Last updated; 6/11/2021

On Friday, May 21st, the legislature adjourned until a potential veto session on June 23rd and 24th, which should not be needed, or until October 19th if both the Senate President Pro Tempore and House Speaker decide it’s needed or until January 4th at their typical time pursuant to J.R.S. 29.

This brings an end to a historic 18-week session that will hopefully be the last virtual legislative session. As LCC has done every year, we’ve compiled this exhaustive list of issues and legislation discussed and explored during the past 5-months.

This report will be edited as action is taken on bills passed or more details become available. As of Friday, May 21st, the Governor has said that he plans to sign the budget the legislature has passed. If you have concerns with any of the issues in this document, we encourage you to reach out to our advocacy team at [email protected] or set up a time to sit down one-on-one using this link.

In this Update;

- The Session at a Glance

- Issues and Legislation This Session

- Budget

- Act 9 (H.315) Bridge Grants

- Unemployment Insurance – Passed

- Miscellaneous Tax Bill – Passed

- Miscellaneous Revenue Bill – Postponed

- Property Transfer Tax

- Manufacturing Inputs Tax Modernization

- Manufactured Housing Credits

- 53, an Additional Miscellaneous Tax Bill – Chopped Up

- Internet Service Tax – Defeated

- Corporate Minimum Tax Changes and Corporate Tax Reform – Postponed

- Military Retirement Pay – Postpone

- Economic Development Omnibus Bill and Other Initiatives – Added to Budget

- Broadband – Passed

- Childcare – Passed

- Miscellaneous Alcohol Bill – Passed

- Health Insurance Changes to Benefit Small Businesses – Passed

- Bottle Bill – Postponed

- Commercial Cannabis Changes – Passed

- Pensions Governance Changes – Passed

- Various Housing Efforts

- Act 250 – Delayed

- Contractor Registry – Postponed

- Tax Structure Commission Report

- What’s Next?

- Economic Issues

- Tax Proposals

- Government

- Energy and the Environment

- State House Business Moving Forward

- Thank you to all of our sponsors

The Session at a Glance

The start of the 2021 legislative session was amidst a great deal of uncertainty in federal policy, national politics, state budgeting, and of course, COVID-19. As LCC continued typical legislative advocacy efforts, we also needed to take on the additional tasks around COVID-19 guidance, restrictions, and policy work for our members. Virtual legislating meant that, as was described by the Senate President Pro Tempore in her closing remarks, “a problem that might take 15-minutes to resolve, could take hours or days.”

On the whole, this session was not entirely kind to businesses, as the legislature levied an additional $100 million in unemployment taxes on businesses, only appropriated $30 million of the over $1 billion in flexible federal funding to cover the over $500 million in businesses’ demonstrated unmet need, and an effort was necessary to prevent state taxation of the full federally funded and facilitated PPP program. While sufficient attention was not paid to the acute need of small businesses, major advancements were made in infrastructure and broader economic development that will have a downstream impact on businesses, as federal COVID-19 relief dollars have provided the opportunity to address systemic problems in childcare, housing, broadband, water quality, and numerous other areas where Vermont policymakers have been able to agree issues exist, just not how to address, or more realistically, pay for them.

Early in the session, a commentary by our Chamber President was published in VTDigger urging the legislature to keep the focus of their work on dealing with COVID-19 until the pandemic passes. From LCC’s perspective, the legislature’s work needed to be about addressing the problems directly in front of us in the next six months. This is not to say that work cannot also build capacity for the future too; that kind of win-win is ideal.

So, how did they do by this measure? One could say that the legislature did a good job responding to the long term, structural needs of our economy; however, as we said, some of the more acute needs of the business community might have been underserved.

Back to menu

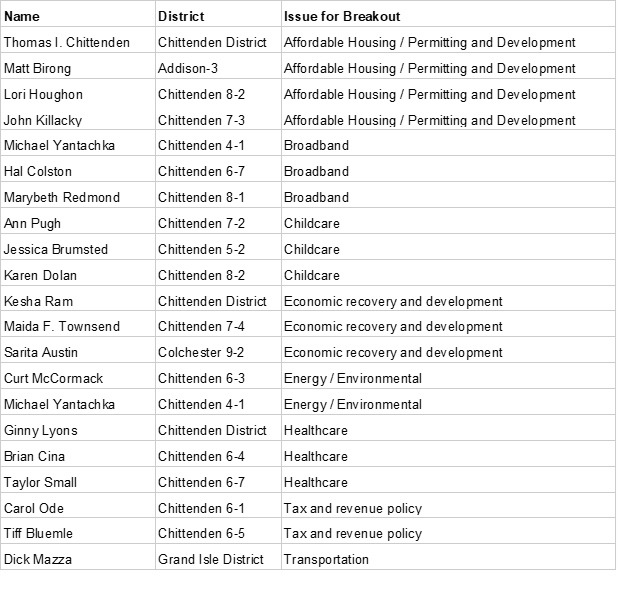

Legislative Breakfasts

LCC continued to host two legislative breakfasts, as we do every session, and transitioned them to virtual events due to the pandemic. For our first breakfast, we had breakout sessions with numerous legislators to discuss housing, childcare, transportation, healthcare, and economic development.

Unfortunately, the Governor needed to miss this breakfast due to exposure to a COVID-positive person. We rescheduled his appearance and had an additional event during a standing meeting time that LCC hosts for partnered organizations with the staff of our congressional delegation. We also included Congressman Peter Welch in the meeting to give a great deal of perspective.

Our second breakfast was held with Lt. Governor Molly Gray, Senate President Pro Tempore Becca Balint, and Speaker of the House Jill Krowinski, allowing our members to hear directly from the three most powerful officials in the Vermont legislature.

LCC is very grateful to our legislative breakfast series sponsor, New England Federal Credit Union, who has continued to make these events possible and worked with us in the face of changing variables over the past 14-months.

Special thanks to the sponsor of our Legislative Breakfast Series:

Federal Aid

It is worth taking a moment to note that much of the work of this legislative session would not have been possible if not for the enormous amount of federal aid that has come to the state since the pandemic started. LCC’s advocacy team last summer began hosting weekly meetings with staff from our congressional delegation, Administration officials, leaders from the business community, and others to help break down, understand, and plan around federal action.

