Thank you to this week’s sponsor of our Advocacy Update:

April 11, 2025

Rewind: We all remember trying to navigate pandemic unemployment assistance, the paycheck protection programs, the employee retention tax credit, and all of the other programs that needed to be put together at the last minute to deal with a massive economic disruption.

- Of course, these were programs aimed at responding to a global pandemic.

Fast forward: The deluge of drama from D.C., whether it’s tariffs, funding cuts, or policy pivots, has left businesses and policymakers feeling like they are reliving the chaos of the pandemic all over again;

- However, this time, it didn’t need to be this way.

Zoom out: There are important lessons for all policymakers to learn about how one should and should not roll out policy.

- Many in management might be familiar with the concept that a poor plan, perfectly executed is better than a perfect plan poorly executed.

- Whatever your political persuasion and position, no one can argue that tariffs, as a plan, were poorly performed and caused unnecessary strife.

Moving forward: In the absence of certainty, stability, and predictability at the federal level, it is imperative for the state and local governments to provide as much stability and predictability as possible.

In this week’s update:

- Deluge and decreased dollars from D.C.

- House’s education transformation bill proceeds towards Senate

- “Feels Like 2020 All Over Again” – The Instability of the federal government is on display

- The Laundry List

We strive to make these concise and easy to read. Feedback is not just welcomed, it’s encouraged – [email protected]

Deluge and Decreased Dollars From D.C.

This week, Congressional Republicans narrowly approved the compromise budget resolution the Senate passed last week, which is yet another step closer to using the reconciliation process to cut upwards of $1.5 trillion from the federal budget.

- The GOP lost only two House Republican votes despite about a dozen others having threatened to oppose it because the cuts didn’t go deep enough.

Back here in Vermont: The tally for how much the state is losing grows daily with impacts to essential services; however, as we’ve reminded our readers over the past 12 weeks, the impacts we are seeing are from executive action, and Congress has been working on finish sentence

