Thank you to this week’s sponsor of our Advocacy Update:

April 21th, 2023

If you read last week’s update, you might have felt it was a little slim. You’re not wrong, last week was a week where the committees were heads down, sifting through testimony and many different iterations of potential legislation provided by staff. This week, the image of the final iterations of some legislation started to take shape, potentially. That final caveat of “potentially” is there because while there are four to five weeks to go, a lot can happen, and there is a lot of distance to close between the House, Senate, and Governor.

This week set up a few contentious conference committees between the House and the Senate. It also certainly set up a few showdowns between the Democratic supermajority and the Governor who, again this month, ranks as the most popular Governor in America.

In this week’s update;

- Housing bill has everyone’s attention

- Business groups testify on the “homeless bill of rights”

- House committee continues to attempt to erase severe and pervasive standard

- Money Committee looks at Personal and Corporate income to pay for childcare

- Clean Heat Standard Passes House

- VTDigger series gives context to legislators’ employment and income

- The Laundry List

Housing Bill Has Everyone’s Attention

Now that the House Committee on General and Housing passing the bill, with many of the members protesting the lack of time and latitude to work on the bill, S.100 has made its way to the House Committee on Environment and Energy for consideration. House E&E has been bogged down for weeks now with the Clean Heat Standard, and that legislation still required a great deal of energy from the Committee this week, however, the committee was still able to get some substantial testimony in on the housing bill.

As it’s been from the start, S.100 attracts significant attention from not just advocates but legislators who are not on the committee of jurisdiction but would like to see the bill foster more housing development, which is the number one issue for constituents. The Rural Caucus stepped in with a letter this week to push that the legislation make more meaningful modifications to Act 250, such as extending the area covered by the 25/5/5 trigger and having the development of under four units not count towards 10/5/5 or 25/5/5.

Business Groups Testify on “Homeless Bill of Rights”

The House Committee on General and Housing discussed H.132, which refers to itself as the “homeless bill of rights.” The Committee heard from the Burlington Business Association and the Lake Champlain Chamber on the atmosphere and strained relationships that have become apparent in downtown Burlington as well as other more densely populated areas in the state. It was made clear in testimony that the business community had a deep level of empathy for this community and is leaning into solutions based on that instead of draconian measures seen elsewhere in the world that would create a wedge. The Lake Champlain Chamber identified the crux of the issue as the bill’s ability to be exploited by those who are not homeless yet could make a case they have “perceived homelessness,” which paired with vague language that protects “harmless activities associated with homelessness” without defining what those are would have unintended consequences, specifically in “places of public accommodation.”

The Lake Champlain Chamber also testified that the “legislation represents a capitulation to the discriminatory land use and zoning that our state has erected to make sure that certain people cannot find housing here and cannot settle down in our state. If we truly seek to support our homeless population, we should seek to house them….”

House Committee Continues to Push End of “Severe or Pervasive” Standard

The House Committee on General and Housing continued its work on S.103, which moved very rapidly until now. The bill would do a number of things, chief among them (and focus on by testimony from those representing employers) is that the language says that discriminatory action “does not have to be severe or pervasive,” which erases a long-standing standard for harassment or discrimination cases. The bill also has language about a comparator having to be someone of like characteristics, which means there is no objective community standard, making litigation over trivial matters much more likely. Due to this, employer liability insurance and new litigation that will be brought about from the increase in trivial matters will create higher costs for employers in the state.

The bill also looks to prohibit “no rehire” provisions in settlement agreements in these cases. The committee heard from those representing employers and employees that these are something that benefits both employers and employees. An underlying assumption of advocates for banning these provisions is that there is a coercive nature to these agreements when in reality, it is part of a negotiation between two parties each represented by legal counsel, and crafting an agreement that best serves their needs.

