Thank you to this week’s sponsor of our Advocacy Update:

May 14, 2021

There is (supposedly) only about a week left in the session, however, there is a lot left to do and a lot that can happen between now and then. The budget is seeing big changes daily and the interim final guidance from the U.S. Treasury on how to use American Rescue Plan funds complicated some aspects of the budget.

In this week’s update;

- Favorable PPP language passes Senate; please ask House to concur with no further changes

- Re-opening speeds up; normal returning soon

- Treasury guidance on ARPA funds creates some difficulties

- Check-in on economic development proposals

- Unemployment bill goes off the rails

- SBA updates on PPP: RRF oversubscribed, Vermont likely to get very little

- The Laundry List

PPP Language Passes the Senate; Please Ask the House to Concur Without Further Changes

The Senate passed H.436, the miscellaneous tax bill, today which undoes the provision of Act 9 that would have made PPP loans forgiven in 2021 taxable income. LCC is incredibly grateful for this result which is the product of outreach from businesses and collaboration between LCC and over 55 other partnered organizations, however, we’re not safe yet! The bill will now head to the House Committee on Ways and Means, which will need to consider this component, among other provisions, in this bill. We need your help! Please, take a moment to send a quick message to members of the House Ways and Means Committee members asking them to concur with the Senate-passed language and keep PPP from being taxed. Reach out to our advocacy team at [email protected] for more information.

Re-Opening Speeds Up

This week brought a lot of good news on many different fronts that have meant that Vermont can advance its reopening plans earlier than planned. This week, Vermont’s vaccination plan moved to Step 3 two weeks ahead of schedule! Some good news from this week includes;

- Vermont reaches 70.3% vaccination – this number is significant not only because it is the upper benchmark for Step 3 of the Vermont Forward Plan but it is also where some experts would say a population has reached herd immunity. With this news, Vermont’s reopening plan will progress to Step 3.

- Younger people can be vaccinated – As of yesterday, May 13th, Vermonters between the ages of 12-15 can be vaccinated with parental permission after the CDC announced the news earlier, The Vermont Forward Plan is based on the total population of Vermont, not just adults, so any younger Vermonters who get vaccinated in the 12-15 age range will help the state reach its goals. Already 7,300 Vermonters in this age range have signed up for vaccination and Vermont is receiving an additional 5,000 Pfizer doses next week, which should help reach this population. Those making appointments for this age group will only see clinics with the Pfizer vaccine and parental/caregiver consent is required. To create an account (or use an existing account, adding the child as a dependent) and book an appointment, visit the Department of Health website or call (855) 722-7878.

- CDC says fully vaccinated people can stop wearing masks in most indoor places – the big takeaway here is that being vaccinated means the vaccine protects you and others in nearly every situation. The Governor will amend the executive order to reflect the CDC guidance today. Employers still need to have employees wear masks under their Step 3 and OSHA guidelines for the time being. Employers and businesses will still be allowed to have their own policy and masks will still be required in public transportation, healthcare, and similar settings.

- The House unanimously passed a Resolution to return to in-person legislating 30-days after the expiration of the emergency order – The resolution would have any veto session and additional legislating done this session continue remotely, however, it opens the door for a test-run of in-person legislating this summer. The Senate seems less convinced on returning and many wonder if the legislators will try to cling to the flexibility that they have gained during the pandemic. LCC testified last week with a strong position that the State House is the people’s house and any efforts to return to the building must be first about bringing the public back, then bringing legislators back.

Governor Phil Scott says he will extend the state of emergency in Vermont for another month, however, it will reflect the CDC guidance to allow vaccinated people to no longer need to wear a mask or physically distance in most indoor settings.

Are you experiencing vaccine hesitancy in your workforce? We want to hear more and help. Please reach out to our team at [email protected]

Treasury Guidance Issued for ARPA Money, Creating Some Difficulties

This week, the U.S. Treasury issued the interim final guidance for the Coronavirus State and Fiscal Recovery Funds alleviating stress in some areas and dialing it up in others. The guidance has a lot of overlap with the CARES Act CRF guidance, so many assumptions based on that have proven true. The guidance has cast doubt on a few areas that the legislature wanted to fund with these dollars, predominantly child care, higher education, housing, and Weatherization. Yesterday, the House took the firm stand that the provisions of S.109, the Enhanced Energy Savings Act, cannot use ARPA, possibly putting this program in jeopardy. This has made for a tough time for the Committee of Conference hashing out the differences between the House and the Senate in H.439, the budget bill. They are scrambling to shift funding sources and find alternatives. Despite all this, the Committee believes that they can finish their work by Tuesday evening, which generally signals the “pencils down” moment for everyone else in the legislature.

