The Vermont Legislature had an opportunity to help Vermont small business owners collectively save millions on their federal taxes and bring additional revenue to the state while doing so by establishing a state and local taxes, or SALT, cap workaround. Unfortunately, the House did not see the Senate’s wisdom here, and this opportunity is going unrealized. The Senate added to S.11 language, which would create the opportunity for those who have LLCs, LLPs, or S-corporations to work around the cap on state and local taxes (SALT) established as part of the Trump Administration’s tax cut bill. More than 21 organizations, and counting, signed on to a letter to the Speaker of the House imploring the House to concur with language sent by the Senate and join the growing list of 27 other states who provide this relief to their businesses.

We’re already rebuilding momentum for next year. If you collect your income from an LLC, LLP, or S-corporations, you need to be vocal about this issue.

We need to adopt a SALT Cap workaround because…

-

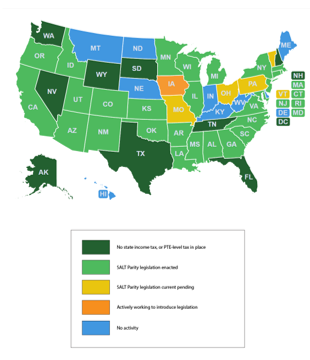

More than 27 other states (keep in mind there are states without income tax where this is unnecessary) have enacted the SALT cap workaround, and so should Vermont! Vermont is sending millions to Washington that 27 other states aren’t.

-

Other states are moving to enact the SALT cap workaround, putting us at a further competitive disadvantage.

-

We are sending millions to the federal government we do not have to – that money could be staying here in Vermont and being put to work to help Vermonters. Vermont is always looking to draw down as many federal dollars as possible, so why not now?

-

The federal government will pick up the cost of this tax cut that the state legislators have within their power to create.

-

As we see growing inflation, this provision can help small business owners across the state keep their prices down by covering some of their margins.

-

SALT was capped as a punitive measure meant to hurt blue (democratic) states like Vermont, which utilizes it the most because they have high taxes.

-

In any other area of government, our strategy is to draw down as much federal money as possible and not send money to the federal government when we don’t have to.

More Background on the SALT Cap Workaround

The amount of your state and local taxes (SALT) that you could deduct was capped as a punitive measure to hurt blue (democratic) states with higher taxes, such as Vermont, as part of the 2017 Tax Cuts and Jobs Act. Not long after this happened, tax attorneys in Connecticut discovered a way to work around the cap with an entity-level tax.

In November of 2020, the IRS gave its blessing to the workaround and a continually growing list of 27 other states have enacted an IRS blessed SALT cap workaround to rebuff this partisan, politically charged policy. Vermont is sending millions in tax dollars to Washington than these other states aren’t, putting us at a competitive disadvantage.