If you are concerned about this legislation, please contact [email protected]

Money Committee Looks at Personal and Corporate Income to Pay for Childcare

S.56, the childcare bill, passed out of the House Committee on Human Services and will now need to make stops at multiple other committees before it can be passed by the House. It would then be sent back to the Senate, where that chamber could start to address the major divide between the two chambers. Chief among those divides is how to pay for it.

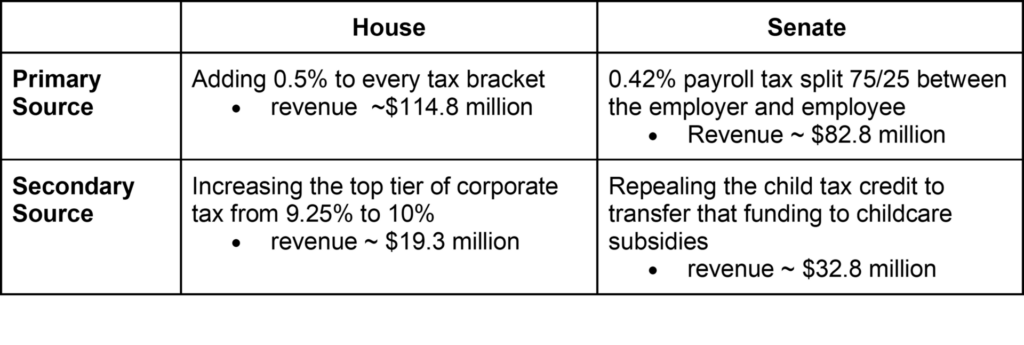

When the bill passed the Senate, we speculated in week 11 and again in week 12 that S.56 “will face major scrutiny by the House, where it is expected that members may abandon the payroll tax, possibly for a consumption tax or, it’s rumored, a corporate tax.” Now here we are in week 15, and the House Committee on Ways and Means has rolled out their proposed funding package, which includes an income tax increase (in lieu of payroll) and a corporate tax. This is not to say that there won’t be other places where those frequently discussed taxes might be added before the session ends, so stay vigilant.

The House Committee provided some context to their thinking in conversations. They believe an income tax could be more sustainable, more progressive, and better meet the request that businesses and individuals each pay their fair share. Citing the business support for the childcare funding, the Committee felt that an increase in the corporate tax would be the proper way to achieve this.

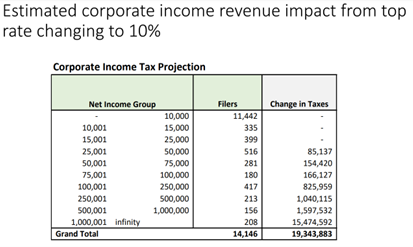

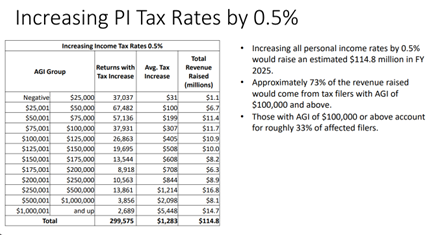

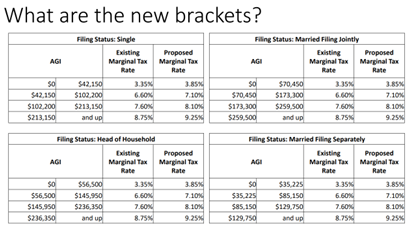

The Committee looked to increase the top tier of corporate tax to 10% and then increase personal income tax by an additional 0.5% across all brackets. The package also increases an increase in the Earned Income Tax Credit (EITC) from 38% to 59%, which would more than offset the effects of the tax increase on those lower-income filers, leaving them with less tax burden than before at the cost of about $14 million.

The Senate had funded the bill with a 0.42% payroll tax, a reallocation of the funding for the Vermont child tax credit, and the roughly $50 million base funding the Governor found.

