August 21, 2020

As recently remembered in a column in VTDigger, ahead of the Civil War, President Lincoln sent a telegram to Vermont’s Governor Erastus Fairbanks simply saying, “Washington is in grave danger. What may we expect of Vermont?” Fairbanks responded only, “Vermont will do its full duty.” Though much has changed since then, the juxtaposition of Vermont’s politics and COVID-19 response to that of our federal government, which is at a stalemate and in grave danger of delivering nothing to states desperate for aid, echos the no-nonsense, down to brass tax ethos of our brave little state. Let’s hope we live up to that legacy as the legislature returns next week to pass this fiscal year’s budget.

In this week’s update:

- Governor proposes budget with no new taxes or substantial cuts

- The cavalry is NOT coming – federal relief update

- Maximum economic grant award raised to $150,000

- Governor gives more local control for limitation, BTV uses it

- WEBINAR: Federal Judge vacates provisions of FFCRA

- Most asked questions this week

- The Laundry List

Governor’s Proposed Budget

The old adage, “under promise, over deliver” might be the best way to summarize this week’s budget news, however unintentional the circumstances might be. Despite our state’s dire financial situation, Governor Scott was able to present a budget that represented no cuts to essential services and no new taxes. How? A combination of better than expected revenues from last fiscal year (a trend from the previous four fiscal years) and cost-saving measures across almost every government sector from both changes in operation during the pandemic and changes moving forward.

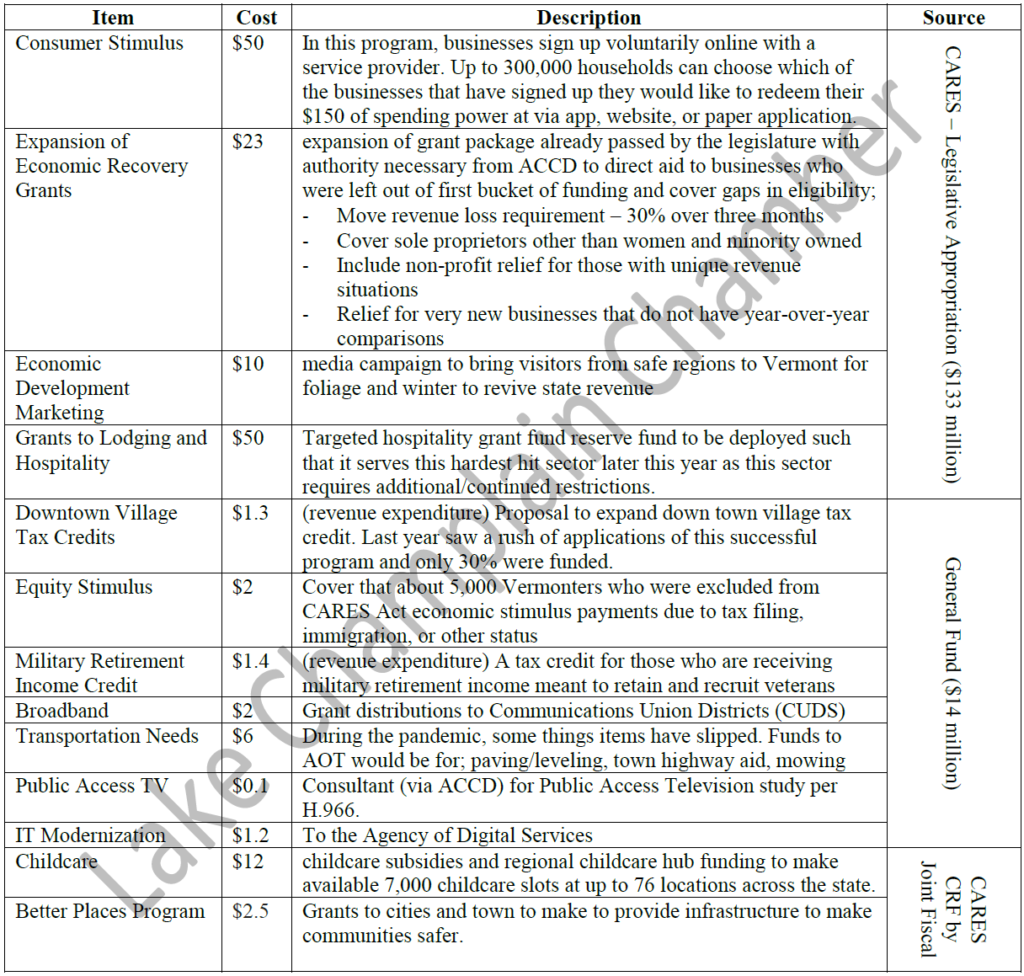

Here are some major items in the Governor’s proposed budget at a glance:

Some key points in this budget:

- This is a full-year budget and will override the first quarter budget passed previously.

- General Fund spending is down to $1.66 billion in this budget from the $1.71 proposed in January.

- The Governor’s proposed budget includes accommodations for $20 million required to cover the 25% in cost-sharing from enhanced unemployment benefits under the President’s Executive Memorandum that would add up to $400 in enhanced unemployment benefits. More federal guidance is still needed on this matter (see federal update below).

- On average, departments and agencies are finding 2.2% in spending efficiencies to create about $40 million in savings. For example, the shift to remote work, curtailing some standard business, hiring freezes, no travel expenses, and a freeze on executive pay.

- A potential point of contention is $30 million in “bridge funding” to help the state colleges that the administration included, however, some legislators did not feel confident that it was as secure enough of a priority during testimony.

- The Governor’s budget would move some General Fund money to the Transportation Fund, a move that triggers those who subscribe to the dogma of fund segregation.

- It was realized this week that a potential unintended consequence of the first quarter budget only funding one of the two years of the pay act is that the contract with the state employees union might need to go back to arbitration.

The legislative money committees began working through the Governor’s proposed budget this week in company with committees of jurisdiction to budget topics ahead of the full legislature reconvening on Tuesday. A point of speculation among many observers is still how much non-COVID or budget-related work legislative leadership will allow as advocates and lobbyists have receive mixed messages.

There are already two opportunities to give public feedback on Thursday, August 27, 2020 from 5:00 p.m. to 6:00 p.m. and Friday, August 28, 2020 from 1:00 p.m. to 2:00 p.m. via videoconferencing. Learn more here.

Federal Relief Update – The Cavalry is NOT Coming

A stalemate continues in our nation’s capital for yet another week. The House will be back this weekend to address concerns related to the functioning of the postal service after reports that mail was intentionally slowed down. There was speculation that a “skinny stimulus” package could be added to any package passed through the House to support the postal service; however, the Speaker is adamant that this will not be the case, as she does not want this to become another battleground, despite a large push for passage of already agreed-upon items by the Blue Dog Caucus and 117 of her members signing on to a New Dem Coalition letter calling for a stand-alone vote on enhanced unemployment benefits this weekend. We remain cautiously optimistic that some form of relief can come before October.

Aside from that action, it is a game of “hurry up and wait” on regulation and guidance stemming from the President’s Executive Memoranda.

Enhanced Unemployment – the Vermont Department of Labor is in communication with FEMA and intends to submit an application for the funds necessary to provide Vermonters with the enhanced federal benefit of $300 made possible under the executive memo. The state will be eligible for an initial tranche of many equivalent to three-weeks of benefits and up to 5% for administrative cost. The prevailing thought is that FEMA only has four-weeks of funding, however, if larger/more states do not make use of the program there could be more.

- Payroll tax deferment – all eyes are on the Treasury as they draft guidance on the measure. In the meantime, multiple national businesses and business organizations have made clear the provisions will do more harm than good. Our Government Affairs Manager sat down with Steve Trenholm of Gallager Flynn and Company to discuss the implication for the President’s Executive Memoranda on payroll tax deferments and what employers should be doing to prepare for liabilities that arise from offering such a deferment or not offering it. Watch the video here.

Economic Recovery Grant Maximum Raised to $150,000 for new and existing grants

All businesses in the lodging, retail, hospitality, arts, travel, and event affiliated sectors that have continued capacity are eligible for Economic Recovery Grants for Vermont businesses negatively impacted by the COVID-19 pandemic will see an increase in their maximum award. The administrative change increases the eligible grant maximum from $50,000 in grant funds to $150,000 from the program. This additional $100,000 in grant funding is available to both new applicants to the program and to those businesses that have already received a $50,000 grant.

