Thank you to this week’s sponsor of our Advocacy Update:

April 16, 2021

The Vermont legislative session, by all accounts and indicators, is coming to a close soon, however, there is a great deal of work to be done. Adjournment is tentatively set for May 15, with a veto session scheduled for June 23rd and 24th. If the federal government passes out a new stimulus package after adjournment, the legislature would possibly come back sometime in October for a zoom session as the Legislature has already passed language authorizing themselves to meet remotely until January 7th.

In this week’s update;

- Pushback on PPP taxation continues – we need you to contact your legislators

- Broad internet service tax passes the House in a committee amendment

- LCC and partners propose path forward on economic recovery grants

- Problematic unemployment insurance bill receives preliminary testimony in the House

- Miscellaneous alcohol bill considered in Senate, good amendment proposed

- The Laundry List

Pushback to PPP Taxation Continues – Contact Your Legislators

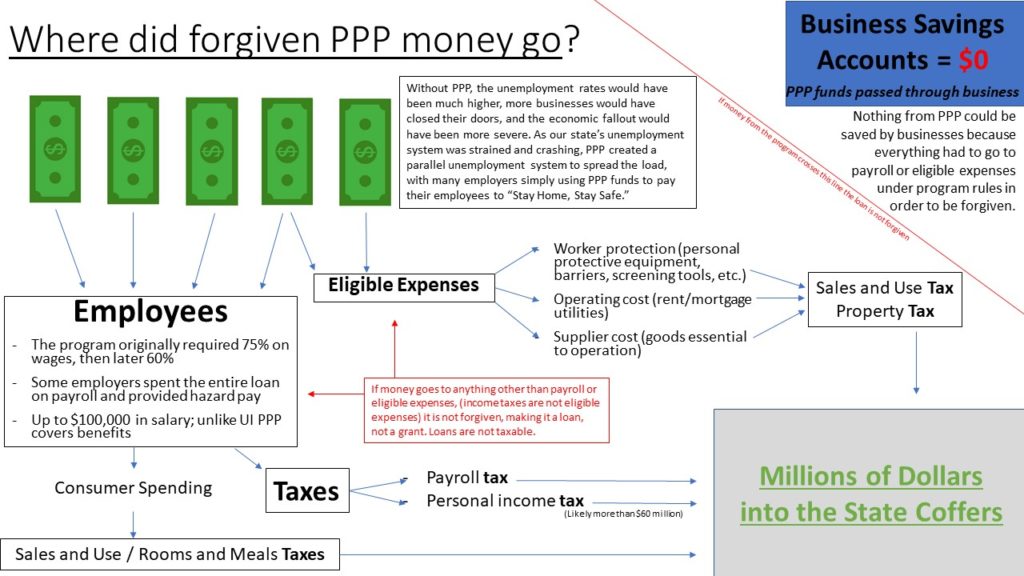

The Lake Champlain Chamber has coordinated an incredibly broad coalition of organizations in response to the Vermont legislature’s decision to tax PPP loans forgiven in 2021. As a result, this week brought a massive amount of constituent outreach with many legislators responding with similar dismay as they were unaware of what passed. Others referred to it as a temporary decision (though it was passed with the intention it would go into law) while promising to hear the testimony that did not happen before the decision was made. LCC is scheduled to testify on the issue on Tuesday in the Senate Finance Committee.

H.315, the legislation where this problematic provision was added in the final hour of negotiation, made it to the Governor’s desk on Monday giving him five days to consider the legislation and make a decision; sign, veto, or let it go into law without his signature. On Thursday, the Governor was on Vermont Edition where he expressed his disappointment and disapproval with the last-minute change to the bill as well as vocalizing his desire that the legislature reverses the decision and not tax forgiven PPP loans.

More constituent outreach is needed, so please, contact your legislator as soon as possible. To learn more about the issue you can read this FAQ sheet put together by our advocacy team.

While some Vermont legislators are backing away from the change, some are insisting (incorrectly) that this was how the program was meant to be despite comments from a spokesperson for Senator Patrick Leahy, the President Pro Tempore of the United States Senate and Chair of the Appropriations Committee telling VTDigger that “Congress wanted businesses and individuals to both receive the full benefit of federal support during the pandemic by not taxing PPP loans.” Additionally, the legislative intent that PPP would not be taxable was clarified by the Congressional Research Service in May of last year with bipartisan agreement on their findings. Out of all the officials involved with the creation, implementation, and taxation discussion around PPP at the national level, the only official who took the position that the Vermont legislature took in H.315 was the Trump Administration’s Treasury Secretary, Steven Mnuchin.

