Thank you to this week’s sponsor of our Advocacy Update:

February 18, 2022

This will be a monumental session if the sheer size and scope of transformational changes being considered come together before the final fall of the gavel. That’s it. That’s all we’re going to say before you jump into this week’s update because once you start reading… you’ll have to agree.

In this week’s update:

- Legislative Breakfast

- All the moving pieces of the budget

- Omnibus Bills Overview

- Omnibus Economic Development Bill update

- Act 250 Round-up

- Shift from property tax to income tax discussed for education funding

- Clean Heat Standard, Weatherization, and Fuel Switching

- House Natural Committee looks at first in the nation EPR

- The Laundry List

NOTE: Before jumping into the update, we want to give a couple of lines at the top of the introduction this week and flag for our members that Homeland Security has recommended entities in the United States be more mindful of potential cyber security attacks in light of the current tension and uncertainty around the situation in Ukraine. The following link will take you to the Cybersecurity & Infrastructure Security Agency website. Please review the material and make sure your systems are robust. https://www.cisa.gov/shields-up

Join LCC our last Legislative Breakfast

We had a fantastic legislative breakfast Monday! We now look forward to our last legislative breakfast on Monday, March 14th.

As the legislature enters the home stretch, check-in with the Governor, Speaker of the House, and the Senate President Pro Tem.

Special thanks to the sponsor of our Legislative Breakfast Series:

Quick Survey

Unsurprisingly, national data is showing a huge spike in employee absences from work due to illness or medical problems. We’re fielding inquiries about Vermont’s experience. Please answer this brief four question survey:

All of the Moving Pieces

State Budgeting in a typical year is hard. Since 2020, no budgeting year is typical; there are new needs, changing revenues, and A LOT of one-time federal and state dollars. As we come to the end of week seven of the legislative session, the overall fiscal picture is becoming clearer. This week the Budget Adjustment Act passed the Senate and this week saw a Committee of Conference for the House and Senate to work out their differences. Committees are hard at work on omnibus bills that would distribute much of the remaining federal funding the state has received. Last session, the Legislature spent about $506 million in federal aid before adjourning. This year, it looks like the Legislature will appropriate about $700 million before the final fall of the gavel between the BAA, this year’s budget, and the omnibus bills.

A concern for many advocates is the scope and complexity of the omnibus bills, which will collide in the money committees. Let’s look at just three of them;

- Omnibus Economic Development Bill – $183.26 million

- Omnibus Housing Bill (Senate) – $43.55 million

- Omnibus Workforce Bill (House) – $70.2 million

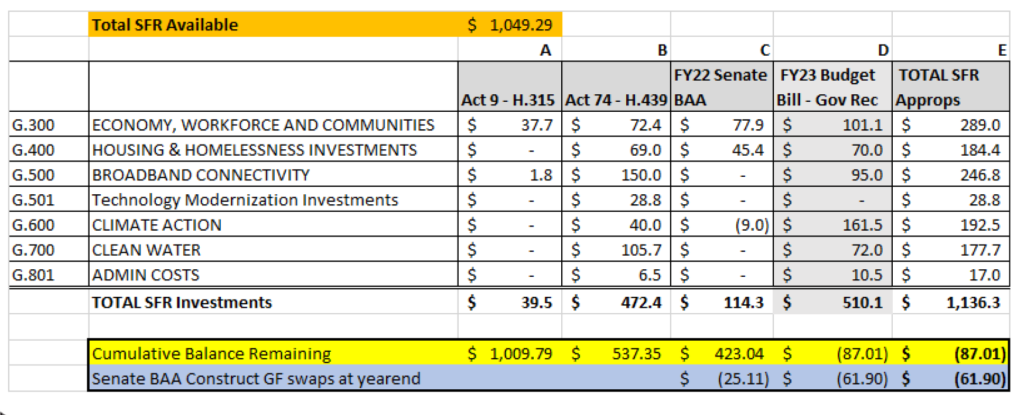

Here is an overview of what appropriations might come down the pike.

