July 24, 2020

All eyes look towards Washington D.C. while states struggle with questions of school re-opening, mask mandates, and travel restrictions, there is little legislative work to be done at the state level. Instead, the ball is firmly in hands of Congress and the White House to deliver a much-needed infusion of cash so that states can continue doing what they’ve been doing since this crisis started: leading in the absence of real, adult leadership at the national level. However, for all the posturing, whispering, and supposed planning leading up to Congress reconvening this week, the results have been pretty underwhelming.

In this week’s update:

Mask Mandate Effective August 1st

In a move foreshadowed by the Governor during his Tuesday press conference, today the Governor announced he signed an order that masks be worn in public places where physical distancing isn’t possible starting August 1st. Masks will be required of anyone over the age of 2, unless the person has a physical or developmental disability that would be complicated by the wearing of one. Currently, there is no penalty structure in place for refusal to wear face coverings, however, businesses can now easily refuse service to customers who don’t comply. The state will continue to focus efforts on education.

While the Governor has been hesitant to create a mask mandate, his administration has said that such a mandate is a tool in the toolbox to combat the spread of COVID-19. In looking at regional trends, the Governor is worried about a resurgence of the virus and spill-over from neighboring states.

You can find signage for your business as well as mask purchasing information in LCC’s resource guide. Read the commentary by our outgoing Chamber President and CEO Tom Torti published in May.

Relief Grant Update

ACCD happily announced Wednesday that the first economic recovery grant payments are being sent to Vermont businesses as of today. Between ACCD and the Vermont Department of Taxes, $45 million is now on the way to Vermont businesses in need. Applications are continuing to be processed, but there is still money available.

Funds are available to Vermont businesses who can demonstrate a revenue decline of at least 50% in any one-month period from March 1, 2020 to August 31, 2020, when compared with the same month in 2019. The Economic Recovery Grants landing page has full details, including eligibility requirements, document preparation instructions, and a series of FAQs to assist businesses in completing the application.

Help for Sole Proprietors Finally Available

The Sole Proprietor Stabilization Grant Program is now accepting applications for grants of $5,000, $7,500 or $10,000 to qualifying sole proprietors through a lottery draw. The program is funded through $1.5 million from the U.S. Housing and Urban Development’s CDBG Program and passed through ACCD. The application window will be open until July 31, 2020 and grants will be awarded through a lottery system on August 14, 2020.

Full details can be found on the program portal, including the program breakdown, eligibility requirements, application materials and timelines, as well as technical assistance and FAQs.

One important detail that this program did not share when it launched is that individuals within the Burlington City limits are not eligible for this funding, as it stems from HUD Community Development Block Grant (CDBG) funding and Burlington is the only municipality in the state large enough for its own HUD CDBG district. Burlington’s CEDO is working on further support for small businesses within its boundaries and we will provide these details as they become available.

Federal Relief Debate and Impacts on Vermont

Congress returned to work in D.C. on Monday with the expectation that before they are scheduled to adjourn on August 7th another piece of legislation in response to the pandemic will be passed. On Wednesday night Senate GOP leaders and the White House announced they’d arrived at a deal, making the fault lines that had already formed even more clearly between the two parties.

While the GOP has put forward their deal, the Democrats have significant bargaining power given their control of the House, the number of Senators aligned with them, and to some extent, the popular nature of some of their proposals. One thing that distinguishes these proposals from our past few rounds of COVID-19 relief is that there is not an intention on the part of the GOP to move all these items in one bill; instead, Republicans intend to move them in multiple, smaller bills. While this may be the de jure method of approach, it will be debated as one de facto package.

Below are some of those fault lines – before you jump into this, understand, there is a long way to go. While the White House and Senate Leadership reached a tentative deal Thursday, they punted until Monday to unveil all the details, and they still need to negotiate across the aisle. With that, here are some big points under negotiation:

Size – The GOP, under the leadership of Mitch McConnell, has drawn a line in the sand at a $1 trillion package presumably due to Tea Party pushback; this new rift is reminiscent of 2008 when after creating the TARP program Republicans drew criticism from their own caucus pressuring leadership to spend less as they campaigned for re-election in fiscally conservative districts. Meanwhile, Democratic leadership under the direction of Speaker Nancy Pelosi already passed their HEROES Act through the House that included $3 trillion and they would like $1 trillion alone in state/local government support. The Democrats are confident that they can get at least $250 billion for local government out of the package. The compromise, or maybe consolation prize, for less or no new funding, will likely come in the form of regulations around the Coronavirus Relief Funds already allocated to states under the CARES Act being loosened, allowing states to apply those funds for things such as revenue replacement.

