Thank you to this week’s sponsor of our Advocacy Update:

While substantial work was done to address housing and public safety this legislative session, it is hard to walk away feeling good. Such measures are long overdue, communities are at their breaking point handling these crises, and implementation is uncertain as these changes will take time, while a double-digit spike in property taxes overshadows much of the positivity that might be felt leaving this legislative biennium.

The legislators sent back to Montpelier by voters next legislative biennium will have their work cut out for them. They will need to turn the tide on Vermont’s inadequate growth in housing stock, aging population, and unsustainable increases in education spending as the student population declines. All of these pressures are bringing Vermont to the brink.

When LCC released our legislative priorities for the session, we focused primarily on housing and public safety, the two highest priorities we heard from our membership repeatedly. After our priorities release, forecasts from the Department of Taxes made our ever-present priority of affordability even more acute, as the perverse incentives of Act 127 pushed up potential property tax rates to over 20%.

Here’s a high-level overview of how the Legislature did on these three priorities this legislative session;

Housing

- Substantial changes to the State’s land-use law, Act 250, were made, following last year’s HOME Act, which will completely reshape development in the state to achieve the housing stock we so desperately need.

Public Safety & Quality of Life

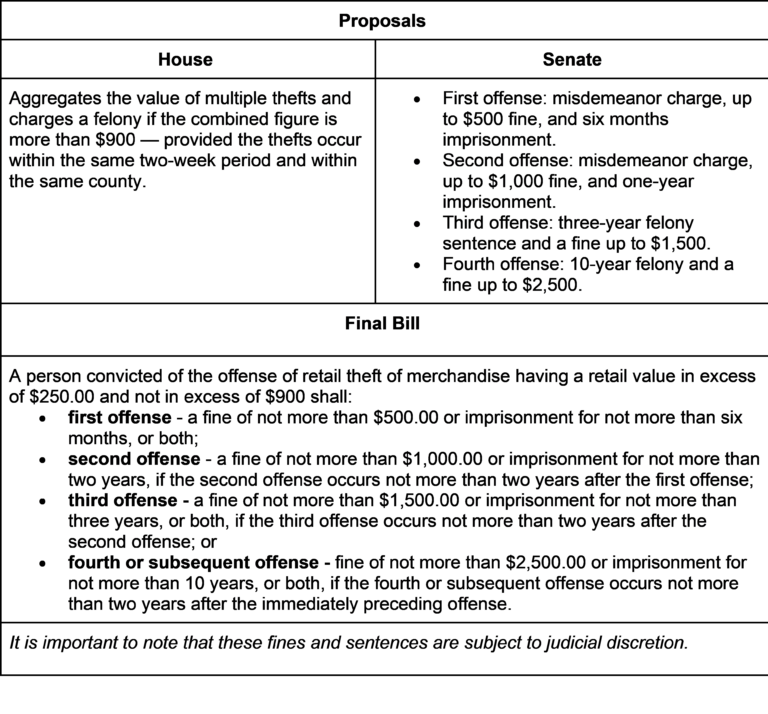

- Passage of retail theft legislation that progressively increases penalties as individuals re-offend.

- The conversation about re-offenders was not restricted to retail theft, as additional legislation addresses repeat offenders with updated bail laws and pre-trial monitoring.

- Legislation also addresses quality of life concerns with the creation of offenses for vehicle trespass and the creation of a Safe Injection Facility with the intention of curtailing public usage of narcotics and needles littering Burlington’s downtown.

Affordability & Budgeting

- Unfortunately, property taxes will increase by 13.8% on average as Vermont’s per-pupil education spending climbs to the highest in the country despite our student population continually shrinking. Fun read on this – check out this report from 2006.

- The Legislature added a 6% sales tax on Software as a Service and levied a 3% surcharge on short-term rentals to raise more revenue for the bloated education fund.

- The Legislature found $25 million in General Fund surplus to help buy down the tax rates, as well as some surplus held from the previous biennium; without this surplus and the new revenues, the property tax rate increase might have exceeded 18%.

- On a more fortunate note, a new top-income bracket and a proposed tax on unrealized capital gains were defeated, though their advocates vowed to work with national partners between now and the next session to make them a reality.

What’s Next?

Now that the Legislature has adjourned, it will not be a “goodbye” but a “see you later” as they will inevitably return for a veto session on June 16th.

- The Governor is expected to veto several bills sent to him. H.72 (Safe Injection Sites), H.887 (the property tax and education funding bill), S.213 (river corridor and floodplain regulation), S.289 (the Renewable Energy Standard bill), and S.259 (Climate Superfund Cost Recovery Program Fund).

