Thank you to this week’s sponsor of our Advocacy Update:

January 23, 2026

This week, we’ve got four high-level topics that cut through every issue:

- The uncertain fiscal forecast,

- the Governor’s call for fiscal discipline in his proposed budget,

- the need to contain healthcare costs or face collapse, and

- regionalization as the undercurrent of all policy, as everyone seeks economies of scale.

That’s everything but the kitchen sink, which in this case, is housing, which we’ll do a deeper dive into next week.

- Of course, the laundry list has other items you won’t want to miss.

- And don’t forget to register for Monday’s Legislative Breakfast at The Nine!

We strive to make these concise and easy to read. Feedback is not just welcomed, it’s encouraged – [email protected]

This Monday – Our First Breakfast in the Series

Every year, we bring legislators, policymakers, and LCC members together to celebrate business ownership and entrepreneurship and advocate for economic opportunity for our region. Sponsored by EastRise Credit Union, our Legislative Breakfasts are opportunities to connect with legislators and those in higher office.

January Legislative Breakfast

- When: Monday, January 26 | 8:30 am

- Where: The Nine | 1205 Airport Parkway, South Burlington

March Legislative Breakfast

- When: Monday, March 16 | 8:30 am

- Where: Dealer.com | 1 Howard Street, Burlington

Thank you to our hosts, The Nine and Dealer.com, for their generous support of our Legislative Breakfast Series!

Thank you to our breakfast sponsor

We have a great group of legislators who have already confirmed their attendance.

A Fiscal Forecast, Revenue Reality Check

The consensus revenue forecast delivered Friday showed revenue remained relatively steady despite the mash of federal and economic factors. However, for the first time since 2017, Vermont has downgraded its General Fund revenue forecast.

As we’ve explained before, this year is bookmarked by two distinct periods of fiscal conditions.

- Behind us is the “sugar high” of the pandemic-era funding abundance,

- Ahead of us is constricted federal funding and a great deal of uncertainty from the national economy.

- Right now, things are chugging along slightly below target with the same systemic problems we’ve had.

Factors highlighted by the consensus forecast and the Governor.

- Inflation marches on: It will cost $139 million more just to maintain existing state services in FY2027, driven by a 9.7% spike in pension obligations.

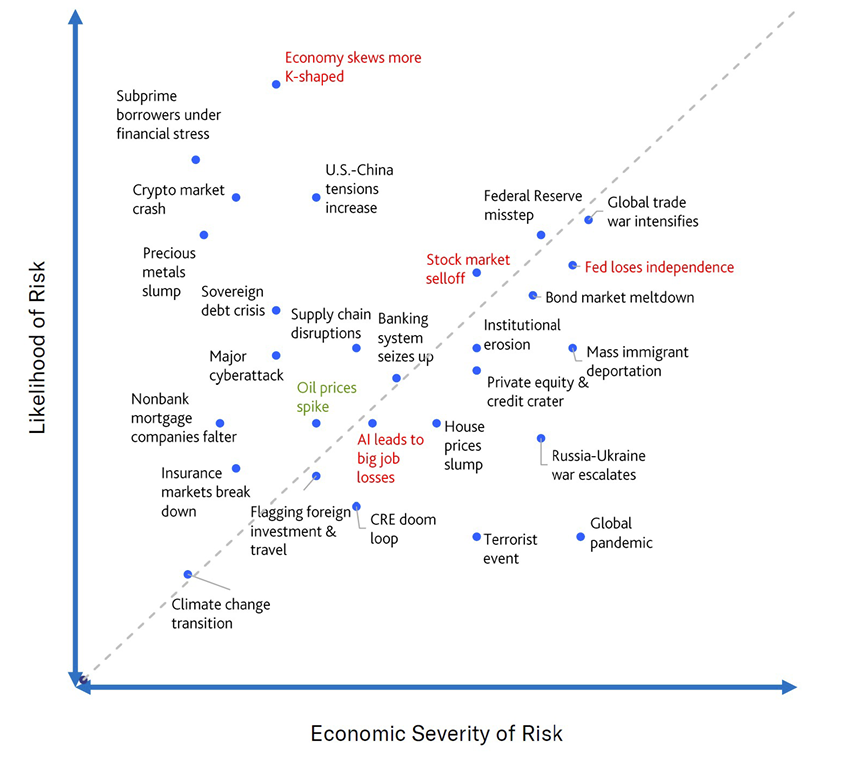

- Macro Risks: A “K-shaped” economy, where the top 10% of earners drive nearly half of all spending, leaves the state vulnerable to volatility in luxury consumption and capital gains.