What does this mean for Vermont? If no new funding comes to the state as it did under the CARES Act and the state only has CRF to spend with more flexibility, it will likely mean our state will spend about $225 million of CRF still left to cover revenue shortfalls, leaving little or no additional funding for business relief or other programs.

It is worth noting that using all this funding to backfill revenue shortfalls will not solve the entire problem. The latest shortfall in the education fund released by the Joint Fiscal Office this week shows a $171 million shortfall. The reason that the legislature is returning in August is because they will have a clearer picture with which to budget with the data and dollars collected from the new July tax deadlines available. A reminder: money committees have already identified $50 million in potential new taxes including a cloud tax, candy tax, “luxury” clothing tax, and a 1% COVID surcharge sales tax.

Federal Pandemic Unemployment Compensation (fPUC) – colloquially known as the “extra $600” this enhancement to unemployment benefits added to the CARES Act at a late stage of development is set to expire at the end of the month and has already been a major point of contention in the framing of the next legislative package. According to a study by the Congressional Budget Office, 1 in 5 Americans has utilized unemployment due to this pandemic, and of that group, 80% have received more in UI benefits than they would at work. While this has made it difficult to fill open positions and created incentives not to work, there is deep nonpartisan and bipartisan agreement that the enhanced benefit, while gratuitous, is preventing a massive dip in consumer spending that would be expected at this level of unemployment; keeping the economy afloat (see the study by JPMorgan Chase).

The parties will need to strike a balance to appease the large number of voters who benefit from this program while also making an enhanced benefit contribute to sustainability. Retaining the benefit as quickly as possible is a major goal of the Democratic leadership, one they will likely fail at, given that due to the mechanics of our government, passing a continuation of the program at its earliest will still mean two or more weeks without it (unless they make it retroactive and explicitly give state DOLs the ability to back pay them benefit).

The deal that the Senate GOP and White House struck would replace the PUC with a roughly 70 percent match of a worker’s wages before they were laid off. This will be a tricky proposition as many states across the country deal with archaic systems to administer their UI program and there are a patchwork of wage replacement formulas already used making changing a formula overnight daunting.

What does this mean for Vermont? The CARES Act requires states to provide fPUC through July 31, however, Vermont, like many other states, ends its benefit week on Saturdays making July 25 the last Saturday of the month. Federal law does not allow the state to pay this particular benefit through Saturday, August 1st. This means that, as we outlined above, even if the benefit is reinstated, it may be weeks until it reaches Vermonters. This could potentially impact the ability of employers to hire on staff.

According to the latest data, Vermont has seen over $564 million (combined general UI and PUA) come to the state in fPUC benefits to date which have had an untold, however, undoubtedly positive impact on the Vermont economy. Given that the state has paid only $230.5 million in general UI payments and $421.5 in fPUC benefits to date, one could surmise that most Vermonters receiving UI benefits are making more than they would at work.

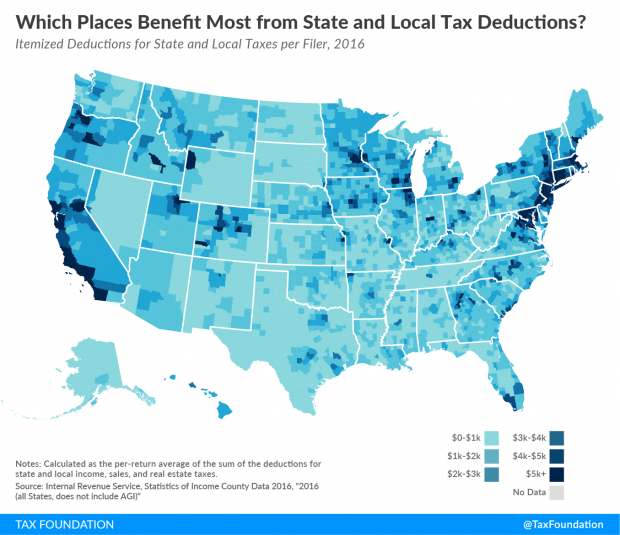

Tax cuts long shots – The Trump Administration this week made clear its desire to see a payroll tax cut which surprisingly was met with little fanfare, especially as the current pandemic contributes to social security becoming an even more rapidly growing unfunded liability. Meanwhile, the House Democrats have already sent to the Senate a reinstatement of the SALT deduction changes that came from the so-called 2017 Tax Cuts and Jobs Act. Both are longshots and likely will not have traction, however, you have not seen the last of them.