Get Engaged – send us an email at [email protected]

- Send us your thoughts! Reach out with your questions, comments, and concerns.

- Sponsor our future newsletters or events!

In This Update

Housing and Land Use Policy

Housing is the limiting factor in the Vermont economy right now, holding back every element of our state’s economy. Reform of Vermont’s 55-year-old land-use law was on the priority list since

Act 250 was written on a typewriter when the Agency of Natural Resources did not exist.

- This historic legislation, H.687, represents a tectonic shift in Act 250 as the program moves to “place-based” jurisdiction and subsides as a barrier in some areas while becoming omnipresent and omnipotent in others.

LCC has advocated for years for the removal of places that now are Tier 1a and 1b to be removed from Act 250 jurisdiction.

- Legislation passed this session, which finally accomplishes the removal from jurisdiction of well-developed areas where Act 250 was duplicative and detrimental (something LCC has pushed for years).

- Language LCC introduced allowing for the conversion of commercial units to residential units without an Act 250 permit or permit amendment, made it to the finish line without much worry or fanfare.

- Additionally, language around inventorying housing stock production for the purposes of transparency and accountability was passed in this session.

Changes to Act 250 and Housing Programs – H.687

This nearly 200-page bill represents a massive shift in Vermont’s development and land-use policy, the full gravity of which we may not appreciate for some time. The legislation reflects compromises made as part of multiple studies this past summer and fall; however, the changes reflect years of policy debates, some spanning decades and many from the 2015 Act 250 50 Years report.

- Transitions to place-based jurisdiction,

- Creates interim exemptions until the new jurisdictional regime is in place,

- Creates new Act 250 criteria around forest fragmentation and a road rule, and

- Increases the property transfer tax on second homes.

The bill transitions Act 250 to place-based jurisdiction instead of the traditional size-based jurisdiction by creating three tiers of jurisdiction, with Act 250 jurisdiction most intense in Tier 3 and non-existent in Tier 1a. This looks like the following;

- Tier 1

- Tier 1a – 20 to 50 municipalities could fit into this tier and leave Act 250 altogether, though they would need to incorporate that criteria into their municipal zoning.

- Tier 1b – most municipalities could fit into this for their core, so long as they do not opt-out. This tier would exempt housing development under 50 units on less than 10 acres.

- Establishes exemptions for any development in Tier 1A areas and in Tier 1B areas up to 49 units of housing, including those part of a mixed-use development, and exemptions for hotels or motels converted to permanently affordable housing.

For a second, we’ll skip from Tier 1 to Tier 3 for the sake of making an explanation easier;

- Tier 3 – consists of “critical resource areas” where any activity within will more than likely trigger Act 250 jurisdiction and would, by some estimates, cover about 18% of the state’s land mass.

- Tier 2 – is essentially anything we have not described yet, which will closely resemble the existing Act 250 program.

- The bill adds a “road rule” that triggers Act 250 if a road is more than 800 feet.

- New criteria exists in the bill for “forest fragmentation.”

H.687 does include interim exemptions until July 2027 (if vetoed, this early date will be a contributing factor and if signed, will need advocacy to push it back the sunset to make the exemptions useful) to accommodate the time it will take to stand up the new tiers, however, it is scaled back from what was offered in S.311. The interim Act 250 thresholds for triggers are pushed to:

- Has no permits for housing within downtowns.

- 75 or fewer units in new town centers, growth centers, and neighborhood development areas in the areas with permanent zoning and subdivision bylaws and sewer, water, or appropriate soils

- 50 units within a quarter-mile along transit corridors or census-designated urbanized areas with 50,000 residents.

- These are contingent on not being in floodplains or river corridors.

- No permit amendment is required for the construction of improvements to convert a commercial structure to 29 or fewer housing units.

None of the units built under these interim guidelines count towards triggering Act 250 threshold.

This section-by-section summary of what the House sent back was then amended by the Senate to arrive at the final version. We will update this page when a final bill and final summary are available.

Despite how promising the bill is, there is a lot to be nervous about in this final version.

- The tier system will need to go through rulemaking, and as the saying goes, and everyone knows, “the devil is in the details.”

- “Critical resource areas” will need to be mapped, municipalities will need to apply for these tier statuses, and developers will need to navigate the new road rule and forest fragmentation language.

- This legislation isn’t isolated; the critical resource areas still to be understood and defined will potentially represent a quarter of the state that will likely not be able to see development.