An incredible amount of federal aid has come to Vermont since the start of the pandemic, starting with the CARES Act up until the most recent American Rescue Plan Act. More aid is likely coming in the form of an infrastructure bill with a price tag in the ballpark of $1.7 trillion. Finally, moving forward, Congressionally Directed Spending, or as they’ve been called in the past, earmarks, will provide a path forward to major projects in the region, and LCC’s advocacy team has already submitted one application with regional partners.

Back to menu

Issues and Legislation This Session

Budget

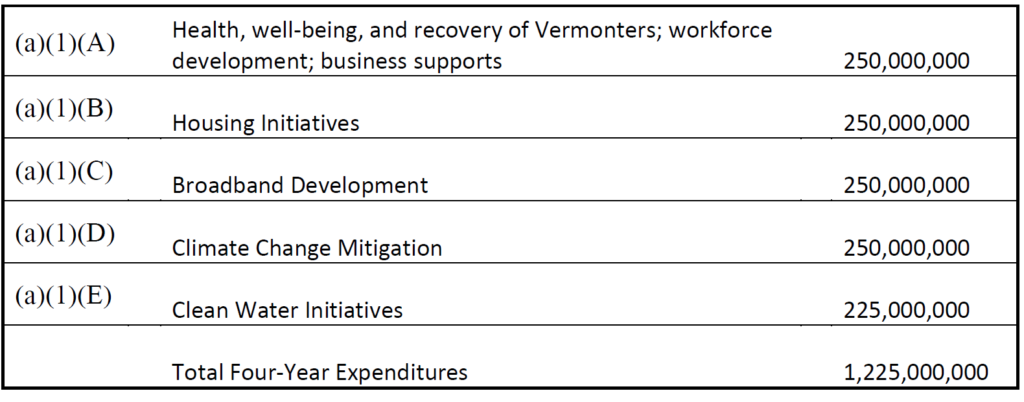

This year’s budget might be the most complicated Vermont legislators will ever see as it draws on remaining CARES Act dollars, Consolidated Appropriations Act dollars, ARPA dollars, and one-time revenues from tax revenues coming in above forecast. The “Big Bill” appropriates $7.35 billion to meet the ongoing costs of operating state government and makes investments in Vermont’s infrastructure and human capital from the federal funds available from the American Rescue Plan Act (ARPA) and other sources. This budget also put $210 million in reserve.

From the start, the concerns of many would be that all of this funding was used as one-time funding, and ensure that committees were not creating ongoing expenses; in most instances that is true.

See highlights from the budget here

This bill does not allocate all of Vermont’s federal funds, and as part of the budget agreement, the legislature concluded that they would spend their federal dollars following this breakdown in the coming years.

In the final days of the session, the issue holding up the budget the most was the teachers’ Other Post Employment Benefits (OPEB). Our state has a commitment to cover teachers’ healthcare when they retire, however, we have not been prepaying these costs in the way you would with typical pension liabilities, gaining investment income. $35 million of the general fund is going to pay for the healthcare of retired teachers. The Treasurer had previously recommended that the state start pre-paying these benefits, rather than pay-go, to save about $800 million in projected unfunded liabilities.

The Senate budget writers had decided already to put about $14.5 million at the bottom line of the education fund to pre-pay OPEB,. In contrast, the House had already decided that they would use that to lower the property tax by about 1.5 cents. The House was adamant that this be paid for with new taxes and suggested that it be done with a cloud tax. The Senate had no money on the bottom line because of the transfer the senate budget writers had done, so Senate Finance thought it would be wise to keep the property tax level. The education fund has been doing well due to sales tax revenues, and the Senate felt as if there was not a danger to doing all of this without the cloud tax, and the Senate is not a fan of that House favorite. (we cover this further in the revenue bill section).

In a last-minute compromise, the budget reserves $150 million general fund and $14 million education fund for pension and OPEB once the Pension Task Force completes its work and provides $200k for that task force. These moves are necessary to protect the state’s bond ratings which have been sliding continually due to our unfunded liabilities.

Back to menu

Act 9 (H.315) Bridge Grants

A bill of many names; The Fast Track bill, CRF bill, Covid Relief Bill, Budget Adjustment Amendment Amendment, and Expedited Budget, H.315 represented the first major decisions on budget allocation in the 2021 session. One significant product of this legislation was the Bridge Grant Program, previously pitched by the Administration as the Gap Grant program.

LCC’s testimony on the Gap Recovery Grants section of the legislation was well received and reflected in the final product of the bill. The Gap Recovery Grants were originally proposed in early January as part of the Administration’s proposed budget, and were intended to be part of the Budget Adjustment Act, to be able to fit the needs of businesses who fell through the gaps in assistance, both state and federal, at that time. Many in the legislature were uneasy about using state dollars, unlike previous state-level grants, which were federal dollars, so criteria were narrowed and the Legislature understandably took its time on the proposal as many felt that money needed to be used with different diligence than federal dollars. Eventually, ARPA passed, and the legislature funded the grant program with $10 million in ARPA funds.

LCC successfully advocated for the program criteria of this new business gap grant to be broadened beyond just those businesses who received no support, giving those businesses who received nothing initial priority for the first 30-days of awards and then priority on a rolling basis. Public guidance can be found at the ACCD COVID-19 Recovery Resource Center. Further guidance and information regarding the launch date for the program, application portal, FAQs, and translated versions of materials will be posted soon. The application portal will be live in early June.

Under the language LCC advocated for, after the program has exhausted its original funds, the Joint Fiscal Committee would be tasked with meeting in the time outside of the legislative session to receive a statutorily obligated report from the Agency of Commerce and Community Development on the use of the funds and any subsequent oversubscription (also could be referred to as underfunding) of the program. However, this language was not included, so businesses will need to wait until January or possibly an October session.

LCC looks forward to the program launching, the funds being exhausted, and a report of the demonstrated unmet need of the state under a legislative approved definition being delivered.

Back to menu

Unemployment Insurance

This contentious bill, S.10, which was later folded into S.62, started its life last biennium during the fall session when the Department of Labor sounded the alarm of a UI tax rate hike due to the automated nature of the UI Trust Fund tax mechanisms. The DOL initially suggested a freeze on rates which would then need to be paid back by contributing employers over the next 10-years. Such a concept was either misunderstood or misrepresented by some labor advocates as the state giving away money to businesses. In the remote environment, narratives with such disinformation are difficult to turn back.

