Thank you to this week’s sponsor of our Advocacy Update:

March 29, 2024

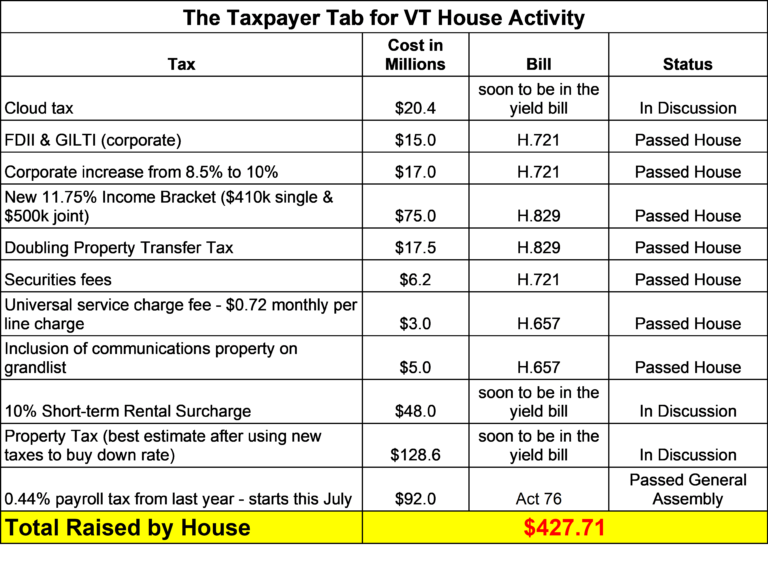

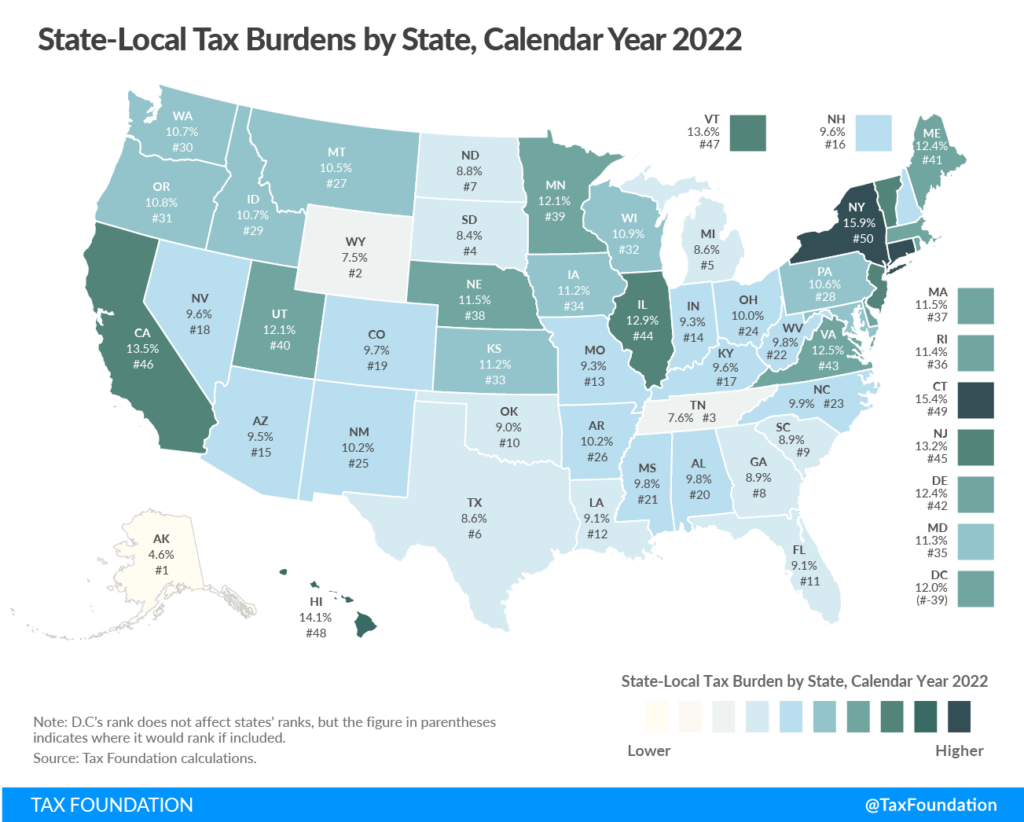

Do you feel Montpelier represents your interests? Vermont is a high-tax state, the fourth highest, to be exact. However, it feels as if this year, we’re trying to take the title of the highest in almost every category.