- At the same time, S.213, which regulates river corridors, could result in some 45,000 parcels of land being pulled into a new permitting system in 2028. Due to our historical development patterns, many of these might be in areas otherwise classified as Tier 1.

- This will all be occurring while the state works towards its goals of conserving 30% of the state by 2030 and 50% by 2050.

- These efforts are laudable and important; however, one is justified in wondering whether scrutiny might overlap between these areas of conservation and development.

- If a large amount of the 50% of the state conserved is not in river corridors or critical resource areas, then it’s possible to imagine a Vermont where much more than 50% of the state is undevelopable.

Housing Appropriations

As in every area of this legislative session, there was substantial disagreement over the right combination of spending and policy to address our housing shortage.

- The House leaned heavily on spending and sent the Senate H.829, which had the express intent of spending approximately $900 million for cumulative housing investments between fiscal years 2026 and 2034, creating a new top marginal income bracket and increasing the property transfer tax.

- The Senate dismissed this legislation in favor of addressing the housing issues through policy means primarily, with limited increased spending, citing over a decade of heavy housing investment and diminished tax capacity.

Here’s a look at housing spending in the budget;

- $16.5 million to the Department of Children and Families for Emergency Housing

- $1 million to extend 10 DCF positions to support Emergency Housing

- $1 million to the Department of Housing and Community Development (DHCD) for the Manufactured Home Improvement and Repair Program

- Contingently appropriates depending on revenues:

- $20 million in Emergency Housing

- $2 million DHCD for the Vermont Housing Improvement Program (VHIP)

- $4 million to DEC for the Healthy Homes Initiative

Revisit our session’s coverage of housing legislation;

- Housing units a tri-partisan coalition around a bill

- Housing Supply Side Efforts in the Senate

- Building Bridges or Battlegrounds? Housing policy about development for some, environment for others

- BE Home Act passes first committee; Rough road ahead

- Will Vermont make progress on housing?

- Housing crisis enters new, more dire phase

- Land-use Legislation Passes out of the Senate Natural Committee, with Clean-up Needed to Support More Housing

- Land-use development and housing bill passes Senate

Affordability & Budgeting

This session highlighted the State’s diminished tax capacity as lawmakers looked to revenue to solve the education spending problem and were hard-pressed to find a source that wouldn’t be detrimental to Vermonters, especially in the wake of passing a nearly $100 million payroll tax last legislative session which will begin collection in about six weeks.

This session would have been easier for budget writers but for the state’s local schools sending very large budgets to Montpelier.

- Forecasts from the Department of Taxes in December indicated that the perverse incentives of Act 127 pushed up potential property tax rates to over 20%.

- While the revenue wasn’t as robust as in previous years, it still was more than adequate to meet the state’s needs, but for the runaway spending.

We saw extreme proposals to tax unrealized capital gains, create a new top-marginal bracket that would have been among the highest in the country, and massively spike the property transfer tax.

- These proposals, dismissed forcefully by the majority in past years, looked tempting to legislators with a massive budget hole to fill.

Structural changes are needed to address Vermont’s issues with education funding, as this spending trajectory that many have long criticized as unsustainable will hurt Vermont’s quality of life and the Vermont economy.

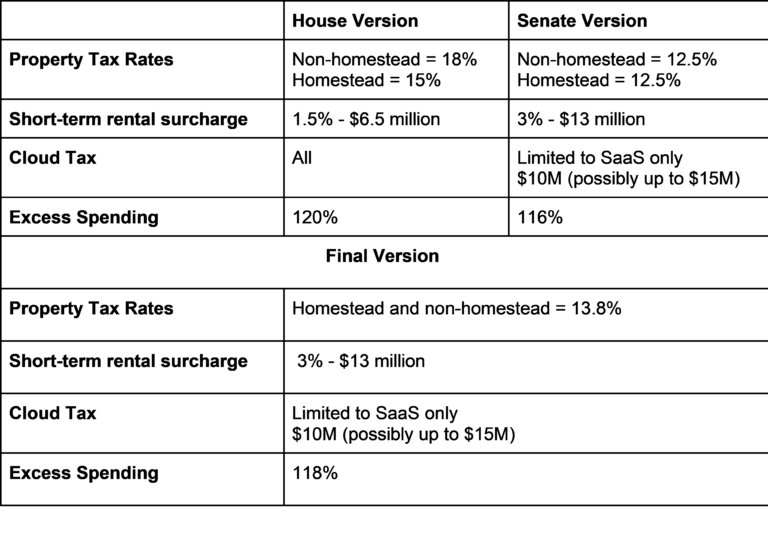

Yield Bill – Property Tax Increase of 13.8% & Cloud Tax – H.887

The annual legislation setting property tax rates to fund Vermont’s education system was in large part out of the control of legislators, as the state’s system of locally controlled school budgets paid for with statewide tax dollars reached a breaking point that was undeniable.

