This Update is Created by the Lake Champlain Chamber for Distribution by

January 20, 2023

This week, the Legislature could be described as a scenic Vermont river; on the surface, the river seems calm and slow, however, just beneath the surface, a heavy current carries material downstream, depositing it in certain places until it’s piled up enough for those on shore to notice it. On the surface, there have not been many bills introduced, and no final solutions are evident, however, just beneath the surface, bills are being finalized, co-sponsors arranged, and strategies for negotiations already in place.

In this week’s update;

Register for LCC’s Legislative Breakfast Series

We’re back in person! LCC is pleased to announce that we’ll resume our long-standing Legislative Breakfast series, sponsored by New England Federal Credit Union.

- February 6th – 7:30 to 9:00 a.m. at Hula

- March 13th – 7:30 to 9:00 a.m. at The Flynn

Governor Delivers His Budget Address to the Legislature

The Governor addressed the legislature this week to outline his vision for this year’s $8.24 billion proposed budget, outlining his longstanding message of fiscal conservatism and his desire to be thoughtful, deliberate, and disciplined in utilizing the “once in a lifetime” opportunity that unprecedented federal aid has provided. The Governor noted that he did not want to grow spending to need to make cuts in the coming years inevitably.

The Governor previewed a $17 million affordability package with tax cuts to help all Vermonters. He asked the legislature to finally fully eliminate the tax on military pensions and alluded to enacting the state and local tax deduction cap workaround. The Governor also requested $4 million to help refugees, immigrants, and new Americans settle into Vermont communities.

Economic Development

- $10 million for rural development and investment grant program to help develop and facilitate industrial space across the state to welcome new businesses and industries.

- $5 million one-time increase in the Vermont Training Program. This investment will also meet the state’s obligation for the CHIPs and Science Act, which will allow us to draw down those federal dollars.

- $12.5 million one-time increase in the brownfield mitigation to help infill development in downtowns where soil contamination is a major obstacle.

- $4 million for the New and Relocated Worker Program.

- $200,000 annual base increase for Regional Development Corporations.

- $9 million for state colleges and $10 million for transitional infrastructure. The state colleges would also see an annual increase of $2.5 million.

- $1 million in the state’s internship program.

Housing

- $20 million for a missing middle rental housing revolving loan fund for development focussed on the gap in middle-income rental housing development.

- $15 million into the Vermont Housing Improvement Program. The Governor already asked for $5 million in BAA. The program has already helped move 300 families out of homelessness.

- $10 million for the Healthy Homes Initiative.

- $22 million in general assistance transitional housing for those experiencing homelessness.

- $500,000 to help municipalities make improvements to zoning.

Childcare and Paid Leave

- $56 million in ongoing financial assistance in childcare using existing continued revenue growth.

- The Governor took aim at requirements that prevent families from accessing subsidies because they do not have access to a childcare center that is eligible for those subsidies, so he suggested making changes to those requirements.

- One-time finding to recruit, educate, and retain early childhood educators.

Healthcare Stabilization and Public Safety

- $10 million in additional funding to go towards stabilizing the healthcare systems of the state.

- The Governor proposed removing the provider tax on home health agencies which is about $6 million.

- $9.2 million for a two-year pilot to help primary care providers address mental health

- Identified beds for violent people with mental illness

- $10 million to help unify public safety and public service team on the ground as is being piloted in Bennington currently.

Infrastructure, Climate Change, and the Environment

- $150 million to take full advantage of federal programs that require state matches for infrastructure, noting that for every invested state dollar, we get four federal dollars back.

- $3 million in the Budget Adjustment Act to help communities identify projects and use federal funds.

- $5 million for a Clean Heat Homes Initiative.

Other

- $444 million for the continued pension obligation.4

Childcare Report Highlights Disappointing Trajectory

The long-awaited Rand report was delivered this week, and the prevailing feeling from many is “underwhelming” or “disappointing.” RAND was asked to deliver a report that could show how Vermont families could pay no more than 10% of their income towards childcare while also raising wages within the early childhood education (ECE) sector. The presenters of the report made the rounds in the State House this week to all the committees of the relevant jurisdiction.