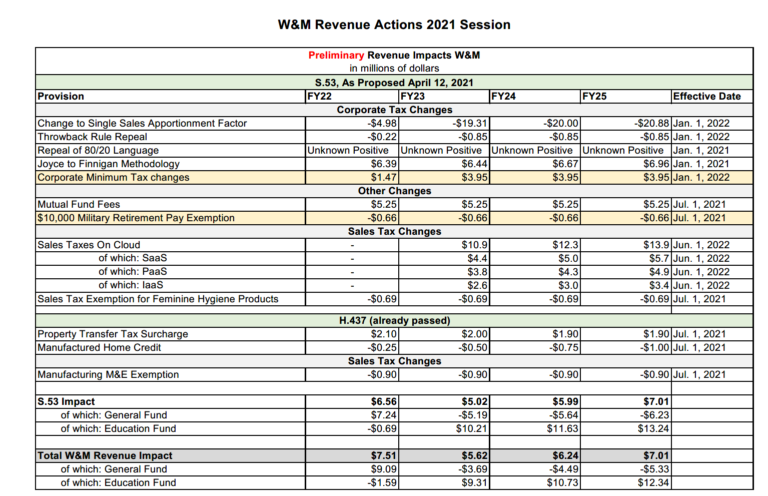

Broad Internet Service Tax Passes House in Large Committee Amendment

As we reported last week, the House Committee on Ways and Means was considering a large amendment to S.53, a bill sent to them by the Senate that exempts feminine hygiene products from the Vermont sales tax. The amendment, an overview of which can be seen below, contains many changes to the corporate sales tax, a reconfiguration of the Corporate Minimum Tax (CMT) tax brackets with some increases, an increase in mutual fund registrations fees, an exemption in military retirement pay, and most impactfully to the future of Vermont a tax on nearly (or more likely than not, every single) internet service. This legislation passed the House and is now headed to the Senate.

Internet Service Tax

This legislation would tax nearly all online activity that you pay for at a sales tax rate of 6%. In the past, similar proposals to tax online services have been restricted to a few services in a specific category, however, under the legislation passed everything we’ve come across is taxed. While this has been pitched as a tax on the tech sector, businesses who use common services such as Square, MailChimp, Constant Contact, Quickbooks, Salesforce, or any similar tools will need to pay.

The House Democratic caucus was told that this was not a new tax, and it was just a repeal of the sales tax exemption on “vendor-hosted prewritten software.” The definition of “vendor-hosted prewritten software” accessed remotely was also expanded to now include Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS) (see expansion summarized by their legislative Counsel here) which were never included before.

Think of it as if we had an exemption on the taxation of ketchup; the House just repealed the exemption on the taxation of ketchup while also changing the legal definition of ketchup to include mustard and relish because, from the Committee’s perspective, these things often end up all getting mixed together on a hotdog and they felt it was just simpler to call them all ketchup.

For the past few years, the cloud conversation has been specifically about SaaS, as the proponents of taxing SaaS contested that they aimed to tax software that used to be “in a box,” with the most common definition being something such as tax software that moved from a CD-based to a web-based delivery system. It was very shocking when the Committee members took the next step of expanding the legislation to things that were never in a box, such as CRM or accounting tools which could never have been “in a box” and would have been services one paid for. LCC testified to this point last week as well as how this legislation runs counter to our visions of Vermont’s economic future. Vermont does not tax services and despite a recent Tax Structure Commission report suggesting that we do the Committee has expressed a desire to not pursue taxing services. The Committee heard from an attorney with the Vermont Department of Taxes that such mismatched treatment of internet services might mean the legislation falls afoul of the federal Internet Freedom Act, which states that a state cannot tax a service differently exclusively for the reason that it is delivered over the internet.

If this legislation advances, Vermont will be one of only eight states which taxes internet services this broadly. We strongly suggest reaching out to your Representatives to express disapproval and your Senators to ask them to not take up the proposal when it gets to them. You can find their contact information here.

Military Retirement Pay

This proposal has gone nowhere for the last five years and was likely added to the bill to attract more support for the tax increases. The purpose for exemption military retirement pay, which the Lake Champlain Chamber supports, is to recruit and retain highly skilled members of the military who upon retirement have many working years left and often make decisions based on this factor. A last-minute effort was made by Representatives Laura Sibilia and Matthew Birong to increase the exemption in the bill from $10,000 to a more meaningful $30,000. Vermont is one of only three states that does not exempt military pension payments.