- Unfortunately, property taxes will increase by 13.8% on average as Vermont’s per-pupil education spending climbs to the highest in the country despite our student population continually shrinking.

- The Legislature taxed Software as a Service with the state’s 6% sales tax and levied a 3% surcharge on short-term rentals to raise more revenue for the bloated education fund.

- The Legislature found $25 million in General Fund surplus to help buy down the tax rates, as well as some surplus held from the previous biennium; without this surplus and the new revenues, the property tax rate increases might have exceeded 18%.

- The bill does not contain cost-containment measures beyond some changes to excess spending thresholds, and instead will study the issue.

LCC has been deeply involved on your behalf throughout this process,

- organizing a policy proposal from the business community that soon after was implemented,

- testifying on various economic factors at the root of the education finance system

- pushing for further action to prevent future tax hikes .

The end result of LCC’s work is reflected in the yield bill:

- Act 127’s 5% cap was scrapped early in the session, which helped put downward pressure on budgets, as one-third were voted down on town meeting week, and multiple budgets had repeated no votes in the month after.

- The final yield bill contains a cloud tax, however, LCC worked to ensure that Infrastructure as a Service and Platform as a Service will not be taxed. We will continue to work with the Tax Department through implementation to exclude business inputs from the tax regime.

- LCC pushed back on the House version of the legislation that would have taxed businesses and renters/landlords at a higher rate of 18%, with the final legislation having the same rate for homestead and non-homestead ratepayers.

What’s Next?

- Things will get worse next year as school contracts that have already been negotiated include double-digit percent pay increases and expected increases in the cost of health insurance.

- The legislation stopped short of anything transformational, such as what was suggested in the first draft of the yield bill, and instead opted to create a commission to study and report back on the education system’s future.

- The yield bill tasked a Commission on the Future of Public Education with proposing cost containment measures and a comprehensive system overhaul.

The Governor has already vowed to veto this legislation, citing a desire for a low, single-digit increase, so the Legislature will be back in June to further work on this legislation.

Budget – H.883

The Governor signaled he could sign the final budget bill which tops out at $8.6 billion, roughly $21 million more than he proposed.

- The budget meets all reserves and pension obligations, and invests in key areas like housing, workforce, economic development, human services, and the environment.

- The revenue forecasts estimate General Fund revenues for FY 25 to be $2.1B, slightly lower than FY 2024, and FY 2024 and FY 2025 revenues are projected to be $111.1M below FY 2023.

- One-time expenditures include flood and disaster mitigation, housing initiatives, human services programs, election funding, agriculture, wildlife support, and property tax relief.

H.883 Conference Committee – Base Appropriations Summary Final |

H.883 Conference Committee – One-time Revenue, Appropriations, and Transfers Summary Final |

Misc Tax – H.546

The bill, typically housekeeping, goes further than typical this year as it includes a provision allowing municipalities to levy a local option tax without seeking approval from the Legislature for a charter change, as is typical in our state.

- The local option tax will be a source of revenue many municipalities will be looking for in the coming years as the tax capacity for property taxes gets oversubscribed by state-level education taxes.

The bill also increases the Renter Credit, which will help blunt some of the increase in rents that will come from the large increase in statewide property taxes.

- The bill expands the eligibility for the renter credit by increasing the income limit from 50% of Area Median Income (AMI) to 65% of AMI. Doing so is expected to enhance the value of the renter credit for the 4,000 existing recipients and make the credit accessible to up to 3,000 more applicants.

“Wealth Taxes” Attempted

Proposals attempting to target more resourced Vermonters with a new top-income bracket and a proposed tax on unrealized capital gains were defeated, though their advocates vowed to work with national partners between now and the next session to make them a reality.

- A tax on unrealized capital gains was suggested and added to the miscellaneous tax bill as a study, which was then pulled out. The taxation of unrealized gains is problematic for many reasons, including a current Supreme Court case on the matter, the problems with unrealized losses, and how to value assets.

- An addition of a new top marginal bracket for personal income tax bracket of 11.75% starting at $500,000 of income (married filing jointly) passed the House, however, it was dismissed by the Senate.

Read more about those proposals here.