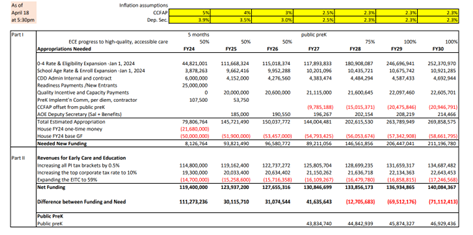

The Committee spent some time understanding how corporate tax works and is continuing to understand this package which some are saying is their final solution and some are saying is just an option. There is some agitation over the shortfalls this package creates in the out-years. As can be seen below, by FY 29, the funding gap will grow to about $70 million. It’s also worth noting that this conversation and the upcoming negotiations are not solely about childcare. House leadership, by all evidence, is adamant that both childcare and paid family and medical leave are enacted this year, while the Senate is looking to only act on childcare.

Clean Heat Standard Passes the House; Cost Containment Amendment Fails

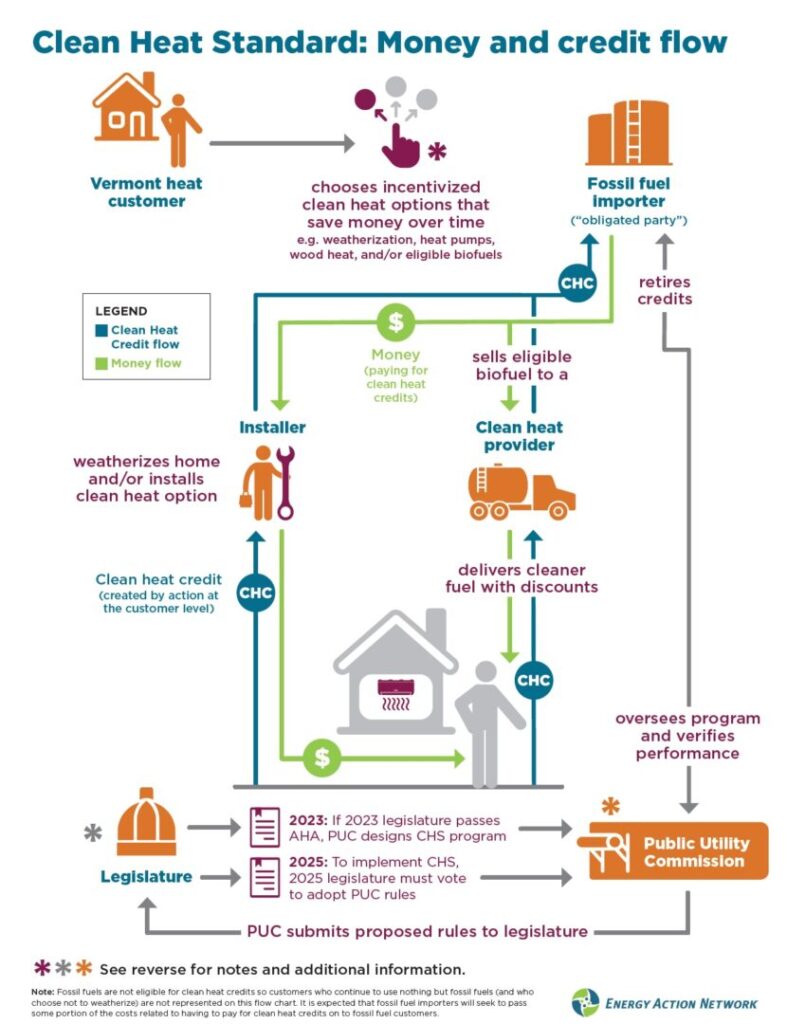

After a lengthy floor debate, the Clean Heat Standard passed 98 to 46. The bill directs the Public Utilities Commission to spend the next year and a half and about $1.6 million dollars on developing what can be put most simply as a cap and trade system in an attempt to lower the greenhouse gas emissions from non-transportation fossil fuels. A check-back provision in the bill requires the legislature to vote to enact the program after it is designed by the PUC but before full implementation.