This incorrect narrative plagued the process of making any UI changes for 8-months as any proposal that would grant employers perceived, yet not actual, monetary relief was met with a call for a reciprocal increase in benefits to UI claimant benefits. However, this was not a conversation about digging a hole deeper; it was a discussion of how to dig out of a nearly $300 million hole that was caused by government orders that asked businesses to close their doors to protect public health.

The House Commerce Committee understood this and put forth an elegant counter-proposal to the Senate’s version of the bill S.10. Along this bill’s path in the House, the House Committee on Commerce and Economic Development did a great deal of due diligence. The Committee heard from their Joint Fiscal Office about new dependent benefits as well as others that benefit all Vermonters, including those on UI. They heard about how frequently cited statistics in previous discussions around UI were incorrect and heard from the Department of Labor about how they are battling fraud from organized criminals outside of Vermont at the cost of hundreds of thousands to Vermont contributors.

In a disappointing turn of events, the House Committee on Commerce and Economic Development was forced to walk back their version of the UI bill due to political ultimatums. The Senate, it appears, was willing to walk away from negotiations and allow the worst-case scenario to play out for employers unless the House Commerce Committee added an increase in unemployment benefits to the bill. Faced with two paths that would damage employers, members of the House voted for a version of the bill that they felt would do less harm than nothing being done at all.

LCC is not happy with this outcome and is opposed to the $100 million tax increase. The UI language of S.10 was folded into S.62, which still contains the positive technical corrections from House Commerce’s bill; however, it adds an additional benefit of $25 per week for the next 10-years to all claimants’ benefits. This $100 million tax on businesses will only make economic recovery more difficult, and the hole in the UI trust fund, which employers did not cause yet are responsible for closing, much larger.

The proposal’s proponents will say that the legislature is giving the business community $300 million in UI tax relief; this is not true. Yes, the end target size of the UI trust fund is smaller because the language removes the experience of the fund in the year 2020 from the calculation of how big it should be; however, that is not relief. Think of it as if someone incorrectly labeled a dozen eggs as $6 and you needed the legislature to correctly label it with the price it should be at $2; you wouldn’t stand for a legislator telling you, “aren’t you happy that I gave you a $4?” they didn’t make $4 magically appear, they just corrected the price to be the true price, and then didn’t overcharge you.

Despite this increase in costs, the removal of 2020 from the calculator of the end trust fund balance size means that the tax rates will go to schedule-3 this July, then schedule-4 in July 2022, and likely back to schedule-3 in July 2023. The bill also provides the ability for the VDOL to apply experience rating relief for COVID-specific reasons created under Act 91 except for those cases in which the employer has been shown to not follow the rehire provisions.

Finally, as part of the legislation, an Unemployment Insurance Study Committee was created to examine the solvency of Vermont’s Unemployment Insurance Trust Fund, its benefit structure, potential grants of authority for the Commissioner of Labor to reduce or waive certain penalties, and potential measures to mitigate the liability of reimbursable employers for some benefit charges. This Committee will do its work between September 15th and December 31st and consist of four members from the House and Senate economic development and money committees.

Back to menu

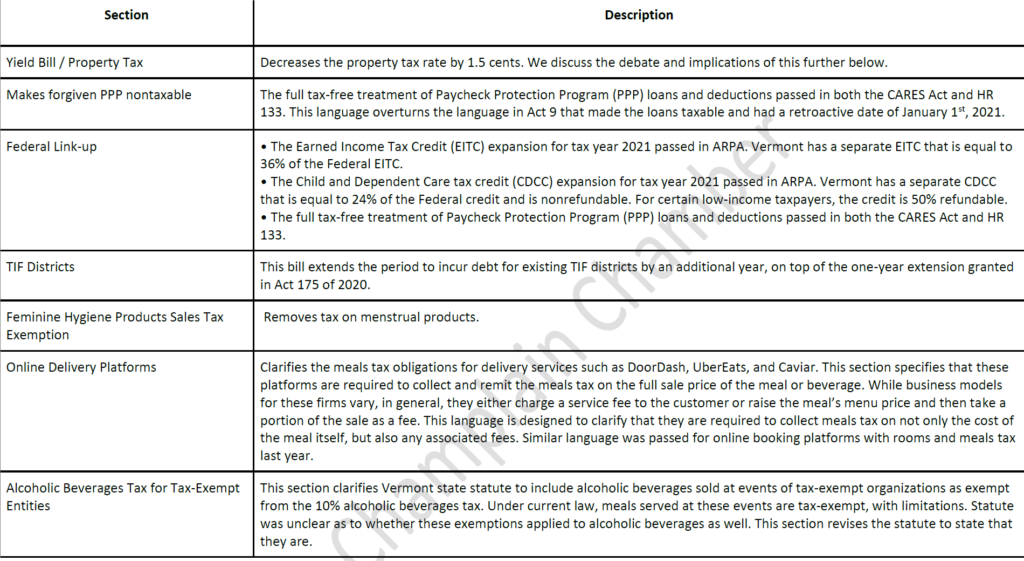

Miscellaneous Tax Bill – Passed

This year’s miscellaneous tax bill contained an overwhelming number of provisions as the bill was continually layered on. These included;

LCC worked incredibly hard to repeal the language in Act 9 that would have taxed forgiven PPP loans and had amassed a coalition of over 55 organizations to do so. We are incredibly grateful for those partners as well as the legislative champions who protected this essential program.

Read more about this and the other changes to the Vermont tax code in the Vermont Department of Tax’s session highlights.

Back to menu

Misc Revenue Bill – Postponed

In the final days of the session, the Senate Finance Committee struggled with the miscellaneous revenue bill, H.437, sent to them by the House. If they didn’t pass the bill, the budget would have had a deficit of about $1.5 million. The Committee was frustrated because they felt that they were in a position where the Appropriations Committee was telling them how big the pie had to be to bake it and cut it up. The crux of the issue was a property transfer tax surcharge on properties over $1 million that the committee did not want to levy on businesses. The bill did three big things:

Property Transfer Tax

The bill added a marginal surcharge to the property transfer tax, meaning it is applied to the value of the property transferred above $1 million, so properties transferred over $1 million would pay 1.95% (1.25% plus 0.5% new surcharge + 0.2% clean water surcharge) on the value of the transfer over $1 million, up from 1.45% currently. This would have been on property transfered by deed, excluding controlling interest transfers. This provision was later added into S.101, a bill that focussed on municipal bylaw modernization.

