Transfers

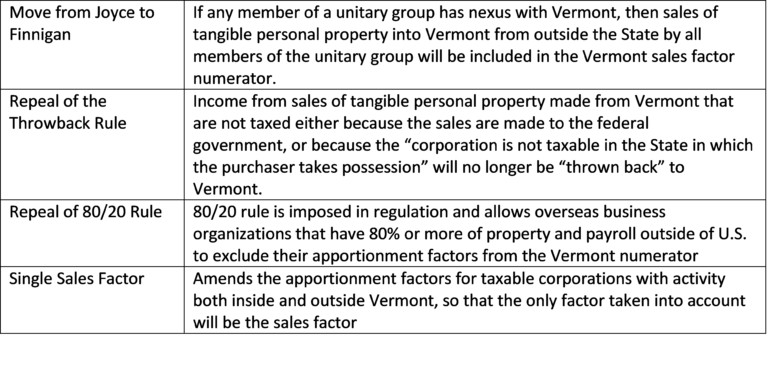

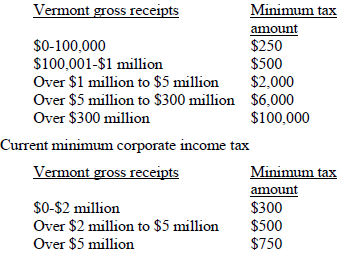

S.53 – Corporate Tax Modernization

The legislature picked up where they left off in the last session on corporate tax modernization, which was in the works ever since the state moved to market-based sourcing in the previous biennium.

These new rates may represent multiple steps backward for companies that might have taken a step forward from the rest of the package because it delivered them benefits for their investments in payroll in property in the state. Other states, such as our neighbor New York, have an alternative minimum for advanced manufacturing and tech businesses due to the other liabilities in the form of payroll and property.

This bill was also an attempted vehicle for an internet service (cloud) tax, which was removed in the Senate.

H.510 – Child Tax Credit and Other Tax Relief

This bill was the subject of a great deal of back and forth between the Governor and the House. Governor’s proposed budget had many tax items that the House passed up on early. When it arrived in the Senate, it was only the new child tax credit and social security exemption. The Senate went to work developing something that could actually be enacted into law. The final version accounts for $39.7 million in tax credits as follows.

Child Tax Credit – House Priority – $31.8 million

-

- It creates a new refundable tax credit, with no sunset, for families with children younger than five years old. The $1,000 per child credit is phased out for both single and married tax filers, beginning at $125,000 in Adjusted Gross Income (AGI) by $20 for every $1,000 of income, until $175,000 when it is completely phased out.

Expanding the Child and Dependent Care Credit – Governor’s Priority – $3.44 million

-

- The state will now increase its match of the CDCC to 72% of the Federal CDCC. This is a fantastic credit that helps households recapture their expenses for the care of children and adults in their households.

Appropriation for childcare retention payments – Senate Accommodation – $1 million

-

- The Governor sought an income tax exemption, and the Senate decided to instead make this an equivalent appropriation.

Raise Securities Registration renewal fee $150 – Senate Accommodation – $3.6 million in new revenue

-

- It increases the renewal fee paid by securities dealers to the Department of Financial Regulation for selling their products in the state from $1,500 to $1,650. This was done rather last minute to raise the funding needed to balance the proposal.

Expand EITC from 36% of Federal to 38% – Governor’s Priority -$1.5 million

Student Loan Interest Deduction – Governor’s Priority -$2.2 million

Social Security Exemption – $1.67 million

Military and CSRS exemptions – Governor’s Priority -$0.71 million

Manufactured homes tax credit – $0.25 million

Appropriation for Aid to Aged, Blind, and Disabled Program: -$0.75 million

Read more in the fiscal note here.

H.738 – Miscellaneous Tax Bill

A few items slipped into the miscellaneous tax bill, which are longtime priorities of the Lake Champlain Chamber.

The bill links up to federal allowances of 529 college saving plans, allowing money from Vermont’s 529 plan to be used for student loan payments up to $10,000 and preventing any Vermont Higher Education Investment Plan (VHEIP) tax credit from being recaptured if a plan holder used their funds for that purpose. A debate started in 2020 when this use wasn’t included in the link-up after the federal government allowed it.

The bill also includes broadening the sales tax exemption for manufacturing inputs to include inputs used as part of an integrated production process, which was worked on in the House last session only to sit idle in the Senate. This $700,000 revenue expenditure provides a clearer path to compliance and, as a result of that, encourages the state’s manufacturers to invest in new equipment and upgrade existing equipment.