If you can’t read this without getting dizzy, that’s understandable. The critical part is column D. The three bills are running at almost double the amount recommended in the Governor’s budget meaning. Granted, those aren’t all SRF funded, as Treasury guidance prevents some expenditures and overlapping components of these bills.

Omnibus Bills

Here is a quick overview of the three omnibus bills. These are currently being updated as items change today.

As you can see, these are massive bills with a lot of overlap.

Omnibus Economic Development Bill Update

This week, the Senate Committee on Economic Development, Housing, and General Affairs continued the work on their Omnibus Economic Development bill. The Committee seemed to be in unanimous agreement that the Economic Recovery Grant (ERG) program will be moved to a forgivable loan program administered by VEDA. The Chair discussed a desire to move the $17.5 million creative sector program into the VEDA program, a prospect not many are interested in seeing.

The Scott Administration told the Committee that they hope to see the remaining $26 million in economic recovery grant (FY 22) dollars reappropriated to the capital investment program and $20 million in FY 23 appropriated to VEDA for the forgivable loan program. This shorts the business community $6 million in recovery dollars for this purpose, and everyone would like to see that $6 million go to VEDA.

The Committee still is struggling to see eye-to-eye with the Administration on the capital investment program. The Chair noted this week the bill is the size of the state’s capital improvement bill, which the institutions committees spend the entire session sifting through project-by-project, getting at the unease he and others have of allowing ACCD to grant out such large sums. At the same time, no one is satisfied with the outcome of the net fiscal impact test created under the enabling statute for the program and when Treasury guidance mandated for the funds is overlaid, you get a fairly unworkable program. Those Treasury restrictions were not fully published when the program was put in statute and the Administration has advocated for the removal of the net fiscal impact test given that the Treasury guidance makes it redundant and that it is not conducive to recovery funds.

ACCD is also requesting a one-time appropriation of funding for brownfield redevelopment to follow up on the $25 million appropriation last year.

Omnibus Workforce Bill

There is a new draft of the bill, a summary of which can be viewed above in the omnibus bill overview section. More will be added to the draft and certainly, more will need to be removed from it. It currently totals a little over $70 million. A possible new portion includes $15 million in excess property tax dollars to be utilized for career technical education centers to buy older homes and renovate them. Additionally, proposals for recruitment and relocation from ACCD and VDTM present in the omnibus economic development bill may be added to the workforce bill.

Not in this bill, yet related and overlapping to some extent is H.483, an act relating to potential new models of funding and governance structures to improve the quality, duration, and access to career technical education in Vermont. The bill is vitally important to addressing disincentives for students and schools to consider CTE as an alternative track and potentially achieve equity of treatment between trade schools and dual-enrollment programs allowing students to have access to college education while in high school. The House Education Committee is in possession of the bill, however, they had a joint hearing with the House Commerce and Economic Development Committee regarding the bill this week.

House Natural Resources Committee Looks at New Extended Product Responsibility Program

H.115 would take a step towards creating a first in the nation Extended Product Responsibility (or EPR) regime for many products that are not already covered by such a program

With this legislation, it’s easy to break it down into the who, what, when, where, and why?

Who? This bill covers those who manufacture, sell, license, or import, more than $5,000 of covered products in a program year. Alternatively, any of these entities or a group of these entities could identify another entity as the stewardship organization that is responsible on their behalf.

What? The bill looks to regulate the disposal of what it calls covered household hazardous products which are products, and possibly the containers for products containing components listed in the bill via reference and cross-references to a web of overlapping federal and state list of substances that most simply can be described as toxic, corrosive, or flammable. The bill also does envision applying its principles to propane containers as well, though they heard testimony that this is not entirely necessary due to the nature of how these containers are already traded. The bill would not cover products already covered under other EPR programs, such as light bulbs, batteries, paint, etc.

Manufacturers (as defined by the bill) of these products are tasked with developing their own stewardship plan for the retrieval of these products when a future end-user wants to bring them to the waste stream. These stewardship plans would need to meet minimum requirements, and need to be updated continually. A group of manufacturers can create a stewardship plan and create a stewardship organization charged with carrying out the stewardship plan.