Manufacturing Inputs Tax Modernization

Presented as part of the Governor’s budget and economic development plans, this proposal sought to clean up the assessment of sales and use tax on manufacturing equipment by streamlining the Manufacturing and Machinery Equipment Tax Credit. This involves expanding the exemption to include all equipment, a change from direct use standard to integrated plant theory. In doing so, the Tax Department conceded that the status quo is difficult to comply with. This $700,000 revenue expenditure could provide a clearer path to compliance and, as a result of that, encourage the state’s manufacturers to invest in new equipment and upgrade existing equipment.

LCC’s Government Affairs Manager testified in House Ways and Means on the tax treatment of manufacturing inputs alongside one of our members who did a fantastic job of making a complex issue more approachable. LCC’s advocacy team testified that from our perspective, tax policy should not create “gotcha” moments because it is not clear, and such policy only stifles innovation and economic development. The integrated plant theory’s shift from a physical relationship of manufacturing inputs to an economic relationship creates greater predictability for existing businesses and any new businesses.

Unfortunately, this measure was not enacted but we think we might have another shot at this next year, so please contact our advocacy team if this issue is important to you.

Manufactured Housing Credits

Finally, the bill expanded the first-year credits for the manufactured homes component of the Affordable Housing Credit from $425,000 to $675,000. Some legislators also have concerns with spending money on manufactured homes as they do not appreciate in value the same way as stick-built homes and would rather see money directed to dwellings that appreciate. This provision was later added into S.101, a bill that focussed on municipal bylaw modernization.

The Bill’s Path

This bill created mixed feelings for the Lake Champlain Chamber which was in support of the second two items and not in support of the first. Our hope was the Senate Finance Committee would have removed the property transfer surcharge on businesses and continued with the other items in the bill. We believed they might be able to do this for one, or a combination of the following reasons; first, there is natural growth in the property transfer tax due to the hot real estate market we are witnessing; second, this amount of money is relatively small when compared to the massive amount of ARPA dollars the state is receiving, and there may be a chance to offset this revenue.

Ultimately, the bill did not move past the Senate Finance Committee. The House Ways and Means Committee added the PTT language and the manufactured homes tax credit to S.101, which also did not make it across the legislative finish line.

Back to menu

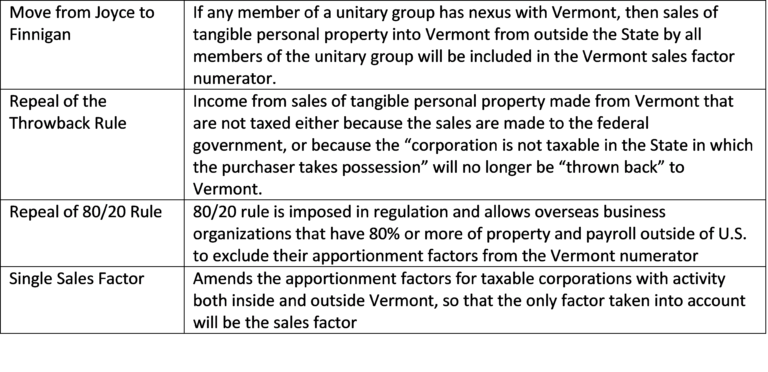

S.53, an Additional Miscellaneous Tax Bill – Chopped Up

S.53 started its life as a relatively simple bill removing the tax from feminine hygiene products. When it arrived in the House, the House Committee on Ways and Means added a large amendment to S.53. The amendment, an overview of which can be seen below, contained many changes to the corporate sales tax, a reconfiguration of the Corporate Minimum Tax (CMT) tax brackets with some increases, an increase in mutual fund registrations fees, an exemption in military retirement pay, and most impactfully to the future of Vermont, a tax on nearly (or more likely than not, every single) internet service. S.53 went to the Senate, where it was not received well. The Senate Finance Committee removed the language on feminine hygiene products and added it to the miscellaneous tax bill. The rest of this language was not enacted.

Internet Service Tax – Defeated

This legislation would have taxed nearly all online activity that you pay for at a sales tax rate of 6%. In the past, similar proposals to tax online services have been restricted to a few services in a specific category, however, under the legislation passed, everything we’ve come across is taxed. While this was pitched as a tax on the tech sector, businesses who use common services such as Square, MailChimp, Constant Contact, Quickbooks, Salesforce, or any similar tools would need to pay a tax.

The House Democratic caucus was told that this was not a new tax, and it was just a repeal of the sales tax exemption on “vendor-hosted prewritten software.” The definition of “vendor-hosted prewritten software” accessed remotely was also expanded to now include Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS) (see expansion summarized by their legislative Counsel here) which were never included before.

Think of it as if we had an exemption on the taxation of ketchup; the House just repealed the exemption on the taxation of ketchup while also changing the legal definition of ketchup to include mustard and relish because, from the Committee’s perspective, these things often end up all getting mixed together on a hotdog and they felt it was just simpler to call them all ketchup.

For the past few years, the cloud conversation has been specifically about SaaS, as the proponents of taxing SaaS contested that they aimed to tax software that used to be “in a box,” with the most common definition being something such as tax software that moved from a CD-based to a web-based delivery system. It was very shocking when the Committee members took the next step of expanding the legislation to things that were never in a box, such as CRM or accounting tools which could never have been “in a box” and would have been services one paid for. LCC testified to this point as well as how this legislation ran counter to our visions of Vermont’s economic future. Vermont does not tax services, and despite a recent Tax Structure Commission report suggesting that we do, the Committee has expressed a desire not to pursue taxing services. The Committee heard from an attorney with the Vermont Department of Taxes that such mismatched treatment of internet services might mean the legislation falls afoul of the federal Internet Freedom Act, which states that a state cannot tax a service differently exclusively for the reason that it is delivered over the internet.

Corporate Minimum Tax Changes and Corporate Tax Reform – Postponed

In addition to these changes, the Ways and Means Committee made changes that reflect years of work from the Ways and Means Committee and are net positive for businesses they affect. They include:

In an attempt to raise revenue to offset provisions in S.53, the House Ways and Means Committee looked to the CMT brackets with increases to the tax for anyone with gross receipts over $100,000. One of the new brackets that was created covers those with gross receipts of $300 million or higher, which is only about 10 filers in Vermont.