The highlights of the report:

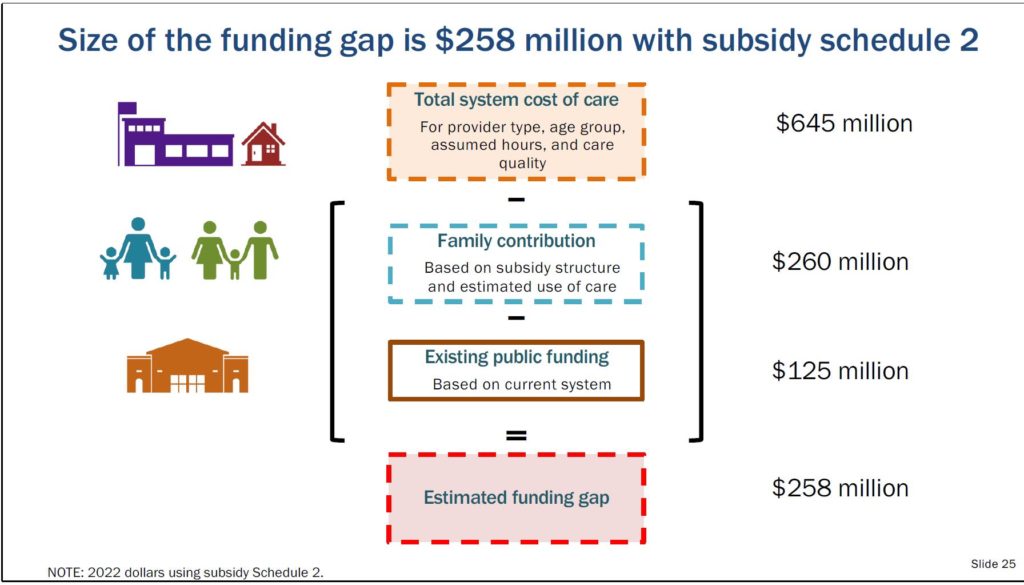

- The whole ECE system requires $645 million to accomplish a cap of out-of-pocket cost to 10% of household income for families making less than 350% of the federal poverty level (FPL).

- State and local funds currently contribute $125 million in childcare funding

- Under scenarios outlined in the report, capping out-of-pocket expenses at 10% of income would leave about $245 million for families to pay toward the cost of childcare.

- Adding those family, state, and local dollars together, the funding gap to cap costs at 10% of household income could range from $190 million to $290 million, depending on the rate schedule utilized.

- This massive investment could bring between 612 to 2,900 employees into the labor force.

To put that last number in perspective, according to advocates, to deliver this level of childcare, it will take 2,500 new childcare workers, which then pulls between 612 to 2900 workers off the sidelines, netting at best about 400 new workers in the economy if we hit that upper limit. The presenter of the report also noted that what we’ll likely witness is a reshuffling of people in the workforce.

2% of the total workforce, or about 6,000 people, have children and are not in the labor force. So, the report suggests that about half of those who are not in the labor force with young children would enter the workforce under the correct circumstances.

This report and its end goal were pitched as a workforce solution, a way to bridge the workforce gap, which, as we covered last week, was about 3,300 in 2019 and has since increased to 23,000. With a range of 612 to 2,900 people brought into the workforce and 2,500 likely needing to move into the ECE labor sector, this doesn’t seem to present that solution. From LCC’s perspective, investments in early care and learning as well as supporting working families are important for both our economy and quality of life. We are interested in additional policy solutions beyond what is presented in the report.

That said, we’re talking about an investment that might pay dividends outside of the immediate need, which should likely be the context for the conversation. Rand’s Economic modeling estimates closing the funding gap in schedule 2 would likely lead to between $59 and $218 million in additional Gross State Product and between $1.5 and $18 million in state and local tax revenue.

The report highlights that the increased requirement that childcare workers have a bachelor’s degree is creating a large portion of the upward pressure on the cost of labor in the field. Some legislators have honed in on the extreme amount of credentialing that is causing some of these issues. With such a high price tag, understandably, legislators want to talk about cost-saving measures.