Other Tax Changes

Changes to the Property Transfer Tax – H.687

In an attempt to tax second home sales more heavily, the H.687 contains language that if a home fit for year-round residency is being sold and the next owner is not a homestead or a landlord, a property transfer tax of 3.4% will be applied to the sale.

- The House had previously sent the Senate H.829 with a 3.65% tax rate for the marginal value of transferred properties greater than $750,000, with an increase to the threshold for the general rate; this was struck.

- This language also increases the limit for the base 0.05% of the property transfer tax up to $200,000 of value on a primary residence, the language created by the House to help lower-cost properties.

Changes to Corporate Tax Attempted – H.880

H.880 attempted to raise funding from changes to the state’s corporate taxes that ultimately failed;

- Add back the amount of Foreign Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI) deducted at the federal level and increase the reported net income to Vermont for those corporations with those types of income. This move would make Vermont an extreme outlier, but it would raise $15 million.

- Increase the top bracket for corporate income tax.

Universal Service Charge Changes – H.657

The bill updated and changed taxes and fees assessed on telecommunications and cable providers and certain digital services. Provisions of the bill include:

- Repeals the 2.4% Universal Service Charge (USC) for landline, postpaid wireless, and interconnected Voice over Internet Protocol (VoIP) consumers and replaces it with a $0.72 monthly charge per access line.

- The 988 Suicide and Crisis Hotline has been added to the list of programs funded by the Vermont Universal Service Fund (VUSF).

- Two studies were created assessing how to tax and charge communications property placed in the State Right of Way (ROW).

More about this legislation can be found in the JFO Fiscal Note.

Public Safety & Quality of Life

Headed into the session, there was a strong mandate to address public safety concerns in the state. There were a number of pieces of legislation aimed at addressing public safety concerns, many of which made it to passage and will have a substantial impact on the administration of criminal justice in our state.

LCC spent last summer and fall meeting with members, stakeholders, and legislative leadership to stress the importance of bold public safety legislation in the coming legislative session. Specifically, we urged for action to address the handful of actors with many repeat offenses within our community.

The three main issues are;

- Vermont’s court system is facing a backlog,

- The time between arrest or citation and eventual justice is too long, and

- Individuals are reoffending and not facing consequences.

LCC made public safety a top priority heading into this legislative session, and we are happy with some of the outcomes. While we put our support behind revisions to retail theft legislation, meetings with community members and stakeholders identified a much broader issue with repeat offenses, of which retail theft was a component.

- Many of these offenses happened while offenders were awaiting trial, causing them to violate the conditions of their pre-trial release, an area of law that LCC worked with Senate leadership on and is reflected in S.195.

It is important to note that all of these new laws are optional tools for prosecutors and judges, as they can still use their discretion for charging and sentencing.

Retail Theft – H.534

After years of pushback from the business community around retail theft, the Legislature finally arrived at a solution on the final day of the legislative session.

Criminal Justice System Funding

Whether the state criminal justice system needed more funding or not was a topic of debate between the House, Senate, and Governor throughout the session. The final results of appropriators’ debates brought funding to the issue, however, it will likely still not be enough.

- Looking just at resources to Vermont’s state’s attorneys, who face incredibly high caseloads, we see that they are granted only a few positions on a temporary basis.

Here is a look at some of the budget’s public safety spending;

- $1.86 million to the Office of the Defender General for caseload relief

- $2.86 million to the Judiciary for new positions to address the criminal justice system backlog and court security in addition to three new superior court judges

- $297,000 to court diversion to address increased caseload

- $661,000 to the Department of Corrections (DOC) for the pretrial supervision and electronic monitoring programs as outlined in S.195

- $300,000 for Community Justice Centers

Repeat Offenses & Pre-Trial Monitoring – S.195

While H.534 got most of the attention around repeat offenses, S.195 impacts repeat offenses more broadly.

- Most notably, in this legislation, the $200 cap on cash bail is lifted for individuals with multiple offenses.

- The legislation also creates the ability for pre-trial monitoring of those with multiple offenses or violations of conditions of release. The Department of Corrections estimated last month that setting up a pretrial supervision program would cost about $890,000, though the Budget provides $661,000 to the Department.

Pre-Trial Diversion – H.645

This bill creates a pre- and post-charge diversion for certain eligible first-time and low-level offenses. It also proposes to create a post-adjudication reparative program governed by memoranda of understanding that is required to outline eligible offenses, a process to supplement eligible offenses, evidence-based screening procedures, and confidentiality provisions.

- Advocates for Restorative Justice programs point to the programs’ ability to lessen the courts’ caseload by diverting low-level cases instantly to restorative justice programs.