Let’s take a look at what the Legislature may do this year;

- First, let’s not forget that in July, you or your employees will start paying a 0.44% payroll tax, which will amount to $92 million in FY 26 as a result of last year’s legislation.

- The House voted to create a new top marginal bracket for those making ~$410,000 ($500,000 married filing jointly), which is the highest marginal tax bracket for that income level in the U.S.

- Property taxes are on a trajectory to increase by over 18% (though they can be as high as 40% in some districts) to make up the newly revised $197 million gap in the education fund.

- However, the Legislature is looking to buy down that rate spike by likely levying new taxes on online services of all kinds, a 10% surcharge on short-term rentals, and possibly some tax on sugar-sweetened beverages.

- The House has now passed adoubling of the property transfer tax.

- No matter what is done, nationally, Vermont will rank as having the highest property taxes to fund the highest per-pupil education spending for below-average educational outcomes.

- The House has also increased the fees on your investment or retirement accounts, created a new streaming tax (on top of the sales tax, which is applied), and the communications infrastructure that you use.

- While some might cheer for making corporations pay more in taxes by creating the highest corporate tax rate in the country and becoming an outlier by including FDII and GILTI income, this is just a reminder that consumers eventually end up paying that.

It’s not as if this is a new response, As one member of the Ways and Means Committee, Rep. Scott Beck, pointed out,

“In the last 10 years, personal income tax receipts in the state of Vermont have grown 54%, sales tax receipts have grown 65%, and property taxes have increased by 53%. Corporate income tax has nearly tripled in the last 10 years.”

Revenue to the State has been increasing but spending has been on a runaway train and when the Legislature has been forced with hard decisions, they’ve just looked to Vermonters to pay more, labeling anyone who pushes back as unwilling to pay their fair share.

The House passed its budget this week, and while the difference between the Governor’s proposed budget and the one the Democratic party-controlled Legislature might look close on dollar amounts, they are very far apart on content. Notably, the Governor did not propose all the taxes noted above.

Here is where you find your legislators’ contact information; let them know what you think. Feel free to reach out to us for help.

In this week’s update;

House Passes Act 250 Bill; Overview of Housing Development Legislation

(90-second read)

The House passed H.687 on a vote of 89-51. The Act 250 bill, as the sponsor describes it, “while not a housing bill per se,” had been held up by House leadership under criticism for not doing enough about Vermonters’ number one issue leading into this session, housing. The bill now heads to the Senate, where all will need to be mindful that it does not have the votes to override a likely impending veto unless it changes dramatically.

As described by the bill’s architect, H.687 does four main things;

- Changes in Governance and Appeals: The bill creates a professional board, the Environmental Review Board, to oversee the administration and operation of Act 250, which was defended as “the heart of the bill.”

- The ERB would hear appeals of jurisdictional opinions and district commission decisions instead of the environmental court, which, notably, is just a return to the Board structure of 20 years ago.

- Changes in Jurisdiction: Jurisdiction would no longer be determined by the size of a project and instead by location.

- This is done by establishing tiers of jurisdiction, with Tier 1 areas possessing the most relaxed regulation, tier 2 areas representing the new Act 250 changes, and Tier 3 areas designed to protect critical natural resources.

- Future Land Use Mapping: the bill establishes categories with common definitions for Regional Commission future land use maps. These maps will underpin the tier system outlined above.

- This mapping isn’t expected to be created for some time, and the implementation of the tiers is not expected until mid-2026.

- Designated Areas Program: the bill condenses the Designation Area program into only two categories: Centers and Neighborhoods.

