Thank you to this week’s sponsor of our Advocacy Update:

March 11, 2022

Almost exactly two years ago today, on Friday the 13th, legislators packed up and left Montpelier for what many thought would be a two-week lockdown. The House over the past month has been easing into in-person legislating, and the Senate joined them this week, with nearly all members of both bodies present. While the State House still feels different, with fewer people, masks, and committee rooms reserved for members and staff, it is starting to feel closer to what folks remember. Another important anniversary this week, exactly one year ago, the American Rescue Plan Act was signed into law on March 11th, 2021, bringing billions in federal funds to the state of Vermont. It’s hard to believe that all of that money will have been appropriated when this session adjourns. COVID has made two years of legislating feel like a decade, however, walking the hallways of the legislature this week, there seemed to be a new sense of life and optimism for many.

As we close out week nine, we’ve hit the crossover deadline for most bills, meaning that if a bill did not pass out of the committee of jurisdiction, it should not proceed any further this session. Bills from money committees have a crossover date of March 18th, next Friday. Of course, there are exceptions, and this year the deadline seems less important as many larger items have missed the deadline. Traditionally, a bill could go before the Rules Committee and get special permission if it misses the crossover deadline, or a proposal that was supposed to be dead because it died in bill form might be drafted as an amendment on another bill. Nonetheless, you have a better idea of what the rest of the session looks like at this point. There were over 720 House and 286 Senate bills active this biennium.

In this week’s update:

- Join us for our Final Legislative Breakfast Monday

- Omnibus Housing Bill Passes out of Committee

- Omnibus Economic Development Bill Work Continues

- Bill Overhauling Discrimination Litigation Slows

- Non-unanimous Jury Trial Bill Passes out of Committee

- Miscellaneous Revenue Bill Gets Committee Time

- Ukraine Conflict’s Nexus to Vermont

- The Laundry List

- Big Education Spending and Taxation Changes Pass Senate Committee

Final Legislative Breakfast Monday

We look forward to seeing you this coming Monday, the 14th, at 8:00 a.m. for our third and final legislative breakfast of the session. As a reminder, this breakfast will feature Governor Phil Scott, Senate President Pro Tem Becca Balint, and Speaker Jill Krowinski. We’ll hear remarks from them and have time for questions. Want to get ahead of the line to ask questions? Go ahead and submit them here. We suggest making sure you read our latest newsletter ahead of the breakfast for context. And don’t forget to set your clocks forward an hour on Sunday.

Special thanks to the sponsor of our Legislative Breakfast Series:

Omnibus Housing Bill Passes out of Committee

This week, S.226, the Omnibus Housing Bill, was passed by the Senate Committee on Economic Development, Housing, and General Affairs, representing a massive package to address one of the state’s top workforce and affordability challenges.

One contentious change to the bill is the last-minute addition of the contractor registry bill, which has drawn multiple vetos from the Governor. The hope is that with such a large piece of legislation, with many things the Governor wants, the registry can survive.

Omnibus Economic Development Bill

The Senate Committee on Economic Development, Housing, and General Affairs continued work on the Omnibus Economic Development bill but did not finish their work as expected. The latest draft follows the contours of earlier drafts, however, there is a great deal of uncertainty on what will make it into the final package.

A summary table can be found here.

These are items that have recently been changed;

- Paid Family and Medical Leave – The Committee heard from the Department of Financial Regulation, which is the process of receiving information from a Request for Information (FRI) they put out to help them put together a Request for Proposals (RFP) for a private insurance carrier to stand up a paid family and medical leave program in the state. The intention would be to have state employees covered under the program and then open it up for voluntary participation for businesses with more than 20 employees and at a later date, individuals who would like to opt into the program.

- Capital Investment Grants: The Auditor vehemently disagreed with the state’s consultant on the eligibility of this program for federal coronavirus relief funds in a memo.

- VEDA Forgivable Loan Program: The program has proceeded fairly similarly, however, some more details have been ironed out. Eligibility will be determined by a decline in net operating income. As written, a loan would be capped at six months of expenses or $500,000 – whichever is less, and eligibility would be determined by a decline in net operating income. VEDA will consider a pre-pandemic normal year of operating expenses to try and achieve that level.

