Thank you to this week’s sponsor of our Advocacy Update:

January 14, 2021

LCC’s team follows a lot of legislation in any given session with a wide range of topics because everything affects how our members do business. We try to balance keeping you informed with not overloading you with information. Feel free to reach out to our team with any questions, comments, or concerns on the legislation you see listed here by emailing [email protected]

In this week’s update;

- Join us for our legislative breakfasts

- State finances overview

- Revenue and tax bill introduced with long-standing LCC priorities

- Senate Finance takes up the corporate tax bill

- Act 250 work aimed at governance and reversing legal precedent

- House General Committee ponders discrimination legislation

- Bill aimed at curbing retail theft moving in Senate

- The Laundry List

Register Today for Our (Virtual) Legislative Breakfast Series

We are pleased to announce more details on our upcoming legislative breakfasts. Be sure to register today to reserve your space!

Monday, January 31st – 8:00 – 9:15 a.m.

Join legislators from our region for networking and conversation about their efforts as they cap off their first month back in session.

Monday, February 14th (Valentines Day) – 8:00 – 9:15 a.m.

Good intentions don’t always make good policy, and a potential increase in income meant to push some to prosperity isn’t always met with a proportional policy impact; we call this situation a “cliff.” Join LCC, leadership from the Leap Fund, and analysts from the Atlanta Federal Reserve to discuss addressing benefits cliffs. Read more about this work in the New York Times.

Monday, March 14th – 8:00 – 9:15 a.m.

As the legislature enters the home stretch, check-in with the Governor, Speaker of the House, and Senate President Pro Tem about how they see the session going and what they want to see done before the legislature adjourns.

Special thanks to the sponsor of our Legislative Breakfast Series:

State Finances Overview

This week, there are many moving parts around forecasting and debt planning for the state, setting up for the Governor’s budget address next week.

- The Emergency Board, consisting of the Governor and the Chairs of the Legislative money committees, met this week to hear the consensus forecast from the state and legislative economists. The long-and-short of it is that the over $10 billion directed to the state in federal funding has percolated through the economy, creating solid revenues returns of $44 million more this year than was previously anticipated in July. However, revenue will only exceed those forecast by $26 million next year and be flat the following year. https://aoa.vermont.gov/revenue

- The Budget Adjustment Act (BAA) will be voted out of the House Appropriations Committee today with the hopes of having it out of the House next Thursday. This will free up the Committee to begin work on the FY 23 budget. We’ll update you with the complete picture of the BAA when more documents are available.

- Pensions Taskforce Brings Forward an Initial Agreement The long-awaited report from the Pension Task Force was released to great fanfare Monday night. The initial deal hammered out between unions and legislative leadership would reduce the unfunded liability by $2 billion of the $3 billion. Under the proposed deal, the state would provide a one-time $200 million Appropriation of General Fund money and then commit to appropriating half of all future revenue surpluses to close the gap.

Revenue and Tax Bill Introduced with Long-Standing LCC Priorities

The House Ways and Means Committee did an initial walkthrough of H.527, an act relating to tax relief for Vermonters. The legislation contained an exciting assortment of LCC priorities, including:

- Create a student loan interest payments deduction of up to $2,500.

- Add Vermont to the growing list of states that allow federal SALT cap workaround for passthrough entities and create a credit for pass-through entities who pay tax in other states.

- Clarify the sales and use tax exemption for manufacturing machinery and equipment left out of the shuffle in last year’s miscellaneous tax and revenue bills.

- Increasing earned income tax credit from 36% to 45% of federal EITC.

The bill would also change alternative minimum tax for a few Vermonters, create a workforce credit for industry shortages, and renew the first-time Vermont homebuyer credit.

Senate Finance Reviews Corporate Tax Bill

Last year, the House sent the Senate a bill that reflected years of work from the Ways and Means Committee on corporate taxation, and the Senate Finance Committee simply did not have enough time to cover it all. Before the session, the Finance Committee met to discuss this bill, and LCC testified in opposition to the cloud tax provision(link).

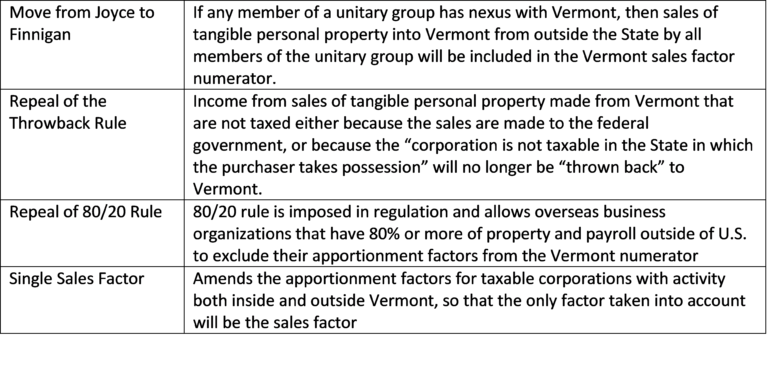

A general rule of thumb is that companies with a large property and payroll presence in Vermont would benefit from this bill more than a company with a more significant sales presence. The corporate provisions primarily consist of;

In an attempt to raise revenue to offset provisions in S.53, the House Ways and Means Committee looked at the CMT brackets, cloud tax, and mutual fund fees. One of the new brackets that were created covers those with gross receipts of $300 million or higher, only about ten filers in Vermont. Those brackets, along with other details from the bill, can be found here.