If the program sounds complicated, that’s because it is, as you can see in the infographic to the left, which simplifies it as much as it can. In short, credits can be earned by certain activities, such as installing heat pumps, that reduce fossil fuel use. Fossil fuel dealers then have an obligation to purchase those credits or create their own.

Many in the legislature have taken the perspective that the bill is an overpriced study because, as we noted earlier, the legislation is directing the PUC to design the program but not implement it. The issue with that logic is that there is a high likelihood that whatever the PUC creates and brings back to the legislature they will likely say is too well calibrated and complicated to adjust for whatever the legislature doesn’t like, and at this future date, there will be a doubt that the state will meet the greenhouse gas targets statutorily mandated under the Global Warming Solutions Act. This will lead advocates to claim that the confluence of sunk costs and impending citizen suit via GWSA means that there is no time or ability to do anything other than accept what has been presented by the PUC. That’s just our prediction, and we did predict the outcome of GWSA correctly.

The bill has been contentious for many reasons, with the potential cost being one in particular. We’ve covered, as have the press, the controversial cost estimates by the Secretary of the Agency of Natural Resources that the program could add up to 70 cents per gallon to the cost of fuel, which environmentalists and some lawmakers protested as preposterous despite not having an estimated cost of their own. An amendment was offered by Rep. Jim Harrison on the floor to establish a ceiling on credits so that no more than 20 cents a gallon would be felt by customers, but that effort was rejected by a vote of 101 to 43.

The bill now goes back to the Senate, where it should quickly move due to the changes in the House being rather minor. This would put the bill on the Governor’s desk soon, where many expect a veto, as he has expressed dismay with the bill and requested a more extensive checkback provision.

VTDigger Series Offers More Insight into Legislator’s Employment and Income

We normally wouldn’t dedicate a section of an update to a series done by the media, however, this is an advocacy update, and it helps to have context about legislators as you think about advocacy. Do you have an interest in what legislators do for a living, what streams of revenue they might have, and what boards or other positions they might fill? Well, it’s not exactly easy to find those things, so the team over at VTDigger set out to collect that information from the places the legislators are compelled to list it and then compile it. What they created is not fully illuminating, mainly because many legislators leave it incomplete or answer briefly. If you want to take a look, this is the first part of their series.

In a later edition of the series, Digger pointed out that, “[m]ore than 40% of state senators and at least one-third of House members draw income from retirement savings and Social Security.” They go on to note that “of the legislators who did record some sort of employment in 2022 candidate forms, the most common categories included education, advocacy, and retail and hospitality.”

It’s helpful information to have when considering the makeup of the legislature and informs the public perception around recent conversations to increase legislative pay and extend them benefits.

The Laundry List

There are many moving pieces, and we do our best to add the ones that don’t get a section in the newsletter yet should be on your radar here. On any given day in the State House, there are about 175 hours of committee time outside of floor time, and then the hallway, cafeteria, or other time spent legislating.

- Read past updates here – week 1, week 2, week 3, week 4, week 5, week 6, week 7, week 8, week 9, week 10, week 11, week 12, week 13, week 14, and the last session’s wrap-up.

- Writer’s NOTE – We will not be publishing an update on May 12th.

- The House Committee on Appropriations removed the funding from H.94, the bill which handles VEGI, TIF, and VEPC. The funding of $250,000 would have funded the study to assess the future of state economic incentives. The bill will still proceed without funding.

- Action on H.288, a bill that would make changes to dram shop law in the state, was passed over on Thursday in Senate Judiciary. If you want, or need, to see liquor liability insurance rates decreased, you should contact members of the Senate Committee on Judiciary and express this concern.

- Governor Scott signed S.54, an act relating to individual and small-group insurance markets, which will allow these markets to remain unmerged and will result in lower health insurance rates for businesses.