Safe Injection Facility – H.72

After more than a decade of discussion and debate, the Vermont Legislature has passed a bill that will create a pathway towards a Safe Injection Facility in Burlington where individuals can consume pre-obtained illegal drugs with access to harm reduction supplies, drug-checking services, addiction treatment, medical services, and overdose reversal medications.

- This legislation will inevitably be vetoed by the Governor, and it is unclear if the Legislature will have the votes to override a veto.

Vehicle Trespass – H.563

Vehicle thefts and break-ins erode public safety and quality of life while often supporting the commission of other crimes. The changes in H.563 will assist in prosecuting such disturbances, as our state notably did not have laws covering such activity.

- Vehicle Trespass: If someone goes into another person’s car without permission and knows they’re not allowed to, they can be jailed for up to three months, fined up to $500, or both. If they do it again, they could face up to a year in jail, the same fine, or both. One does not need to be warned not to trespass for this to apply, as is currently the predicament with existing law.

- Operating a Vehicle Without Owner’s Consent: If someone takes, operates, or uses someone else’s car without permission and should have known they didn’t have the owner’s consent, they could be fined up to $500. If they knowingly do it without permission and knew they didn’t have consent, they could be jailed for up to two years or fined up to $1,000, or both.

“Raise the Age” & Narcotic’s Penalties – S.58

This legislation was controversial, to say the least, and covered many uncomfortable topics for legislators to debate. The legislation;

- Adds increased penalties for dispensing Fetanyl and Xylazine.

- Creates a two-year minimum term of imprisonment for selling or dispensing a drug with death resulting.

- The bill adds crimes committed with a firearm to the list of “big 12 crimes” in which a juvenile can be tried as an adult.

- Pushes back some of Vermont’s “raise the age” legislation’s implementation, which Governor Scott requested in his first address to the Legislature this session, calling it a mistake.

Revisit our coverage of public safety and quality of life legislation from the session;

- Navigating perspectives: criminal justice challenges and approval of safe injection facilities

- Public Safety: Seeking Solutions Amidst Analysis Paralysis

- Public safety everywhere, but no consensus yet

- Public safety and quality of life conundrums stop legislators

- Public safety and quality of life update

- Court Funding, Fentanyl Penalties, “Raise the Age,” and Safe Injection Facilities

- Public safety bills considered in the House and Senate

- Public Safety Bill Check-in

- House and Senate Honing Final Versions of Public Safety Bills

Commerce and Employment

Privacy Bill – H.121

This piece of legislation was a vestige of the first half of the biennium and quickly became contentious when advocates made changes to the House version and passed legislation in the Senate. While the legislation was aimed at large data brokers and holders, the language was concerning for Vermont’s small businesses with the issues the legislation came down to;

- Private right of action (PRA):

- This would make the state an outlier and leave businesses open to frivolous suits. As originally proposed, businesses and nonprofits were concerned the expansive Private Right of Action would put them at risk of frivolous and costly lawsuits. Business advocates made the case that it would be best if complaints were processed through the AG’s office.

- Interoperability/conformity to larger regulatory regimes

- There are two major models in the United States. California’s, which covers their 40 million residents (5th largest economy in the world), and Connecticut’s, which covers about 100 million Americans. The further we are away from them, the harder it will be for businesses in our little state of 645,000 people to comply with any legislation.

The Senate version of the bill remedied the issues business groups had with interoperability by changing definitions for greater interoperability and completely removing the PRA in favor of a study of the appropriateness of a PRA done by the Attorney General’s office and the Agency of Digital Services.

- The House was unsatisfied with this version as it did not contain the PRA they thought was essential.

- A final, 11th-hour compromise amendment resulted in the restoration of a more narrowed Consumer Protection Act PRA that would be available to consumers to use only against large data holders and data brokers, violating sections of the bill related to consumer health data and sensitive information. The availability of the PRA to consumers is delayed until 2027 and sunsets in 2029. The AG’s office is required to report back to the legislature on the appropriateness of a PRA for Vermont in 2026.

- The compromise also includes the definitional changes that the Senate proposed to enhance interoperability.

- Large data brokers and data holders are entities that, during the preceding calendar year, processed the personal data of not fewer than 100,000 Vermont consumers. The Legislature felt this excluded all Vermont businesses and nonprofits.

- The strike-all amendment incorporates S.289, the Kids’ Code bill, which seeks to protect younger Vermonters online.

VEGI – H.10

The perennial slog pushing back the sunset of the Vermont Employment Growth Incentive Program continued this year, resulting in a two-year extension of the program.