H.736 – Transportation Bill

The transportation bill, or T-bill, saw an increase in funding over a typical year due to federal funds available making substantial investments in electric vehicles and the infrastructure to support them. Two other large items were;

Airport Study – A great deal of back and forth between the Senate and House about the ultimate make-up at the committee. The Burlington International Airport Working Group was created in the transportation bill to bring a report examining the existing governance structure and alternatives to the current governance structure of BTV recommendations. There will be ten members in the working group, with some appointed by the neighboring municipalities as well as other appointed members.

Fare-Free Transit – Also in the transportation bill was $1.2 million to Green Mountain Transit to maintain fare-free service in urban areas and to restore service cuts to pre-pandemic levels.

See the final language of the bill here.

H.737 – Property Tax and Education Surplus

As we covered this session continuously, the legislature came into the session with an education fund surplus of over $95 million. The session saw a great deal of back and forth on how best to allocate that. H.737 is what’s called the yield bill and sets the property tax rates for the year, which will be slightly lower this year by using $20 million surpluses to buy down the homestead rate to $1.385 per $100 of assessed value and the nonhomestead to $1.466 per $100 of assessed value.

H.737 also sets aside $22 million in reserve for funding polychlorinated biphenyls (PCBs) remediation in schools. The Agency of Education, Department of Health, and Agency of Natural Resources will submit a plan next January about how PCB funding will be prioritized and spent. In the meantime, if there is a “critical health emergency” between July and January, the agencies can come before the Emergency Board that can allocate money to address it. The House is being asked to concur with these changes.

Finally, the yield also accommodates $29 million for S.100, providing universal school meals.

You can find the full education fund outlook and allocations here.

S.287 – Per-pupil Adjustment for School Spending Formulas

This year saw a massive overhaul of the formula used to assess school funding and by virtue of that, local property taxes. We did a deep dive into this about nine weeks into the session, and the language we looked at there is very close to what the final version is. The House has made changes to the per-pupil weighting bill sent to them by the Senate, which are not proving popular since they would recreate the chasm between districts with more English Language Learners (ELL) and the rest of the state. The House ended up walking away from the language.

This bill will result in a great reshuffling of education funding across the state with some districts seeing dramatic increases in property taxes and other seeing notable decreases.

S.100 – Universal School Meals

S.100 had multiple issues along the way for both the policy and the funding. Initially, the bill sought to use $36 million from the education fund surplus to pay for free breakfast and lunch in the coming year after federal pandemic funding subsided. On the policy front, a number of legislators did not agree with universal meals because some kids might have access to the meals when they do not need them.

On the funding side, there were multiple issues. First, some advocates felt that the service should have an ongoing funding and not be dependent on surplus. This set off a chain of events in which the House Committee on Education sought to use an internet services (cloud) tax, sugar-sweetened beverages excise tax, and tax on candy to pay for it. Then there were issues when the bill got to the Senate as members there wanted to use the surplus set aside to pay for this proposal for remediation of PCBs and other deferred maintenance on schools. Ultimately, the funding for this year survived, however, if the program is going to continue as envisioned, they’ll need to find a permanent funding source.

Governance

S.286 – Pension Bill

The long-awaited bill came as a result of a Task Force created last legislative session and reserves set aside to start contributing to Other Post Employment Benefits. This bill contains a $200 million one-time General Fund appropriation in FY 2022 to the pension systems to pay down unfunded liabilities. The bill is expected to reduce Vermont’s long-term unfunded retirement liabilities for state employees and teachers by approximately $2 billion by prefunding other post-employment benefits, modifying the pension benefit structure, and making additional State and employee contributions to the retirement systems.

The bill was vetoed by the Governor due to the fact that it did not create the ability for employees to elect for a defined benefit plan instead of a defined contributions plan. The response was that doing so would usher in the collapse of the defined benefit plan and what some see as an admission that the program is only functioning because it uses current employee dollars to fund current retirement benefits. The veto was overridden unanimously in both the House and the Senate.

Read more about the final arrangement here.

Charter Changes

Essex

- The Governor signed H.491, an act relating to creating the City of Essex Junction and the adoption of the City charter. When signing H.491, Governor Scott noted, “I know this issue has been the subject of debate for decades, and I’m happy to see a resolution. Congratulations to the people of Essex Junction on the establishment of Vermont’s newest city.”

Burlington

- We had a section about “Burlington’s Big Splashes” at one point this session, and as the session wrap’s up, it is worth looking at what ripples occurred.

- The Governor also signed H.448, allowing the City of Burlington to potentially assess a carbon impact fee on new construction. When signing H.448, Governor noted, “Although I’m concerned by the potential cost impacts this could have for Burlingtonians, I’m signing the bill because any new policy that could result from it will need to be brought back to Burlington residents for their final say.” Burlington will need to create a program and bring it back to voters.