Military Retirement Pay – Postponed

This proposal has gone nowhere for the last five years and was likely added to the bill to attract more support for the tax increases. The purpose for exempting military retirement pay, which the Lake Champlain Chamber supports, is to recruit and retain highly skilled members of the military who, upon retirement, have many working years left and often make decisions based on this factor. Representatives Laura Sibilia and Matthew Birong made a last-minute effort to increase the exemption in the bill from $10,000 to a more meaningful $30,000. Vermont is one of only three states that does not exempt military pension payments.

Back to menu

Economic Development Omnibus Bill and Other Initiatives – Added to Budget

The omnibus economic development bill reflected many proposals that have been floating around for years and were now more possible due to the influx of federal funds and one-time budget surpluses. In the final days of the session, the House and Senate Committees struggled to find common ground on multiple issues in the bill. Once the compromise was reached, there was not enough time for the bill to move procedurally through the legislature, so the Appropriations Committee decided to fold the bill into the budget.

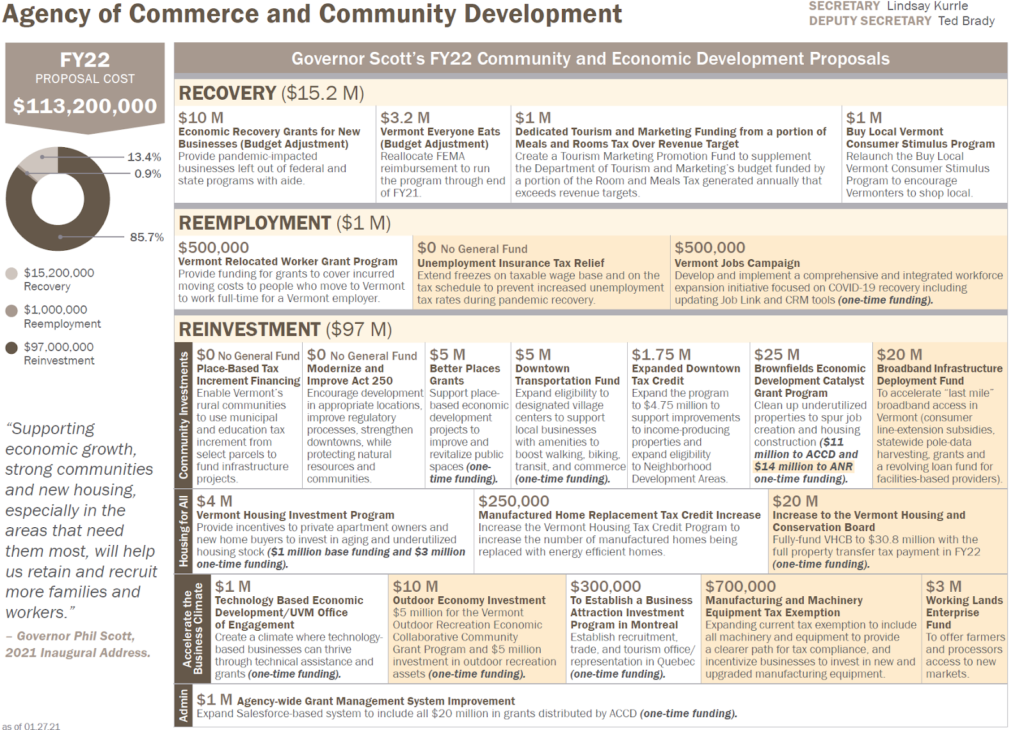

The bill reflects many of the proposals put forward in the Governor’s budget, as seen in the graphic below.

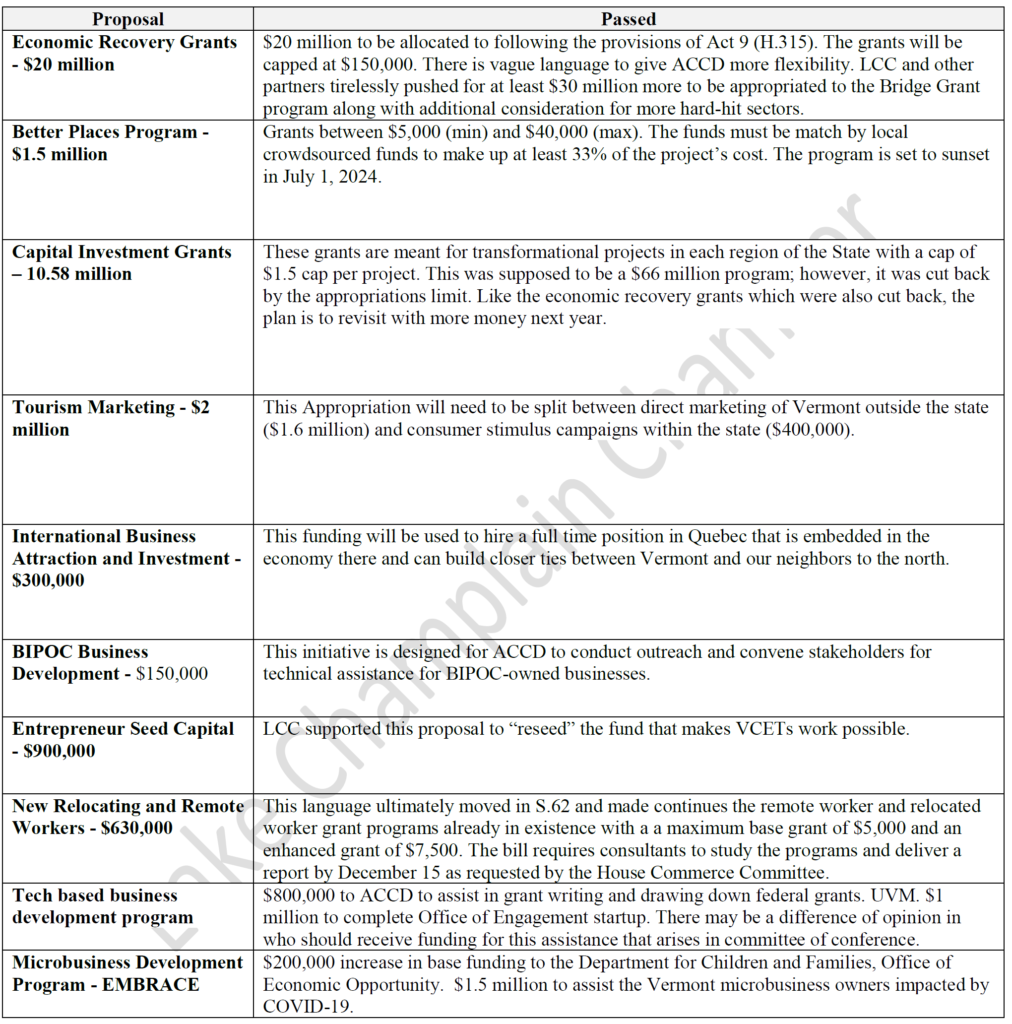

The economic development initiatives that progressed are as follows:

This package represents quite possibly the largest one-time investment in Vermont’s economic development ever seen. However, as we noted in the budget section, much of the package is focused on long-term needs and not the short-term needs of some businesses economically harmed through no fault of their own. The language LCC worked to put into Act 9 expanding eligibility beyond the just businesses that received no assistance is even more important given the small amount of funding economic recovery grants received.

Other efforts not in the omnibus bill:

- See the Broadband section to understand further the $150 million appropriated there and Housing section regarding the $40 million appropriated to VHCB and millions towards other housing needs. ARPA funding meant that the dollar amounts in these areas could be raised.

- All told, the legislature appropriated $20 million for weatherization this year from various funding sources, though stopped short of the larger vision put forward by the Senate Natural Resources Committee.

- Unfortunately, the manufacturing sales tax modernization did not make it into any final bill that made it across the finish line, and H.437 was left on the wall in Senate Finance.

- The budget appropriated $11 for brownfield mitigation, and the legislative committees of jurisdiction are interested in including more ARPA funds next year.

- S.101 was part of this mix of development proposals and primarily contained language on bylaw modernization grants. The House Ways and Means Committee also took the expansion of downtown tax credits in the original version of H.159 in anticipation of adding it to this bill. They also added to the bill later the manufactured homes tax credits and the property transfer tax surcharge from the revenue bill added to it by the House. The House and Senate could not reconcile their differences on this bill in a timely manner, so the budget conference committee planned to add the bylaw modernization grants to the budget to ensure it made it.

- A proposal for place-based Tax Increment Finance Districts, or more commonly referred to as “mini-TIFs” contained in S.33, did not go very far after ARPA money became available as the Auditor and multiple committees of jurisdiction thought that direct spending would be a better way for communities to meet their development needs.

LCC and partners did a considerable amount of work to advance economic recovery grants. The resulting $20 million will be funneled through the program created in Act 9, as discussed above.

Back to menu

Broadband – Passed

For years the Vermont legislature has grappled with covering the 60,000 addresses in the state without high-speed internet access, an overwhelming task that could cost up to $300 million. Federal aid has made significant progress possible, with funding from the CARES Act, ARPA, and a possible infrastructure bill later this year. The Vermont legislature passed H.360, which appropriates $150 million to this goal and establishes the Vermont Community Broadband Board. The Board is comprised of five members; two appointed by the Governor, one by the House Speaker, one by the Senate’s Committee on Committees, and one by the Vermont Communications Union District Association. While the five-member broadband board is still being established, the Department of Public Service can expend $20 million in grants toward projects.

An ongoing debate throughout the session was the prioritization of Communication Union District (CUDs) at the expense of Incumbent Service Providers (ISPs). CUDs are a relatively new concept unique to Vermont with enabling legislation for them being passed in 2015; since then, nine districts cover 200 towns in the state. LCC’s input into the process was focused primarily on ensuring that one partner at the table was not prioritized to the exclusion of others (link to letter).

Eventually, a compromise was reached in a committee of conference to allow ISPS to qualify for grants so long as they work with a municipality that does not have a CUD before June 1st, 2021, and the ISP serves no more than three counties. Additionally, the ISP must also be working towards universal coverage in that region and cannot inhibit a neighboring CUD’s work to extend service.

Back to menu

Childcare – Passed

Ahead of the new legislative biennium, childcare was a topic that would come up in nearly any legislative conversation you were in with all questions towards the unpublished, yet universally known three-year goal of childcare advocates; a 1% of higher payroll tax that would prevent Vermont families from spending more than 10% of their household income on childcare costs by 2025.

H.171 was introduced to put some short-term funding to further subsidize families under 150% of the federal poverty level and create a study to be conducted this summer around technical changes to childcare governance and a funding source to make the 10% goal a reality. On or before July 1, 2022, a study will be delivered by an economist or independent consulting entity to the legislature outlining how to achieve this goal, under H.171.

The final bill appropriates a total of $12.7 million, with $5.5 million going towards subsidies so that starting October 1st, families making 150% of the federal poverty level will have child care costs covered. Families making 150%-350% of the federal poverty level will have smaller co-payments. The bill also provides tuition assistance for early childhood educators as well as student loan repayment support.

Towards the end of the session, a new variable came into this discussion, the American Rescue Plane Act. ARPA provided additional funding through the Childcare CDBG and stabilization funds, with this legislation containing instructions on how the one-time windfall could be best spent. The federal changes to the Child and Dependent Tax Credit under ARPA also created a web of other policy considerations. LCC is engaging with stakeholders to understand interactions between the Vermont childcare subsidies and the CDCC, as more investment in subsidies means less recovered via CDCC by families. If the CDCC is extended in perpetuity, it might be an interesting factor to consider in the study this summer on the future of Vermont’s childcare.

Back to menu

Miscellaneous Alcohol Bill – Passed

This year’s miscellaneous alcohol bill, H.313, includes language that LCC began pushing for last year around continuing alcohol to-go, which was started by the Executive Order during the pandemic. The bill extends the practice for two years, with a study due on January 15, 2023, on the economic impact and impacts, if any, on public safety. The bill also reduces fees for some holders of a manufacturer’s or rectifier’s license with an on-premise third-class license to now pay the $1095 fee instead of $230. The bill makes additional changes to tastings and festival permits.

The bill also requires a report on or before October 15, 2021, from the Office of Legislative Counsel and the Joint Fiscal Office regarding sports betting. LCC had hoped, and it looked like for a time there, that the legislation would include language to allow the retail sale of canned cocktails, however, this language was removed in the final days; conversation on this will resume when the legislature reconvenes.

