Thank you to this week’s sponsor of our Advocacy Update:

February 4, 2022

In this week’s update:

One Legislative Breakfast Down, Two More Coming – Register Today

We had a fantastic legislative breakfast last week. Thank you to the members and legislators who attended. Our next breakfast is only 10 days away, and we are incredibly excited to dive into the subject of benefits cliffs with the subject matter experts we’ve lined up.

Monday, February 14th (Valentines Day) – 8:00 – 9:15 a.m.

Good intentions don’t always make good policy, and a potential increase in income meant to push some to prosperity isn’t always met with a proportional policy impact; we call this situation a “cliff.” Join LCC, leadership from the Leap Fund, and analysts from the Atlanta Federal Reserve to discuss addressing benefits cliffs. Read more about this work in the New York Times.

Monday, March 14th – 8:00 – 9:15 a.m.

As the legislature enters the home stretch, check-in with the Governor, Speaker of the House, and Senate President Pro Tem about how they see the session going and what they want to see done before the legislature adjourns.

Special thanks to the sponsor of our Legislative Breakfast Series:

Quick Updates

In the absence of substantial updates on many issues, we’re changing the format a little to give you a quick overview of what’s changed since our previous updates.

- The Budget Adjustment Act is moving to a vote in the Senate and the Senate version saw relatively few changes over the House version. The notable changes were:

- The addition of $1 million from the General Fund to ACCD to provide a state match for the U.S. Economic Development Administration funding to be allocated equally between the Build to Scale and Good Jobs Challenge.

- The bill saw a rather last-minute amendment this week which sought to require contractors taking on state capital improvement projects to pay above the prevailing wage if the project is over $200,000 in cost, Davis-Bacon over $10 million or submit a plan.

- The Senate Finance Committee advanced a friendly amendment that would continue the unmerging of the health insurance market as was done last session to make the most use of advanced premium tax credits. Previously, individuals and small businesses were in one market. It’s estimated that unmerging the markets saved small businesses between $13 and $17 million this year. These credits are held up at the federal level due to the stalled Build Back Better proposal; however, they have bipartisan support. The language gives insurers direction as they prepare and submit rate filings for the 2023 plan year. They may continue with an unmerged market if federal legislation passes before September 1st.

- The Medical Monitoring bill, S.113 passed the Senate 30-0 this week after a consensus was reached which will codify the Crawford decision, as we discussed in week 3’s newsletter. The language was amended to remove what little daylight existed between what was proposed and the legal precedent. The bill will now head to the House.

- The Vermont Child Tax Credit, possibly the largest package in Vermont’s history, was passed by the House Ways and Means Committee and will be on the House floor for consideration today. As we previously covered, there is disagreement over how this $58 million could be best spent.

- Workers’ Compensation premium tax is set to be increased to cover the cost of administering the program. It cost $2.8 million to administer the program and the current rate (1.4%) would raise only $2.3 million, thus H.559 will raise the rate to 1.5%, the rate it was three years ago. This doesn’t represent an increase in cost to administration, instead, it is reflective of a decrease in case volume due to workforce contraction as well as better workplace safety. Last week, the Administration announced that for the sixth consecutive year, the worker’s compensation rates have decreased in Vermont, this year saving collectively $8 million.

- There is a clear divide and conquer strategy between the Chairs of House Commerce and Economic Development and the Senate Committee on Economic Development, Housing, and General Affairs;

- Senate Economic Development is taking the lead on an Omnibus Housing Bill and an Omnibus Economic Development Bill. This week they continued work on their Omnibus Housing Bill with a focus in testimony this week on Accessory Dwelling Units. We provide a more detailed overview of the state of the Omnibus Economic Development bill in this update.

- The House Commerce Committee is taking the lead on the Omnibus Workforce bill and took a great deal of testimony this week with a focus on Career Technical Education (CTE).

- Speculation is swirling around how heavily utilized the Governor’s veto pen might be this year. Already there is an indication that Scott may seek to stop a gun restriction bill, ranked-choice voting that would start in 2024, the contractor registry bill, a rental registry, and the medical monitoring bill. Vetoes have broader implications than just stopping legislation. They tend to make all interactions slightly more adversarial between the two branches of Government, which clouds other conversations and ends up framing talking points for electoral politics.