- Paid COVID Sick Days: The Committee discussed language that would enable reimbursement for paid sick days employers gave to employees for reasons related to COVID-19, similar to the expired Families First Coronavirus Response Act leave. The Joint Fiscal Office modeled (using Massachusetts’ data from their paid leave program) that the legislation would cost $27.5 million.

The bill still contains elements we’ve covered before, including a $15 minimum wage by 2024, language to attempt to enable the extra unemployment benefit created last year, a Vermont Film Commission, and dollars for the Vermont Department of Tourism and Marketing.

Bill Overhauling Discrimination Litigation Struggles with Crossover

The House Committee on General, Housing, and Military Affairs attempted to close in on a final version of H.329, a bill that in the most recent draft does three things:

- It eliminates the “severe and pervasive” standard for incidents that rise to the level of “discrimination” or “harassment” and expressly states that the statute should be read “liberally.” The bill also did not create did not establish a floor for such definitions, leaving the possibility that petty slights could be considered “discrimination” or “harassment.”

- The bill would make it so that claimants are not required to demonstrate the existence of comparators when asserting discrimination.

- It establishes a six-year statute of limitations for these claims, which may have already been applied under case law for those seeking economic claims (lost wages), however, it is unclear if it would do the same for those seeking personal injury damages which previously had only a three-year statute of limitations under case law.

Previously in the bill (and taken out this week) were two components:

- There was language around internal processes for reporting discrimination or harassment, which would be confusing for employees and likely would have encouraged employees to skip this process in favor of litigation.

- There was also language in the bill to prevent summary judgment, which was seen by some legal experts as a legislative overreach.

Things became difficult this week when language around public accommodation that would have brought schools into the legislation spurred pushback from schools and educators’ associations. They proposed an exemption wherein they follow the current law instead of adopting the bill’s language. The bill was also supposed to go to the House Committee on Judiciary for review as the language sought to overturn a half-century of court precedent. This did not happen in part due to the school-related language. The Committee Chair is determined to pursue this legislation despite the setback and will likely attempt to add this bill as an amendment to another bill going through the Committee.

LCC understands that these issues are sensitive and the complicated nature of legislation such as this means that our work to find suitable solutions can be mischaracterized. If you have any questions or want to more thoroughly understand our position, we’d welcome you to reach out to us directly.

Non-Unamious Jury Trials Bill Passes out of Committee

The Senate Committee on Judiciary advanced S.178, reducing the requirement for obtaining a jury verdict in a civil case from unanimous to 80 percent. This is despite testimony from Judge Thomas Zonay, a Vermont Chief Superior Judge, who had polled all current civil judges and found that no judges are in favor of this legislation.

Currently, Vermont requires verdicts to be unanimous. Under this bill, the plaintiffs’ attorneys will only need to persuade 10 out of 12 jurors (or 5 of 6). Many see this as an effort by the plaintiffs’ bar to obtain more frequent and larger verdicts. This is of concern because often, jury dynamics can be such that minority voices can easily be cast aside during deliberation and the majority of the jury can ignore the views of jurors who see things differently.

Older Miscellaneous Revenue Bill Gets Attention

An area of concern exists in the property transfer tax surcharge discussed in Senate Finance in H.437 and Senate Economic Development as part of their omnibus housing bill to pay for the expansion of the manufactured homes tax credit. The component got left out of legislation last year and had been mentioned a few times here and there, yet came back in full force this week.

The proposed increase in the manufactured home credits is four times that of the previously proposed increase, so a worry would be that the tax would be increased to cover it. While the tax is being marketed as a “mansion tax” because it levies a surcharge of 0.5% on transfers of property by deeded title when the value of the transfer is over $1 million, this affects both residential and commercial properties, so that is not a completely accurate framing. While the amount may seem small, it can be big in a large commercial transaction and can add one more tax to the list of costs to a transaction that can deter corporate decision-making. Finally, there has been a discussion of broadening the tax to be on controlling interest transfers, not just deed transfers.

Also, in H.437 and not discussed much, this session is a long-standing Chamber priority: the manufacturing inputs exemption. Will Baker from the Department of Taxes presented a fantastic visual of the issue and attempted to explain that this is a matter of opportunity cost for the Department as issues with the complexity of this tax result in many auditing hours and subsequent litigation that the Department has sometimes lost and sometimes won with unfortunate impacts on the business that just misinterpreted the statute.