- Federal Cliff: The “H.R. 1” federal Reconciliation Act looms as a massive threat, with projected losses of $133 million in Medicaid funding and up to $1.7 billion in hospital revenue over the next decade.

- Education Fund: This fund requires $2.56 billion this year, a 39% increase over five years. It currently relies on nearly $800 million in non-property tax revenue, including sales, lottery, and rooms and meals to remain stable.

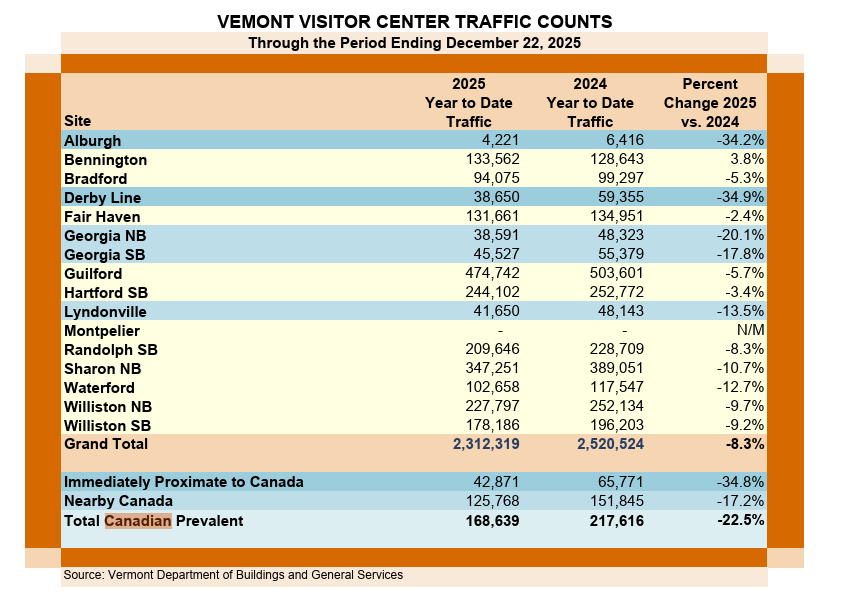

- Tourism slowdown: The continued bombardment of our neighbors to the north by our commander in chief has led to noticeable slowdowns in Canadian tourism, affecting the state coffers.

The Hidden Liabilities?

Other factors are being discussed outside of the spotlight.

- Tax delinquency’s blind spot? Vermont’s education fund depends on property taxes collected by municipalities, which are on the hook for taxes even when their residents are delinquent.

- The municipalities often take on short-term debt to maintain cash flow, and no one is responsible for aggregating all the delinquencies statewide.

- Those working in municipal government are reporting rising delinquency rates, especially since covid-era homeowner assistance ended.

- Is the state essentially “offloading” its revenue risk onto local treasurers without tracking the total exposure?

- Tax delinquency’s blind spot? Vermont’s education fund depends on property taxes collected by municipalities, which are on the hook for taxes even when their residents are delinquent.

- New land use laws driving us to a “valuation cliff?” Keen observers of land-use policies over the last three years are concerned that about 70% of our state could be affected in value.

- As the state transitions to place-based jurisdiction for Act 250, some properties may become unbuildable because they are in an area designated Tier 3 or because it is difficult to build a road under the new road rule. Some are concerned that this will decrease their value and even the value of properties around them, degrading the grandlist of the state.