Senate Economic Development Bill Takes Shape

In response to possibly the most frequently asked question this week, no, there is not a draft omnibus economic development bill available for public viewing (there are some economic development bills from members of that committee introduced). LCC has compiled all the elements at play.

Recovery Grants

This topic is still under debate, though a consensus is forming and LCC hopes to see something materialize early next week. As we’ve previously covered, the latest round of grants is underutilized because criteria were over-restrictive, leaving $26 million of grants unused. Three issues are at play here.

- First, the Scott administration is hoping to move from a grant program to a $20 million forgivable loan program run by VEDA which is alarming to many businesses that are concerned about loans. These loans would function as grants if the borrower met certain criteria, similar to PPP loans.

- Second, there is consensus that the latest round of grants was overly restrictive, however, there is not yet consensus on a formula to arrive at the amount of financial assistance for an awardee. There is a heavy emphasis from the Committee members on operational costs and not a focus on revenue loss which formed the basis of earlier recovery grant programs.

- Third, the Administration would like to move funding from the current grant program to the oversubscribed Capital Investment Program (described below). They interpret language in Act 9 from last session as potentially giving them authority to make this reallocation, a belief that the Committee and their Counsel reject.

These might be part of the omnibus economic development bill or it may be part of the budget; the vehicle remains to be seen.

Capital Investment Grants

The Legislature is working to build on the grants created under last session’s economic development package. The current program is oversubscribed with over $61 million of requests for $10 million in funds, though subsequent Treasury guidance may make many applicants ineligible.

Per the enabling legislation for the grants, ACCD needed to develop an economic model for measuring positive externalities and have that model approved by the legislative Joint Fiscal Office. These include six factors: education, climate, labor force participation, downtown, racial justice, and tourism. ACCD sees further grants being directed primarily to childcare, housing, and education in ways that meet that model and Treasury guidance.

Members of the Committee don’t seem so sure that the model is well suited to the current economic environment, specifically around childcare which they see as a part of the factor for labor force participation.

Tourism, Marketing, Recruitment, Retention

VDTM is proposing a one-time General Fund appropriation of $8.46 million (GF because ARPA prohibits relocation). The funds would be allocated over a three-year period, at $2.82 million per year, as highlighted below.

Grand List Enhancement Program

The Administration has proposed a $20 million proposal to reverse declining or stagnant grand lists in the over 150 Vermont towns currently in that condition by making capital improvements to these areas.

New and Relocated Worker

The Administration has proposed a $1 million general fund appropriation this year and one-time $5 million appropriations for the next three years to this program.

Project-Based TIF

For a few years now many have been pushing to make Tax Increment Financing districts available to smaller communities by allowing them to implement them at a smaller scale. Many legislators don’t see the need for these in the presence of ARPA funding, and this viewpoint has, for the last few years, presented an obstacle in these conversations.

LCC will testify on the bill next week. The Committee is looking to advance the legislation within the next three weeks, ahead of the Town Meeting week recess.