Corporate Taxation and Military Retirement Income Exemption Advances

The Senate Committee on Finance passed S.53, which makes important changes to the state’s corporate tax. The Committee advanced the bill with language similar to that reported previously, however, without the single sales factor language from S.53 and the corporate minimum tax changes. While removing the corporate minimum tax language is welcome news, the removal of the single sales factor is troubling due to the complementary nature of the original legislative package. Also officially removed from the bill is the cloud tax section, which has sat idly by since pre-session testimony.

The bill will very likely be decided in a Committee of Conference and there are many indicators that the Senate Finance Committee has worked to position themselves well for negotiations at that time. A section-by-section of the bill can be found here.

Also in the bill, as it moves, is the long-debated military retiree tax exemption as previously passed by the House. The Senate’s language will be included with the stipulation that retirees must choose between the military retiree exemption or the Social Security benefits exemption when they reach Social Security eligibility. There will also be a full exemption on military survivor benefits without restrictions.

Ukraine Conflict Impacts and Nexus to Vermont

In a global economy, the impacts of a war ripple through the global economy. Yes, there have been wars in the past 70 years, however, few have been at this scale, interrupted global trade at this level, or featured the economic warfare that sanctions represent. Commodities such as oil, natural gas, wheat, neon (essential to semiconductor manufacturing), and nickel have been affected by the conflict at a time when we are already reeling from the pandemic supply chain shocks. These effects pile on to the already massive inflation the economy has suffered from the last two years of supply chain interruptions and market shifts.

Vermont is a very rural state that is highly vehicle dependent, and while the state has many intentions to move to electric and more efficient vehicles, it’s not happened yet and heavier vehicles have not yet hit a level of market ubiquity. The most obvious impact to Vermonters is the pain at the pump. This week, Congressman Peter Welch called for the 18.4cents per gallon gas tax to be suspended at the federal level; six democratic governors proposed this as a solution this week as well. The Governor rejected doing the same at the state level with Vermont’s 30.17cents per gallon gas tax, citing the need for that revenue for transportation infrastructure.

Legislators moved quickly to send $644,826 in aid to Ukraine, plus a couple of thousand dollars the state has received from the sale of Russian alcohol, the sale of which the Governor banned. The state pension fund also liquidated about $6 million in Russian holdings this week.

Laundry List

For those new to our advocacy updates, the “laundry list” is where we give quicker updates and highlight interesting news. There are about 624-hours of legislative committee time each week and then additional conversations outside of committee, local news, and federal conversations. With all that, not everything makes it to a full newsletter item. Have feedback for us? Email [email protected].

- Here are links to our past advocacy updates from this legislative session: Week 1, Week 2, Week 3, Week 4, Week 5, Week 6, Week 7, and Week 8.

- Due to the continued work on the omnibus workforce bill at the time we published, we don’t have an update, however, this is a link to the most recent version.

- You can read a recap of what happened during Town Meeting Day from VTDigger here. Education spending will rise 5.36% after 96 school districts approved their budgets, with six rejected.

- The President should soon sign a $1.5 trillion government omnibus funding bill after multiple continuing resolutions have kept our federal government running since he took office. The legislation enables the last of the Bipartisan Infrastructure Framework previously passed and Vermont’s Congressional Delegation was able to bring home about $200 million dollars in congressionally directed spending.

- This week the report of the Committee of Conference was accepted by the Vermont House, passing the Budget Adjustment Act. As was covered last week, the Governor and the legislature do not see eye-to-eye on the whole package.

- The House Committee on Natural Resources unanimously advanced H.115, a bill that would create a requirement for those importing products that fit the definition of Hazardous Household Waste to create stewardship organizations to handle that waste.

- The Clean Heat Standard was passed out of the Appropriations Committee on a vote of 8-4 and will head to the House Floor next week for a vote.

- We’ve seen a high rate of resignations from the legislature, with the latest departure of the youngest member of the House making the sixth (that we could remember) this biennium. This week, the Governor appointed Rep. John Kascenska (R) to fill a vacancy created when Rep. Patrick Seymour (R) resigned. Kascenska is a business owner from Burke, and he’s been assigned to the House Committee on Commerce and Economic Development.

