Thank you to this week’s sponsor of our Advocacy Update:

January 28, 2022

Every week we pull a substantial amount of information together to present to our membership, partnered organizations, and legislators in Advocacy Update. We appreciate the feedback we get in the form of emails back, calls, and even seeing our text shared by others (they do say imitation is the sincerest form of flattery after all!). We welcome all the feedback. We also want to encourage you to engage with legislators on these issues! Democracy is a participatory sport, and as the saying goes, if you’re not at the table, you might be on the menu.

So, how do you do that? Reach out to our team if you want to learn more about what you read here, or don’t read here. Reach out to your legislators about what you read. If you don’t know who they are, you can find them here. And finally, attend our events to meet and network with the people making policy that affects your life and business.

In this week’s update:

Join Us for Our (Virtual) Legislative Breakfast Series – First One Is Monday!

Of the 14 standing committees in the House, we’ll have members of 10 of them join us Monday.

If you are looking to register for Monday’s event, we ask that you email [email protected]

Monday, January 31st – 8:00 – 9:15 a.m.

Join legislators from our region for networking and conversation about their efforts as they cap off their first month back in session.

Monday, February 14th (Valentines Day) – 8:00 – 9:15 a.m.

Good intentions don’t always make good policy, and a potential increase in income meant to push some to prosperity isn’t always met with a proportional policy impact; we call this situation a “cliff.” Join LCC, leadership from the Leap Fund, and analysts from the Atlanta Federal Reserve to discuss addressing benefits cliffs. Read more about this work in the New York Times.

Monday, March 14th – 8:00 – 9:15 a.m.

As the legislature enters the home stretch, check-in with the Governor, Speaker of the House, and Senate President Pro Tem about how they see the session going and what they want to see done before the legislature adjourns.

Special thanks to the sponsor of our Legislative Breakfast Series:

Let’s (really) Dive Deep into Housing Issues in Vermont

This week, an article by VTDigger made a large splash when it discussed that it costs more to build a home in Vermont than the home is worth. It came as no surprise to many, as evidenced by the ongoing dialogue on a local planners and developers’ listserv. It would have come as no surprise to readers of the Economist, which in early 2020 highlighted a working paper from the Bank of England showing that in many parts of America building houses has become more difficult since the mid-2000s, due to tough zoning laws, and suggested that it was then just as hard to build in Burlington as in San Francisco. And it certainly came as no surprise to the Lake Champlain Chamber, who has been advocating on this for decades, as employers complained of the issue and multiple surveys through Burlington Young Professionals highlighted this as one of the primary factors in losing young Vermonters. Our advocacy efforts have been fixated on housing over the last decade with efforts ranging from student loan relief, down payment assistance for first-time buyers, land gains tax reform, and of course, Act 250 modernization.