- The bill moved in various places, however, the main vehicle for much of the biennium was H.10, which sought to make various changes to the structure and governance.

- The bill sought to create a forgivable loan program administered by VEDA, which would have required a loan loss reserve from the state. Late in the session, appropriators cut that funding to provide flood relief to businesses, thus making the original vehicle, H.10, superfluous.

- In the end, a stripped-down version of H.10 made its way across the finish line, with an extension of the sunset included.

- Next year, advocates will need to be prepared to come back to the Legislature with revisions to the program that accommodate the issues critics of the program see.

“Captive Audiences” – S.102

This legislation spans the whole biennium and is aimed at preventing employers from holding what is described as “captive audience” meetings in which they express their perspective on unionization, however, the language used to accomplish this is specifically referring to political and religious messages. Such broad language could allow employees to opt out of things such as DEI training, ESG investment discussions, or Earth Day events because they find them political in nature.

The bill is modeled after a bill Connecticut passed, which is being challenged in the Second Circuit Court of Appeals (Vermont is part of that same jurisdiction).

- The Committee heard from the Solicitor General that a challenge to this legislation would be costly and time-consuming and that Connecticut’s ruling would stand for Vermont.

- The Lake Champlain Chamber testified that the Committee should stop pursuing this and allow Connecticut to bear the cost of a challenge to the legality of such legislation.

- LCC cautioned that the Committee was playing with a double-edged sword as they challenged two long standing National Labor Relations Board pre-emptions around free speech by passing their language with questionable legality. This caution was echoed by the Committee’s legislative counsel the next day.

The legislation was passed with bipartisan support and is unlikely to be vetoed.

Pay Disclosure in Job Listings – H.704

H.704 requires Vermont employers to disclose compensation, or a compensation range, in job advertisements to prospective employees.

- Employers must include the compensation or range of compensation in any advertisement for a Vermont job opening, with exceptions for commission-based or tipped positions that require disclosure of payment structure or base wage.

- Employers have flexibility in hiring employees within or outside the advertised compensation ranges based on factors like qualifications or market conditions.

- The Attorney General’s Office is tasked with publishing guidance for employers and employees regarding these provisions by January 1, 2025, and conducting outreach and education in coordination with stakeholders ahead of the law, which takes effect on July 1, 2025.

UI Changes, Medical Leave, VEGI, & Baby Bonds – H.55

This legislation did not make it across the finish line despite it being a place for numerous provisions.

- Unemployment Insurance (UI) Amendments: These include extending the period for which individuals can collect UI benefits without affecting employers’ contributions, allowing the Department of Labor to waive overpayments, and imposing penalties for false statements related to UI benefits. These changes are expected to have insignificant fiscal impacts.

- Unpaid Leave: the bill amends the current statute to replace the term illness with a medical condition such as rehabilitation from an accident, illness, injury, disease, or physical or mental condition including treatment for substance use disorder.

- Vermont Baby Bond Pilot Program: This initiative establishes a trust for designated beneficiaries born after July 1, 2024, with an initial accounting of $3,200 per individual. The program aims to provide financial support for education, housing, business investment, or retirement.

- Workers’ Compensation for PTSD: The bill would shift the burden of proof for PTSD claims onto the State for certain State employees, potentially increasing annual workers’ compensation benefits costs by up to $425,000 and attorney fees by $105,000, although no significant immediate impact is expected for fiscal year 2025.

- Firefighter Cancer Screening Grants: It requires subsidizing cancer screenings for Vermont firefighters, but funding details are contingent upon appropriations from other legislation.

- Vermont Economic Growth Incentive (VEGI): The bill extends the VEGI sunset provisions, as a secondary location for the language as the session came to a close and all parties wanted to ensure the language wasn’t lost.

Read the Fiscal Note here.

Constitutional Amendment on the Right to Organize – PR. 3

The Legislature took the first step in the five-year process of amending the state’s constitution to enshrine union support.

That “no law shall be adopted that interferes with, negates, or diminishes the right of employees to collectively bargain with respect to wages, hours, and other terms of and conditions of employment and workplace safety, or that prohibits the application or execution of an agreement between an employer and a labor organization representing the employer’s employees that requires membership in the labor organization as a condition of employment.”

The language did not draw great attention from many stakeholders for a few reasons;

- The passage was inevitable due to a veto-proof number of legislators sponsoring the legislation.

- The language is ill-advised as some believe it will constrain the future ability of the Vermont Legislature to create employment policy such as the Legislature’s long sought-after paid family and medical leave, as such a proposal would interfere, negate, or diminish the rights of employees.

