This week’s Legislative Update is sponsored by:

May 22, 2020

It’s amazing how in the last few months since the pandemic hit the world has turned upside-down and we’ve reinvented much of our government and regulatory framework. What started out as about a three-page executive order has snowballed into what now might be as much text as you expect in any given legislative session. It’s been a frustrating exercise for all of us, however, a necessary one to protect our communities and preserve a delicate balance between our economy and public health. It’s worth taking a second to stop, look around, and express some gratitude to everyone.

Just don’t pause too long though, because there is a lot to do still. The legislature hopes to finish the “skinny budget”, an economic relief package, and other business by June 19th. In this week’s update:

- Governor continues to open the spigot on the economy, proposes state stimulus

- Are you ready for your employees to request paid FFCRA leave?

- Mask mandates in some places and LCRCC’s opinion

- Updated revenue forecast and budgeting process

- Federal relief update and state-by-state look

- PPP loan forgiveness and tax information

- COVID-related Workers’ Compensation conversation in House Committee

- Unemployment update

- Tax updates and help

- The Laundry List

Governor Continues Turning the Spigot, Proposes State Stimulus

ACCD has released updated guidance allowing for the limited opening of outdoor restaurants on May 22. There is also updated guidance for professional services, yard sales, and swimming facilities that goes into effect immediately.

Today the Governor also announced additional dentistry and outpatient operations can reopen. Salons and barbershops will be able to open on May 29. Gyms and spas do not have a specific open date set yet, however, guidance is promised to be released next Friday. Unfortunately, the Governor also announced that all fairs and festivals will need to be canceled this summer. Finally, interior residential and commercial construction may occur in occupied structures as of May 22.

Vermont will continue the trend of reopening so long as positive test rates do not exceed 5% and hospital intensive care units bed capacity stays below 30%. Our neighbors are continually seeing new cases, so outside-Vermont travel restrictions seem likely to stay in place. If all goes well, we can expect to see the acceptable size of gatherings increased to 25.

Refer to the updated Restart Memo for details.

Three important things to note as announcements such as these roll out:

- First, do not look at just the sector-specific guidance relevant to you. It is not enough to look at the new regulations for restaurants and implement them, you will also need to follow the new guidance for all businesses including VOSHA training, an operation plan to accommodate the new VOSHA guidelines, and other health and safety measures. These may seem like obstacles, however, in this brave new world regulation protects everyone’s health, and if that is not enough, it protects you from liability.

- Second, the guidance from Addendum 5 to the Executive Order dated March 23, 2020, requiring all businesses, and non-profit and government entities to implement telework procedures to the extent possible is still in effect and is in your best interest. If there really isn’t a good reason to return, stay remote.

- Third, all of this regulation is new, made quickly, and has not had as many eyes on it as would traditionally be the norm. When in doubt, follow the interpretation that is most protective of human health.

- Finally, yes we said three, however, this last one applies to you in your personal life; everyone is doing the best they can in a changing landscape. When you are out at shops or restaurants, please be kind and understanding to employees and proprietors as they try to navigate all this.

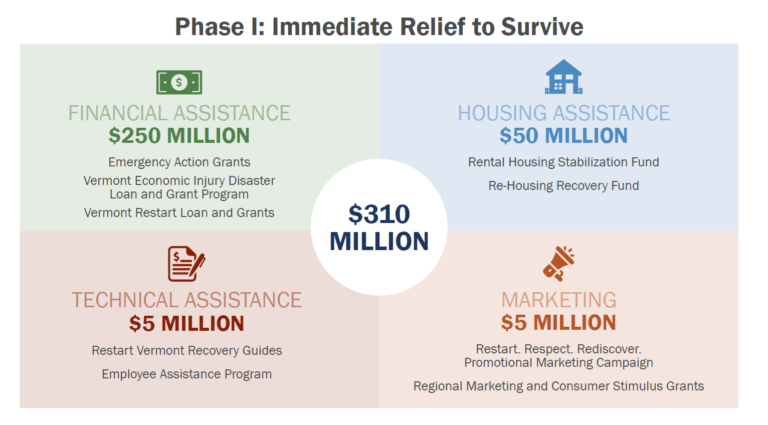

Wednesday, Governor Scott proposed a $400 million economic relief and recovery package, using federal CARES Act funds. The two-phase proposal will start with $310 million for immediate relief to the most impacted sectors and businesses to be followed by $90 million for long-term recovery efforts. The Agency of Commerce and Community Development and the Governor have already begun working with the legislature towards the passage of this historic relief package, with the House Commerce Committee hoping to get through the work within two weeks, however, expect it to take about four weeks for a package to be enacted into law.

