This Update is Created by the Lake Champlain Chamber for Distribution by

April 28th, 2023

The legislature is moving towards a target adjournment date of May 12th, which means that soon many members will be in the “hurry up and wait” period of the session. Leadership and a few committees will try to close gaps between the House, Senate, and Governor, which are all very far apart on their major priorities – the budget, childcare, paid family leave, and housing. We’ll focus much of this update on those four pieces of legislation standing between this legislature and their planned adjournment, breaking down at a high level the stance of the three players and summarizing the gap that needs to be closed.

Despite this work to adjourn next month, there is no doubt in almost everybody’s mind that the legislature will be back to work on these issues after a seemingly inevitable and pre-scheduled veto session on June 20th, likely to revisit these bills as well as others, such as the clean heat standard. The Democratic caucus will seek to wield its new supermajority of 103 members, plus five more often aligned progressives, against the most popular Governor in America.

In this week’s update,

- The gaps that still need to be closed

- Massive corporate and personal income tax increases proposed for childcare funding

- Bill expanding auditor’s authority gets its committee time

- Governor and House Leadership trade jabs over clean heat standard ahead of veto

- Problematic labor bills continue to move

- Questions on the VT Saves Retirement program answered

- The Laundry List

The Gaps Yet to Be Closed Between the Governor, Senate, and House

How the year ends and how soon legislators leave will depend on a few bills that we’ll dive into in this part of the update; the budget, paid leave, childcare, and housing bills. We’re going to try our hand at “smart brevity” here to simplify this.

The Budget – the Senate voted out the budget by a vote of 24 to 5 this week. Usually, when the budget is done, the session is done, however, this year, the budget committees will likely be waiting on their peers in other committees to finalize other pieces of legislation that need to be funded by the budget.

- The House sent the budget to the Senate with a significant gap between the House and Senate’s visions and far out of step with the Governor. Their budget also included $120 million in funding for paid family and medical leave, which was dead on arrival in the Senate.

- The Governor has been adamant that the budget should hold in reserve funding to match federal funds from the IIJA, and he has lambasted the House for not doing so. He’s also criticized the growth of 13% in the general fund in the budget.

- The Senate closed the gap between them and the House, however, there are still some differences that need to be worked out in a Committee of Conference. The Senate had a relatively more conservative outlook on the economy and tax revenue as it begins to lag.

- The Gap is relatively small between the House and Senate. When they come to an agreement, they will still likely be about $140 million above the Governor’s recommended budget. The Senate paid heed to the Governor’s recommendation, however, they did so by levying about $20 million in increases in DMV fees; the Governor would have hoped to see that come from surplus funds.

Paid Leave – the bill sits on the wall in the Senate Committee on Economic Development, Housing, and General Affairs with no indication that it will move. Will the House go gracefully, or will they muddy up the adjournment process to attempt to pass this long-standing priority?

- The Governor is already in the process of a three-part rollout of enrollment in a voluntary paid leave program that would be managed by a private, third-party administrator.

- The House sent to the Senate H.66 back in early March, which would have created one of the most generous paid family medical leave programs in the country at a cost of about $120 million.

- The Senate has not taken action on the bill, with the Committee of Jurisdiction not holding any hearings. Instead, the Senate folded in a much more narrow paid leave provision that would only include only parental leave, at a smaller cost of $15 million, as part of the childcare bill they sent to the House.

- The Gap between the two chambers couldn’t be any bigger as the Governor moves ahead with his own plan, the Senate shows no interest in passing any such bill this year, and the House continues to build their final expectations around H.66.

Childcare – the bill (S.56) has been deliberated by multiple House Committees this week and will not make it to the House floor until mid-week next week at the earliest.

- The Senate sent a bill to the House, which it was readily apparent would be changed in the House.

- The House is adamant that they would not accept the Senate’s use of reappropriating the funding for the VT Child Tax Credit to pay for the package, and early scuttlebutt indicated that the House would hope to use a corporate tax. We cover in the section below the massive tax increases that the House is considering.

- The Governor has been adamant that he doesn’t want to see new taxes and identified about $50 million in base funding in his budget to double the size of childcare subsidies this year.

- The Gap between the House and Senate is relatively large, and it might take some time to close. This bill will likely be the one that presents the largest obstacle to adjournment. No matter what, it is safe to say the legislature will be seeking to spend at least an additional $120 million on childcare subsidies that are paid for by a combination of taxes on employees and employers, and It’s still unclear how the Governor will handle such a bill.

Housing – this legislation might be the least difficult to move over the next two weeks, however, land use bills have a tendency to be catalysts for surprise skirmishes. This is the number one issue for voters, and leadership must deliver on this.