- H.708 was passed by the legislature and vetoed by the Governor. The legislature failed to override the veto. There is a lot to glean from such a high-profile failed veto override. We predicted in an earlier update that the bill wouldn’t go to the floor for a veto override because the House wouldn’t have the votes. The legislation was framed as a ban on “no-cause evictions”; however, when many legislators learned more about the issue, they realized that the legislation allowed tenants to extend their lease beyond their initial contracts without a landlord’s consent. Many legislators were uneasy with the bill; however, it is a charter change and affects the Speaker’s district; the combination of the two was enough to whip most, but not all of the votes necessary.

The Laundry List

- H.667 – A bill was put forward around restrictive covenants, which did not see committee testimony; however, it was the topic of conversation between a working group of advocates and legislators.

- H.175 – expanding the bottle redemption program – This bill, which comes back year after year, did not make it over the finish line, and if it had, it would likely veto target. It appeared as if neither the Senate nor the House, would have the votes to override it. You can read details about the last version of the bill in this JFO fiscal note.

- S.178 – this bill would have enabled non-unanimous jury verdicts in civil trials passed the Senate. The changes to the bill stipulated, “unless the parties stipulate otherwise, a verdict or finding agreed to by at least eighty percent of the total number of jurors serving on a jury in a civil trial shall be taken as the verdict or finding of the jury.” The bill saw testimony in the House which decided to not pursue the legislation.

- S.101 would have remedied the issues developers and homebuilders see around duplicative wastewater and sewer permits. The bill stalled the whole session, and this language at times found other homes; however, it never made it across the finish line. Advocates will be back to pursue this efficient and elegant solution in the next biennium.

- Interest in “just cause evictions” language was a component of some housing conversations this year. As we discussed, this failed in the Burlington Charter change.

- Earlier in the session, there was some interest in remedying retail theft was explored; however, the Committee of Jurisdiction decided not to pursue this further.

- H.606 will committed Vermont to the worldwide “30 by 30” movement, which aims to conserve at least 30% of the state’s land by 2030 and 50% by 2050.

- Unemployment Insurance for nonprofits came under more attention this session due to the special relationship that these employers have with the UI trust fund in which they do not contribute to the fund and reimburse any benefits paid to their employees from the fund. Also under scrutiny was the ability of nonprofits with fewer than four employees to not offer unemployment benefits. This might be an issue that legislators revisit next biennium.

- S.269 extended the self-managed energy efficiency program pilot program another three years and has language reauthorizing the VEGI program until 2024. This bill passed and is expected to be signed by the Governor.

- House passed a first in the nation extended product responsibility (EPR) bill that then sat idle in the Senate.

- S.33 – made changes to Tax Increment Financing (TIF), however, it did not create the expansion of “mini-TIF” districts in the state as many have been pushing as a matter of regional equity.

Next Biennium

We cannot state enough how different next year will be with half of the chairs in the House and more than a third of the Senate retiring. The State House is kept alive and on track by the institutional knowledge of many of those people. The Senate will also need a new Pro Tem, who will need to learn their new role alongside many new Senators learning the job. They’ll be returning in a much different environment, absent the sugar high of federal COVID recovery funds and potentially without the large education fund surpluses.

We’ll break down some speculation about new policies in the same way we broke down what happened this year.

Economic, Workforce, Business, and Employment Issues

There are a whole host of proposals that will be reignited by an election cycle and new legislators in the build. Predominantly, we expect minimum wage and paid family and medical leave proposals next year. The Administration is still working on potentially standing up a paid family and medical leave program.

A longtime priority of LCC, a state and local tax deduction cap workaround, did not advance; however, it had a strong coalition of support on the issue. Next year, we will be back again to attempt to lower the amount of taxes Vermonters send to the federal government and bring additional state revenue. When you see your House member in your community, you should ask them why the House opposed this. Here is a copy of an example of how the proposal would work for a business owner.

As we noted in the description of the miscellaneous alcohol bill, a conversation has begun around Vermont’s control state status.

Housing, Development, Energy, and Environmental Bills

The conversation around Act 250 modernization will begin again with proponents of housing looking for modernizations such as removing areas of enhanced designation from Act 250 jurisdiction and environmental groups pushing for the road rule, forest fragmentation, and new governance language they lost this year. Duplicative wastewater and sewer permits language was explored in this session, and this language at times found other homes; however, it never made it across the finish line. Advocates will be back to pursue this efficient and elegant solution in the next biennium.

