Thank you to this week’s sponsor of our Advocacy Update:

March 24, 2023

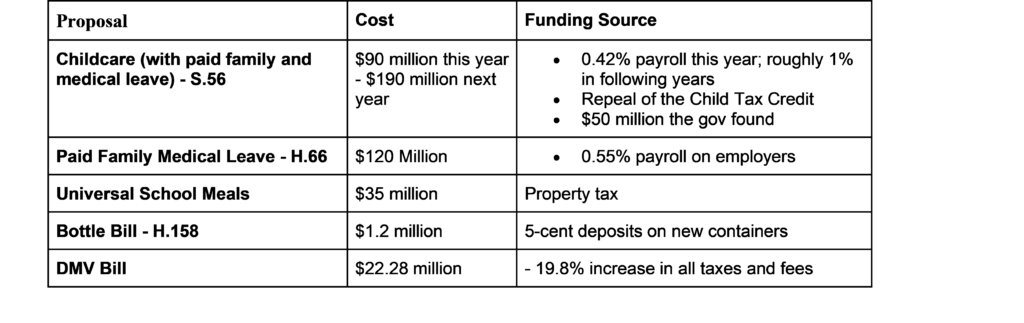

Yesterday, the University of New Hampshire released a poll covering the areas of most concern to Vermonters. Coming in at number 1, “housing” (32%), which should come as no surprise, and numbers 2 & 3 were “cost of living” (9%) and “taxes” (9%). The news comes in a week in which there is contention around how best to create more housing while legislators discuss what could conservatively be estimated as more than $400 million in new taxes.

This year is shaping up to be an expensive one. The Chair of the Senate Committee on Appropriations shared with colleagues today that the draft budget is $400 million above the Governor’s recommended budget. The House is likely not far behind the Senate, with over $340 million above the Governor’s recommended budget. The education fund will also likely need a 3.6% increase in property taxes, and depending on how legislators choose to use surplus funds, it could be higher at 8.3%.

Here’s a look at some of the high-price items that are making their way through the legislature.

In this week’s update;

- Childcare proposal receives its funding provisions; payroll tax

- House, Senate, and Governor all have different, competing visions for paid leave

- We had a fantastic tourism day at the Vermont State House

- HOME Act back and forth continues; we need your help with proposed amendment!

- Workforce Development Bill nears final approval

- The Laundry List

Childcare Bill Get’s Funding Mechanism, Advances

The Senate Committee on Finance this week began its work on S.56, the childcare bill that was sent to them by the Senate Committee on Health and Welfare. The Committee is looking to levy a 0.42% payroll tax that can be split 75:25 between the employer and employee. The payroll tax will increase in the second year of the program to an estimated 1%+/-.

The payroll tax would be higher if not for the bill repealing the Child Tax Credit passed last year, which rolls $31.8 million into the state’s childcare subsidy program. The Senate Committee on Finance also added back the requirement that those receiving childcare subsidies be participating in the workforce (there are exceptions for circumstances such as job searching, education, and other understandable life circumstances), which was previously removed by the Senate Committee on Health and Welfare.

In short, this legislation does the following;

- Seeks to increase the wages of childcare workers,

- Raises $190 million from a payroll tax, repurposing the VT Child Tax Credit, and utilizing some ongoing budget surplus,

- Increases subsidies to Vermont households utilizing childcare so that they do not feel the impact of those increases in childcare wages,

The crux of the issue here is that the transformation we need in our childcare system is reliant on the hypothesis that increased wages will bring more people to work in the childcare sector, however, as frequent readers of this update or those paying attention to Vermont demographics will tell you, we are lacking people in Vermont to cover all jobs, even at the salary levels imagined by the proponents of this bill.

The program also advanced with a paid parental leave program, as covered in previous updates.

Once the bill has passed the Senate, it will face major scrutiny by the House, where it is expected that members may abandon the payroll tax, possibly for a consumption tax or, it’s rumored, a corporate tax.