When? The Bill would take effect in 2023 with collection plans being due for approval by July 1, 2024. Collection plans would need to be created for five-year time periods.

Where? The legislation would only affect the product sold into Vermont and it is unclear if products being manufactured in Vermont for sale outside of the state would need to comply.

Why? The charge on this is mostly being led by an out-of-state lobby group that hopes to establish an EPR program in any state possible with the intention to then have other states adopt it. Waste handlers in the state also see this as an opportunity to reclaim costs associated with various products which find their way into their waste stream at extra burden in the form of time, energy, and money Estimates put this at about $1.6 million in cost across the state.

LCC will submit written comments in lieu of testimony as the impact to our members is not entirely clear, given most LCC members likely fall into the category of consumers, rather than producers, of these products.

If you have concerns about this legislation, please reach out to us at [email protected]

Shift from Property Tax to Income Tax Discussed

Both the House Committee on Ways and Means and the Senate Committee on Finance have carved time out each week to address the ongoing conversation around restructuring education finance in the wake of the Per-Pupil Weighting Taskforce report. One portion of this report suggested moving more of education funding from property to income tax.

As a general reminder, Vermont already does base property taxes on income for most households, as we sensitize them in the form of property tax credits based on your income. Vermont’s property tax is among the most expensive and complex in the country.

The House Ways and Means Committee spent some time looking at what is being referred to as a “residential education tax” which would be an income tax on individuals who would otherwise pay the homestead property tax, and apply the tax to Adjusted Gross Income rather than household income which is how tax credits are calculated now. There was a consensus in the Committee be the place to start and that they would then address renters in the future.

The Committee had a walkthrough of some projections from JFO. It seems that this proposal is not ready for primetime, however, it is unclear how quickly proponents would like to move on these changes.

Here are some potential issues with doing away with the property tax for residential to focus on income.

- Serves as a form of rent to create proper economic incentives for right-sizing residences.

- Income is volatile; property tax is based on setting a yield based on what it will cost to deliver education, so this proposal would envision setting a tax for individuals based on their previous year’s income. This could replace complexity with complexity.

- The tax will also need to be unique to the town one lives in, because education spending, and therefore education tax, vary at a town-by-town level.

- Under this proposal, perverse incentives are created for higher earners to claim residency in other states and pay the non-homestead property tax.

- This proposal does little to address the high statewide costs of education or any disconnect between local decisions and statewide financial impact.

- This list could stretch miles if time allowed. Feel free to send us your thoughts at [email protected].

Act 250 Round-Up

The path looks bleak for Act 250 changes as we move into week 7, which is very disappointing because, as we’ve covered in-depth, we desperately need this reform to make the most of federal dollars and quickly address our housing crisis. Here is a quick overview of where things stand on either side of the legislature this week.

Senate: Comes to an Impasse, Yet Still Moving

The Chair of Senate Natural Resources made his intention clear early in the week to advance S.234, the Act 250 bill that consumed most of the Committee’s attention this session. By about mid-week, it was made clear that the Governor and the current chair of the Natural Resource Board would not support the bill as drafted due to increased jurisdictional triggers, despite some elements that increased the attempted incentives for more developed areas.

The Committee pushed on anyway, working towards agreement amongst themselves, which also seems slightly elusive. A significant pain point and a reason this bill has not been able to advance were on full display as a prominent environmental group characterized the Administration’s position on the bill as only weakening the program without expansion of program jurisdiction. Removing areas with equal, if not higher, regulatory thresholds than Act 250 from the program is not weakening the program – it’s removing duplicity.

House: Governance Conversation Continues

The House Natural Resources Committee is continuing its work on governance changes with H.492. After years of work on Act 250, this Committee is now predominantly focussed on the governance structure for appeals and a pre-determination process. For appeals, the bill envisions them going to a new environmental review board instead of the e-court and much of their conversation is around how the board is formed and who reviews the nominations. It’s unclear if the Administration would support these components and many are skeptical of predetermination being weaponized later on in the process, especially with the new appeals process.

