June 12, 2020

Vermont’s reaction to a global pandemic required thousands of small Vermont businesses to close their doors. Those who have been able to reopen recently are operating at a fraction of the capacity they typically would. Despite seeing years of hard work to build their business slip away, business owners have been willing to take these drastic actions in order to maintain the health and safety of their communities. It is our turn to support them, and in turn, create the economic opportunity that will allow us to move forward. Today, the Vermont House passed S.350 which will take what has been promised to be the first of multiple steps towards offering financial relief to Vermont’s small businesses. The Lake Champlain Chamber is appreciative; however, we feel the work is nowhere near done. A great deal of support is needed to keep alive the businesses that have shut down either partially or entirely to protect public health.

In this week’s update;

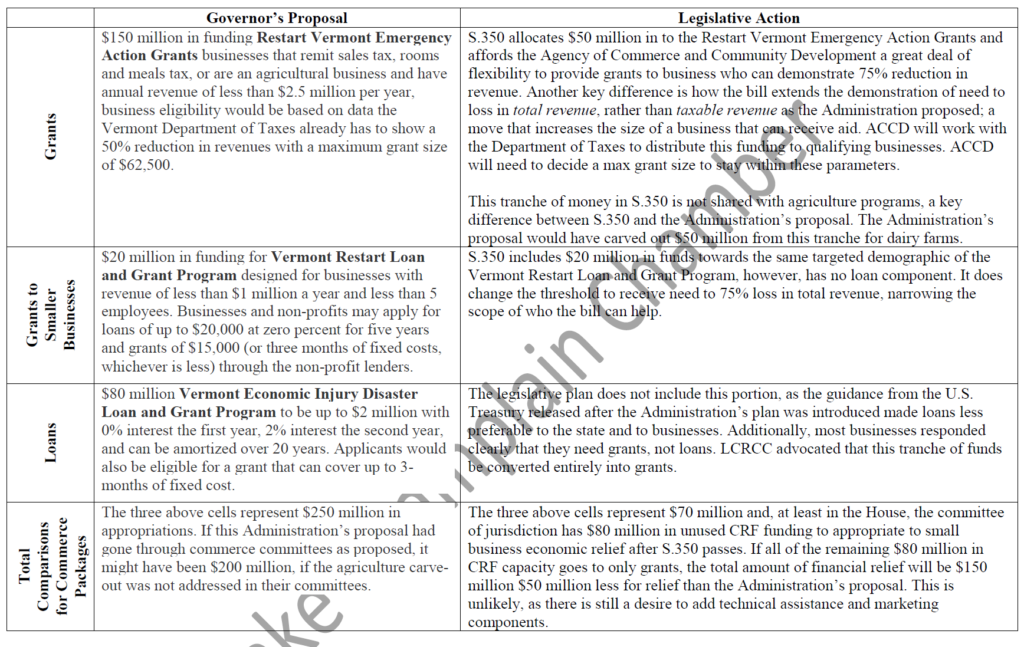

CARES Act Dollars Deployment

Last week the Lake Champlain Chamber sent this letter to House and Senate leadership calling for the Legislature to appropriate no less than $250 million in grants to businesses as quickly as possible, with the greatest degree of flexibility. Reminding legislators that the assistance is crucial and must get into the hands of businesses fast. This week, we followed up with a group sign-on letter to the same effect. Today, the Vermont House passes S.350, which is promised to be the first phase of relief to businesses. The bill allocates $70 million to grants that can be rapidly deployed to businesses. Governor Phil Scott used his Friday press conference to urge the legislature to pass all of his proposed relief package, stating that he doesn’t believe the legislature understands the “dire need, dire fear” Vermont small businesses are facing. We’ve outlined the differences between the Administration’s proposal and what the legislature has undertaken in the below table.

This round of grants, unfortunately, does not serve sole proprietorships because the Commerce Committee felt that the federal Pandemic Unemployment Assistance provided relief to these businesses. The committee has promised they will address this in the next round of grants. The Lake Champlain Chamber also disagrees with limiting the grants to only businesses that have a 75% loss and not those with smaller losses. We expressed these concerns among others in our letter to leadership last week. We suspect that these funds will be quickly over-subscribed as there is so much need.