What does this mean for Vermont? Vermont easily fits the profile of a state that would benefit from the reinstatement of SALT and this would be beneficial to our state.

- Stimulus Checks – In the deal the White House struck with GOP leadership Wednesday night, another round of stimulus checks will be provided following the same distribution formula as the CARES Act. Presumably, this will mean that the checks of $1,200 will be available to tax filers who make up to $75,000 and checks of $2,400 to joint filers making up to $150,000. An earlier proposal involved an income threshold of $40,000 a year. Who wouldn’t want to send folks a check during an election year and take credit for it?

What would this mean for Vermont? As we indicated earlier, just a cursory look at our state’s UI numbers show that those receiving UI currently are likely receiving more on UI than they would at work and the end of the PUC program will mean a dramatic change about 50% of what they would be making at work. Those folks also likely fall under the proposed income threshold.

- Liability protection – On Tuesday 21 Governors sent a letter to House and Senate leadership calling for liability protections for businesses, schools, and hospitals, stating that, “when Americans take sensible steps to implement public health best practices, they should have confidence that they will be secure from unreasonable claims.” This is just the latest in a long conversation about liability protections that have taken place since this crisis started. McConnell has made it clear that this is an objective that must make it across the finish line with whatever other relief comes before the August adjournment, a goal Pelosi will likely need to accommodate given the number of Democratic members that agree. The Republican proposal circulating envisions a five-year shield, starting retroactively in December of 2019, from liability except for cases of gross negligence, misconduct, or recklessness.

- Other items – Much, much more will be coming out that we didn’t highlight above mostly due to the less controversial nature of it. FFCRA correction – many would hope to see a correction to issues around arising from unforeseen consequences of the Families First Coronavirus Response Act.

- Funding for schools so they can re-open – the deal struck tentatively between the White House and GOP leadership would allocate $105 billion – of which $30 billion would go to colleges and universities.

- More PPP funds – The GOP proposal is also expected to include a second round of Paycheck Protection Program (PPP) funds. There is a general interest in adding a few billion dollars to the program and dropping thresholds to access it. Additionally, it is likely that the package will streamline forgiveness for smaller loans (under $150,000). Finally, there is discussion around lowering the upper limit of employees a business has from 500 to possibly 300.

- PPE Assistance – one topic of conversation is financial assistance for businesses to pay for personal protective equipment and other coronavirus-related expenses.

- Student debt – the CARES Act put a hold on the accumulation of interest and payment on federally held student debt until September. Democrats have put forward legislation to continue that for another year.

Most Asked Question This Week

How do I handle my employee’s need to quarantine upon returning from a vacation or non-work-related trip? How do I prevent small vacations from turning into multiple-week absences?

This is a difficult one we tackled in last week’s legislative update where we shared materials.

The Laundry List

- Event Assistance – Hosting a big event? Want another set of eyes on your plan? The Lake Champlain Chamber facilitated an ad hoc working group that helped draft the restart guidance for large events and that group is willing to serve as a peer review team for others who are attempting to navigate the guidance. For more information, email [email protected].

- Personally Identifiable Information Updates – As of July 1, 2020, more types of information—including health and genetic information, login credentials, and additional government IDs like passport numbers—are considered “Personally Identifiable Information” that requires notice to consumers if stolen or otherwise subject to a breach. By helping businesses understand the law, the guidance aims to help ensure that timely notice is provided to Vermont consumers so they can protect themselves if their sensitive information is exposed. Find guidance here.

- Zoning Guides for Vermont Neighborhoods – The Department of Housing and Community Development (DHCD) announced the completion of Enabling Better Places: A Zoning Guide for Vermont Neighborhoods. This how-to manual promotes practical, small steps that Vermont’s cities, towns, and villages can take to address widespread regulatory barriers that limit the choice of conveniently located homes available at prices Vermont’s people can afford.

- Champlain Parkway – The public comment period for the Limited Scope Draft Supplemental Environmental Impact Statement (LS DSEIS) is open from July 10, 2020 to August 24, 2020. The public is invited to submit comments on the LS DSEIS in writing at the public hearing, through the mail, email, or on the project website. Verbal comments can be made during the public hearing or by telephone. champlainparkway.com/nepa/.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team