When both sides collide?

It remains to be seen how this plays out, however, both bodies are moving at a pace to hit crossover. This is a marked difference from previous years when it was only being worked on by one body of the legislature at a time. The Senate is looking to further study governance and leans more towards master planning which is another way to get at predeterminations. This sets the stage for neither side of the legislature being in agreement with the other’s work and the Administration not agreeing to anything that the legislature has produced.

Meanwhile, there is a wild card on a parallel track to both of these Committees in the form of the omnibus housing bill. We’ve seen this story play out before with the Natural Resources Committees gutting the Housing Committees’ good work in favor of not moving pieces of Act 250 reform separately.

Miscellaneous Alcohol Bill to Take Shape Next Week

The House Committee on General, Housing, and Military Affairs will start putting together a bill based on the components of the Commissioner of the Department of Liquor Control’s testimony next week. The Commissioner discussed with the Committee these main items:

- H.178 which would create a new category of low-alcohol spirit-based beverages under the category of vinous beverages, thereby allowing them to be sold in private distributors, rather than the state-controlled retail outlets. The beverages would need to be below 16% alcohol by volume, packaged in a metal can, and less than 24 ounces in volume.

- The Commissioner presented language to expand the number of special permits for IV Class licenses (manufacturers) from 10 to 20.

- Establish new Direct-to-Consumer shipping language for purchase of out-of-state alcohol which in the archaic world of liquor laws would send a signal and set Vermont up for reciprocal status among other states.

Clean Heat Standard, Weatherization, Fuel Switching

The House Committee on Energy and Technology plans to move forward with the latest draft of the Clean Heat Standard possibly next week. As we’ve covered in previous updates, the program is akin to the renewable energy (also sometimes referred to as portfolio) standard electrical utilities have and would require fuel dealers to either create credits by undertaking action that limits use of traditional fuels or to buy them from someone who is doing that work in order to comply with the standard.

The Committee heard from the Administration about the $131 million ($80 million ARPA) they seek to spend over the next 4-years to weatherize 8,400 homes. These projects would generate credits that could be used for the CHS program described above. There are significant concerns that there will be workforce challenges as the limiting factor to this work. They also reviewed H.518 which contemplates $48 million in energy improvements and technical assistance for about 2,000 municipal buildings under a State Energy Management Program. It is unclear if those projects would count toward credits under CHS.

As the Legislature considers moving the clean heat standard, they are at the same time looking at fuel switching in state-owned buildings at the time of replacement of a heating and cooling system under H.600. One interesting thing to note in the context of the conversations going on in other committees around fuel switching, is that there is a way for State buildings to get out of it if it is, as the bill defines, “financially intractable” meaning when the non-fossil fuel appliance exceeds by 20 percent the cost of the fossil fuel appliance it is replacing. It s very interesting that a different standard is being applied to the state.

The Laundry List

- Here are links to our past advocacy updates from this legislative session: Week 1, Week 2, Week 3, Week 4, Week 5, Week 6.

- The Burlington Charter Change (H.448) was passed out of the Government Operations Committee and made a stop in the Ways and Means Committee this week before heading to the floor today. Meanwhile, a previous Burlington charter change, H.454, which will put a representative from Winooski on the Board of Airport Commissioners was signed by the Governor this week.

- Non-Unanimous Juries for Civil Trials was a topic of conversation in Senate Judiciary this week as that Committee began a discussion of S.178, a bill sponsored by the Chair of that Committee which would lower the threshold for civil trials to only have two-thirds of the jurors come to a consensus; the bill would leave criminal trials untouched and continue to require unanimous verdicts.

- A report covered by the Burlington Free Press shows the pandemic has limited options for child care, the onus of choosing between raising children and developing a career has increasingly fallen on women.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team

Help us seek economic opportunity for all Vermonters. Support our advocacy work.

Become a member of the Lake Champlain Chamber or connect with our advocacy team to learn more about sponsorship opportunities