- Similarly, a river corridor bill passed two years ago in response to severe flooding could potentially impact more than 45,000 properties totaling over 209,000 acres across 5,000 miles of river, potentially freezing them in time and pulling them off the grandlist, or greatly reducing their value.

Bottom line: While education reform has been mostly about how to spend money, the tax base beneath the whole system might be eroding, as if you are finally remodeling your kitchen and dining room only to realize your foundation has been washed out beneath you.

Governor Urges “Discipline” for FY 27 Budget

Governor Phil Scott addressed a joint assembly on Tuesday to deliver his proposed $9.4 billion FY2027 budget.

- This was the first glance at many of the Governor’s priorities for the session, after he dedicated his entire State of the State address to education reform.

- The major theme of the address was fiscal discipline, as pandemic-era federal assistance ends and we sail into uncertain waters.

Education: Short and Long-term Adjustment

Vermont’s education system is hitting a $3 billion price tag, threatening a 12% property tax hike.

- The Band-Aids:

- The Governorproposes using $105 million in one-time surplus and reserves to “buy down” the tax increase by about half.

- The Governor endorsed the Senate President Pro Tem’s plan for structural caps on school district spending for FY2028 and FY2029.

- The Cure? The Governor urged marching forward on implementing Act 73.

Transportation: A Structural Deficit

The Transportation Fund faces a $33 million gap as gas tax revenues fail to keep pace with the tripling of road repair costs.

- The Fix: Scott plans to stop “diverting” transportation taxes to the education fund and will eliminate 31 positions within the Agency of Transportation to balance the books. He remains firmly against a gas tax increase.

- The difficulty: pulling revenue from the education fund could increase property taxes.

Housing: Pilots Made Permanent and Pivot

Making Pilot Programs Permanent: The budget shifts successful pandemic-era experiments into the state’s long-term “base” budget.

- VHIP Permanent: $4 million to permanently fund the Vermont Housing Improvement Program, which creates units by repairing vacant or blighted properties.

- Preserving Mobile Homes: $800,000 for the Manufactured Home Improvement and Repair program to protect existing affordable stock.

The Homelessness Pivot: Ending the Motel Era: Scott is doubling down on the transition from motels to permanent shelters with integrated services.

- The Bridge: $21.2 million in one-time funds to wind down the hotel/motel program while eligibility is tightened.

- The Infrastructure: $6 million to start up new permanent shelters and $10.2 million in base funding for “medically vulnerable” and recovery-focused housing.

Public Safety: Accountability the Focuss

- Accountability: Following a successful Burlington pilot, $500,000 is earmarked to expand “accountability courts” to clear backlogs of repeat offenders.

- Juvenile Justice: The Governor this year is again pushing to repeal “Raise the Age” for 19-year-olds to restore accountability in the legal system.

Regionalization Everywhere You Look

Whether we are talking about adapting for flood relief, EMS, transit, or housing, policymakers are all hitting the same ceiling: the town line.

- In nearly a dozen reports and countless legislative conversations, Vermont’s lack of robust regional governance has been identified as a primary obstacle to progress.

- The question is no longer if we need to scale, but how.

The Uncanny Parallel: To the keen observer, there is a distinct sense of déjà vu. In 2018, nearly every legislative committee claimed a “unique” workforce crisis, ignoring the reality that they were all witnessing the same universal demographic shift.

- Today, we are repeating that mistake with regionalization. Whether it’s healthcare, education, or justice, committees are struggling with scale in a vacuum, treating shared structural failures as isolated incidents rather than a shared reality.

Zoom Out:

- Public Safety: Windham County is seeking regional policing models to maintain an essential service that no single town can provide alone.

- Healthcare: The transformation of rural healthcare depends entirely on regional hubs that ignore municipal boundaries.

- Education: The “Redistricting Task Force” is now proposing Cooperative Education Service Areas (CESAs) to manage cost, while stricter supporters of Act 73 still want to see 10-20 school districts statewide. Both are just an attempt at scale.

- Property Taxes: Act 73 recently mandated a shift toward Regional Assessment Districts, acknowledging that the volunteer lister model can no longer keep pace with modern valuation practices.