Back to menu

Health Insurance Changes to Benefit Small Businesses – Passed

An opportunity presented itself due to the American Rescue Plan Act that could have major implications for Vermonters. ARPA capped health insurance premiums at 8.5% of income for individuals making up to $95,000 or about $265,000 per joint filers. This change would cover 90% of Vermonters. The state has previously considered dividing the individual and small group health insurance markets, however, it would increase rates in the individual market by about 7%, as the small group market is keeping the individual group market stable.

S.88, now Act 25, divides the markets and decreases the rates in the small group, providing relief to businesses, and increases the rates in the individual group, however, the individual groups would be offset by the changes to ARPA. The legislature would do this for 2023 on a trigger for the possibility that this provision in ARPA is extended in perpetuity.

Back to menu

Bottle Bill – Postponed

This bill, H.175, was very contentious, however, many were confident from the start of the session that it would not be finalized during this half of the biennium. The bill sought to increase the deposit fee on bottles going through the Vermont bottle deposit program and sought to expand that program to additional beverage containers. The bill was later paired back to only focus on the expansion and the higher fee was reduced. The legislation would create significant difficulty for smaller businesses who would need to track and label products in a unique way, specifically for Vermont. LCC will work with partners further in the time between now and when the legislature reconvenes.

Back to menu

Commercial Cannabis – Passed

Last year, Act 164 legalized commercial cannabis in Vermont. This year, the legislature followed up this year with S.25, which aimed to make modifications to the commencement of the legal market and make some additional accommodations for social equity.

The legislation establishes the Cannabis Business Development Fund to help people of color and others affected by past marijuana laws to open businesses in the new marijuana market. The legislation also restricts advertising of cannabis products from certain mediums “unless the licensee can show that not more than 15 percent of the audience is reasonably expected to be under 21 years of age,” along with numerous other restrictions and safety warnings. Finally, the bill establishes a new format for licensing fees to be approved before January 2022.

During this session, the Governor appointed members of the Cannabis Control Board established under Act 164, and they were able to weigh in on the proposals.

Back to menu

Pensions Governance Changes – Passed

This issue has been boiling for decades, and this session was poised to be the session where substantial solutions were offered. Past legislatures made decisions to forgo contributions to the state pension system, which, combined with poor investment returns and other factors, has created a massive unfunded liability affecting the state’s bond rating and consuming a substantial amount of the state’s budget each year. As LCC’s advocacy team sometimes will joke, “we often can’t have nice things because we are busy paying for our other mismanaged nice things.”

About halfway through the session, House leadership put forward a proposal that closely mirrored proposals by the Treasurer, which would have adjusted benefits for employees not within 5-years of retirement and add in $150 million in state dollars. The changes were not well received by the state employees or teacher unions, and the plan quickly unraveled.

After this, the deliverable for the session was scaled back to create a new taskforce: the Joint Legislative Pension Oversight Committee and to make governance changes to the Vermont Pension Investment Committee (VPIC) (which is a Commission, not a Committee). Under H.449, the Pension Benefits, Design, and Funding Task Force is directed to provide recommendations for legislative action on or before December 2, 2021. As discussed in the budget section, the legislature is anxiously awaiting these recommendations and already has some funding set aside for follow-up action.

Back to menu

Various Housing Efforts

This year, the Vermont Legislature appropriated over $190 million in the budget to housing initiatives. This represents $ 99 million in ARPA State Fiscal Funds, $40 million in General Funds, and $ 51.0 million in APRA Rental Assistance. $94 million in ARPA funding was directed to building shelter capacity for the homeless, which will have a great deal of long term impact along with an additional $40 million in general fund dollars for transitions from emergency housing. VHCB received $40 million for low and moderate-income housing.

S.79 – Delayed

In addition to direct funding, the Legislature passed S.79, which created the VHIP program and a rental registry for both residential units and short-term rentals (STRs) such as Airbnb and VRBO. An STR is considered any dwelling rented out for more than 30 days or 14 consecutive days.

The rental registry creates five new positions at the Department of Public Safety in the Division of Fire Safety funded by fees collected by those registering properties. Towns that already have rental registries, of which there are about five, are exempt from the program. These state employees would respond to statewide complaints around health, safety, sanitation, and the fitness of habitability. This might create issues for more unusual STRs, such as hunting camps and boutique options.

Proponents of the registry also continually advanced that having a central database of rental properties would be helpful in placing tenants, responding to natural disasters, and dispersing information. Many legislators, especially those who are landlords, were unhappy with the legislation and highlighted many unintended consequences and perspectives that they felt were not considered in the program’s creation.

LCC had some hesitations around the existence of a rental registry and its economic impact, which were shared with other advocates, however, LCC remained agnostic to the proposal for much of the session. We will closely monitor the impacts of the program on the rental market moving forward. LCC supports efforts to register STRs due to their impacts on housing stock in the state, and LCC had already engaged on this issue at the municipal level.

S.79 also created a revolving loan fund for people making 120% of area income – focused on marketing to marginalized communities who typically have not been able to buy homes and build equity. S.79 did not make it across the finish line due to procedural hurdles and will already be in the final stages of passage when the legislature reconvenes.

Back to menu

Act 250 – Delayed

Another session, yet another missed opportunity to correct issues in Act 250. The bulk of discussion around Act 250 during the session was educational after the legislature rejected an Executive Order by the Governor that would have reorganized the Natural Resource Board. See a side-by-side of the changes the Executive Order would make here.

In testimony that can be watched here, LCC testified early in the creation of the omnibus economic development bill that, given all of the strong downtown components being advanced this session, LCC suggested the Committee consider adding a provision to remove areas of enhanced designation from Act 250’s jurisdiction. Such a change would help communities capitalize on all of these proposals as they quickly move to revitalize and recover from the pandemic by building affordable housing and dense, walkable downtowns. This narrow change to Act 250 is pretty ubiquitously agreed upon; however, it keeps getting hung up in the larger Act 250 debate. We asserted that this narrow change brings positive environmental benefits by driving development into downtowns with plenty of reviews making it less suited to a conversation in the natural resources committees and better suited to economic development and housing committees.

We’ll discuss this more in the section about legislation next year.

Back to menu

Contractor Registry – Postponed

This legislation, H.157, sought to regulate contractors conducting home improvement work. The bill requires contractors to register with the Office of Professional Regulation and provides an extra-judicial form of handling complaints through that entity. Two new positions to regulate this new structure would have been created and were designed to be self-funded using the registration fees collected. Under the bill, contractors conducting work worth $2,500 or more would be required to register, carry insurance and have a written contract. In the event of misconduct, registration can be suspended, revoked, or conditioned. As part of a last-minute amendment, businesses that are already licensed or registered by OPR and the Department of Public Safety would need not register to avoid being duplicative.