House, Senate, and Governor All Have Very Different Visions for Paid Leave; They’re On a Collision Course

On Thursday, the House passed H.66, which has remained largely unchanged since it was first introduced with its 103 sponsors. The bill seeks to create the most generous paid family and medical leave program in the country, with an initial cost of $111.5 million to start and an ongoing cost of $94 million.

The Governor has long had his own vision, moving forward with a paid family and medical leave plan administered by a third-party insurance company. The voluntary plan is already being stood up for state employees, with availability for private businesses to join in its second year and private individuals in its third year.

Then there’s the Senate, which hasn’t yet voted on a proposal, however, it has had three Committees (a sizable proportion of the Senate) pass their childcare bill, which includes 12 weeks of paid parental leave. The plan is less generous than the other two plans; however, it attempts to stay small to deliver a benefit to parents quickly and efficiently.

Fantastic Tourism Day at the Vermont State House

Thursday was Tourism Day in the State House, and it was a fantastic showing of businesses from every corner of Vermont.

Following a pandemic hiatus, Tourism Day at the State House returned for the first time since 2020. Over 150 tourism and hospitality industry leaders were present throughout the day to engage with legislators and raise awareness of the collective contributions of these industries to the Vermont economy.

The day was centered on the Vermont visitor economy and destination stewardship and management. Business and policy leaders connected during a coffee hour with Governor Scott, a joint hearing on the visitor economy with the House Commerce and Economic Development and the Senate Economic Development, Housing, and General Affairs Committee, and an evening reception.

Rep. Stephanie Jerome (Rutland-9), a stalwart supporter of the tourism industry, offered House Resolution, H.C.R.52. “The Vermont visitor economy is an incredible asset. It draws visitors to our towns, supports our local businesses, and is one of our largest employers. It generates tax revenues and creates jobs, it unlocks wide-ranging economic activity in both our rural and urban communities,” stated Rep. Jerome.

Business leaders reflected on the ongoing economic impacts of the pandemic and reinforced that collaboration is integral to the success of their businesses and communities. 13 million annual visitors contribute $3.2 billion in spending and support over 30,000 jobs, 10% of Vermont’s total workforce.

The HOME Act Nears Final Agreement Between Two Committees; We Need Your Help

The two committees of jurisdiction spent the week going back and forth with their amendments to S.100, also known as the HOME Act, attempting to find a final version that they both could agree to advance to the floor. By Thursday, they had arrived at a version that they felt was a suitable compromise, however, many are still not content. The Governor used his Tuesday press conference to bring together advocates to push back on changes made to the legislation.

In particular, many are frustrated with what has been done to the changes to Act 250 in the original bill, which have been scaled back to a superfluous scale. The original bill would have created a 25-units of housing trigger for the entire state, the Senate Natural Resources Committee restricted that trigger to only in “designated areas,” which represent about 0.3% of the state.

There is an amendment that will be considered to meet halfway to have that trigger in all towns that have planning/zoning and subdivision. We need your help! Please reach out to your Senators and ask them to support moving the 10/5/5 trigger for Act 250 to 25/5/5 in more areas than the bill currently allows. You can find your Senators here.

Here are some good talking points;

- S.100 is less effective without meaningful relief from Act 250!

- Designated areas represent about 0.3% of the state’s land, and within those areas, the increase of the trigger to 25 will be relatively inconsequential – we need relief from this restriction in more areas than this.

- In a poll this week done by UNH, housing is the number one concern for Vermonters.

- About 55% of the state has planning/zoning and subdivision, which are suitable places to have a 25-unit trigger for Act 250. These communities can use these changes in a sustainable way to provide the housing they desperately need.

- The Senate Economic Committee heard from developers of housing that the 10-unit trigger effectively serves as a cap on the amount of housing they can create for their communities. One developer, who was also at the Governor’s press conference this week, built 9-units in their town and now cannot build a duplex without triggering Act 250.

If you have any questions about these issues, please feel free to reach out.