Financial assistance – Emergency Action Grants for food and accommodation services, retail, and agriculture; Vermont Economic Injury Disaster Loan and Grant program; and small business focused Vermont Restart loans and grants. ($250 million). Businesses that received federal support will not be excluded, though they will need to show that they will not be duplicating uses and preference will be given to those who have not received federal aid. Every type of business is eligible for assistance and will fit into one of four categories

- Restart Vermont Emergency Action Grants ($150 million in funding) – If you remit sales tax, rooms and meals tax, or are an agricultural business and have annual revenue of less than $2.5 million per year, you will be eligible for a grant sized using data the Vermont Department of Taxes already has with a maximum grant size of $62,500. If this is not you, then you are eligible for:

- Vermont Economic Injury Disaster Loan and Grant Program ($80 million) – these loans can be up to $2 million with 0% interest the first year, 2% interest the second year, and can be amortized over 20 years. Applicants will also be eligible for a grant that can cover up to 3-months of fixed cost. However, if you are a smaller business, you might qualify for:

- Vermont Restart Loan and Grant Program ($20 million in funding) – this program is designed for businesses with revenue of less than $1 million a year and less than 5 employees. Businesses and non-profits may apply for loans of up to $20,000 at zero percent for five years and grants of $15,000 (or three months of fixed costs, whichever is less) through the non-profit lenders.

Housing assistance – Rental Housing Stabilization Fund for property owners and a Re-Housing Recovery Fund to address homeless need. ($50 million)

Technical assistance – Restart Vermont Recovery Guides created through a network of business and community assistance providers, and Employee Assistance Program to support the mental health and wellbeing of business owners and their families. ($5 million)

Marketing support – Promotional marketing campaign to promote Vermont to Vermonters and deliver a toolkit of creative assets to be used by local communities, and regional marketing and consumer stimulus grants to encourage local spending, with implementation strategies to be proposed by local entities. ($5 million)

ACCD is hosting a series of sector-based webinars to help explain the relief and recovery package and how it will support various sectors throughout the economy. Full details of the plan can be found here.

Supplemental Guidance on Restaurant Opening

Effective tomorrow, outdoor dining will be allowed in the state with many restrictions listed on the ACCD website which we have provided some additional suggested guidance on below:

- As we previously said, these are just the sector-specific guidelines, restaurants must also fulfill all the new standard operating procedures

- Reservations or call ahead seating is required. LCRCC suggests at that time the reservation is made informing the party with the following restrictions to prevent debating them with the customers when they arrive:

- Members of only two households and ten total people may be seated at the same table. This is not arbitrary, it is meant to reflect the latest guidance on gatherings. Note, that guidance on gatherings uses the term “trusted households.” You may also want to inform the party making the reservation of that.

- Operators must maintain an easily accessible log of customers (we interpret as everyone at the table) and their contact information for 30 days in the event contact tracing is required by the Health Department.

- Despite being able to operate, ACCD still cautions that ordering via phone or electronic means is preferred and that takeout service rather than tableside delivery of food is preferred. Cashless/touch-less transactions are strongly preferred.

- Tables must be spaced a minimum of 10 feet apart and LCRCC suggests measuring from the edge of the table, not center.

- Operators must limit the total number of customers served/seated at one time to 50 or their maximum licensed seating capacity, whichever is less.

- Disposable menus are required and disposable/single-use condiment packets are encouraged. Multi-use condiments and all other items for general use must be cleaned and sanitized between customers.

While guidance from the Department of Liquor Control is confusing, you can use a creative outdoor solution and submit a notice to DLC that you will fill out an outdoor consumption permit, and then within two weeks, you will need to fill out the permit. You will be able to operate until the permit comes back at which time DLC will notify the town at which time your municipality which will have the ability to prevent this style of operation.