Paid Family and Medical Leave

After years of debate over how to extend such a benefit to Vermonters, Governor Phil Scott, in partnership with The Hartford, announced this session that employer enrollment for the Vermont Family and Medical Leave Insurance (FMLI) program started February 15.

- Eligible employers with two or more employees can enroll starting February 15th and create customized plans tailored to the unique needs of their workforce and business.

What You Need to Know:

- FMLI benefits provide partial income replacement for various situations, including;

- caring for a family member with a serious health condition,

- bonding with a new child, addressing one’s own serious health condition,

- caring for a military service member, or

- meeting needs related to a family member’s covered active military duty or call to active duty.

Key Features of FMLI Plans:

- Option to provide combined family and medical leave or standalone family leave insurance.

- Flexible contribution arrangements: fully paid by the employer, split between the employer and employees, or fully paid for by employees as a voluntary benefit.

- Benefit duration options are six to 26 weeks per 12-month period.

- 60 to 70% wage replacement, with additional options available through underwriting review.

Phases of Implementation:

- The initial phase of the program was successfully launched for Vermont State employees in July 2023.

- This announcement is part of the second phase.

- In the final phase, FMLI benefits will be extended to individual workers, self-employed individuals, and employers with fewer than two employees in Vermont. This phase is set to commence in 2025, with benefits starting on July 1, 2025.

Learn More:

Employers in Vermont who are interested in exploring the Vermont FMLI program further can collaborate with their employee benefits brokers or visit fmli.thehartford.com for detailed information.

Environment

Climate Superfund Cost Recovery Program Fund – S.259

S.259 introduces the “polluter pays” model in Vermont. This legislation mandates that major oil companies compensate for the damages caused by their products contributing to climate change in the state. The funds collected from these companies would be channeled into a Climate Superfund Cost Recovery Program Fund.

- Anticipating resistance from oil giants, lawmakers and stakeholders are preparing for potential legal battles, which could lead to substantial litigation costs for Vermont.

- The Administration continually emphasized the need for thorough research and strategic planning, suggesting a careful approach to ensure the bill’s resilience under judicial scrutiny.

- The Governor will likely veto this due to concerns about the cost of Vermont litigating such legislation.

Renewable Energy Standard Changes – S.289

This legislation would amend the state’s existing renewable energy standard to require that most retail electricity providers’ annual load be 100% renewable energy by January 1, 2030.

- The cost of the changes has been the crux of the debate, with the Governor’s administration putting the cost at over $1 billion and the Joint Fiscal Office estimating the cost at between $150 million and $450 million between FY 2025 and FY 2035.

- The bill will likely be vetoed by the Governor due to his administration’s concerns over cost.

PFAS and Lead Regulation – S.25

S.25 seeks to regulate limits to the intentional addition of harmful chemicals in various consumer products and ensure compliance through certification processes.

- It would ban PFAS in clothing, makeup, menstrual products, diapers, and nonstick frying pans starting in 2026 and in turf starting in 2028.

- The policy also includes a first-in-the-nation ban on phthalates, formaldehyde, and mercury in menstrual products and restricts the chemicals in makeup.

- The bill directs the Vermont Department of Health to study a potential limit on lead in cosmetics and period products.

It’s unclear whether the Governor will sign this legislation.

The Laundry List

Regional and county governance – S.159

- The pandemic, last summer’s flooding, and our public safety crisis have laid bare the issues with Vermont’s unique lack of county government and relying on small, disconnected towns.

- S.159 creates a County and Regional Governance Study Committee composed of six legislators for up to 10 meetings.

Professional licensure regardless of immigration status – H.606

- H.606 will make professional licensure easier for new Americans in over 50 different professions.

Reenvisioning the Agency of Human Services – S.183

- S.183, creates a study tasked with reenvisioning the Agency of Human Services structure, analyzing options, and proposing recommendations by February 1, 2025. This amends the original bill, which aimed to divide the agency into two separate entities.

Prior Authorization – H.766

- A bill that changes prior authorizations in healthcare was controversial during this session and was opposed by insurers who claimed that it would increase costs, while hospitals and legislators claimed that it would lower costs.

- The impacts of the change will undoubtedly be a topic of debate in future sessions, as the state will continue to struggle with costs inflating in every area.

- There is a possibility that this bill is vetoed.

Past Legislative Updates

Read updates from Week 1, Week 2, Week 3, week 4, Week 5, Week 6, week 7, week 8, week 9, week 10, week 11, week 12, week 13, week 14, week 15, week 16, week 17, and the last session’s recap.