Workforce Development Bill Nears Passage in the House

Not included in last week’s update due to the bill being finalized was the House Committee on Commerce and Economic Development’s workforce development bill. After making the crossover deadline late last week, the bill has spent time in the House Ways and Means and Appropriations Committees. The bill allocates about $41 million in funding to various ends to support the Vermont economy. The bill is rather large, so we suggest you pursue this summary by the Joint Fiscal Office Here. Some items of note are;

- Vermont Training Program – Section 19 appropriates $5 million from the General Fund in the fiscal year 2024 to the Vermont Training Program to fulfill Vermont’s obligation to procure incentives in accordance with the Produce Semiconductors for America (CHIPS) Act.

- Small Business Technical Assistance – Section 30 appropriates $1.25 million from the General Fund in the fiscal year 2024 to ACCD to establish the Small Business Technical Assistance Exchange, established in Section 29 of the bill, to provide grants of no more than $5,000 per business for technical services.

- Rural Industry Development Fund – Section 36 creates the Rural Industry Development Grant Program, which will provide grants through local development corporations for business relocation and expansion efforts. It establishes the Rural Industry Development Grant Fund for this purpose. Grants shall not exceed $1 million or 20 percent of the total project cost. Section 37 transfers $10 million from the General Fund in the fiscal year 2024 to the Rural Industry Development Grant Fund.

The Laundry List

There are many moving pieces, and we do our best to add the ones that don’t get a section in the newsletter yet should be on your radar here. On any given day in the State House, there are about 175 hours of committee time outside of floor time, and then the hallway, cafeteria, or other time spent legislating.

- Read past updates here – week 1, week 2, week 3, week 4, week 5, week 6, week 7, week 8, week 9, week 10, and the last session’s wrap-up.

- The Governor allowed the Budget Adjustment Act to go into effect without his signature this week.

- We missed in our crowded crossover coverage last week a bill that creates the VTSaves Program. VTSaves is a state-administrated, auto-enroll IRA program that would replace the Green Mountain Secure Retirement program enabled by legislation in 2018. GMSR has been difficult to start up, given the program’s complexity and fees. VTSaves follows a number of states that have been successful in launching auto-IRA programs. The plan is without a direct cost to employers and is voluntary for employees who can opt out of the default 5% contribution if they choose. More information can be found here.

- The House Committee on Ways and Means took up H.10, a bill regarding the Vermont Employment Growth Incentive Program, which was sent to them in a much more reasonable version than it was first introduced. The committee has made minimal changes, however, as the week went on time constraints have seemed to prevent them from getting to the bill.

- After a great deal of debate, the House advanced H.230, which has numerous provisions to prevent suicide. Among them is a provision around safe storage of firearms which drew unusual support from the Lake Champlain Chamber, which had formally endorsed the concept as a mitigation measure for increased violent incidents in downtowns involving firearms.

- Problematic labor bills we’ve previously covered are still advancing. We suggest that you reach out to your Representatives on these bills and urge caution when considering them.

- The House passed H.127, the online sports wagering bill authorizing the Department of Liquor and Lottery to design and operate an online sports wagering system in the state. The Commissioner shall negotiate and contract to authorize a minimum of two but not more than six operators to operate a “sportsbook” in Vermont through a mobile sports wagering platform. Operators will be selected through a competitive bidding process, and revenue share to the state shall not be less than 20 percent of adjusted gross sports wagering revenue. The bill also authorizes the Department of Mental Health to manage and administer a problem gambling program with revenue coming from the Sports Wagering Fund: $250,000 in FY24 and five percent but not less than $500,000 in subsequent years.

- H.228, making changes to Vermont Dram Shop law that will decrease the cost of liquor liability insurance, passed the House this week and is on its way to the Senate.

- LCC is excited to celebrate the community at our 112th Annual Dinner! The evening begins with a Cocktail Reception from 5-7 pm and is followed by the dinner and awards ceremony at 7 pm. This annual event brings together business executives, community leaders, and elected officials to recognize business and leadership achievement. Learn more here.

- Every year, Leadership Champlain gathers a cohort of 36 professionals from diverse backgrounds who share a commitment to community leadership to explore Vermont’s political, economic, and cultural landscape through monthly seminars, leader interviews, and a Service Project. Applications for Leadership Champlain are open now. Apply here! We are also currently seeking Service Project proposals from the Lake Champlain region’s municipalities and non-profit organizations. Learn more here.