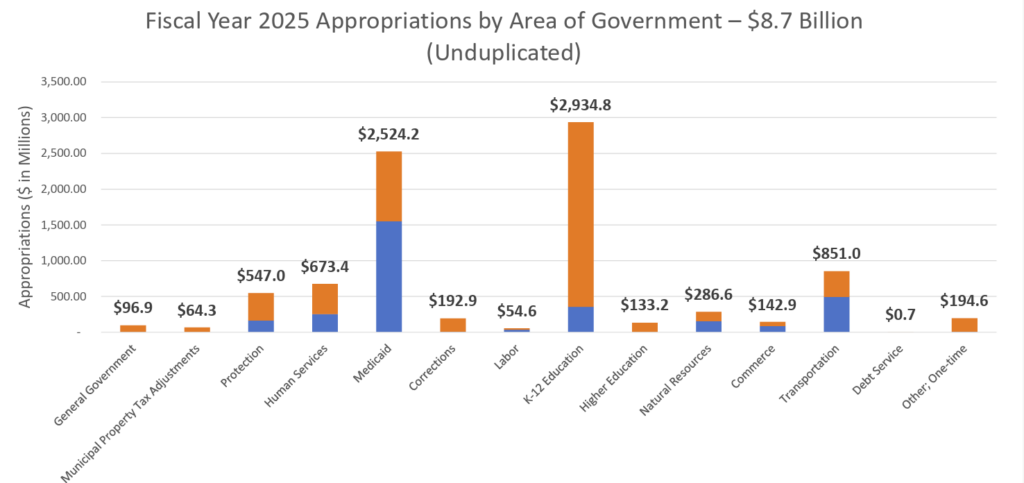

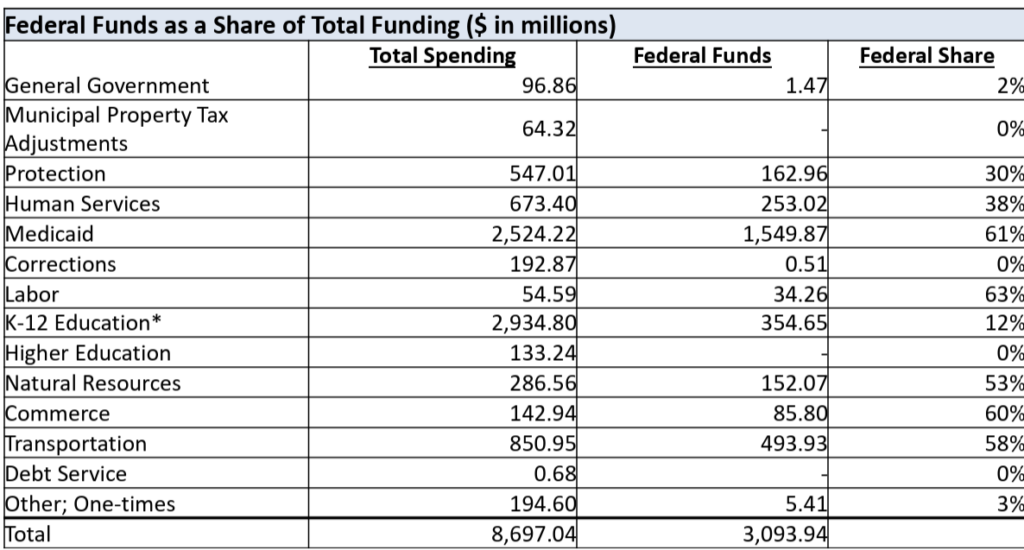

Potential Pain Points: The Vermont House Appropriations Committee got more granular on the one-third of the state’s budget that comes from federal funding, which is a source of vulnerability and concern. Major areas of federal support include;

- Over $1.5 billion for Medicaid,

- Roughly $354 million in Education funding, and

- Nearly $500 million in Transportation funds at a time when financial constraints mean the state will repair half as many roads this year.

The state is starting to draw the ire of the Trump Administration and that was seen in two distinct ways this week.

- Climate Superfund – An executive order this week calling on the U.S. Attorney General to identify ways to halt the enforcement of laws, such as the climate superfunds, that he said have threatened “American energy dominance.” Read more about that here.

- Education curriculum – A directive from the Trump administration would instruct school districts to certify that they are not engaging in “illegal DEI.” Noncompliance could put millions of federal dollars under threat. Read more here.

House’s Education Transformation Bill on the Move

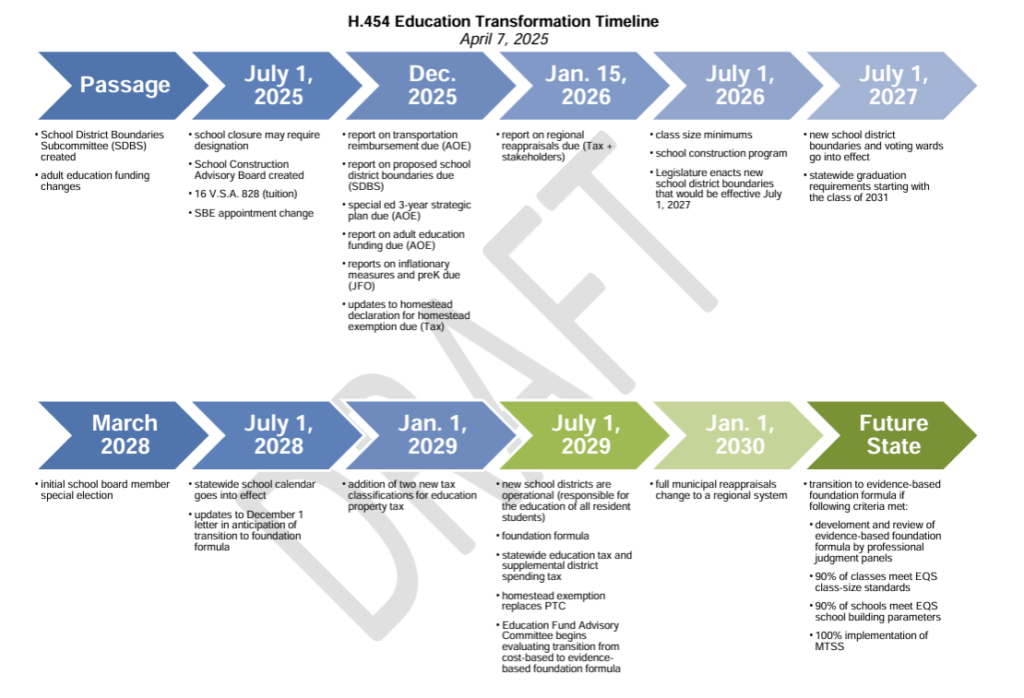

The most monumental change in Vermont education history since the Brigham v. State decision is one step closer to becoming a reality.