- Transit: The Lake Champlain region continues to lose transit service as a centralized municipal entity tries to navigate funding without upsetting dozens of contributors.

State of the State: We are piling Regional Assessment Districts on top of Solid Waste Districts, which sit on top of Communications Union Districts (CUDs), Fire Districts, and Regional Planning Commissions.

- If everyone draws their own maps, we don’t get efficiency; we get a maze of overlapping jurisdictions that no citizen (and few legislators) can navigate.

What’s ahead? The County & Regional Governance Study Committee had started meeting on this issue before electoral losses meant that the committee lost its co-chairs. The Committee has been reconstituted and will begin meeting monthly.

Bottom line: Vermont is facing 21st-century challenges with a 19th-century government, and modernizing to achieve scale can deliver cost savings, easier navigation, and better outcomes for Vermonters.

- However, efforts to do this to date are disconnected, duplicative, or delayed.

Healthcare: Contain Costs or Collapse

Vermont legislators are aggressively moving to overhaul how healthcare is paid for and regulated in Vermont, with the understanding that they need to contain costs or face a system collapse.

Legislators are looking at four high-impact bills to tighten the reins on the industry:

- Primary Care Reform (S.197): Aims to move 15% of total state health spending to primary care by 2029 via flat, monthly payments instead of billing for every visit.

- Targeting Private Equity (H.583): Attempts to regulate financial practices by banning leveraged buyouts of healthcare providers, requiring biennial ownership disclosures to the state, and boosting provider autonomy by voiding most non-compete agreements.

- Rx Savings (H.577): Vermont is eyeing a multi-state consortium to give all residents access to drug discounts, slashing generic costs by up to 80%.

Regionalization: Faced with intense pressure, hospitals are pivoting to regional “shared services” and are reporting cutting $230 million in costs for FY2026. For example, two hospitals are now sharing a single neurology service to keep care local without doubling the overhead.

Zoom out: Federal policy changes under HR 1, aka the One Big Beautiful Bill, are creating massive long-term budget holes:

- Tax Loss: A phased-in cap on provider taxes could cost Vermont $133 million annually by 2032.

- Planned Parenthood: The state is currently forced to use $1.1M in General Funds to cover federal funding prohibitions.

- Federal grant help: Vermont is finalizing its award of a $195 million annual federal grant to fund mobile health and rural workforce training; however, policymakers are struggling at times with the fact that it is for “redesign only,” not for lowering premiums.

The Laundry List

Hundreds of hours of committee discussion each week culminate in our advocacy update, so not everything makes it into the overall update; however, we often cover what is left on the cutting-room floor here for our most dedicated readers.

- Read previous updates: Week 1 and Week 2

- The Caucus for Vermont’s Economy is having its second meeting today and already coalescing around some central themes: a shared desire for our state to render better “customer service,” understanding that regulatory overreach has led to preventing good things from happening in our communities, and a lamenting that we’ve lost economic momentum and with it, some broader prosperity that made them want to call Vermont their home.

- Davos Dig Implicates Vermont: Vermont was mentioned in a jab from JPMorgan Chase CEO Jamie Dimon on stage at Davos this week. Dimon criticized the President’s proposal to cut credit card interest rates and suggested that he try it first in Vermont and Massachusetts.

- State House Upgrades? If you’ve been to the Vermont State House, you know there are a lot of doors you can come through. A proposal that’s been in the works for some time now might mean there is an obvious one. This rendering offers a glimpse of a new curved-glass atrium on the west side of the building, providing space for security screening and a new lobby.

- Lodging surcharge bill: The Chair of the Senate Committee on Economic Development, Housing, and General Affairs has introduced a bill that would create a 2% surcharge on lodging in an attempt to raise funding for affordable housing.

- The Department of Housing and Community Development has shared the latest on the Homes for All initiative, highlighting recent progress on the 802 Homes project and the launch of our Small-Scale Developer Training Program.

Hey! You read the whole update. You probably have some thoughts on the content or how we delivered it. Feel free to reach out with those at [email protected].