The legislature will also need to do something about curbing emissions after the failed Clean Heat Standard. Speculation is that the Global Warming Solutions Act will give the Agency of Natural Resources the authority to adopt draconian measures as dramatic as banning fossil fuels infrastructure from meeting the state’s greenhouse gas emission targets. Next session, it might be wise to revisit the alternative weighting measures proposed in testimony for GWSA and later seen as necessary in Taskforce Meetings.

Other legislation such as the bottle bill, EPR, and an increase in the renewable energy standard are also likely to return.

Tax, Revenue, and Appropriations

The general consensus is that the next few years will be alright due to some further surpluses and residual federal relief dollars floating around or reallocated; however, they will be leaner than the last three, and it’s thought that around 2025, the state will hit some financial troubles. Some experts believe a recession is looming soon, and obviously, the last few years have taught us that anything can happen. The state does carry forward about $225 million in rainy-day funding.

There will also be issues to deal with around inflation, with everything from COLAs to CLAs. While many legislators retire or move on, they leave in their wake promises for programs that future legislators will need to find a way to be funded.

Here are some funding requests we already know will be seen;

- Childcare – $100 to $525 million – Last session, the legislature passed a study to determine the cost of providing childcare which is due in December.

- Universal meals – $30 million – The legislature passed S.100, which envisions four years of universal school meals; however, the first year is paid for with surplus.

- Child Tax Credit that passed this year and we discussed above has no sunset and will be a continued ~$40 revenue expenditure for the state.

- PCB remediation – plus general maintenance of schools H.727, the miscellaneous education bill, lays out the timeline for PCB testing in schools, and the yield bill, H.737, sets aside some funding for remediation; however, more might be needed in future years.

- Property taxes – the yield bill bought down this year’s rate, so if they go up next year, it is going to be especially surprising. Additionally, if the changes in per-pupil spending increase costs, that will be felt.

- Paid family and medical leave – this is a perennial issue that the members of the Senate pushed this session and would likely cost about $70 to $130 million. It has lost a lot of favor in the past few years after the liberal wing of the Democratic party tanked the latest version with the help of the local chapter of a business group because it did not go far enough.

- As part of the compromise on S.210, in lieu of a rental registry, a complaint-based enforcement program was created and funded for one year with ARPA funds. That will cost $400,000 in the out years.

- All of the other programs that will see shrinking funding after the federal relief runs down; TANF, LIHEAP, fare-free transit, and many other items that Vermonters have gotten used to.

The Evergreen List of Attempted Taxes and Fees (New Additions)

The evergreen tax bingo card items came up this year, with a couple of new ones. Here is what we saw and can expect to see again.

- Cloud (Internet Services) Tax – The Joint Fiscal Office again increased the revenue estimate for this proposal. Read more about this here.

- Sugar-Sweetened Beverage Excise Tax – Another classic source for new revenue was discussed in Senate Finance this week, with a presentation from Joint fiscal showing that a sugar-sweetened beverage tax could bring in $17.2 million annually from a $0.01 per ounce tax and $29.0 million annually from a $0.02 per ounce tax. The Commissioner of the Department of Taxes encouraged the Committee to decide if they were looking at this as a public health issue or as a revenue source and take testimony from both perspectives.

- Department of Financial Regulation Fees – added to S.53, the corporate tax modernization bill, in the final days of the House Ways and Means Committee was an increase in Department of Financial Regulation fees to try to pull in more revenue. This revenue source was eventually added at the last minute to H.510.

- New Tax on Vacant Homes – We often joke about how there is a tax policy bingo card with classic tax ideas that come up. We finally have a new one: properties over $400,000 that are not lived in for more than six months would face a 1% surcharge under a proposal brought forward by Senators Pearson and McDonald. The tax is expected to bring about $30 million in revenue to the state. See the amendment here.

- Property Transfer Surcharge – a surcharge of 0.5% on transfers of property by deeded title when the transfer value is over $1 million. This applies to both residential and commercial properties transferred by deed or controlling interest.

- Universal service charge and per line charges

Finally, it’s possible that legislators might revisit the work of the Tax Structure Commission next session. It’s been called on in support for many one-off proposals over the years, such as cloud tax; however, the report called for a complete restructuring. The legislature has also avoided doing things supported by Commissioners of the report, such as the SALT workaround.

Final Remarks

The session brought positive results for the business community. This work is only possible because of the support our dues-paying members provide. If you’ve made it to this point in the update, that means you find our work valuable and we’d ask that you consider being a member (if not already) or sponsoring our advocacy content. Reach out to [email protected] for more information.

If you want more information on any of these sections, feel free to reach out at [email protected] or schedule an appointment using this link.