- The House Ways and Means Committee walked through H.492, which makes substantial changes to the governance of Act 250, drafting to draft an amendment based on the fiscal note presented to them by the Joint Fiscal Office. The amendment includes additional funding and will remove the billback authority the bill created for the Board to assess costs to an applicant for additional personnel related to a particular proceeding. The amendment will have billback be part of a study.

- The Senate Committee on Natural Resources approved the weatherization bill, S.284, with $20 million for the Office of Economic Opportunity, focused on low-income homes.

- The Senate Committee on Economic Development, Housing, and General Affairs discussed sports betting this week and recommendations from a study committee. They faced limited time and would like to continue the conversation Tuesday.

Changes to Education Spending

This week, the Senate Committee on Finance advanced a bill that changes the way different school districts send and receive money from the state education fund. In the House, the Ways and Means Committee has discussed shifting residential education property taxpayers’ exposure to education funding from property to income. There are few things more complicated than property tax and education funding in Vermont. It’s a complicated web of funding sources, overlapping jurisdictions, and politics that disenfranchise even the most competent Vermont policy observers from any part of the political spectrum.

LCC observes these issues with these evergreen concerns:

- They are occurring in the absence of discussion of the level of spending currently.

- The proposals shuffle spending in the state, however, they may also increase spending.

- These proposals could further strengthen the disconnect between voters’ and districts’ decisions and the cost they create in taxes.

- The disconnect between local grand lists in proportion to local spending and the statewide grand list to statewide spending is likely to grow further.

How we pay for education in the state;

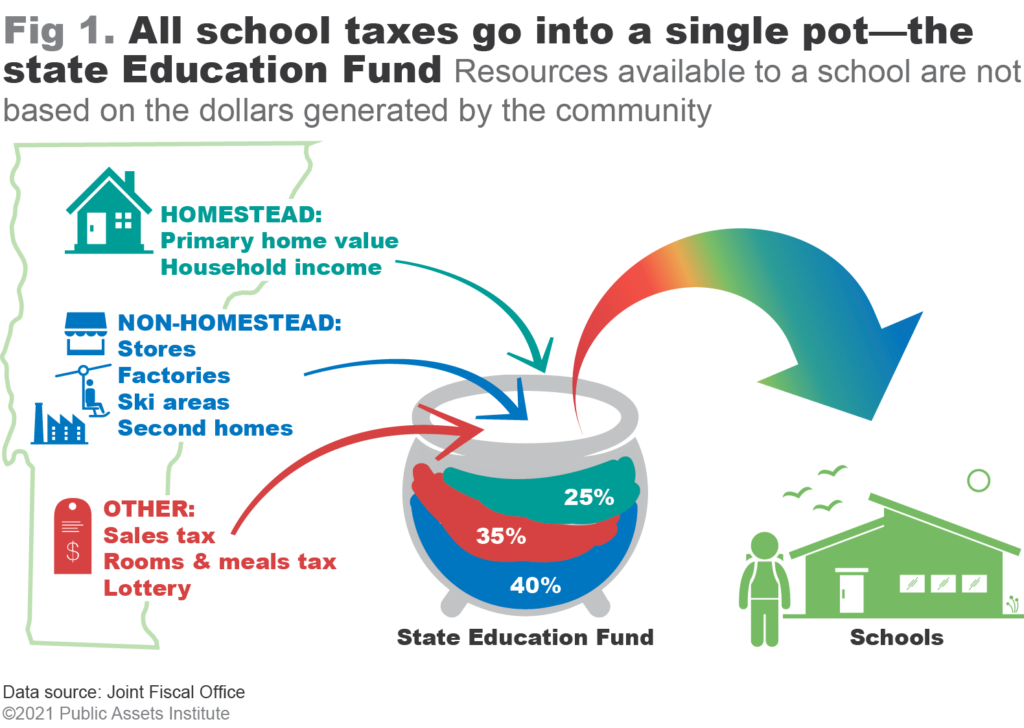

Let’s start with the pure basics. Vermont’s education revenue raised in the state comes primarily from property taxes (income sensitized) and sales tax. The single most influential component of Vermont education funding is Act 60, which is a direct result of Brigham vs. Vermont, a case that compelled the state legislature to create a system in which education funding is not directly proportional to the grand list of the community the spending is in. As a result, education property tax is aggregated at the state level and redistributed back to the communities on a per-pupil basis.