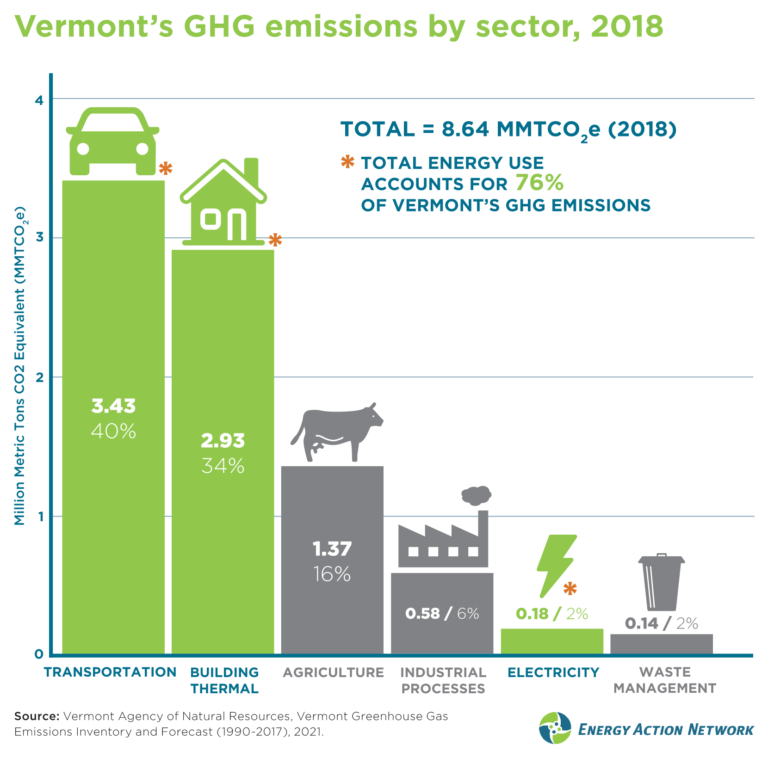

Clean Heat Standard Now in Comprehensive Draft Form

This week saw an initial draft of the much anticipated Clean Heat Standard in the House Committee on Energy and Technology. As you can see by the accompanying chart, thermal energy accounts for much of the greenhouse gas emissions in the state behind transportation. The bulk of Vermont’s climate action to date has focussed on electrical utilities and industry, which you can see in the accompanying chart contribute the smallest share of emissions.

Utilities that operate under the regulation of the quasi-judicial Public Utilities Commission since 2015 have been subjected to a renewable energy standard, which (put most simply) required electrical utility companies to purchase an increasing amount of renewable energy, purchase renewable energy credits equal to the amount of that energy when they cannot actually source it, or pay a higher alternative compliance fee.

Fast forward six years and the legislature is contemplating creating something similar for all thermal energy. The Standard will be administered by the Public Utility Commission with assistance from a Clean Heat Standard Technical Advisory Group and be applied to fuel wholesalers, Vermont Gas, and the in-state entity that makes the first sale of the fossil-fuel-based thermal energy source in the situation the wholesaler is an out-of-state entity. The drafted plan and subsequent legislation envision the “obligated parties” either reducing their greenhouse gas emissions to a target or purchasing credits to offset their emissions, similar to the RES.

There are some major differences between electrical utilities and thermal energy providers in Vermont, which might be the reason much of Vermont’s efforts have been focused on less emitting sectors. None of these are meant to be reasons not to move forward with such a proposal; they are just acknowledgments of the challenges.

First, alternatives are less commonplace, need broader market acceptance, and might not be able to handle broader market acceptance. Alternatives include electrification of heat as well as woody or liquid biofuels while leaving the door open for other innovations. Unlike RES implementation, it is not a grid operator weighing the pros and cons of a new alternative source, it is a fuel installer and a homeowner. There is also the worry that as other states move to adopt similar policies the market for these alternatives might not have reached maturity to handle the demand.

Second, this sector with the exception of VGS, operates in a very different regulatory environment than the PUC. This change would be like moving this sector from homeschooling to a boarding school. It will likely be a rough process to build this structure and businesses in this sector will need to adapt very quickly to credit trading and accounting.

Third, currently, under Tier III of the electrical utilities RES, electrical utilities are required to acquire fossil-fuel savings through energy transformation projects. There may be overlapping jurisdiction with the existing Tier III program that will need to be sorted out, as the larger utilities already have the acumen and incumbent advantage in the space.

LCC Employee Roundtable: Discrimination Bills & COVID Pressures

This month, as part of the recurring LCC Employment Attorney Roundtable, we discuss legislation making its way through the House with good intentions to focus on discrimination, and perhaps, some unintended consequences. You can read previous updates on this legislation here.

None of the information in this video constitutes legal or financial advice.

The Laundry List:

If you’re still looking for more to read, here are links to our past advocacy updates from this legislative session: Week 1, Week 2, Week 3, Week 4.

If you want to read more about Act 250 and housing, check out last week’s piece on that.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team

Don’t ever miss an update. Subscribe to stay in the know on all things advocacy