Act 250 Work Aimed at Governance and Reversing Legal Precedent

There are multiple bills aimed at Act 250 introduced this session, two of which the House Committee on Natural Resource, Fish, and Wildlife looked at this week.

The Committee began exploring H.492, which would make changes to Act 250 governance by reverting permit appeals from the Vermont Superior Court Environmental Division to the Natural Resource Board, which under this legislation would be renamed to the Environmental Review Board, have a full-time chair, and four half-time members in what is pitched as a way to professionalize the board while keeping the district commission structure.

The Committee also discussed H.509, which is aimed at reversing the unanimous Vermont Supreme Court Snowstone LLC decision. Put most simply, this decision reduced the scope of Act 250 in towns that have minimal land-use laws to trigger jurisdiction when one acre or more of land is physically disturbed by a project rather than if the project is on one acre or more.

H.509 also calls for a pre-application process with the intent to encourage communication and avoid issues earlier. This process would require developers to submit the plans for a project to the District Commission, municipal and regional planning commissions, affected State agencies, and adjoining landowners not less than 30-days before the official project application. The Committee heard from the former Chair of the NRB that this would not work that way. We suggest that if you work with Act 250, you reach out to the Natural Resources Committee with feedback. Feel free to reach out to our team for help.

House General Committee Looks at Discrimination Bills

The House Committee on General, Housing, and Military Affairs looked at two bills around discrimination this week.

- H.320 prohibits agreements that prevent an employee from working for an employer following the settlement of a discrimination claim similar to those on the books around sexual harassment claims. Two attorneys, one representing the Bar Association, testified that while they want to protect individuals who file these claims, the bill has unintended consequences and removes a valuable tool from the people it’s designed to protect.

- H.329 does three significant things. First, it defines “harassment” such that it does not need to be severe or pervasive to be ruled unlawful, nor does it need to be compared to the treatment or outcomes of similar employees. Second, it would create a six-year statute of limitations for harassment and discrimination within housing, public accommodations, and employment. Third, If passed, an employee would not need to go through an employer’s internal processes before filing a legal claim against an employer.

Bill Aims to Curb Brazzen, Repeated Retail Theft

The Senate Judiciary Committee heard testimony this week on S.180, a bill that would assess penalties on retail theft based on a three-month period by aggregating the amount of stolen items to potentially reach the $900.00 threshold that triggers a larceny charge. The last few years have seen a marked increase in retail theft, with nearly every retailer seeing unprecedented theft. There was a proposal based on language introduced in 22 other states that has also been introduced in Congress as the INFORM Act, which would create stricter policies for online marketplaces to mitigate the part they play in the sale of stolen property. Senators think this language will slow the bill down and plan to revisit separately. The Committee will mark up the bill and possibly vote next week.

The Laundry List

- Read last week’s update here.

- What are you wearing for a mask these days? All experts are saying it is time to upgrade your masks. The legislature is requiring (K)N95s or a surgical mask for when or if they return to under the Golden Dome. This week, Senator Sanders introduced a bill aimed at producing more N95s and sending them to Americans. At this time, there are 800,000 cases a day nationwide, expected to peak in early February, with a peak of more severe indicators such as hospitalization in late February to early March, given these lag by three to four weeks.

- The long-awaited and often stalled contractor registry bill is now moving. There have been two main cruxes; the price threshold for registration and the duplication of regulations for professionals installing heating equipment. The House moved back to $3,500 when the Senate wanted $2,500, but the battle continues. Read side-by-side here

- An introduced transportation bill has some worried. The bill would create a “feebate” structure for vehicles and require employers to install level II charging stations, among other things. You can read more here.

- Governor Scott this week appointed Golrang (Rey) Garofano, a Democrat, to fill the Chittenden-8-1 House District vacancy created when former Representative Marybeth Redmond (D-Essex) resigned last month. She currently serves as a child care quality program administrator at the DCF.

- The Commissioner of Liquor and Lottery continued to make a case for legalizing sports betting today in the Senate Economic Committee, citing neighboring states’ move to legalize, offshore operations not having consumer protections, and the potential for solid tax revenues.

Interesting Economic Context

- The Commissioner of the Department of Liquor and Lottery told the Senate Economic Committee this week that non-alcoholic/low-alcoholic beverages (think non-alcoholic beer) grew 33% last year.

- During the EBoard Meeting this week, the Legislature’s economists said that there are nationally about 40,000 new vehicles available, instead of the typical ~1.3 million. Apportioned to Vermont, that would be about 77 available vehicles.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team

Don’t ever miss an update. Subscribe to stay in the know on all things advocacy