Finally, we suggest watching this webinar by SCORE which gives very technical advice about how to run your operation efficiently within the new restrictions with technical guidance on things such as maximizing space, table, turnover, and order.

None of the above supplemental guidance constitutes legal or financial advice.

Are you Ready For Your Employees’ Paid FFCRA Leave Requests?

Join LCRCC and Sheehey Furlong & Behm for a webinar that will provide an overview of the Families First Coronavirus Response Act (FFCRA) its interaction with other state and federal programs, and how to use it to the advantage of you and your employees.

Masks Mandated by Some Businesses and Municipalities

It’s been hard to miss how divisive the conversation around masks has become, despite the fact that 61% of Vermonters surveyed said they wear them voluntarily. This week, LCRCC President Tom Torti waded into the conversation with an opinion editorial entitled, “Be Safe, Be Selfless, Wear a Mask” as municipalities such as Burlington and South Burlington took steps to mandate masks and as a potential showdown brews in the State House.

You can find resources such as signage, language explaining your business choices around masks, and mask procurement sources, as well as many other helpful resources, on the Lake Champlain Chamber’s COVID-19 resource page.

Updated Revenue Forecast and Budgeting Process

This week legislative money committees heard that the pandemic has set back the revenues in most state funds about 5-years of growth even once we rebound. There was a slight glimmer of hope as the FY 20 revenue forecast was readjusted to just about $60 million better than previously thought, with the education fund looking about $13 million better. Part of this is thanks to the recent South Dakota vs. Wayfair decision which has allowed our state and many others to tax online sales by entities such as Amazon. The state would be in a very difficult place without the ability to collect online sales. This week, committees also got their first glimpse at FY 22 forecasts. There may be a modest bounce back in FY 22, however, revenues will be down about $221 million.

The Joint Fiscal Office recommended to the appropriations committee staying with a three-month bill and not going beyond that time frame. They also recommended that if the analysis necessary for the other three-quarters of the FY 2021 budget was not going to be ready by October, the legislature could pass a one-month budget bill in August. The budget in August will need to consider the next year and half, setting up the state for FY 2022.

Federal Relief Update

On Friday, the HEROES Act passed the house and the proposal initially received strong pushback from Senate Majority Leader McConnell and Senate GOP. In the past 48-hours the cracks are starting to form after Fed Chair Jerome Powell painted a bleak economic picture for the next few years if there was not another stimulus plan. Vulnerable Senators facing reelection, such as Susan Collins of Maine, are not too thrilled with the idea of postponing more aid and are protesting the scheduled Memorial Day week-long recess that is coming up.

It looks as though the best-case scenario for the bill would be the passage in mid-June, if not July, as there is a great deal of horse-trading that this starting offer Speaker Pelosi sent over will be subjected to before it can pass the Senate. McConnell will likely seek to limit the federal PUC benefit as well as additional language to restrict a business’s liability for illness, a proposal Speaker Pelosi has signaled she is amenable to considering.

Treasury Secretary Munchin said this week that the White House is considering some aspects of this bill, such as loosening restrictions on the use of Coronavirus Relief Fund dollars from CARES and adding flexibility to the Payroll Protection Program. He also said that Congress should act soon to extend key components of the CARES Act in parallel to any work that might be done on a fifth relief package.

As we outlined last week, the $3 trillion dollar HEROES bill envisions:

$900 billion for state and local governments with $187 billion for municipalities through modified Community Development Block Grants and $500 billion for states

Loosening the restrictions on CARES Act Coronavirus Relief Fund dollars to allow states to offset “lost, delayed, or decreased revenue stemming from the COVID public health emergency.”

$200 billion in hazard pay for essential and frontline workers

$10 billion expansion of the food stamps program

$175 billion in housing assistance for renters and homeowners

$75 billion for public health measures like testing and contact tracing

Another round of stimulus checks for households

Changes to Paycheck Protection Program to allow more flexibility

Extends the federal Pandemic Unemployment Compensation benefit, the extra $600 on top of the state maximum, through January.