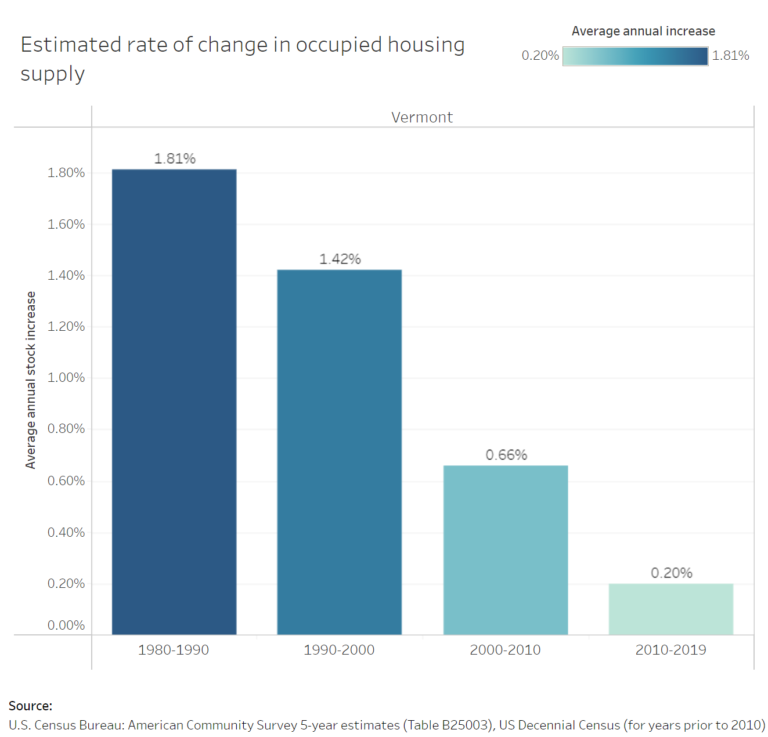

As the graph above shows, the rate of production has slowed dramatically, and at the same time, the population grew and housing stock came offline because Vermont has the second oldest housing stock in the country. Finally, the pandemic agitated the market even further, which we don’t need to recap.

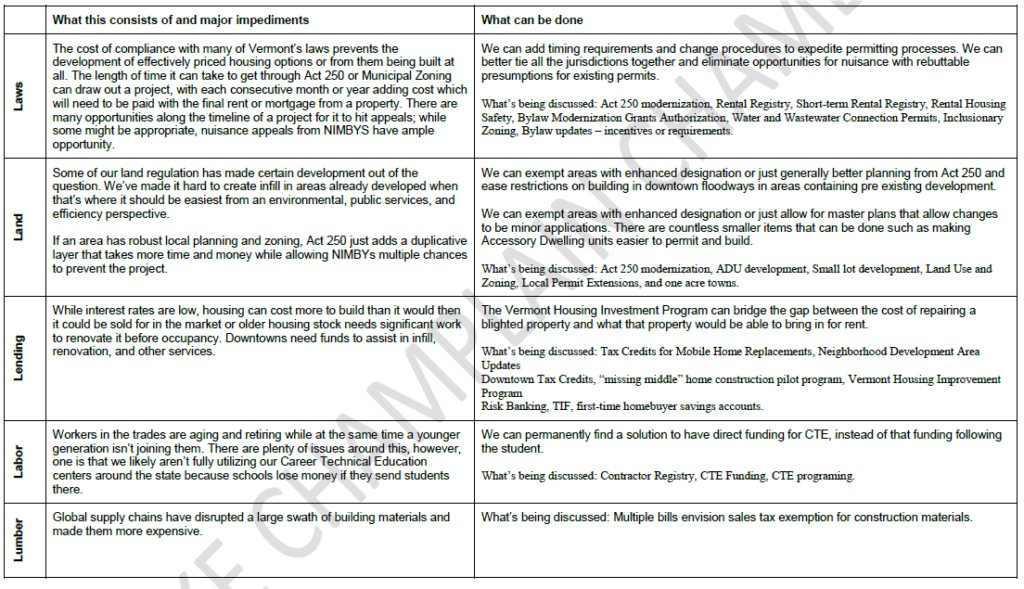

In a world where everyone is scrambling to build more housing quickly, it’s helpful to break down the issues into what is being referred to as the five Ls of housing; Land, Lending, Labor, Lumber, Laws.

Generally, this is what is bouncing around in the State House to address housing pressures. A Vermont rental registry, which was proposed last session and vetoed by the Governor, is held up by many to be a massive benefit to housing efforts, however, that remains to be seen and many speculate that it may have the opposite effect on housing stock.

The Senate Committee on Economic Development, Housing, and General Affairs is working on an omnibus housing bill that will cover much of this territory. Here is a quick overview of all the legislation in play, or proposed this session, as it relates to housing.