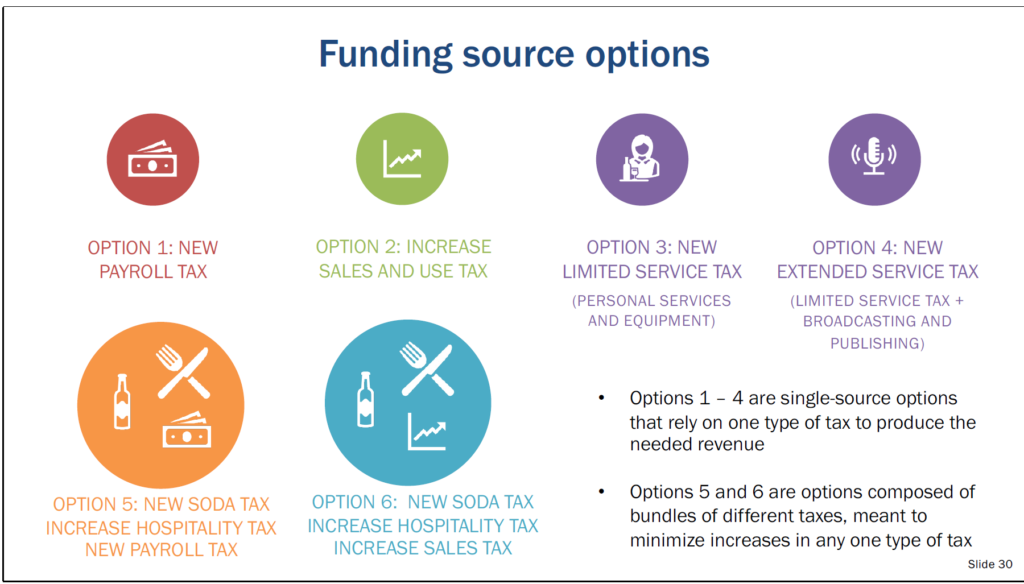

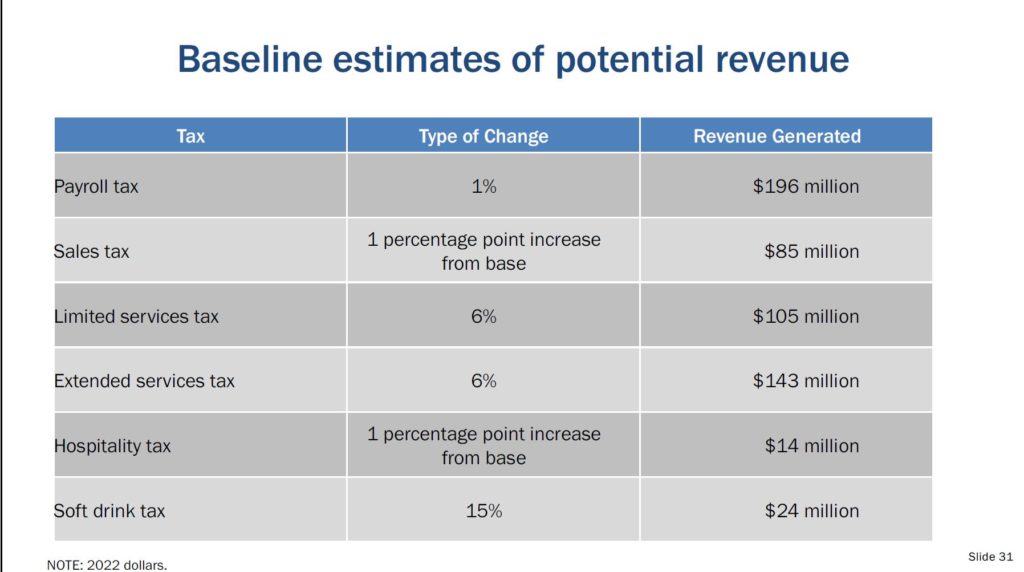

The report highlights how Vermont subsidizes more than any other state in the country, up to 350% of the federal poverty level, with families under 150% of the federal poverty level paying for nothing of their childcare. In the report, this is “schedule 1.” The cost of achieving the baseline scenario, schedule 2, which would cover households with income up to 350% of the federal poverty level such that they need not spend more than 10% of their income on childcare, would cost at least $190 million alone. The report considered four funding options to fund that schedule with a single source, as seen below. The Senate Committee on Economic Development heard testimony from a coalition of businesses brought together by childcare advocates in favor of a 1% payroll tax to fund childcare.

Emergency Board Hears Good News For This Year, Bad News For Future Years

The Legislative week started with a briefing to the Emergency Board of consensus revenue forecasts from the Governor and Legislature’s economists. The long and short: we’ll see unprecedented, massive surpluses this year, however, the fiscal year starting this July, we’ll have a massive revenue downgrade of 9%, worse than what we saw in the 2009 recession.

The timing of all this is so uncertain. What was appropriated years ago by the federal government is just now hitting the streets and adding to inflation in our economy as the Federal Reserve tries to curb it, making their job of reducing inflation difficult and worsening the odds that they’ll accomplish their “soft landing.”

Household balance sheets were faring better from the pandemic, and that is starting to wane, indicated by credit card debt ticking up and household savings decreasing. This tax month, economists are expecting the second-highest income tax filing on record in Vermont. The worry is when this other shoe drops, we don’t want to be dependent on that revenue and then see a large swing down in personal income tax, which also spikes refunds the state pays out.

The downgrade doesn’t end next fiscal year, it will continue for years to come. The “great unwinding” is near, was the message, and recently, 2/3rds of economists surveyed expected a recession in the near future.