As we said over the past few weeks, in addition to advocating for relief, you can make sure you are ready to capitalize on it in the event the legislature passes it by making sure you have a myVTax account and are up to date on filings. Also, failure to pay taxes won’t disqualify you, however, all indicators point to an applicant needing to have filings up to date and be on some manner of payment plan. The names of every business and the amount they receive as a grant will be publicly available in required weekly updates from ACCD.

There is an old saying in politics, “never let a good crisis go to waste,” and on Thursday, a group of legislators attempted to do just that by stuffing a laundry list of proposals into the requirements for any Vermont businesses to receive economic relief grants from the state. The group put forward a proposal that would among other things, limit access to grants for any business that does not pay their employees more than 160% of the Vermont minimum wage ($17.54/hour) along with other requirements. Each of these proposals has been the subject of years of debate and the signatories’ proposal aimed to bypass the legislative process by adding it to pandemic-related relief to small Vermont businesses. While these may be worthwhile proposals to debate, this is not the time or place to do so.

As we reported last week, the Speaker sent memos to each House Committee chair outlining how much of the $1.25 billion Coronavirus Relief Funds (CRF) allocated to the state under the CARES Act their committee has to utilize. In the memo, the Speaker explained that the state has already spent about $275 million of the funding and will in the immediate future spend another $575 million, with a plan to hold $400 million in reserve until the legislature returns in August, presumably in hopes the that rules governing the funding will change so that it can be used to backfill lost revenue.

On Thursday and Friday, House committee chairs supplied the House Committee on Appropriations with memos outlining their committee’s recommendations and priorities for spending CRF funding. All of these proposals will be folded into a final bill which the Speaker has said will be passed in the coming days.

Lake Champlain Chamber Successfully Advocates for Reimbursable Employers’ Relief

Reimbursable employers are non-profit employers who do not pay taxes into the unemployment trust fund and instead are charged by the Department of Labor for benefits paid to their employee’s unemployment trust fund. Many reimbursable employers are seeing increases in charges, not necessarily because they sent employees home, but because the employees left them recently enough to have them in their wage history and have now been laid off by their current employer. Additionally, these employers were unable to be assisted by the UI rate freeze achieved in March.

CARES reimburses this cost by up to 50% and then allows states flexibility and discretion on how to deal with the other 50% of that charge. Our advocacy team successfully brought this issue before the House Ways and Means Committee and asked them to use some of their discretionary funding to help which they recommended to the Committee on Appropriations. While the amount of CRF funding at the discretion of Ways and Means is not enough to cover all of the charges, it should help these many nonprofit organizations that fall into this category that are providing important community services.

Act 250 Modernization; All or Nothing?

A simple ubiquitously agreed upon piece of legislation has become a Christmas tree on which the Senate Natural Resources Committee hopes to add H.926, the House Act 250 modernization bill, and potentially a bill about tree wardens. Despite the fact that removing areas with enhanced designations from Act 250 is not controversial and that the change could have positive impacts on communities’ housing stock and sustainability, large environmental groups have been resistant to these changes because the popular changes have served as a bargaining chip to achieve their goals for changes in the 50-year old program.

In a memo to the committee, the Lakce Champlain Chamber called on the committee to move S.237 as a stand-alone bill and revisit a larger Act 250 modernization package in the next legislative session when more citizens and stakeholders could engage. We should not let the opportunity to do good, non-controversial work be passed by any longer.

PPP Update and FAQs from this Week

There is still plenty of funding for the Paycheck Protection Program and now there are more favorable conditions, so if you have not explored applying for one, you should act quickly. The program is set to expire at the end of the month and it is still unclear what happens to the funding if it is not used by then. We’ve heard a couple frequently asked questions around PPP and we thought in this week’s update we’d take a moment to answer them.

- I have an existing PPP, can I get the 5-year timeline?

While the PPP Flexibility Act applies the 5-year extension to only new borrowers, existing borrowers do have the ability to receive the same term if both they and their lender agree to it. To mitigate your expectations: a 5-year loan at 1% interest is difficult for a lender, so it may be a difficult proposition for them. - I applied for a PPP and got it, however, I returned it because it was clear it wouldn’t help me. Now that the PPP Flexibility Act has passed, this program could work for me. Can I apply?