Act 60 might have made education funding more equitable, however, an unintended consequence of the legislation is the stagnation of grand lists across the state. In the meantime, school spending has grown across the state. So we are now in an environment in which it doesn’t matter how big the grand list in a town is, the yields and rates are based on the size of the statewide grand list and total statewide education spending. The current system is designed to ensure that approved budgets are fully funded and that towns that spend the same amount per pupil will have the same tax rate irrespective of how much property value the towns have (this is before the Common Level of Appraisal (CLA) is applied).

To put a finer point on this, before Act 60, a town would be incentivized to grow their grand list if they wanted to grow their education spending, since Act 60 a town can stagnate its grand list with the same or increasing education spending. Only 27 towns have seen consistent grand list growth of 1% or more over the last decade over 150 Vermont towns are considered stagnant.

Per Pupil Weighting

At the conclusion of the last legislative session, the legislature created a taskforce to report back on changes to the per-pupil weighting for education fund distribution to the local districts. The Taskforce originally suggested a move to categorical aid from per pupil, however, this was abandoned in favor of readjusting per-pupil weights.

The large changes being considered right now are to the enrollment count, poverty ratio, and weights for each pupil. Previously the enrollment count was an average of the students in a district this year and the previous year and would now be an average of the previous two years. After this count, to determine a district’s per-pupil weight, the Commissioner of Education would apply the poverty ratio. The poverty ratio gets changed in title to “pupil from an economically deprived background” and to qualify, a student is eligible for free or reduced-price lunch for now. The intention would be to then move to a universal income declaration form to collect data from the district to better reflect on those who are in poverty and assist in reducing stigma. The General Assembly will create the new ratio to be not lower than 185 percent of the current year Federal Poverty Level for the 2023-2024 school year and DOE needs to convene stakeholders by October 2022 to inform.

The final step would have the Commissioner apply weighting factors. These factors used to be additive and multiplicative and are changed in the latest draft legislation to only be additive and the most dominant weight is English Language Learners. Weighting factors would include:

