Thank you to this week’s sponsor of our Advocacy Update:

May 7th, 2021

The end of the session is starting to feel more real as larger bills take their final shape and people begin to openly hypothesize about Committees of Conference, the final stage of a bill that cannot be negotiated between the House and Senate by any other means than each body sending three members to meet. In the Senate, morning committees had their last meetings this week.

In this week’s update;

- Miscellaneous tax bill passes out of Senate Finance

- Unemployment legislation resolved by House Committee

- Economic Development bill passes Senate committee; check-in on other proposals

- LCC discusses business aid with tourism caucus

- UI work search questions resources

- Congressional Delegation requests ideas for earmarks

- The Laundry List

Miscellaneous tax bill; Committee Moves to Not Tax Forgiven PPP

The Senate Finance Committee reshaped and unanimously voted out the miscellaneous tax bill, H.436, to also include complete conformity with the federal tax code as well as the addition of the yield bill and the exemption of sales tax on feminine hygiene products, as well as other items. An overview of the bill can be found here.

As the Committee discussed the possibility of not overturning Act 9, as the taxation of PPP would bring in new tax revenue, they were pleasantly surprised to learn that recent guidance from the U.S. Treasury allows forgone revenue from conforming with the federal tax code as an eligible use of ARPA funds. In short, to tax PPP loans would be a conscious choice to take millions of dollars from Vermont businesses instead of the federal government. This also affects the state link-up to the Earned Income Tax Credit and the Child and Dependent Care Credit, which LCC testified in support of in the House Ways and Means Committee.

The bill will need to be passed by the Senate and then be considered by the House. The working assumption by members of the Senate Finance Committee is that the House Ways and Means Committee will reject some of their positions in the bill and that the bill will need to be settled by a Committee of Conference. “This is going to be a long conference committee,” said the Chair of Finance.

Unemployment Bill Resolved in House Committee; More Negotiation to Come

Along this bill’s path in the House, a great deal of due diligence was done by the House Committee on Commerce and Economic Development. The Committee heard from their Joint Fiscal Office about new dependent benefits as well as others that benefit all Vermonters, including those on UI. They heard about how frequently cited statistics in previous discussions around UI were incorrect, and heard from the Department of Labor about how they are battling fraud from organized criminals outside of Vermont at the cost of hundreds of thousands to Vermont contributors.

In light of all these factors, the Committee voted 8-2 to pass their revised version of the Senate’s bill. When the bill heads back to the Senate, the ultimate resolution of the legislation will likely take place via a Committee of Conference. On Thursday the bill was referred to the House Committee on Ways and Means. The bill is expected to be debated on the House floor on Tuesday.

Artificial Pain for Employers – Removed

The bill corrects the formula used to arrive at the correct unemployment trust fund balance size over the next 10 years by removing 2020 from the calculation. Unemployment use in 2020 is so anomalous that the fund would need to reach about a billion dollars if that experience was included in the calculation. Now instead, the fund will likely need to reach about half a billion dollars. This is not a gift for employers (as some would try to spin it) as employers still need to refill the over $300 million difference between the current balance and the balance the fund was almost at before the public health measures necessary to fight the pandemic pushed employees onto the employer-sponsored unemployment insurance system. Under this draft of the bill, the base tax rate for the fund will go to Schedule 3 in July and Schedule 4 next July.

Artificial Gain for Employers – Retained

By the virtue of the labor market dynamics over the last year, and likely other factors, the average weekly wage in Vermont will increase this year pushing up the maximum weekly benefit for UI claimants by somewhere between 7.5% and 11% this year. The Committee included language which would ensure that if the average weekly wage decreases in the subsequent year that the maximum benefit doesn’t decrease.

Read more about the state of the UI Trust Fund and program via Vermont Business Magazine.

Economic Development Bill Passes Out of Senate Committee; Check-in on other Economic Development Proposals

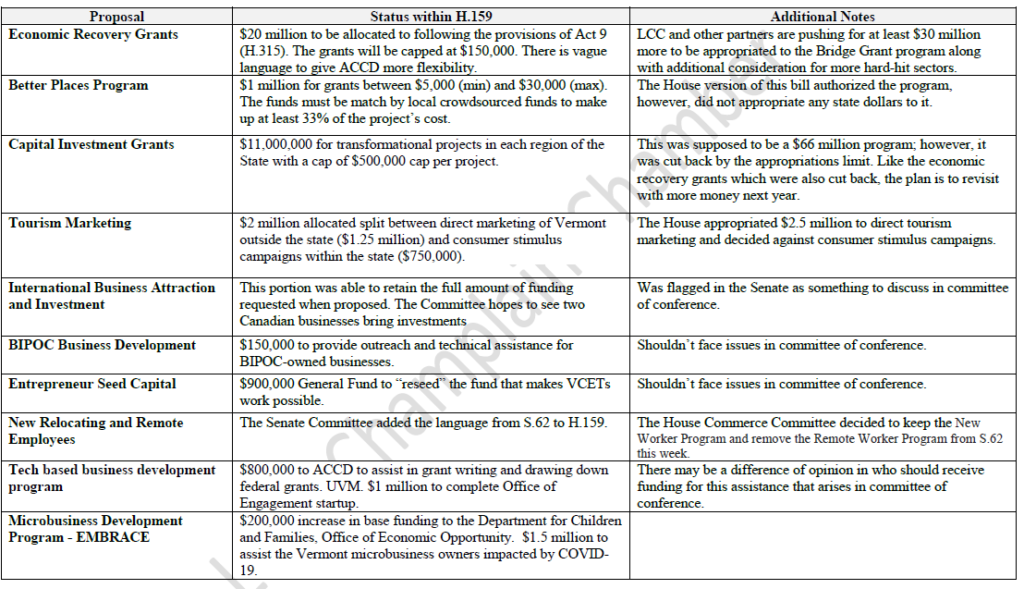

After a long laborious process that included the budget for the bill being halved, the Senate Committee on Economic Development, Housing, and General Affairs passed their version of H.159. The bill now includes capital investment grants, economic recovery grants, and the new Relocating and Remote Worker Program that it did not include when it left the House.