This bill was held up in the final days due to procedural hurdles and will already be in the final stages of passage when the legislature reconvenes next.

Back to menu

Tax Structure Commission Report

The Tax Structure Commission this year issued a report after two years of testimony and deliberation, the Commissioners, Deb Brighton, Stephen Trenholm, and Bram Kleppner, honed in on a set of eight recommendations they believe will make Vermont’s revenue system work better for Vermonters.

- Restructure the homestead education tax

- Broaden the sales tax base

- Modernize income tax features

- Undertake analysis in order to eliminate tax burden/benefit cliffs

- Improve the administration of property tax

- Create a comprehensive telecommunications tax

- Utilize tax policy to address climate change

- Collaborate with other states so each state can build a fairer, more sustainable tax system

You can watch them present this draft report to the Ways and Means Committee here.

LCC submitted comments, which can be read here. The House Committee on Ways and Means heard from the Joint Fiscal Office on the subject of expanding the sales tax to clothing. The Committee has discussed this in previous years, though more narrowly focussed on luxury clothing to fund water quality projects and other needs. In the last few years, there has been a greater interest in expanding the sales tax base in general, including clothing and services.

LCC members heard from the Governor in a virtual question and answer opportunity that he does not support proposals to broaden the sales tax, adding that he is open to having this conversation but not during this pandemic and recession.

Back to menu

What’s Next?

Every year, the conversations of one legislative session tend to inform the next. Some of the work of this session will carry over to this summer, with study committees on unemployment insurance, childcare governance, and funding, as well as a task force to deal with pension issues.

Here are some of the issues to expect next year;

Economic Issues

When legislators cut back the amount of Economic Recovery Grants to $20 million this year, it was with the understanding that there would be another $20 million in the coming year. Many items in H.159 are multi-year items, and the legislature will need to check in on them and address them.

Childcare will be front and center as we return and the study mandated after H.171 is delivered to the legislature indicating what revenue(s) might be used to cover the bill’s goal that could cost over $300 million a year. A report will be coming back on the UI trust fund in December, as we discussed earlier (link), which will likely set up a contentious legislative discussion. Additionally, the Pandemic Unemployment Assistance Program helped many sole proprietors and gig-economy workers who otherwise might now have a safety net, and following the pandemic, the legislature might seek to create a similar system.

Tax Proposals

It is safe to expect that a number of tax change proposals we saw this year will be back next year. The internet tax is most certainly going to return, given the reasons we’ve outlined. The Senate Finance Committee is not philosophically opposed to many of the corporate tax changes that we outlined from H.437, however, they were not given much time to consider what is the product of multiple years work from the House Ways and Means Committee.

If the federal government were to extend in perpetuity the increase to the Earned Income Tax Credit and the Child and Dependent Care Credit, the Vermont legislature would need to respond accordingly by either offsetting the revenue expenditure or decoupling from the federal credit.

In the miscellaneous revenue bill, the legislature asked the Department of Taxes to report back to them on how best to appraise difficult properties at a local level such as hydroelectric dams and anaerobic digesters. They also asked them to provide more information and granularity around different kinds of residential property taxpayers, such as second homes, camps, and properties of that nature.

Finally, the House Ways and Means Committee expressed interest in a major overhaul of the local options tax. The Committee also had a discussion in their downtime about how they would like to act on next year an overhaul of the sales tax in the state. They discussed broadening the sales tax with additional goods, though likely not taking suggestions from the Tax Structure Commission to broaden the sales tax base to services. The committee would look to extend the local option sales tax across the state and then let towns that currently do not have local options to have the 1% go to their payment in lieu of taxes (PILOT). The Committee would not look to affect local option rooms and meals tax, as this is an adjustment to online marketplace sales tax changes. This is a developing idea that will likely take some work next session.

Government

The legislature will need to act on pension reform following the report from their newly created taskforce, and this will certainly be a contentious issue. The House voted 108-40 to reject an executive order from Governor Scott to create the Agency of Public Safety, which would consist of the Department of Fire Safety & Emergency Management, and a Department of Law Enforcement, which would bring the Vermont State Police and Motor Vehicle Enforcement under one roof.

This year’s budget contained $500,000 for school PCB testing, however, no funding for any work that needs to be done to mitigate the contamination if it is found in many schools, such as Burlington High School.

Energy and the Environment

One would hope that next year might be the year that the legislature does something about Act 250. As we reported, the action this year was mainly just educating themselves on the issue further and rejecting Executive Orders from the Governor. It is clear, progress on Main Streets is being held up by a congress on State Street. At the risk of sounding like a broken record in yet another session recap, we offer the following; the Vermont legislature must completely rethink the conversation of Act 250 and transition it away from being one of natural resources and towards one about affordable housing. They must also become comfortable with the idea of moving small pieces of Act 250 modernization independently, despite the unwillingness of certain environmental advocates.

The Senate Natural Resources and Energy Committee will likely want to focus on e-waste legislation (S.126) as well as the creation of renewable energy standards. The Senate will also need to address the Bottle Bill sent to them by the House. The weatherization provisions in this year’s budget represent only an hors d’oeuvre of what the Senate Natural Committee envisioned, so expect them back for more.

The House Corrections and Institutions Committee received a primer this week on the history behind the 3-acre general permit under which there are 700 projects affecting 8,000 landowners. The Committee heard that it is likely to cost landowners hundreds of millions of dollars and among those projects, DEC has identified at least eight state-owned properties needing upgraded stormwater treatment systems at a cost of $6.6 million for design and construction which will be funded via the Capital Bill. This year’s budget included $10 million for stormwater retrofit work of properties under this permit, however, much more work will be needed.

State House Business Moving Forward

At this time, it looks like the virtual days are far behind us, however, much of the accessibility and recording of legislative proceedings we saw come about because of the pandemic are here to stay. Still, there are some unanswered questions around how the legislature will conduct business when they return, as many have suggested limiting public access to prevent overcrowding of committee rooms in the wake of the pandemic. LCC testified this session on the need to return to legislating in a manner that allows more community involvement than before, not less.

Back to menu

Thank you to all of our Sponosrs

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team