Student loan forgiveness of up to $10,000 a month for borrowers struggling and an extension of the interest and payment freeze for borrowers through next September

A rollback of the 2017 $10,000 cap on the deduction of state and local taxes (SALT)

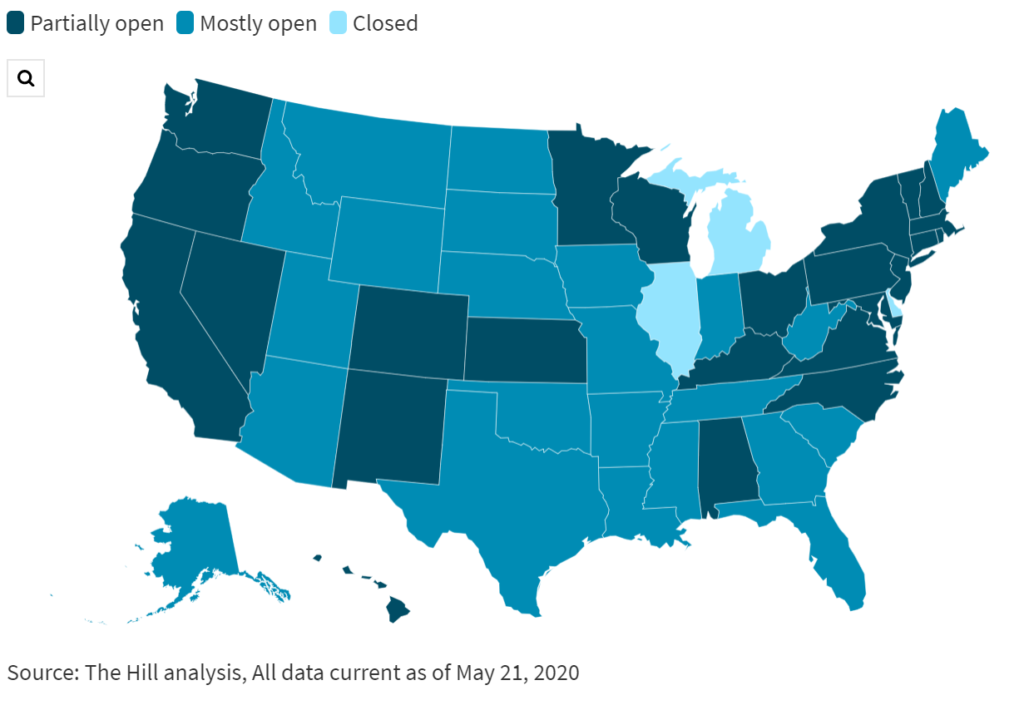

One thing is clear, more money is needed, not just for the states that are still shut down. When looking at where states fall on the spectrum of open, to reopening, to closed, it becomes apparent that reopening fast won’t save you and might do long term damage in this climate.