The final product still has many details to be worked out and the Committee Chair doesn’t see the bill as a finished product as the bill is certainly destined for a Committee of Conference. One item in the bill that is yet to be determined butis of great importance is the amount of funding available for economic recovery grants. LCC hosted a press conference with partner organizations and businesses on Wednesday to urge the Legislature to appropriate more dollars toward economic recovery grants (see coverage here). If you are in need of economic recovery grants, we suggest sending a note to your representative requesting an appropriation of $50 million in grants.

A breakdown of H.159 can be seen below.

Other Economic Development Proposals;

- The House Ways and Means Committee intends to remove the Downtown Tax Credit program sections of S.101 and keep the language that extends the program to Designated Neighborhood Development Areas. The Committee is also considering adding the language from another bill they worked on, H.437 (the miscellaneous revenue bill) regarding the manufactured housing tax credit as well as a surcharge on the property transfer tax. The bill does not contain the substantial sections of water permit reform that were already removed by House Natural. A section of the bill creating grants for municipalities to update their bylaws to specifically encourage increases in housing choice and opportunity in smart growth areas remains intact.

- The sales tax reform for manufacturing inputs put forward by the Governor and included in H.437 could be in jeopardy if everything of priority to the House and Senate is being removed from the miscellaneous revenue bill to be added in other places. The language does not appear to be a high enough priority for either body making it easily dropped in conference committee. We encourage interested businesses to reach out to their legislators.

- Project-based Tax Increment Finance Districts (TIF), often referred to as “Mini-TIFs” have been stripped from S.33 by both the House Commerce and Economic Development Committee as well as the Ways and Means Committee. A number of stakeholders have urged the Committee to use the bill to extend the length of the existing TIF districts by three years to help mitigate the effect of the pandemic on the building process, cost of supplies, and change of use.

- The Senate Finance Committee this week finished up their work on the broadband bill H.360 that was sent to them by the House. The Committee made what LCC saw as a necessary change by not excluding small telecommunications companies from receiving some of the over $100 million in federal funding the state is appropriating to broadband buildout. The House version of the bill only would have allowed Communications Union Districts (CUDs) to access the funds.

LCC Discusses Recovery Grants, Tourism Funding, PPP Taxation with Tourism Caucus

This morning, LCC joined the Tourism Caucus to discuss the state of major bills related to the Caucus’ goal to advance tourism in the state. The Caucus will be sending a letter to leadership requesting that $50 million be appropriated to Economic Recovery Grants and the leadership ensures that forgiven PPP loans go untaxed.

WorkSearch Requirement Brings Many Questions

LCC has heard from many members confused about the return to work and work search requirements for UI claimants and is in the process of seeking further guidance. The Department of Labor will be hosting additional webinars on the issues associated with work search requirements. Details on upcoming events may be found here. A town hall focused on work search for employers is Monday, May 10. Recordings of these and previous events are uploaded to the Department’s YouTube Channel and may be viewed online. Additionally, more FAQs around work search requirements can be found here.

Congressional Delegation Seeks Ideas for Earmarks

We’ve all been talking about earmarks returning for months, however, they are officially here and you can start to see some of the results of our Congressional Delegation’s request for potential funding. Earmarks, or as they are referred to now, Congressionally Directed Spending (CDS) direct a portion of discretionary spending to specific projects in their states in the Fiscal Year 2022 federal appropriations process. All CDS requests must be submitted by 5:00 p.m., Friday, May 21, 2021. The purpose of this application is to identify high-impact projects in Vermont that can reach completion with assistance from the federal government. Congressionally Directed Spending is capped at one percent of all discretionary spending. For-profit entities are not eligible to receive Congressionally Directed Spending. CDS funding will likely be in the range of $200,000 to $1.5 million.

- You can submit electronic application forms here for Senator Leahy.

- The projects selected by Congressman Peter Welch can be found here.

- Suggestions can be submitted to Senator Sanders here.

The Laundry List

- Read last week’s update here

- Senators Kitchel, Sears, and Westman were appointed to the Committee of Conference for H.439, the budget bill today after the House requested a Committee of Conference. They will represent the Senate in the coming negotiations.

- LCC testified today on the future of State House access which has become controversial in the past week. LCC commented that public access to the State House should be the primary, not a secondary goal.

- Commissioner of Environmental Conservation Peter Walke presented the universe of need of about $1 billion to the House Committee on Natural Resources, Fish, and Wildlife this week. There is about $260 million in need for 3-acre stormwater rule retrofits with money from ARPA money appropriated to water quality will be focused on engineering support for 3-acre sites.

- The Restaurant Revitalization Fund applications opened this week and it looks as though, after just two days of the program, it might be oversubscribed. The SBA reported that there were over 186,000 applications, far above the 100,000 it expected it could accommodate. It is still important that you apply for this program as there is the distinct possibility that it could be backfilled with more federal funding.

- A statewide Short-term Rental registry passed out of the House, S.79.

- S.20 (chemical bill) passed the House this week and will head back to the Senate for consideration.

- H.313, the miscellaneous alcohol bill was referred to the Senate Committee on Finance this week which has since passed the bill out. The bill allows the sale of alcoholic beverages for off-premises consumption, or “to-go” for first, second, third, and fourth-class licensees until July 1, 2023 among other items.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team