- Notably, the House Ways and Means Committee amendment took aim to undercut the benefits of tax increment financing as a benefit of the designation program.

There are a number of other issues related to housing circulating the Legislature this year;

There are a number of other issues related to housing circulating the Legislature this year;

- S.311 is consistently framed in juxtaposition with H.687 for its starting paradigm as a housing bill, not just a biodiversity protection bill, which aims to make changes to Act 250 to promote housing.

- S.213 is a bill aimed at development in river corridors. It has been the subject of some concern as it further limits where development can happen. While there is an understanding of its need, the overlapping context of legislation saying where not to develop is adding up fast.

- H.829 passed the House and includes various appropriations to housing programs in fiscal year 2025 and in fiscal year 2026 as part of a stated General Assembly intent for more housing investments between fiscal year 2026 and 2034.

- H.639 is a bill that is focused on flood protection, however, it incorporates accountability

- Then there is the budget, where debate has been fierce as the House cut funding for the state’s most efficient housing rehabilitation program, VHIP, to $1 million from $6 million which would render the program inoperable halfway through the fiscal year.

- Additionally, multiple pieces of legislation look to increase the property transfer tax, which, from an economic perspective, taxing the sale of housing in a tight housing market is a bad idea when you want to incentivize market activity.

- Finally, as the Lake Champlain Chamber pointed out in testimony to the Education committees, “whether we like it or not, discussions about education property taxes are discussions about housing, as these taxes impact individuals choices and planning, and thus the housing market.” Watch that testimony here.

What Should Be Done About Vermont’s Unsustainable Education Funding?

(2-minute read)

As we noted in this week’s intro, no matter what is done in this legislative session, Vermont will rank nationally as having the highest property taxes to fund the highest per-pupil education spending for below-average educational outcomes.

Vermont has a responsibility under statute to provide a high-quality system at a cost Vermonters can afford. We are failing on both counts.

Vermont’s education funding is a run-away train because communities are not closely tied to the decisions they make, given our statewide funding model that is driven by local control. With seven weeks left in the session, there is a discussion in the House Ways and Means Committee about changing the model.

- The Chair of the House Ways and Means Committee will advocate for adopting a “foundation model” for funding. This model, which is common in other states, ensures a minimum amount of state aid per student.

- Another member of this Committee is proposing to build on this while maintaining a connection between local spending decisions and taxes. This would involve two funding pots:

- one from non-property tax revenue that would fund the foundation

- one from homestead property taxes, with additional spending funded exclusively by homestead property taxes, tying local spending decisions more closely to local taxes.

While this idea has promise and is welcomed for its potential ability to curb the issues plaguing the system, it is worth noting that our education funding system is incredibly complex. This year’s crisis is partly the result of “unintended consequences” of changes that came after years of study.

The House Education and the House Ways and Means Committees had a joint hearing on the state of our education system with the Chair of Ways and Means putting forward two main questions to the Committees, “what problem are we trying to solve?” and “what tools do we have to solve this problem?”

- The conversation honed in on the dichotomy of having local control of the expenditure of state funds along with the creation of many unfunded mandates on schools over the past decade as the Legislature has looked to schools to fix societal problems.

- The Committees got an overview of the available budgets from schools that now allow fiscal analysts to project an education funding gap of about $197 million.

- In conversation, it came to light that 2025 and 2026 are going to be very difficult as the collective bargaining agreements, which are about 80% of our education system’s cost, that districts that negotiated kick in with increases of upwards of 12%.

The Lake Champlain Chamber joined the Education Committees last week to discuss the “big picture” of the relation of the education fund to the economy and will join the House Ways and Means Committee next week. You can watch that testimony here.

Court Funding, Overdose Prevention Centers

(90-second read)

This week saw the passage of H.880 in the House and S.58 in the Senate. There was also testimony in Senate Health and Welfare on H.72, which would create two overdose prevention sites, with one in Burlington.

H.880: Investments in the judicial system

As we’ve discussed in updates before, the speed at which individuals get through the judicial system and the surety that there will be consequences for their actions are significant factors in whether they will re-offend. The House passed H.880 this week, which seeks to invest in the state’s court system to clear the case backlog in the next four years.