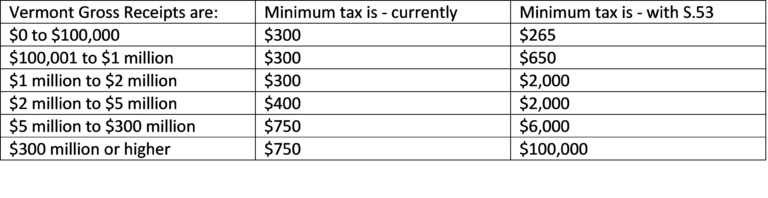

Corporate Minimum Tax Changes

To raise revenue, the amendment made changes and additions to the CMT brackets with increases to the tax for anyone with gross receipts over $100,000. One of the new brackets that was put in place covers those with gross receipts of $300 million or higher which is only about 10 filers in Vermont.

Larger Corporate Tax Changes

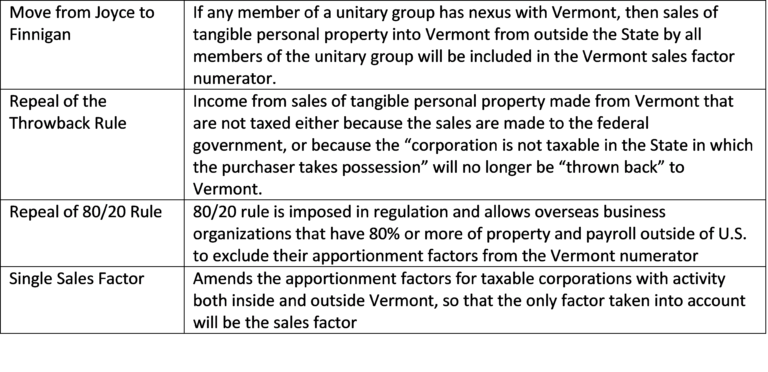

These changes reflect years of work from the Ways and Means Committee and are net positive for businesses they affect. They include;

LCC and Partners Propose Path Forward for Economic Recovery Grants

Yesterday, we sent a letter in collaboration with the Vermont Businesses for Social Responsibility, Main Street Alliance of Vermont, Vermont Retail & Grocers Association, Vermont Chamber of Commerce, and the Vermont Ski Areas Association proposing next steps before adjournment to ensure that American Rescue Plan Act dollars could be appropriated to another round of Economic Recovery Grants. Under the proposal, the Senate would appropriate the $50 million in his proposed ARPA budget to the newly created Bridge Grant program in the newly passed H.315. After the program has exhausted its original funds, the Joint Fiscal Committee would be tasked with meeting in the time outside of the legislative session to receive a statutorily obligated report from the Agency of Commerce and Community Development on the use of the funds and any subsequent oversubscription (also could be referred to as underfunding) of the program.

LCC successfully advocated for the program criteria of this new business gap grant to be broadened beyond just those businesses who have received no support; giving those businesses who’ve received nothing initial priority for the first 30-days of awards, and then priority on a rolling basis. Though there is not much funding, and many businesses will not be prioritized, it is important to apply for the program when it becomes available for two reasons; first, there is a chance that your needs may be met and it could serve to hold your place in line if more funding becomes available. Second, if the program is oversubscribed by a substantial amount, it will make the case for the legislature to appropriate new funds.

The program does have some stringent guidelines, however, applicants that can demonstrate a net operating loss will be eligible for a grant worth up to three months of fixed cost. ACCD will be providing more information shortly and there will be webinars and tools to help prepare applications. In the meantime, it is advised that you start collecting information such as bills and statements to show fixed costs and operating losses to be prepared.

Problematic Unemployment Insurance Bill Receives Preliminary Testimony in House

The House Committee on Commerce and Economic Development on Thursday did a walk-through and heard initial testimony from the Senate and the Department of Labor on S.10. LCC is expected to testify next week.

The Department testimony echoed the issues LCC raised upon passage of the bill, specifically that the “relief” to employers that the bill supposedly includes does not exist because the employers would have to pay for it or the fund balance would need to be reduced arbitrarily despite that balance size being set as a matter of protecting solvency.

Miscellaneous Alcohol Bill Continued to be Considered in Senate

The Senate Committee on Economic Development, Housing, and General Affairs continued their work on H.313, the House-passed miscellaneous alcohol bill which contains a codification of the alcohol to-go rules that have done by executive order during the pandemic. LCC has long been a proponent of making this permanent.