The Big Picture: This bill changes virtually every aspect of the Vermont education system with an eye towards school and school district consolidation, more regionalization, and further statewide uniformity.

- Under this bill, school districts potentially wouldn’t need to vote on a budget every year, and changes to the tax administration would mean voters have more information when they got to vote.

- Still, areas of disagreement abound, as business groups worry about how the legislation segregates property tax payers into different classes and provides the opportunity to not address systemic issues around costs at a future date and instead have certain classes of ratepayers absorb excess spending, disincentivizing further efficiency and reform.

- Of note, no structural proposals put forth by the Governor or the Legislature save money in the short-run, and all look towards cost containment through consolidation at least two-to-three years in the future.

State of play: A highly anticipated floor fight did not happen Thursday evening, and instead, the House advanced the massive education transformation bill by voice vote with anticipation of long floor debate today after both parties worked their votes.

- As we hit publish on this at around noon on Friday, there was still no action on the bill; however, an amendment that represents a compromise from both party’s leadership will be added to keep the bill alive and the discussion moving.

What’s Next? Assuming it passes the House later today, this bill still has a long way to go, as the Senate and the Governor have different visions for how it should be shaped.

Zoom In: Here is a comprehensive breakdown of almost everything in the bill.

- Foundation Formula: The bill moves Vermont to a foundation formula by 2029, establishing a base grant, called an Education Opportunity Payment (EOP), of $15,033 per pupil, structured to adjust automatically for inflation and which is adjusted for student needs by weights.

- Student Weighting: Currently, school weights affect the “tax capacity” or the amount of funding a school district can raise at a specific tax rate. This bill would instead directly affect the funding a school district receives per student.

- This will require many districts to spend more, as some districts in the past would use that tax capacity to buy down their local tax rates.

- Supplemental District Spending: Districts that wish to spend more than the education opportunity payment amount would need to raise the additional funds locally, which will be referred to as supplemental district spending (SDS) though often called excess spending in other foundation formulas nationwide. Districts are limited to no more than 10% of their EOP.

- These funds would be raised using a method similar to the current system with a statewide yield that would force every school district to have the same capacity as the school district with the lowest taxing capacity.

- Revenue raised from the supplemental district spending tax rate above the approved supplemental district spending would go to the Supplemental District Spending Reserve.

- One big difference between the current yield and the yield this legislation seeks to enact is that voters could know the yield value and, therefore, their tax rates ahead of their budget votes, improving transparency.

- Scale & Class Sizes: Starting in 2026, the bill sets minimum average class sizes of 12 students for Pre-K, 15 students for Grades 1–4, and 18 students for Grades 5–12.

- If class size minimums are not met for two consecutive years, the school would be deemed noncompliant with Education Quality Standards (EQS), triggering an administrative intervention process.

- With Vermont’s current average class size slightly over 10, this provision would push many schools to consolidate or reorganize.

- Districts: A new Redistricting Subcommittee would be added to the Commission on the Future of Public Education, composed of five retired superintendents, who will draft new supervisory district maps, with each district serving at least 4,000 students.

- Reappraisal: The bill aims to move to a more uniform and frequent statewide reappraisal system, with regional appraisal districts that are comprised of representatives from municipalities.

- New Tax Classifications: The education property tax system would be restructured from two rates, homestead and nonhomestead, into four tax classes, each with its own statutory rate adjustment factor that modifies the base statewide education tax rate.

- These classes are: Homestead, Nonhomestead Apartment (any rental with landlord certificate), Nonhomestead Residential (second homes predominantly), and Nonhomestead Nonresidential.

- While the rate adjustment factors are all equal in the legislation currently, it is the stated intent of the legislature to use these new levers to bring in more tax revenue from second homes and to lower the tax burden on homestead rate-payers, as well as apartments.

- Those that advocate for business are concerned that the new classification leaves employers vulnerable, as they are isolated in their own class, to tax increases at a later date.