- H.880 would spend about $7.51 million on various judicial positions in the state’s state’s court system to clear the backlog in the next four years.

- The Governor pushed back on whether these positions are necessary in his press conference and noted that most of the issue is the time and resources wasted on people not showing up for court dates.

- H.880 funds these actions by using the same revenue as H.721, two changes to corporate income taxes, and increasing securities registration fees. Disappointingly, the advocacy of business community members on behalf of their communities was characterized as only businesses wanting and needing public safety, so businesses should pay for it.

S.58: tools to curb drug trafficking activity

The Senate passed S.58 this week with only four no votes. The bill would do a few major things to mitigate the current drug crisis in Vermont.

- The bill contains stricter penalties for the trafficking of fentanyl and xylazine and makes distributing of these drugs with death resulting a crime.

- The bill would temporarily roll back some of the “raise the age” provisions that the Governor and some legislators have since indicated were a mistake.

- The bill adds to the list of “big 12 crimes” in which a juvenile can be tried as an adult for crimes committed with a firearm.

- Finally, the bill makes it easier to address properties where drugs are being distributed.

S.72: establishing a safe injection facility

The Senate Committee on Health and Welfare heard testimony this week from various witnesses.

- From a clinical perspective, the Committee heard pushback from the executive director of Journey to Recovery Community Center in Newport, Vermont, who expressed concerns about overdose prevention centers (OPCs), stating that they are a misuse of resources and may not alleviate the substance use crisis effectively. She also highlighted challenges such as the potential for harm within OPCs, the need for boundaries between harm reduction and recovery, and the lack of support for recovery coaches within OPCs.

- The Committee also heard from a recovery coach from the AIDS Project of Southern Vermont about what he saw as the need for a place to use narcotics where they are not alone and are sanitary.

- The Committee began to mark up the bill and will very likely vote on the legislation next week.

Privacy Bill Makes Vermont an Outlier, Making Business Harder

(60-second read)

If you have not taken a look at the privacy bill that has passed the House, you may want to, as it makes Vermont an extreme outlier. Of the 14 states that have passed comprehensive privacy legislation, there are two basic models.

- The California framework: covers only them, however, they are the fifth largest economy in the world, with much of the tech sector based there and over 40 million consumers.

- The Connecticut framework: 13 states have adopted this, bringing its reach to 100 million consumers.

Neither of these two frameworks, together covering nearly half of American consumers, contains a private right of action. The privacy bill just passed by the Vermont House would only be applied to Vermont’s 645,000 residents. The inclusion of such a provision would make Vermont an extreme outlier.

- Advocates are concerned about the Private Right of Action as it could lead to a flurry of frivolous sue-to-settle activity among Vermont businesses.

- The provisions might also make it harder to use services or work with vendors because they would be unlikely to change products for such a small market.

The Laundry List

Hundreds of hours of committee discussion each week culminate into our advocacy update, so not everything makes it into the overall update; however, we often cover what is left on the cutting-room floor here for our most dedicated readers

- Read updates from Week 1, Week 2, Week 3, week 4, Week 5, Week 6, week 7, week 8, week 9, week 10, week 11, and the last session’s recap.

- Burlington City Council voted on Monday to adopt the Neighborhood Code, a fitting bookend to a priority of Mayor Miro Weinberger before he steps down this week. This bill represents a substantial regulatory investment and forwards the community side of the Home Act. Read more here.

- On Saturday, before leaving for a two-week recess, Congress finally agreed on a budget for the fiscal year that began six months ago in a package of six spending bills. Read more about our Congressional Delegation’s activity on the package here.

- As a reminder, applications for Congressionally Directed Spending are still live.

- The Ways and Means Committee passed a property transfer tax last week, precipitating unity among legislators from the greater Burlington area as they pushed back because the new top bracket of $600,000 represents many modest homes within their districts. As a result of the pushback, the committee chair bumped that up to properties in excess of $750,000.00 in value and moved the rate up to 3.65% to bring in the same revenue.