All businesses that received a $50,000 grant award from the Department of Taxes are eligible to request an increase in the new maximum award amount and can do so through myVTax. ACCD will also be contacting eligible businesses that already received a $50,000 grant notifying them this supplemental grant funding may be available to them starting Monday, August 24, 2020.

Businesses that have not yet applied for an Economic Recovery Grant are encouraged to apply if they have experienced losses of at least 50 percent in one month during the period of March to July 2020 (compared to any one-month period from March to July in 2019). Businesses that may not have been eligible based on earlier months are encouraged to evaluate their losses for the month of July as they may now be eligible. More information can be found at the Economic Recovery Grant Program website.

Governor Gives More Local Control – BTV Uses It

Given the notoriously gregarious nature of college students, many in Vermont are worried that these young people will not make smart choices needed for them to do their part in measures to curtail the spread of COVID-19. In response last week, Governor Phil Scott signed an amendment to his executive order, which gave municipalities more discretion in setting gathering size.

Last night, the Burlington City Council passed an order proposed by the Mayor that made use of that discretion. The order limits residential gatherings outdoors to 25 and indoor to 10, both with required social distancing and facial coverings. The order additionally restricts first-class and third-class liquor license holders to only sell alcohol until 11:00 p.m.

WEBINAR: New York Federal Judge Vacates Parts of DOL FFCRA Final Regulations

Join the Lake Champlain Chamber and Primmer Piper Eggleston & Cramer PC for a conversation around the decisions and other FFCRA FAQs on August 26th at noon. In an August 3, 2020 decision, the U.S. District Court for the Southern District of New York vacated multiple provisions of the U.S. Department of Labor’s Final Rule on the Families First Coronavirus Response Act (FFCRA). It is recommended that employers that are covered by the FFCRA change their practices regarding the vacated provisions.

The Court struck down four provisions of the Final Rule:

The “work availability” requirement—that employees are not entitled to FFCRA leave if their employers do not have work for them to do;

The definition of “health care provider”—that employers in a healthcare field have broad discretion to exclude all employees;

That intermittent FFCRA leave can only be taken with the employer’s consent; and

The requirement that employees provide documentation before taking leave. At this time, all other provisions of the Final Rule remain effective.

Register for the webinar here. Information on FFCRA coverage is available here. More information around the decision can be found here.

Most Commonly Asked Questions This Week

What, if anything, should I be doing related to President’s Executive Order on payroll taxes?

Our Government Affairs Manager sat down with Steve Trenholm of Gallager Flynn and Company to discuss the implication for the President’s Executive Monranum on payroll tax deferments and what employers should be doing to prepare for liabilities that arise from offering such a deferment or not offering it. Watch the quick video here.

When can employees return to work after COVID-19 exposure?

- Knowing when it’s safe for your employees to return to work is an important step to keeping your workplace safe and healthy. The Vermont Department of Health has guidance on what do I do if my employee tests positive for COVID-19 and guidance for employees when their co-worker tests positive. The Health Department does not provide letters for employees to return to work. The best and most reliable way to make sure people in your workplace are protected against COVID-19 is to follow guidance from the Agency of Commerce and Community Development.

The Laundry List

Upcoming Chamber event: Leading with Emotional Intelligence: A Webinar to Boost Your EQ on September 3.

Please, please, please respond to the census and urge others to do so! We are starting to sound like a broken record only because this is important.

We’ve updated our Chittenden County Senate Candidate Survey to reflect the results of this week’s primary. See the questionnaire here.

The Legislature is still exploring what options they have to resume regular business in January. Watch this breakdown of their current thought process via WCAX.

- Are you, or an employee, struggling to get the internet at home? Do you have K-12 students or need to work from home due to COVID-19? The Department of Public Service is issuing grants to eligible and qualifying residents to extend telecommunications lines to their homes. Limited funds are available. Eligibility information, program guidelines and FAQs are available on the Department of Public Service website.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team