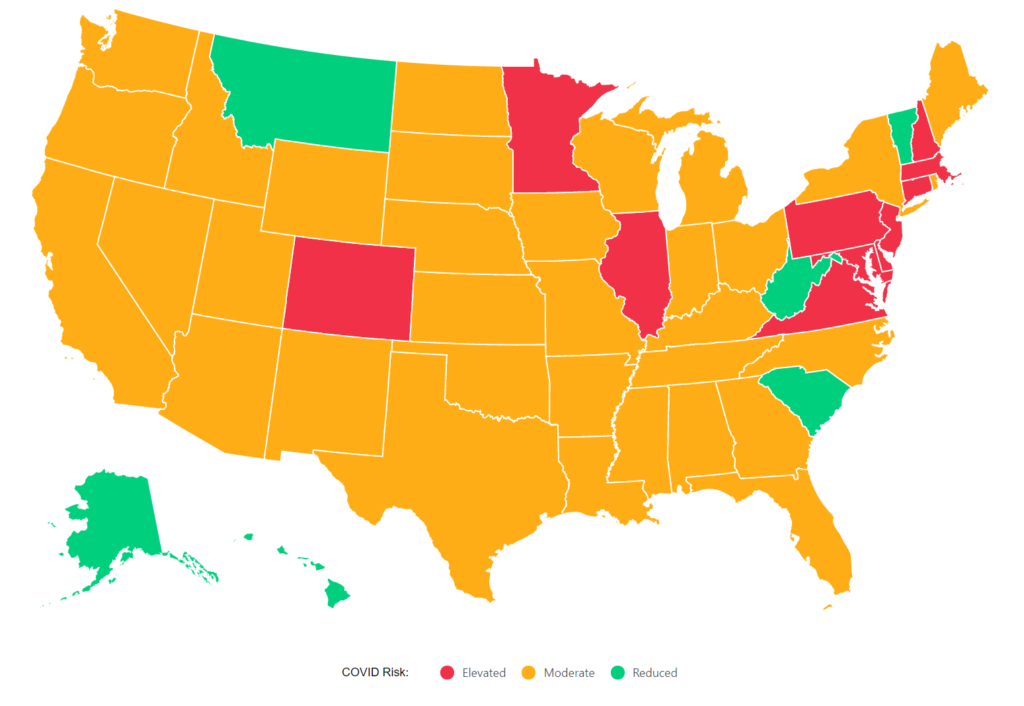

Which is interesting to look at in the context of states that are considered ready to open by COVID Act Now:

A first glance shows that the states reopening are those that are least ready for it and that Vermont is making the right decisions given neighboring states with such elevated risk.

While being partially open is difficult, being fully open wouldn’t ensure that things would go back to normal. According to the Household Pulse Survey from the US Census Bureau, almost half of American households reported that at least one adult in their home has lost wages since the coronavirus pandemic required containment measures that restricted the economy.

Additionally, as seen above, reopenings do not correspond with increasing consumer confidence, so reopening could bring pain without the gain. There is, however, pent up consumer spending and desire to be social, so prepare for the roaring twenties!

Additionally, as seen above, reopenings do not correspond with increasing consumer confidence, so reopening could bring pain without the gain. There is, however, pent up consumer spending and desire to be social, so prepare for the roaring twenties!

All this is to say that it is a difficult rebalancing act to reopen an economy. It requires states to put a little bit of pressure on the gas pedal at a time because you don’t want to apply pressure to the brake pedal and reopening too quickly won’t give you the boost in consumer confidence you even expect.

What is needed in this interim is support for the businesses, institutions, and people that can help them “hit pause” on as much as they can on activities that are not safe at this time and carry on in instances that are. That takes a lot of money, by some estimates nationally 10 trillion dollars, and for our state potentially $600 million per sector.

Paycheck Protection Program Forgiveness and Tax Guidance

Over the weekend, the Small Business Administration (SBA) released the Paycheck Protection Program (PPP) Loan Forgiveness Application and detailed instructions for applying. Additional guidance from SBA for borrowers and lenders is forthcoming. If you are looking for more guidance on PPP forgiveness, Downs Rachlin and Martin will be hosting a webinar Thursday, May 28, from 10:00 – 11:00 am. You can register here.

During an interview with The Hill yesterday, Treasury Secretary Steve Mnuchin said that in light of the bipartisan backing to extend the eight-week statutory duration of the PPP, and that it doesn’t cost any more money to create the flexibility that is being requested, the White House would be amenable to loosening PPP forgiveness criteria.

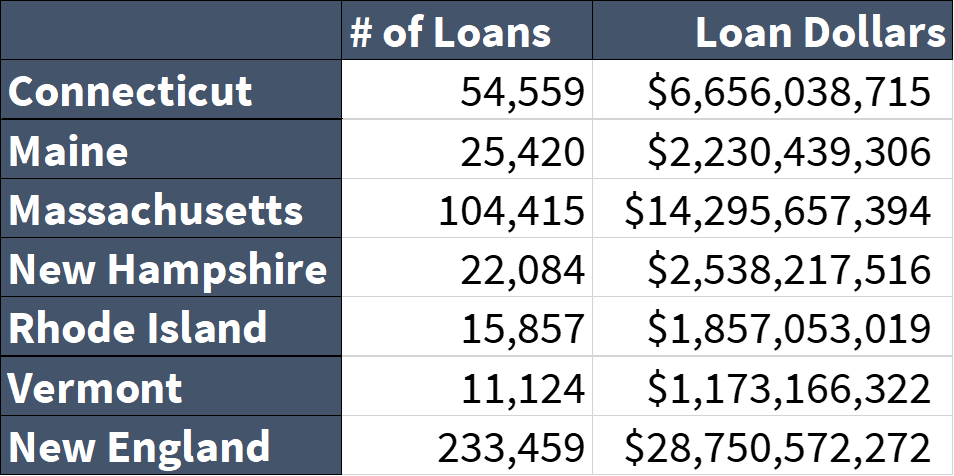

Funds are still available. The SBA recently released an updated Paycheck Protection Program (PPP) Report detailing total data from both rounds of PPP funding through May 16.