The Committee also heard proposed amendments, which LCC is supportive of, to the legislation which would bring Vermont’s Tied House Law into conformity with federal law and inclusion of the language found in S.68 relating to canned cocktails.

Currently, any malt or vinous-based product can be sold in a store, however, anything that contains distilled spirits must be sold by the Department of Liquor Control liquor outlets and distributors. Under this proposed legislation, canned cocktails of low alcohol spirits, of up to 16% alcohol by volume (ABV), would be able to be distributed by stores and Vermont distributors. The Department of Liquor Control supported the position of the Scott Administration which is in support of the legislation, however, DLC asked that the proposed ABV level be reconsidered.

The House Committee on General, Housing, and Military Affairs needed to move H.313 without fully considering these proposals due to time constraints, though they made a commitment to revisit them and will do so next week, The Senate Committee, while supportive, did have some unresolved questions and preferred to see the House resolve these issues and signal support for the provisions.

The Laundry List

- Read last week’s update here

- Have an issue to discuss with our advocacy team? Schedule a time here.

- Governor Scott said this week he is confident Vermont can meet its reopening goals by July 4th despite the cancellation of Johnson and Johnson vaccine clinics. Vermont is expected to receive additional doses of the Pfizer and Moderna vaccines which will keep the state on pace.

- A recent report “The Role of Northwest Vermont in the State Economy” which was prepared for the Greater Burlington Industrial Corporation by the economist Art Woolf shows the three counties of Northwest Vermont combined grew faster than the statewide average, and every county outside of northwestern Vermont grew far more slowly. Read more via the St. Albans Messenger.

- VELCO will hold two virtual public meetings – April 28, 11 am – 1 pm and May 5, 5 pm – 7 pm – to gather public input on the just-released Public Review Draft of the 2021 Vermont Long-Range Transmission Plan. Please join us to learn about the prospects for new in-state transmission projects. To RSVP, obtain more information, or request a sign language interpreter or other accommodation, please call 802.353.9346 or visit velco.com/2021plan.

- As reported in VTDigger’s final reading, the House Committee on Appropriations took some time last Friday to discuss the possibility of Universal Basic Income in Vermont and that “the committee chair said she would be ‘noodling on’ the idea moving forward.”.

- A reminder, the Paycheck Protection Program (PPP) deadline has been extended until May 31st. The Vermont District Office of the SBA continues to offer two weekly webinars on First and Second Draw PPP loans and PPP loan forgiveness.

- The House passed this week a large overhaul to the state’s bottle bill which would expand the beverage containers required to have a 5-cent deposit broadly.

- The second round of sole proprietor grants, ranging from $1,500 and $10,000, is now open to qualifying sole proprietors on a first-come, first-served basis via Vermont Community Development Block Grants (CDBG) funding. Technical assistance resources are available on the grant program website.

- The Lake Champlain Chamber testified on S.20 a bill relating to restrictions on perfluoroalkyl and polyfluoroalkyl substances and other chemicals of concern in consumer products. We urge caution and that any outcome should allow for a delineated and judicious case-by-case approach by the Department of Health in order to avoid unforeseen consequences and realistic timelines for when, if, and how to regulate such substances.

- The House Committee on Commerce and Economic Development is likely to look past the proposed “mini-TIF” legislation in favor of meeting the community needs served by such a program with ARPA money earmarked for municipalities. While this seems like a one-for-one swap, TIF offers a more long-range tool that can leverage additional funds, while one-time money from ARPA would present only short-term support. It would be the hope of the LCC that mini-TIF legislation advances this legislative session.

- The House Committee on Natural Resources, Fish and Wildlife heard testimony this week in support of the Senate passing S.101 which offers encouragement and funding for municipalities to modernize their zoning and bylaws to allow for more housing. The most controversial section involves a waiving of the redundant requirement that a developer must acquire both a municipal level and state level permit for water and wastewater hook-ups. The bill will likely go to the House Ways and Means Committee where they have been waiting for this legislation to address Downtown Tax Credit proposals that were originally introduced in the House-passed economic development bill, H.159.

- Burlington’s City Assessor has completed a citywide property revaluation project that has been underway since 2018. This was the City’s first citywide reassessment since 2004 / 2005 and was required by the State of Vermont. This week, property owners received letters from the City Assessor about their property’s new assessed value and appraised value prompting questions and concerns. Detailed information about the Citywide reappraisal is outlined on the City website.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team