- Income Sensitivity Transitioned to a Homestead Exemption: The bill transitions from the current income-based property tax credit to a homestead exemption model, which would directly reduce the taxable value of owner-occupied homes rather than providing post-payment relief.

- This method is reflective of proposals from the administration as well as the Lake Champlain Chamber. It improves transparency by allowing individuals to more easily know how their property taxes can be adjusted both during filing and during school budget deliberations.

- A major point of departure from what was passed and what was proposed, however, is that this current system would cost the state $45 million in forgone revenue that would need to be made up by those not receiving income sensitivity.

- Statewide Graduation Requirements: The Agency of Education would adopt uniform statewide graduation standards, replacing locally developed requirements, with implementation tied to the new governance structures.

- Statewide School Calendar: The bill calls for a uniform statewide academic calendar to improve coordination across districts and support student mobility.

- School Construction: The bill reactivates a State Aid for School Construction Program, including funding and oversight mechanisms. An initial $450,000 is appropriated to staff and develop this program, with future capital investments expected.

Overall Timeline

“Feels Like 2020 All Over Again” – Instability from the Federal Government on Display

As we lead with in the introduction to this week’s update, the on-again-off-again tariffs are, for many, reminiscent of the pandemic-level disruption to how they do business.

- The volatility and fluidity of the current situation were on full display as only about an hour after testimony concluded, some, not all, of the discussed tariffs were put on pause for 90 days.

- In D.C., bipartisan efforts by our very own Senator Peter Welch have emerged to limit the president’s power to implement tariffs. However, we can’t hold our breath for that.

What has emerged is this;

In the absence of certainty and predictability at the federal level, the best thing the state legislature can do is provide as much certainty and predictability as possible at the state level.

This week, the Senate Committee on Economic Development, Housing and General Affairs and the House Committee on Commerce and Economic Development held two consecutive days of joint hearings.

Wednesday Tariff Testimony:

Businesses from Vermont and Canada joined the joint committee hearing to outline the trade impacts of recent federal policies and rhetoric.

The source of state instability identified:

- The ongoing debate over privacy legislation was identified as a source of instability from the state government if passed as it was last year, containing a private right of action among other provisions that would make Vermont an outlier and compromise the ability of businesses to use web tools that their competitors in other states would have.

- Additionally, issues around public vibrancy and retail theft made their way into the conversation. One retailer explained that a decrease in Canadian foot traffic and inflation in prices will likely make retail theft worse, as crowded spaces prevent negative activity such as theft, and retailers are responsible for paying sales tax on stolen items.

Thursday Tourism Day Testimony:

The impact of the President’s language and tone towards Canada was on full display as tourism businesses from across the state packed the State House for tourism day.

Source of instability identified:

- During testimony, ski areas noted that the proposed segregation of property tax payers into different classes was of concern to Vermont businesses and represents a future source of instability and vulnerability.

If you are looking for further resources on tariffs, they can be found here.

The Lake Champlain Chamber is asking Vermont businesses to confidentially share how they may be affected by new tariffs. Your responses will inform our advocacy efforts.

Start Survey

The Laundry List

Hundreds of hours of committee discussion each week culminate into our advocacy update, so not everything makes it into the overall update; however, we often cover what is left on the cutting-room floor here for our most dedicated readers.

- Read previous updates: Week 1, Week 2, Week 3, Week 4, Week 5, Week 6, Week 7, Week 8, Week 9, Week 10, Week 11, and Week 12.

- Noncompete agreement ban: The House Committee on General and Housing spent time hearing from out-of-state interest groups testifying in support of a ban on noncompete agreements this week. The committee will hear from Vermont associations on Tuesday of this coming week.

- Truck Trouble – A joint letter from numerous Vermont business associations this week called for a one-year delay on the state’s clean truck standard. Learn about that rule here.

- Act 181 (2024) mandated Act 250 jurisdiction for projects in Tier 3 areas as determined by the rules of the Board. During the rulemaking process, the Board will identify what resource areas will be included in Tier 3, where these resource areas are across Vermont, and what types of projects will require an Act 250 permit in these areas. See more about the process and a map containing layers of geographic variables that could be included as jurisdictional triggers.

Hey! You read the whole update. You probably have some thoughts on the content or how we delivered it. Feel free to reach out to us at [email protected].