Also this week, the IRS has ruled that a company that receives Paycheck Protection Program relief money cannot also deduct wages paid with those funds. The IRS and the Treasury Department both note that the payment is not taxable income, so also taking a deduction for the wages paid directly with federal funds would amount to a double tax benefit. See more about the Payment Protection Program on the IRS website.

COVID-Related Workers’ Compensation Moves to the House

LCRCC’s advocacy team this week joined the House Committee on Commerce and Economic Development for a general discussion around Workers’ Compensation. The committee was sent S.342, which would create a rebuttable presumption for certain occupations, and in certain instances, that a case of COVID-19 was contracted at work. The committee will not be taking up S.342 as sent to them, and if they do anything, they will be creating their own bill. The Chair considered looking at language that would create a similar presumption if a claimant could show that an employer was not following OSHA or VDH guidelines.

Also discussed was the ability for an employer to continue paying sick time to the employee, possibly using the Families First Coronavirus Response Act, instead of indemnity payments. To learn more about this, attend LCRCC’s webinar on FFCRA with Sheehey Furlong & Behm on Tuesday.

Unemployment Update

Last week Vermont saw total new and continuing unemployment claims of 57,302, a decrease of 2,651 from the previous week, and representing 199 initial claims, down 714 from the previous week. Nationally, more than 38 million Americans have sought unemployment benefits since March. Vermont’s official unemployment rate sits at 15.6% with the hardest-hit sector, Accommodation & Food Services, losing 18,400 jobs or 61.3% of its workforce

This week, the Vermont Department of Labor launched the Pandemic Emergency Unemployment Compensation (PEUC) program created by CARES which makes an additional 13 weeks of benefits available to individuals who have exhausted their regular state unemployment insurance claim with a benefit year that expired on or after July 1, 2019. The additional weeks of benefits are provided by the Pandemic Emergency Unemployment Compensation (PEUC) program. Individuals will also receive Federal Pandemic Unemployment Compensation (FPUC), an additional $600 to their weekly benefits through the week ending July 25, 2020.

Tax Updates and Help

The Department of Taxes has waived penalties and interest for estimated income tax payments originally due June 15, 2020 so long as they are paid by July 15, 2020. This relief applies to Vermont’s personal income tax, corporate and business/pass-through income tax, and fiduciary and estate income tax. Read more here.

The IRS is offering the following tax help for businesses affected by COVID-19:

The Laundry List

- LCRCC’s advocacy team is looking to hear from reimbursable employees, that is employers who do not pay into the Unemployment Trust Fund and instead get charged for claims from employees or former employees. If that’s you, contact [email protected].

- Vermont State Auditor Doug Hoffer has announced the creation of an online dashboard to help Vermonters track federal and state expenditures related to COVID-19. The online tool is available here and will evolve over time, as the situation progresses and information is updated.

- Vermont’s state parks will open this summer but will not offer overnight camping until June 25th and will be canceling all reservations prior to that date. Park attendance limits will be reduced, and parks will not offer equipment rentals or concessions this summer. Day-use visitors are encouraged to bring chairs and blankets for their visit as common area picnic tables and seating will be removed.

- The Vermont Arts Council is looking for feedback from the creative sector regarding needs, response, and recovery. Businesses and arts organizations can take this survey to provide input.

- ACCD still wants to hear from all Vermont businesses impacted by the response to the COVID-19 virus. Please share these impacts via the ACCD Business Impact Form, which will help us assess the full impact as we work toward solutions.

- Read last week’s legislative update here.

- LCRCC COVID-19 Resource Guide.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you this session.

Sincerely,

The Lake Champlain Chamber Advocacy Team