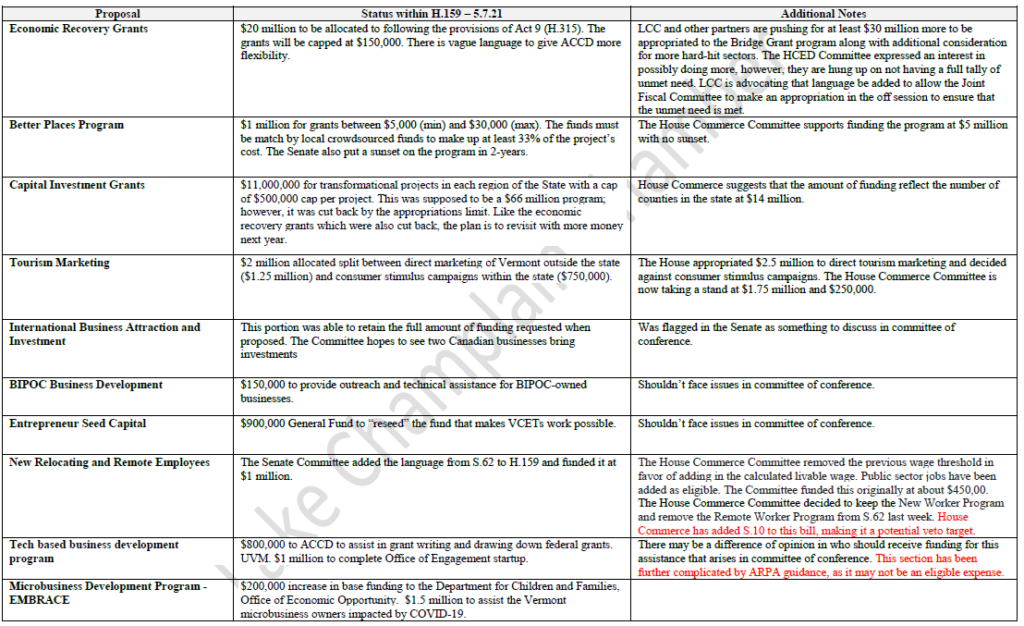

Check-in on other Economic Development Proposals

Much of this information is in flux as the final deals get sorted out. We’ll have more next week, however, for now here is a snapshot.

Unemployment Bill Goes Off the Rails

In a disappointing turn of events, the House Committee on Commerce and Economic Development was forced to walk back their version of the UI bill due to political ultimatums. The Senate, it appears, was willing to walk away from negotiations and allow the worst-case scenario to play out for employers unless the House Commerce Committee added an increase in unemployment benefits to the bill. Faced with two paths that would do damage to employers, members of the House voted for a version of the bill that they felt would do less harm than nothing being done at all.

The business community is appreciative of the work the House Commerce Committee did in their version of S.10 passed last week which made only technical corrections; correcting a calculation where it helped businesses and not correcting one where it helped workers. Ultimately, the Committee had to backtrack on that position because they were less willing than their counterparts in the Senate to allow nothing to be done feeling it would be harmful to businesses.

LCC is not happy with this outcome and is opposed to the $100 million benefit increase. The UI language is now in S.62. While it contains the positive technical corrections from House Commerce’s bill, it adds an additional benefit of $25 per week for the next 10-years to all claimants’ benefits. This $100 million tax on businesses will only make economic recovery more difficult and the hole in the UI trust fund, which employers did not cause yet are responsible for closing, much larger.

The proponents of the proposal will say that the legislature is giving the business community $300 million in UI tax relief, this is not true. Yes, the end target size of the UI trust fund is lower because the language removes the experience of the fund in the year 2020 from the calculation of how big it should, however, that it is not relief. Think of it as if someone incorrectly labeled a dozen eggs as $6 and you needed the legislature to correctly label it with the price it should be at of $2; you wouldn’t stand for a legislator telling you “aren’t you happy that I gave you a $4 discount?” they didn’t make $4 magically appear, they just corrected the price to be the true price and didn’t overcharge you.

SBA Updates: RRF Over Subscribed, Vermont Likely Get Very Little

The U.S. Small Business Administration’s Restaurant Recovery Fund has received more than 147,000 applications from Section 8A businesses (women, veterans, and socially- and economically disadvantaged business owners). These requests are prioritized and come to a total of $29 billion in funds of the which there is only $28.6 billion in funding, oversubscribing the program with only this group. There were more than 266,000 applications overall representing over $65 billion in requested funds nationwide.

Though the program is oversubscribed, money remains in the $500 million carve-out for the smallest restaurants with revenues up to $50,000. The application portal remains open for these businesses. We’ve heard that there is currently no interest in Congress in backfilling the program with additional funds.

Other SBA Updates

The PPP application portal is closed except for Community Financial Institutions (CFIs) which means that the only place left to apply for a PPP loan in Vermont is VEDA, the Vermont Community Loan Foundation, or Opportunities Credit Union. Any application submitted after May 17th will be removed so that the applicant can move to a CFI. The program has about $24 billion left and as of May 8th, Vermont has 8,914 loans processed in 2021.

Laundry List

- See last week’s update here

- The Senate Finance Committee is struggling with the miscellaneous revenue bill, H.437 sent to them by the House since if they don’t pass the bill, the budget will have a deficit of about $1.5 million. The Committee is frustrated because they feel that they are in a position where the Appropriations Committee is telling them how big the pie has to be so that they can bake it and cut it up. The crux of the issue is a property transfer tax surcharge on property over $1 million that the committee does not want to levy on businesses, so they are seeking to raise them only on residential properties. Also caught up in this issue is a move to universal plant theory for manufacturing sales and use tax that LCC supports.

- S.88 an act relating to insurance, banking, and securities was signed by the Governor this week. The bill contains a splitting of the healthcare market into individuals and small businesses which will let the state take full advantage of changes contained in ARPA including subsidies to individuals. Read more via VTDigger here.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team