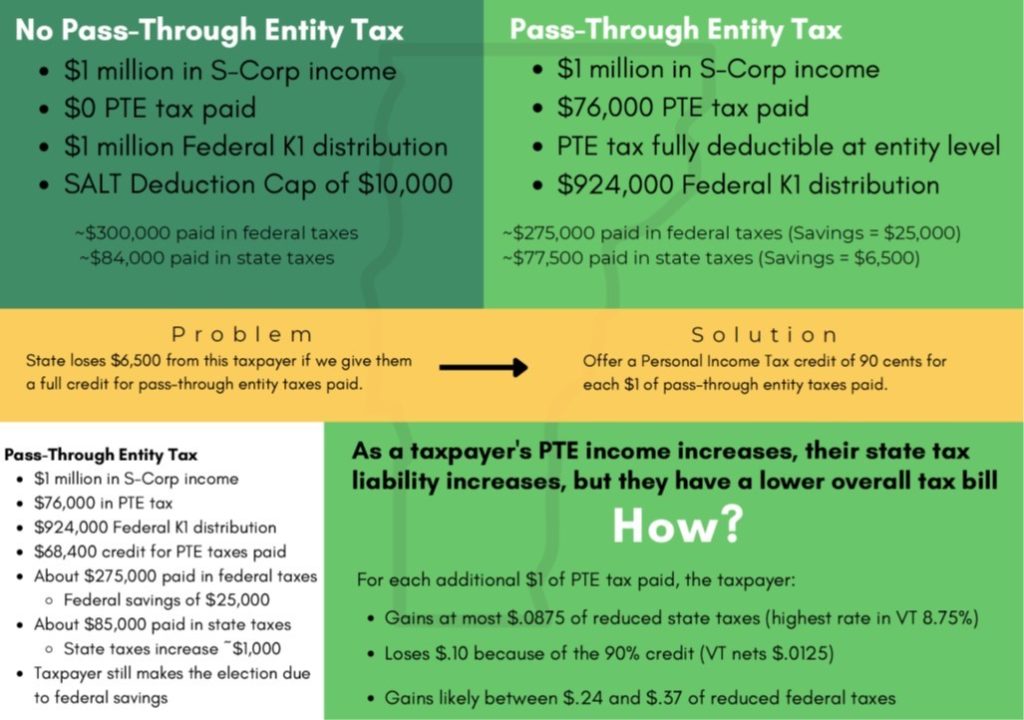

As an added bonus, the mechanics of this workaround allow the state to collect a portion of what is saved, resulting in millions in new revenue for the state.

In any other area of government, our strategy is to draw down as much federal money as possible and not send money to the federal government when we don’t have to; we feel strongly that this situation is no different. The money we are sending to the federal government could be staying here in Vermont and being put to work to help Vermonters. As we see growing inflation, this provision can help small business owners across the state keep their prices down by covering some of their margins or being put to work for capital investment. This is free economic development funding.

The Mechanics of the Pass-Through Entity (PTE) Tax

The state tax paid by the pass-through can be deducted from the pass-through’s income at the federal level because the SALT deduction cap does not apply to businesses, only to individuals. This reduced federal tax is then passed onto the pass-through members, so they pay less federal income tax. The pass-through also passes on the state tax to its individual members. The individual members can then claim a state income tax credit for the tax paid.

If it is easier, you can watch the Commissioner of the Vermont Department of Taxes explain it here.

Frequently Asked Questions:

Would the state lose money on this?

- The federal government will pick up the cost of this tax cut that the state legislators have within their power to create.

- The state will likely make more money on this proposal because of the elective tax liability. A filer would be eligible for credit equal to 90% of the member’s pro-rata share of tax paid by pass-through.

Can you make a progressive case for the SALT cap workaround?

- Remember, the SALT cap is a punitive measure meant to punish progressive states with higher tax burdens. Vermont already has among the highest tax burdens and one of the highest top marginal tax rates in the United States. Other states with similar tax burdens have quickly jumped on this opportunity to lower some of that burden.

- Think of it this way, progressive states mostly have higher taxes because they are offering more support to their citizenry than the federal government does. It’s almost like a tenant fixing their apartment and deducting that expense from their rent.

How much would this save eligible Vermont filers?

- It’s estimated that between 20,000 and 33,000 state filers could elect to use this and bring in savings to the state by lessening what is paid in federal taxes.

Should we wait until every filer in the state can access a SALT deduction again?

- Just because this has been repeatedly stalled in Congress doesn’t mean we should pass up meaningful tax relief for those who have a path available.

- To wait would be to needlessly continue sending Vermont dollars to Washington just because we want the perfect solution instead of a good one for the time being.

Congress will likely do this for everyone, so why don’t we just wait for that?

- People have been saying this for years, however, it is clear Congress won’t get this done, we need to do what we can ourselves.

- Because the SALT cap affects blue states, and because of the partisan nature of Congress, this usually can’t make it to the final round of negotiations in most packages.

This sounds like a handout to the rich?

- No, any business owner making as little as $25,000 can make use of this.

- By electing to pay the PET, the filers are agreeing to pay more in Vermont taxes.

- Vermont already has among the highest tax burdens and one of the highest top marginal tax rates in the United States. Other states with similar tax burdens have quickly jumped on this opportunity to lower some of that burden.

- See this overview from the State Joint Fiscal Office showing the filers impacted.

We would be better served by looking inward to create competitiveness rather than further distorting our tax structures and complicating taxpayers’ returns.

- This is one way to deflect, however, frankly, doing so is unlikely to happen and would take much longer than enacting this simple, proven policy enacted by 27 other states.

This was last updated on 6/8/21 – If you have any questions, feel free to reach out to [email protected]