Yes and no. You might try to apply and your lender will tell you it is not possible to put your application in the pipeline. What you will need to do is contact the SBA, make clear your situation, and ask to be removed from their system so that it does not look as if you are trying to get a second loan. We know, this will be easier said than done. - Is the new 60% payroll figure a hard cliff, or is forgiveness still on a sliding scale?

The SBA clarified this week that forgiveness is still on a sliding scale. Wait for regulations from the Treasury to be finalized and check with your lender about your specific situation. - Will changes to the PPP program that came last week cover all the needs of Vermont businesses?

Not even close. We encourage any business who has found that this program can help them to apply, however, this program does not work for everyone and there is so much need in our state as many businesses have had to close their doors without revenue for so long only to reopen them at a small percentage of their typical volume and capacity.

Revenue Forecast and Budget Woes Dampen, Slightly

In an advocacy update a few months ago, we discussed the impact of Pandemic Unemployment Conpensation (PUC) unemployment benefits (the extra $600) and stimulus benefits as an opportunity of the state, noting at the time that millions in federal PUC dollars go to Vermonters each week and at the minimum, about $385 million in federal stimulus had gone out. This week the Joint Fiscal Office (JFO) confirmed that the Vermont economy acted in the opposite manner you’d expect it to at a time with about 15% unemployment. This was reflected in the sales tax, as it came in much higher than expected with a $21 million improvement in sales tax figures, which likely was because online sales did well across the economy and we now tax online sales, as well as a trend in an increase in the purchase of large items for things like home improvement projects.

JFO reported that they are seeing that the amount of disposable income in the U.S. has actually been higher, especially for below-median income, than pre-pandemic levels due to stimulus payments and PUC benefits. All of this resulted in the budget coming in about $37 million better than anticipated in the last fiscal year.

Sales tax goes to the education fund and another funding source for education fund is the property transfer tax. That sector has been closed for the last few months, however, as it opens up we should see more revenue. Certainly, anecdotally, we’ve seen a lot of press, and many of us have heard about people moving (side note: it is interesting timing that these movements are happening during a census). Those folks will contribute to property transfer tax, and if they actually “technically” move here they will be income taxpayers. Hopefully, the legislature will have a clear picture of this when they return to do the rest of the FY 21 budget in August.

Rooms and meals tax has suffered substantially; however, the rooms and meals tax numbers are better than expected, probably because of food and alcohol deliveries (so please take a moment to help keep those changes). As noted, much of these consumer spending habits will be dependent on if stimulus payments happen again or if PUC benefits continue. It is not typical to see a 15% unemployment rate and see sales tax revenues as strong as they are – pointing to this being artificial.

Unfortunately, the legislature will not have a clear picture of income impacts until income taxes are collected next April. See all the updates to revenue forecasting here.

The Laundry List

- To no one’s surprise, the legislature will not be adjourning on June 19th and instead, their new target is June 26th.

- New data says an additional million people and seven counties in neighboring states are no longer subject to the quarantine because they have a low number of active COVID-19 cases.

- Our advocacy team has been facilitating meetings to form reopening plans for public events and mass gatherings to assist the Restart Taskforce. If you are interested in learning more or participating, please contact [email protected].

- The Senate passed S.227, which: bans lodging establishments from furnishing rooms with small plastic bottles by 2023; tasks Legislative Council with drafting proposals to require the producer of packaging and printing material to accommodate the disposal of these items after their use; brings into the state’s battery stewardship program medical devices such as hearing aids, as well as amending the bottle bill to increase the fee on bottles that are not commingled into the typical deposit stream.

- ACCD issued new guidance this week for organized sports. Effective June 15, 2020, some intra-squad activities and practices can begin to take place. Group numbers, including players, coaches, and officials, may not exceed current limits on social gatherings – currently 25 or fewer individuals. Competition between Vermont clubs (i.e., inter-squad games) is currently anticipated to be able to resume starting July 1, 2020.

- LCC asked the legislature, as you should too, to put into statute the temporary changes that allowed the delivery and to-go distribution of alcohol, as we realize this will need to be a component of the business model for Vermont businesses for some time to come. Sign the petition.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team