- The Senate Committee on Economic Development, Housing, and General Affairs produced a fantastic bill that has subsequently been watered down by the process in more conservative committees that follow.

- The Governor has bemoaned the bill’s loss of meaningful action on Act 250 and pushed the legislature to do more every step of the way.

- The House saw a chance to make some changes in the House Committee on General and Housing, instead, disgruntled members learned their housing charge doesn’t include land use laws or regulations. The Rural Caucus stepped up to make asks for a more permissive bill to meet the needed 40,000 units that must be built in the state. Soon after this update is published, the House Committee on Environment and Energy will pass a bill including some of the Rural Caucuses’ asks.

- The Gap is less pronounced on this legislation as minimal invasive changes have been made to this legislation. As we said above, the legislation has taken a path of becoming more conservative since it was first introduced and thus has become less controversial. Differences still need to be remedied between the two bodies related to housing in budgets.

There are still a number of unpassed bills that are unfinished and are not “must-pass” bills ahead of adjournment, however, are priorities to various chairs, caucuses, or influential members, such as some problematic labor bills, SALT cap workaround), and others.

Massive Personal and Corporate Income Taxes Considered to Fund Childcare

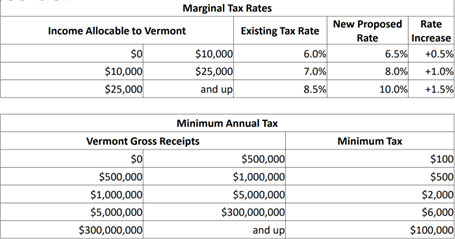

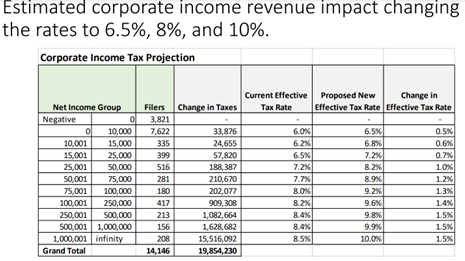

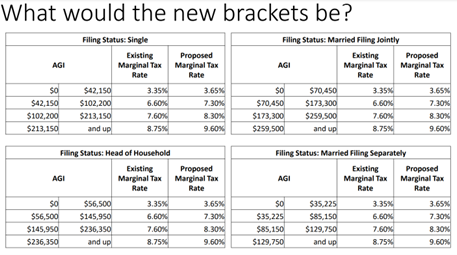

The House Committee on Ways and Means continued to look at how to fund the version of the childcare bill passed by the Human Services Committee. The committee is looking to move higher in taxes than what they considered last week). This week, they’re looking at a modified package to raise the $126 million in new spending by increasing nearly all corporate income tax brackets as well as attempting to make the income tax more progressive by increasing the top marginal rates of personal income tax by almost a full percent.

Meanwhile, the House Committee on Education made multiple changes to the bill. As we covered in our overview section, with each additional day of work the House does on this bill, they drive it further away from a version the Senate and/or Governor will accept.

Bill Expanding Auditor’s Authority to Private Contractors Discussed in Committee

The House Committee on Government Operations and Military Affairs is, as we publish this, taking almost a day of testimony on S.9, a bill that dramatically expands the Auditor’s authority to allow the office to audit private employers who have state contracts. The bill is so sweeping that the auditor could request information about the pay of individual employees of the employer who has the state contract; in fact, the inability of the Auditor to do so is the genesis of the legislation.

There are three main things to understand about this issue;

- The Auditor’s role is to audit the state agencies, which includes the contracts they manage, however, any auditing of the contractors should be a review of their interaction with the state agency according to the terms laid out in the contract. This proposal represents a major departure from this authority.

- If the Auditor feels that the state agency is doing a poor job managing contracts, the Auditor should be bringing that first to the state agency. The auditor should be working through the agency that is contracting with the vendor if the auditor wants to identify new information reported related to the vendor’s performance or improvements in oversight.

- Because of this additional layer of state government and allowing for new performance criteria after the contract is signed, it will likely have a chilling effect on the number of bids for state contracts in a state that already has a difficult business environment.

If you have a state contract or hope to someday offer a service to the state, and you have concerns about this legislation, please reach out to us.

Problematic Labor Bills Continue to Move

The two problematic labor bills of the session continue to move through the legislature. The House Committee on General and Housing voted to advance S.103 this week. As we previously covered, the legislation will erase the existing legal standard by which courts discern discrimination or harassment and fails to adequately replace it. This will cause issues for HR departments as they try to adjust to the long-standing standard disappearing without an adequate or clear replacement as well as potential added costs in the form of employer liability insurance.

Advocates have called for the legislation to go to the House Committee on Judiciary for further review, which did happen for about half an hour this week, however, the Committee will not take possession of the bill and will not make changes to the legislation. The Committee did add language making the same standard changes to the state’s school system, which will require the bill to go to the House Committee on Education.