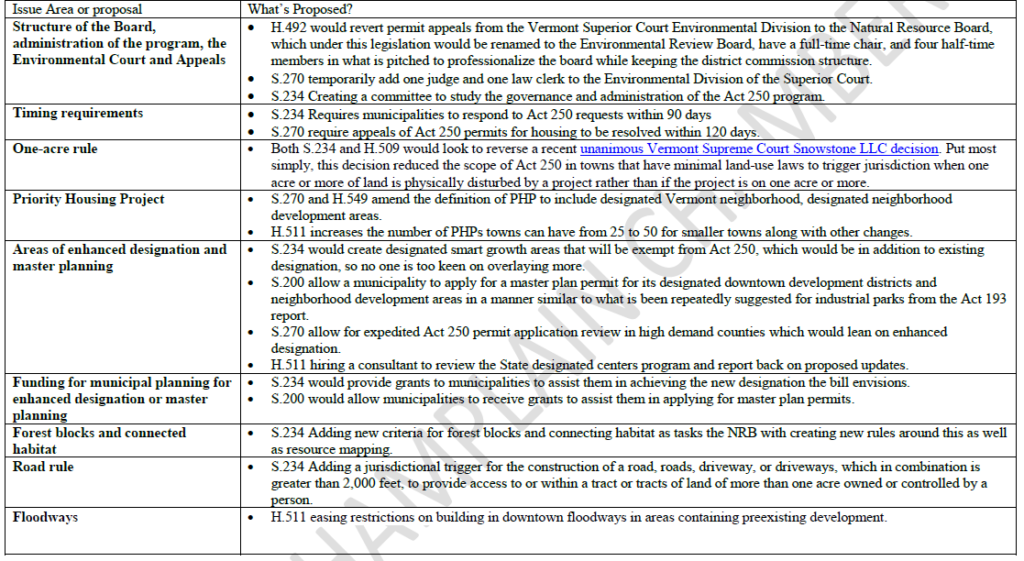

Now let’s focus more on Act 250

At this point, there are only about three to four bills moving on this subject; H.492 and H.511 in the House and S.234 and S.200 in the Senate. For the purposes of this, we want to show you the larger diversity of ideas out there. Federal dollars have a tight timeline to be spent and it would be a shame if the funding couldn’t be fully put to use because they were encumbered by our state’s land-use laws, so there is a sense of urgency (or at least there should be) to reform and modernize Act 250. There is a lot going on in the space of Act 250 – we’re going to try to do what we haven’t seen anyone do and concisely break it down for you.

Three big buckets here: board-level governance, one-acre rule, and everything else. Here’s what’s out there.

This week, the House was focussing more specifically on the governance side and the Senate is focused more on the whole entirety of Act 250.

Now, we’ve outlined the problems, the policy, here comes the politics. LCC’s biggest worry is that an attempt to build a “balanced bill” will result in no bill at all this session. By balanced, we are referring to a bill that removes, or eases, restrictions in places where Act 250 is less needed and then adds burden on more rural areas in the state. Primarily, this refers to the provisions around forest fragmentation and road rules seen above. In a statement that might bring some flack, LCC is agnostic on the issues; we just wish they would stop standing in the way of Act 250 reform.

To be clear, the main and almost only, reason we have heard for not exempting areas with enhanced designations is the balanced bill argument.

Incentivizing development in more developed areas has the effect of protecting our rural landscape and does not face the same political barriers as forest fragmentation or road rule changes. Are we going to let the common-sense, environmentally friendly, and easier to achieve urban changes be held hostage and demand that we create more restrictions in our rural areas?

Back to the broad lens of housing:

Outside of all these bills and policy proposals, there are real people, at all income levels, looking for housing. There was a three-year process to study Act 250 modernization and then we’ve had three years of legislating on the matter. Employers trying to find and keep employees and Vermonters looking for a place to live need progress now.

How Should $50 Million of Assistance Be Spent for Maximum Benefit?

The House Ways and Means Committee continued discussing building a Vermont Child Tax Credit (VTCTC) this week that would be expected to cost about $58 million and deliver $1,200 per child under 6 to parents on a monthly basis with $100 payments. They feel the monthly disbursement of the CTC is more helpful than the lump sum of money delivered by the Earned Income Tax Credit (EITC).

This week, the CTC proposal squared off against the Governor’s proposal, which we shared last week. His proposal has a similar price tag, yet covers more people, including but not limited to retirees, childcare workers, nurses, Earned Income Tax Credit (EITC) recipients, and people with student loans. By the Administration’s assessment, a VTCTC would cover 11% of Vermonters, as opposed to their broad package which would cover 25% of Vermonters.

We see merit to all these proposals, however, what is most effective? Which delivers the highest marginal benefit at the lowest marginal cost? Which interacts best with the over 30 other assistance programs Vermont offers?

Frankly, we think there might be a door number three. The Child Care Financial Assistance Program (CCFAP) only has about $48 million dollars in it and this funding would more than double that. As this program stands, it provides childcare to working parents. While the program is facing technological issues, it should be covering up to 375% of the federal poverty level, or about $100,000 for a family of four with two children and two-income earners. Our economy could use this relief to help get employees to work. With this money, the benefit could be extended to even higher incomes.