Underneath all of this, we’ve witnessed inflation, the likes of which we haven’t seen in 25 years. This makes it feel as if the state is pulling in more revenue, however, what they are truly witnessing in some instances is downstream inflation impacts on taxes that are a percentage of inflated prices.

Another matter of concern is the Transportation fund, which continues its downward dive due to transitions to electric vehicles and fuel price volatility from geopolitical factors.

Housing Bill Introduced

A long-awaited housing bill, H.68, was officially introduced this week. The bill seeks to limit municipal regulation on housing. A similar bill is being introduced as a potential committee bill in the Senate Committee on Economic Development, Housing, and General Affairs. This bill will become a “Christmas tree” to hang other items, such as project-based TIF, a missing middle rental program, and more on.

A point of contention in the bill is the lack of reform to Act 250, which the Vermont Mayors and municipalities would like to see. In the last two bienniums, the Legislature sought to modernize Act 250 following a year-long study of the program and failed to do so in any substantive way.

The bill does the following;

- By Right Duplexes – Creates a Statewide zoning standard to treat duplexes as an allowed use in residential zoning districts and up to a four-unit building as an allowed use in areas of residential zoning districts served by municipal water and sewer;

- Cap Minimum Parking Standard – Set a Statewide zoning standard for minimum parking at one per dwelling unit, allowing builders to determine if additional spaces are needed;

- Create a Statewide zoning standard for a habitable floor density bonus for qualifying mixed-income residential development in areas served by water and sewer, allowing one extra floor to support mixed-income housing in compliance with the Fire and Building Safety Code;

- Hold accessory dwelling units (ADUs) to the same or similar standards of review established by the municipality for a single-family dwelling;

- Zoning Reporting Requirements – Require that specific information be submitted to the Department of Housing and Community Development when municipalities adopt new zoning bylaws;

- Allow towns to give their administrative officer authority to approve minor subdivisions, so a hearing on them is not required;

- Clarify existing law that the character of the area cannot be appealed in decisions on certain types of housing;

- Require an appropriate municipal panel to provide reasons for adjusting dimensional requirements in permit decisions on housing;

- Prohibit towns from requiring more strict energy codes than the State energy codes, except those with existing authority;

- Prohibit deed restrictions and covenants that require minimum dwelling unit size and more than one parking space;

- Require sellers to disclose if a property is located on a class 4 highway or legal trail;

- Exempt wastewater projects from needing a State permit if the municipality can issue an authorization for it;

- Require the Division of Fire Safety to prepare a report identifying potential revisions to the Vermont Fire and Building Safety Code to reduce the cost to develop housing;

- Amend the Vermont Fair Housing and Public Accommodations Act 21 to permit the Human Rights Commission to refer potential violations of the Act to the Attorney General or a State’s Attorney for enforcement, to provide additional time for the Commission to bring an action to enforce the Act, and to increase the criminal penalty for a violation of the Act; and

- Direct the Agency of Transportation to update the Vermont State road standards.

The Laundry List

There are many moving pieces, and we do our best to add the ones that don’t get a section in the newsletter yet should be on your radar here. On any given day in the State House, there are about 175 hours of committee time outside of floor time, and then the hallway, cafeteria, or other time spent legislating.

- Read past updates here – week 1, week 2, and the last session’s wrap-up.

- Currently, nonprofits with fewer than four employees are not required to offer unemployment insurance to employees, which became a point of contention during the pandemic. A bill signed by the majority of the House Committee on Commerce and Economic Development would change that. The bill can be read here. You can look at a longer description of this issue here.

- An LCC and business community priority, the State and Local Tax (SALT) deduction cap workaround, has been introduced as a bill in the House. If you have an LCC, LLP, or S-corp, this could save you money on your personal federal taxes and you should care.

- The Senate Committee on Finance took up and discussed cloud tax, or a tax on internet-based services, this week. You can see their materials here and here.

- There was a tsunami of reports this week, as January 15th was the date that most reports were due back. You can peruse the cornucopia of reports here.

- DFR recommends keeping healthcare markets unmerged, making business insurance more affordable. In the last few years, the Senate Committee on Finance wisely used strong subsidies for the individual health insurance market to separate the small market, which includes employers and the individual market. A recommendation was made to keep the markets unmerged, allowing small employers to retain the more affordable market for another three years. Read more on the history of this subject here.

- S.20 was introduced this week in the Senate, which follows the work of the Lake Champlain Chamber on assessing and preventing benefits cliffs. The bill would pull together a commission to re-envision the state’s Basic Needs Budget to make it a calculator to assist in assessing policy solutions and the combined impacts of all current programs. Find the bill here.

Hey! You read the whole update. You probably have some thoughts on the content or how we delivered it. Feel free to reach out with those at [email protected].