The House Committee on General and Housing will take up for further introduction next week S.102, which aims to prevent captive audiences and allow union organizers to circumnavigate a democratic voting process card-check elections for unions. The Chair has said that this bill will not pass this year, and subsequent committee discussion is in preparation for next year.

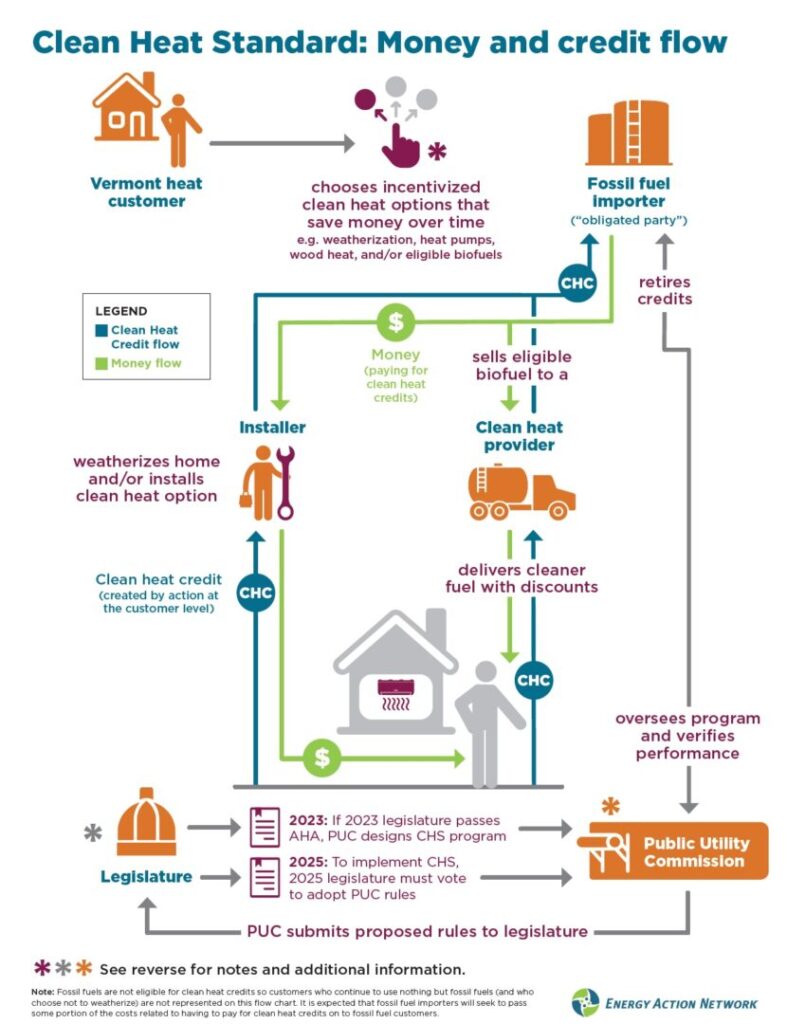

Governor and House Leadership Trade Jabs Over the Clean Heat Standard

The Senate voted in concurrence with the House-passed version of S.5 by a vote of 20 to 10, and the bill will now go to the Governor’s desk, where he will have five days to sign or veto the bill. It is expected he will veto it. Meanwhile, the Governor and House leadership have already started the drama of a veto fight as they trade jabs in the press over what the bill actually does.

As we covered last week, the Governor effectively wants the PUC to create a draft bill the legislature then needs to pass to create the program instead of the current form where the PUC creates the program and the legislature gives approval for it to begin in 2026.

Answers to Questions on the Proposed VT Saves Retirement Program

There have been a number of questions about the proposed VT Saves Program currently under consideration in the House Committee on Government Operations and Military Affairs. LCC reached out to the Treasurer’s Office with some of these questions and received answers which we have provided below.

Who would be eligible to participate in the program? Part-time employees, seasonal employees, temporary employees, contractors not on payroll?

As currently written in S.135, a “covered employee may include a part-time, seasonal, or temporary employee only to the extent permitted in rules adopted by the Treasurer.” This leaves the door open to offering the benefit of VT Saves to employees in this category but allows for a rulemaking process on the part of the Treasurer’s Office and with input from stakeholders to determine how that would be feasible. Contractors not on the payroll are not contemplated here.

How would employee contributions be invested to protect first-time or inexperienced investors? Would options be limited?

One of the key features of VT Saves is that we will work with a prospective vendor to ensure a simple investment line-up, including capital preservation and target-date funds. Most savers use a target-date fund that automatically rebalances an appropriate mix of assets over time, based on a saver’s age. Other states with similar programs place savers into such a target-date fund by default. So, there will be both limited options and “set it and forget it” options that inexperienced investors can utilize.