- Grades – grade levels each have a select weight applied

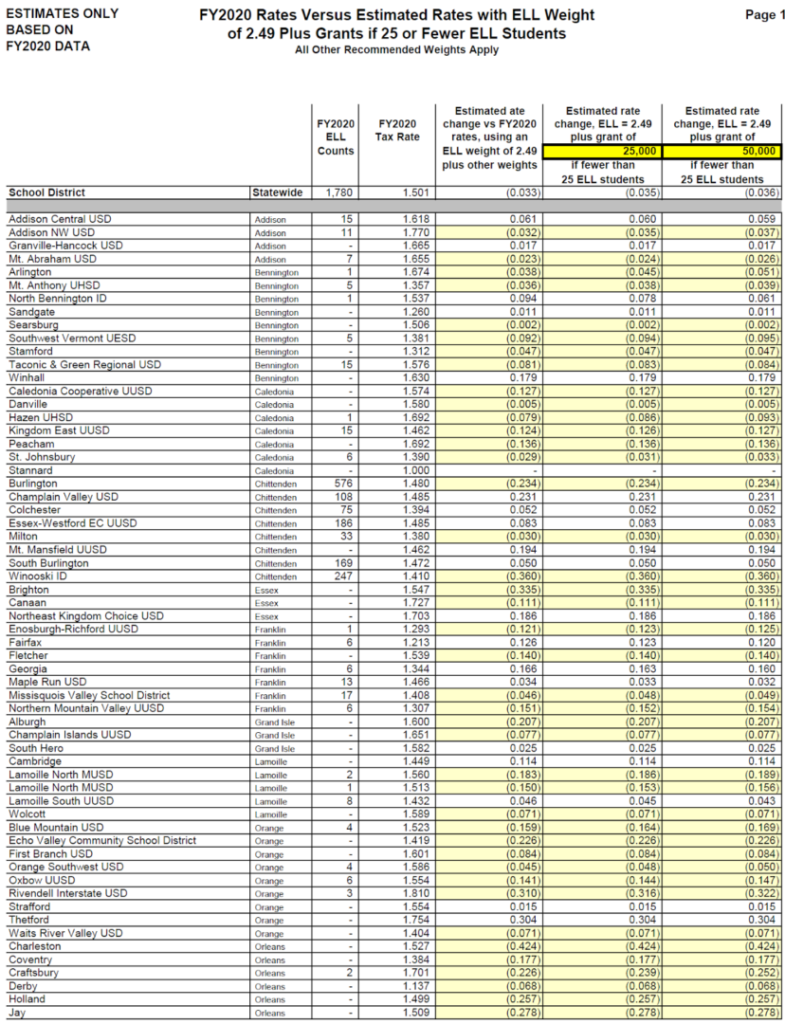

- ELL – Previously in the draft, the ELL was just reflected by a weighting factor, Senate education created a grant to accompany the weight for schools that have a small number of ELL students.

- Sparsity – schools in areas with less population density receive higher weights.

- Small schools – smaller schools receive larger weights. This proposal keeps intact merger grants for those who merged or were forced to merge under Act 46, however, they only get the grant or the small school weight.

Every five years the weights need to be adjusted by recalibrating, recalculating, repeal, addition, or any combination of those.

So, as can be seen here, the proposal just reshuffles the deck mostly, however, with some large consequences in the form of tax increases for some districts. The big losers? School districts that are not sparsely populated, relatively large, and don’t have many English language learners. A great example of this is Champlain Valley Union (CVU) School District as shown below.

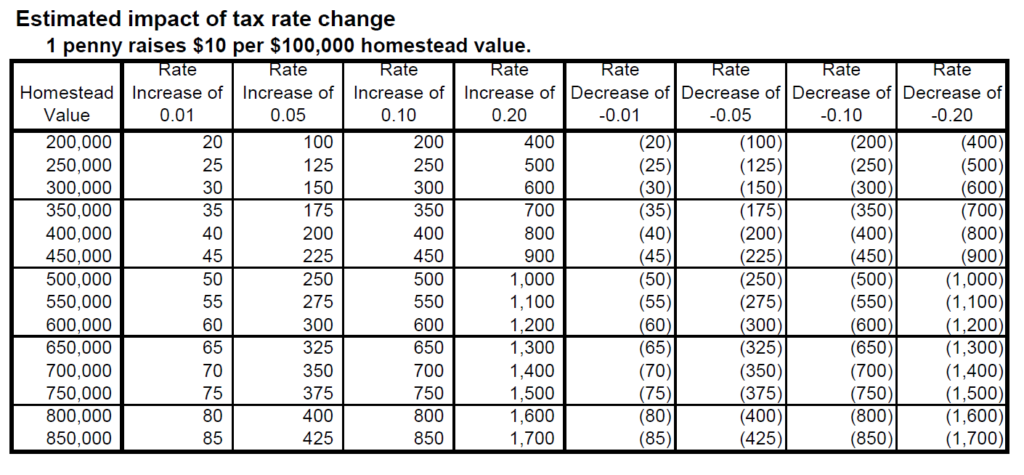

As a reminder, even a small increase in property tax can be very expensive for even a modest home as can be seen by the below table.

For example, a person living in a $250,000 home in the CVDSD, would see a 0.231 increase or, using this table, $570 per year. Furthermore, the legislation’s expansion and revisions of the poverty ratio may create a situation in which it is difficult to predict the trends in future funding. The Legislature’s Joint Fiscal Office was not able to offer any clarity on what this bill will do to future tax rates, as can be seen here.

Big questions from LCC:

- What does this do to the overall cost of education in the state, especially in the out years when the new universal income declaration form is in effect?

- Will this further disconnect local decisions on school spending and tax rates?

- Should there be a higher Federal Poverty Level for areas with higher prevailing wages; Chittenden county has a higher prevailing wage because it has a higher cost of living, should this be taken into account?

- How would this change income sensitivity? 67% of Vermonters will receive a property tax credit (income sensitivity of property taxes) this year. If they are facing an increase in taxes, would we see more people need to use the program?

- What compels people to fill out the income declaration form, and to do so accurately. Most would agree the past metrics might not be perfect, however, what makes this more accurate if compliance lacks.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team

Help us seek economic opportunity for all Vermonters. Support our advocacy work.

Become a member of the Lake Champlain Chamber or connect with our advocacy team to learn more about sponsorship opportunities