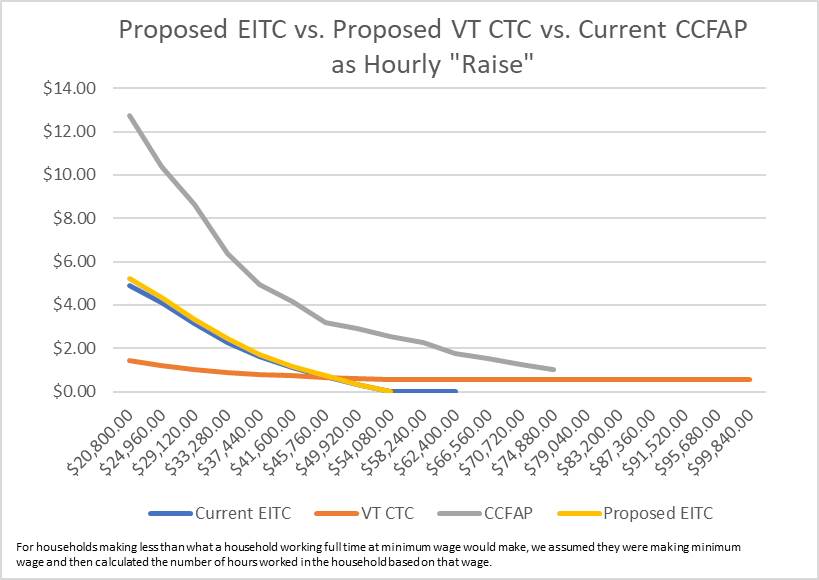

Here is a quick view of this through the lens of the Lake Champlain Chamber.

While this might be overly simplistic, this highlights marginal benefit fairly well. The family stops receiving CCFAP at about $75,000, or about 300% of the federal poverty level. With more funding, we might push that upper limit to about 400% (~$106,000) and provide more assistance at every income level already helped. This is why LCC believes that this funding might be better used for CCFAP and possibly still direct about $7 million in revenue to the VT CDCC. Childcare is a major barrier to participation in the workforce; neither the EITC nor the VT CTC does anything directly to break that barrier. During a workforce crisis such as this, scarce resources should be directed to programs that help Vermonters who want to work and can’t because of childcare (data indicates that this is disproportionately those who identify as women) get to work.

Senate Economic Takes Up Minimum Wage and Paid Family Leave

After a year break from both bills, the conversation is back and legislators are ready to pick up both bills where they left off in previous years.

S.52 would increase the minimum wage to $15 per hour by 2025. The minimum wage went to $12.55 this January as the final stage in the two-year process. The bill that did that represents half of S.23 which would have gotten the minimum wage to $15 at the end of 2025. The Committee discussed a desire to do this as well as a better desire to understand the current prevailing wage.

Similarly, S.65 would pick up right where the original Paid Family and Medical Leave left off, only it seems there might be some more flexibility for changes this time around. Members conceded that the Governor’s proposed plan was more efficient, as the state would contract with a third-party insurance agency under that plan, as opposed to the Legislature’s plan which would require multi-year buildout of state government administration for a plan (at somewhere between two and 80 million dollars if memory serves correctly). The Committee discussed interest in using ARPA dollars to start up the program which then could last long after the pandemic.

The quick overview of S.65:

- Create a Paid Family and Medical Leave Insurance Program within the Department of Labor that may be administered by a private insurance provider.

- A mandatory program to provide eligible employees with 12-weeks of paid parental and 8-weeks family medical leave funded by 0.20% of each employee’s covered wages

- An optional program to obtain six weeks of paid medical leave coverage for their own illness at the cost of 0.38% of the employee’s covered wages.

Much of LCC’s previous advocacy on this issue was directed at containing the cost and risk of a potential program as well as ensuring it is an employee-sponsored benefit. LCC research leads us to believe the cost of an unpaid employee absence can be equivalent to a 13.5% payroll tax, further solidifying our position in the previous session that this should be an employee-sponsored benefit. Even if the benefit is paid by the employee, the employer shoulders a significant cost in loss of productivity, over-time, and potentially hiring a replacement.