Employers have a fiduciary duty to ensure that funds deducted via payroll get to the correct entity. Would employers have that same responsibility under this proposal?

When plans provide for payroll deductions as a means of making contributions to a qualified retirement plan, an employer does have a responsibility to remit those contributions in a timely manner. Plan managers (likely to be a third-party vendor in Vermont) also have a responsibility to ensure that this is a timely process. The primary fiduciary responsibility for the VT Saves program would be vested in the third-party vendor that is the custodian of the funds. For example, in the State of Connecticut, Vestwell serves as the program administrator, and BNY Mellon serves as the custodian.

Would employers need to add an ERISA rider to their insurance?

We do not believe so. VT Saves is not an ERISA-covered plan.

Are we fully utilizing and encouraging Vermonters to take advantage of federal retirement opportunities (IRAs, etc.)?

What we know is that Vermonters, and Americans generally, are not saving enough for retirement and are underutilizing the options currently available to them. This is largely due to a lack of access to convenient and automatic retirement savings vehicles at their workplaces. The AARP Public Policy Institute reports that employees with access to workplace retirement programs are 15x more likely to save than those without.

Also, how would this interact with separate retirement planning the employer may be facilitating for full-time employees? Limits etc.

Employers who currently offer a retirement plan are not required to enroll in VT Saves. The Roth IRA contribution limit for 2023 is $6,500 ($7,500 for those 50 and over). An employee can have multiple Roth IRAs (for example, if they have opened an account at their financial institution), but they do have to make sure that their combined contributions for all accounts are under the annual limit.

What is the role of the employer in the program?Will there be additional administrative burdens on employers, especially very small ones?

Our understanding, based on employer experiences in other states, is that the administrative burden is minimal. We also had the opportunity to walk through the enrollment platform that one of the top two vendors in this space offers. It was an intuitive, web-based software that interfaced with many payroll systems, including Quickbooks, and has the capability of uploading a simple Excel file for employers without any payroll provider. Other states report that employers spend less than 15 minutes on initial sign-up, and just minutes per subsequent pay period.

Lastly, we’d like to understand better any planned education and outreach both to employers and employees.

Education and outreach will be a central focus of our office’s efforts on this front. The Senate’s budget includes a one-time $750,000 appropriation for Treasurer’s Office employees, including an Executive Director and an FTE focused specifically on outreach. The remaining start-up funds are earmarked for education and outreach. AARP of Vermont has also pledged to commit substantial resources and assistance on education for both employers and employees.

The Laundry List

There are many moving pieces, and we do our best to add the ones that don’t get a section in the newsletter yet should be on your radar here. On any given day in the State House, there are about 175 hours of committee time outside of floor time, and then the hallway, cafeteria, or other time spent legislating.

- Read past updates here – week 1, week 2, week 3, week 4, week 5, week 6, week 7, week 8, week 9, week 10, week 11, week 12, week 13, week 14, week 15, and the last session’s wrap-up.

- The Senate Committee on Finance voted out H.110, which would extend the sunset on 248a for three years, and includes a study on how to make the process easier to participate in for municipalities and individuals, how to encourage municipal participation, and recommend any necessary updates to 248a. The Commissioner shall hear from the Vermont League of Cities and Towns, the utilities, and any other interested parties.

- The catalytic converter bill, S.48, passed the House this week. The bill seeks to limit the number of catalytic converters that a person can transport at once or sell to a scrap metal processor per day unless they run a business repairing or recycling vehicles or have the documentation they own them.

- Joan Goldstein, the Commissioner of the Vermont Department of Economic Development, published an op-ed this week outlining the challenges facing Vermont businesses and the potential strain that will be added by the work of the legislature this year. Read it here.

- Governor Phil Scott and ACCD announced five additional brownfield cleanup awards, totaling $3.97 million in commitments, to remediate contaminated sites across Vermont. Since the Brownfields Revitalization Fund opened in October 2021, nearly $11 million in cleanup funding has been awarded to 25 projects in eight counties, which are anticipated to clean up more than 42 contaminated acres and create 554 jobs and 425 units of housing. This represents the most significant state investment in brownfields sites to date.

- Also this week, Governor Scott and ACCD announced the approval of 23 Community Recovery and Revitalization Program grants for projects that aim to spur economic recovery in the state. The projects are expected to support 844 existing jobs, create 115 new jobs, 29 affordable housing units, and 146 new childcare slots. The proposed award amount is $9,541,195, which is expected to support $92 million in total project costs. The CRRP program is funded through the federal American Rescue Plan Act and has a total budget of $40 million.