If nothing else, they would want to amend Vermont’s medical (not sick) leave law to include quarantine; currently, the leave only covers absence for the sickness of one’s self or a family member.

Economic Development – Quick Glance

LCC will testify on Tuesday in the Senate Committee on Economic Development, Housing and General Affairs on the Omnibus Economic Development bill which they intend to create. Last week, the Committee continued their work on understanding the impact of the economic development package passed last year. Most of the discussion focussed on bridge grants and capital investment grants.

Bridge Grants – consensus has formed that the criteria for the grants created to assist businesses affected by the pandemic, were far too restrictive, despite technical assistance and support made available for applicants, and that interfered with their usage. You can see more in this presentation from ACCD. There is a push from ACCD to utilize language in Act 9 that provides them discretion with leftover funds to reapply Bridge Grant funds to Capital Investment Grants instead. As an organization that lobbied for that language, we can say that is not why that is there; it was meant to enable the opening of another round of grants in the interim period between when Act 9 created Bridge Grants for businesses that had received no help at all and when an eventual budget was passed that extended grants to all businesses. LCC would hope to see the Bridge Grant program revert back to the criteria of earlier Economic Recovery Grants.

PPP-style Loan Program for Vermont – the program was announced in the Governor’s proposed budget and since then, details were/are pretty scarce. The proposed $20 million program doesn’t seem to have legs under it just yet, as much as many of us might want it to.

Capital Investment Grants – these grants were oversubscribed, with over $61 million of requests for $10 million in funds. ACCD sees further grants being directed primarily to childcare, housing, and education in ways that meet the criteria of the U.S. Treasury requirements for ARPA dollars and show economic impact to satisfy an economic model the legislature required ACCD to create and have blessed by the Joint Fiscal Office.

LCC’s Team Testifies on Employment Bills

This week, our team testified twice in the House Committee on General Housing, and Military Affairs; H.329 on Tuesday and H.320 on Thursday.

On H.329, LCC asked for greater clarity on some issues and warned of unintended consequences in others. The bill included language that seems to discourage internal processes, which LCC explained is problematic for employers trying to maintain good relationships rather than having things escalate to legal remedies. The bill also looked to, in our opinion, overstep legislative purview, and prevent summary judgment in these cases. Finally, the bill made changes to the statute of limitation on these cases, and it was not clear if the language was trying to codify the existing Fitzgerald vs. Congleton decision for contractual damages or to extend the statute of limitation for personal damages.

On H.320, LCC testified that the legislation would inevitably have unintended consequences that will at best render little aid, and at worst, serve as an impediment to those it is intending to serve.

Both sides benefit from these provisions and from testimony from those representing both sides, they’d like to keep these provisions. The employee in the form of a stronger settlement and the employer in the form of finality. We think an underlying assumption of advocates’ for this bill is that there is a coercive nature of these agreements when in reality it is part of a negotiation between two parties represented by legal counsel and crafting an agreement that best serves their needs. In general discussion with attorneys on this issue, the feeling is that once a relationship is broken, it’s generally broken, and people don’t want to go back anyway.

LCC understands that these issues are sensitive and the complicated nature of legislation such as this means that our work to find suitable solutions on legislation can be mischaracterized. If you have any questions or want to more thoroughly understand our position, we’d welcome you to reach out to us directly. 0

Laundry List

- Read last week’s update here.

- A consensus on S.113 has been reached which will codify the Crawford decision, as we discussed in last week’s newsletter. The language was amended to remove what little daylight existed between what was proposed and the legal precedent. The Senate Judiciary Committee voted this bill out unanimously.

- Vermont businesses will see a decrease in workers comp rates this year, which is welcomed news in a state with the 6th highest rates in the country (link).

- New districts are on their way. You can learn more by visiting the Reapportionment (Redistricting) webpage to view legislative bills and map proposals for reapportioning the House of Representatives and Senate.

- The contractor registration bill (H.157) has finally come to a conclusion with the threshold for work done being set at $3,500.

- Vermont’s December Unemployment Numbers are out

- After decades, we have some good news on the Champlain Parkway!

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team

Don’t ever miss an update. Subscribe to stay in the know on all things advocacy